Tax In Alabama

Understanding the tax landscape in Alabama is crucial for individuals and businesses alike, as it can significantly impact financial planning and decision-making. Alabama, known for its vibrant economy and diverse industries, has a unique tax structure that offers both benefits and complexities. This comprehensive guide aims to provide an in-depth analysis of the tax system in Alabama, shedding light on its intricacies and offering valuable insights for tax optimization.

The Tax Framework in Alabama

Alabama’s tax system is governed by a comprehensive set of laws and regulations, aiming to support the state’s economic growth while generating revenue for essential services and infrastructure development. The state’s tax structure is characterized by a blend of income, sales, and property taxes, each playing a vital role in funding various state initiatives.

Income Tax

Alabama imposes an individual income tax, which is a progressive tax system. This means that as your income increases, the tax rate also increases. The state’s income tax rates range from 2% to 5%, with brackets determined by the taxpayer’s filing status and total income. For instance, a single taxpayer with an income of 30,000 would fall into the 4% tax bracket, while a married couple earning 60,000 jointly would be subject to the 5% rate.

In addition to the state income tax, Alabama also has a corporate income tax, applicable to businesses operating within the state. The corporate income tax rate is a flat 6.5%, making it a consistent and predictable expense for businesses. This stability can be advantageous for long-term financial planning.

| Tax Type | Rate |

|---|---|

| Individual Income Tax | 2% - 5% (Progressive) |

| Corporate Income Tax | 6.5% (Flat Rate) |

One notable feature of Alabama's income tax system is the presence of tax credits and deductions. These incentives are designed to encourage specific behaviors, such as investing in renewable energy or supporting local businesses. For instance, the state offers a tax credit for homeowners who install solar panels, promoting sustainable energy practices.

Sales and Use Tax

Alabama levies a sales and use tax on the retail sale, lease, or rental of tangible personal property and certain services. The base sales tax rate in Alabama is 4%, which is applied to most transactions. However, it’s important to note that local municipalities may impose additional sales taxes, known as “local option taxes,” which can vary across the state.

To illustrate, a resident of Birmingham, Alabama, purchasing a new laptop for $1,000 would pay a total sales tax of 10%. This is because Birmingham has a local option tax of 6% in addition to the state's base rate. On the other hand, a similar purchase made in a rural area with no additional local taxes would only incur the 4% state sales tax.

Alabama's sales tax also applies to various services, including repair and maintenance services, admission fees to entertainment events, and even certain digital products like software and online subscriptions. This broad application of sales tax ensures a stable revenue stream for the state.

Property Tax

Property taxes in Alabama are primarily assessed and collected at the county level, with each county setting its own tax rates. This local control over property taxes leads to significant variations across the state. On average, Alabama’s property tax rates range from 0.3% to 0.5%, with the exact rate depending on the county and the assessed value of the property.

For instance, Jefferson County, home to Birmingham, has a property tax rate of 0.4%, while Mobile County's rate is slightly higher at 0.45%. These rates are applied to the assessed value of the property, which is typically around 10-20% of the property's fair market value.

Alabama also offers property tax exemptions for certain groups, such as veterans, the elderly, and homeowners with low incomes. These exemptions can significantly reduce the tax burden for eligible individuals, making homeownership more affordable.

Tax Benefits and Incentives

Alabama is known for its attractive tax incentives, designed to foster economic growth and encourage business development. These incentives can be particularly advantageous for businesses considering relocation or expansion within the state.

Business Tax Incentives

Alabama offers a range of tax credits and incentives to attract and support businesses. For instance, the Alabama Jobs Act provides tax credits for companies that create new jobs or invest in certain industries. These credits can offset a portion of the company’s income tax liability, making Alabama a competitive choice for businesses seeking tax-efficient growth.

Additionally, Alabama has a robust film and television production industry, and the state offers a film production tax credit of up to 35% of qualified production expenses. This incentive has been a major draw for filmmakers, contributing to the state's thriving entertainment sector.

Individual Tax Benefits

Individuals in Alabama can also benefit from various tax incentives. For example, the state offers a tax credit for college tuition expenses, helping families offset the cost of higher education. Additionally, Alabama has a robust retirement income tax exemption, meaning that a portion of retirement income, such as Social Security benefits, is exempt from state income tax.

Furthermore, Alabama's low property tax rates and the availability of property tax exemptions can make the state an attractive option for retirees seeking a tax-friendly environment.

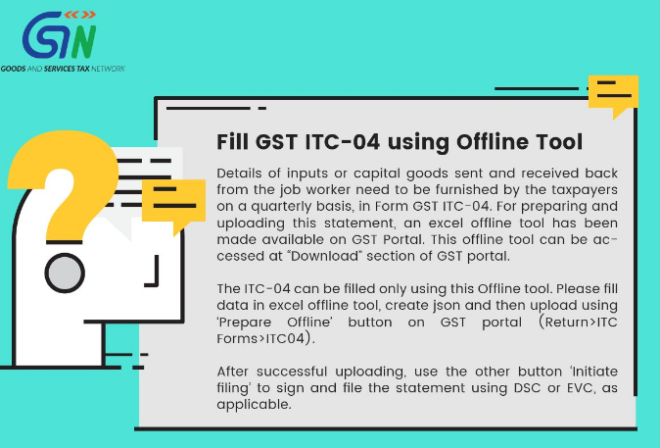

Tax Compliance and Filing

Understanding the tax filing process and compliance requirements is essential for both individuals and businesses in Alabama. The state offers a user-friendly online filing system, known as ALFile, which simplifies the process for individual taxpayers. For businesses, the Business Tax Online platform provides a convenient way to manage various tax obligations.

Alabama's tax department, the Department of Revenue, provides extensive resources and guidance to help taxpayers navigate the system. This includes detailed instructions, tax forms, and even interactive tools to calculate tax liabilities.

Tax Deadlines and Penalties

Taxpayers in Alabama must adhere to specific deadlines to avoid penalties and interest charges. For individual income tax returns, the deadline is typically April 15th, aligning with the federal tax deadline. However, it’s important to note that certain situations, such as military service or natural disasters, may qualify for an extension.

Businesses, on the other hand, have varied tax deadlines depending on their specific tax obligations. For instance, sales tax returns are due on the 20th day of the month following the taxable period, while corporate income tax returns are due on the 15th day of the fourth month following the close of the tax year.

Late filing or payment of taxes can result in penalties and interest, which can quickly accumulate. It's crucial for taxpayers to stay informed about their obligations and plan accordingly to avoid these additional costs.

Future Outlook and Tax Reform

Alabama’s tax landscape is subject to ongoing discussions and potential reforms. As the state aims to remain competitive and attractive to businesses and individuals, there is a focus on simplifying the tax system and offering more incentives.

Potential Tax Reforms

One area of interest is the simplification of Alabama’s tax code. While the state offers a range of tax credits and incentives, some argue that the complexity of the system can be a barrier for businesses and individuals. Streamlining the tax code could make it more accessible and user-friendly.

Additionally, there have been discussions about adjusting the income tax brackets to provide more relief for middle-income earners. This could involve broadening the tax base and lowering tax rates, which would make Alabama's tax system more progressive and equitable.

Economic Impact

The tax system in Alabama has a significant impact on the state’s economy. By offering a competitive tax environment, Alabama can attract businesses and create jobs. The state’s tax incentives, particularly those targeted at specific industries, can drive economic growth and innovation.

Furthermore, the state's commitment to supporting businesses through tax incentives can foster a positive business climate, encouraging entrepreneurship and investment. This, in turn, can lead to increased tax revenue and a more robust economy.

Conclusion

Alabama’s tax system is a complex yet dynamic framework, offering both challenges and opportunities for taxpayers. By understanding the intricacies of the state’s income, sales, and property taxes, individuals and businesses can make informed decisions to optimize their tax liabilities.

As Alabama continues to evolve and adapt its tax policies, staying informed about potential reforms and incentives is crucial. Whether you're a resident or a business owner, staying engaged with the state's tax landscape can ensure you take advantage of the opportunities it presents.

What are the key differences between Alabama’s tax system and those of neighboring states?

+Alabama’s tax system differs from its neighboring states in several ways. Compared to Georgia and Tennessee, Alabama has a slightly higher income tax rate, with a progressive system ranging from 2% to 5%. In contrast, Georgia has a flat income tax rate of 5.75%, while Tennessee does not impose a state income tax on wages. However, Alabama’s corporate income tax rate of 6.5% is lower than both Georgia (6%) and Tennessee (6.5%). In terms of sales tax, Alabama’s base rate of 4% is similar to Georgia’s 4%, but Tennessee has a higher base rate of 7%.

Are there any tax incentives for renewable energy projects in Alabama?

+Yes, Alabama offers tax incentives for renewable energy projects. The state provides a tax credit for the installation of solar energy systems, wind energy systems, and geothermal heat pump systems. This credit is available to both residential and commercial property owners. Additionally, Alabama has a Renewable Energy and Energy Efficiency Tax Credit, which provides a credit for the installation of qualifying renewable energy systems and energy efficiency improvements.

How does Alabama’s property tax system compare to other states in terms of rates and exemptions?

+Alabama’s property tax rates vary across counties, with an average range of 0.3% to 0.5%. This puts Alabama’s property tax rates on the lower end compared to many other states. For example, New Jersey has one of the highest average property tax rates at around 2.35%, while Alabama’s rates are more comparable to states like Florida (0.98%) and Texas (1.84%). Alabama also offers various property tax exemptions, including homestead exemptions for primary residences and exemptions for certain types of agricultural land.

What resources are available to help taxpayers understand and comply with Alabama’s tax laws?

+Alabama provides a wealth of resources to assist taxpayers in understanding and complying with tax laws. The Department of Revenue’s website offers detailed tax guides, forms, and publications for both individuals and businesses. The website also includes an online tax calculator and a tax estimator to help taxpayers estimate their tax liability. Additionally, the Department of Revenue offers a taxpayer assistance hotline and provides educational workshops and seminars to promote tax compliance and understanding.

Are there any ongoing tax reform discussions in Alabama, and what potential changes could we expect?

+Yes, there are ongoing discussions about tax reform in Alabama. One of the primary areas of focus is simplifying the tax code and reducing tax burdens on individuals and businesses. Potential changes could include broadening the tax base and lowering tax rates, particularly for middle-income earners. There is also a push to expand tax incentives for certain industries, such as technology and manufacturing, to attract more businesses to the state. Additionally, there are proposals to streamline the sales tax system and reduce compliance burdens for businesses.