Chicago Sales Tax

Welcome to the comprehensive guide on Chicago's sales tax! In this detailed article, we will delve into the intricacies of the sales tax system in the Windy City, exploring its history, current regulations, and the impact it has on both residents and businesses. Understanding the sales tax landscape is crucial for anyone navigating the vibrant economy of Chicago, whether you're a consumer, a business owner, or simply curious about the city's fiscal policies.

The Evolution of Chicago’s Sales Tax

The story of Chicago’s sales tax begins with its inception in the 1930s, a period marked by the Great Depression and the need for innovative revenue streams. The city, known for its resilience and innovation, introduced the sales tax as a means to stabilize its finances and fund essential public services. Over the decades, the sales tax has undergone several transformations, adapting to the changing economic landscape and the evolving needs of the city.

One of the pivotal moments in the history of Chicago's sales tax was the introduction of the Regional Transportation Authority (RTA) tax in the 1980s. This additional tax, dedicated to supporting public transportation, showcased the city's commitment to sustainable infrastructure and its ability to utilize tax revenue for specific public benefits. The RTA tax, still in effect today, is a prime example of how Chicago leverages its sales tax structure to address critical urban challenges.

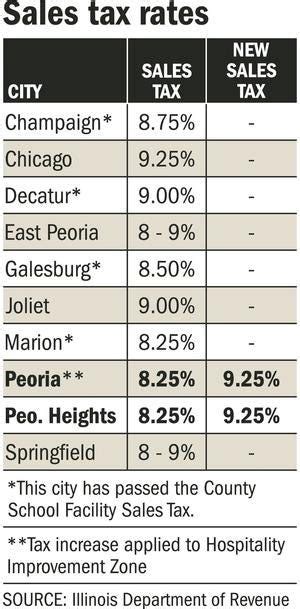

As we navigate the complex world of sales taxes, it's essential to understand the various components that make up Chicago's sales tax system. The sales tax rate in Chicago is not a one-size-fits-all percentage; it is a combination of state, county, and city taxes, each serving a unique purpose in the city's fiscal framework.

| Tax Jurisdiction | Tax Rate | Purpose |

|---|---|---|

| State of Illinois | 6.25% | General state revenue and funding for education. |

| Cook County | 1.25% | Supports county operations and services. |

| City of Chicago | 1.25% | Finances city infrastructure, public safety, and community initiatives. |

| Regional Transportation Authority (RTA) | 1.75% | Dedicated to maintaining and improving public transportation. |

This breakdown illustrates the multifaceted nature of Chicago's sales tax, where each jurisdiction contributes to the overall rate, ensuring that the tax revenue is directed towards specific, essential public services.

Impact on Businesses and Consumers

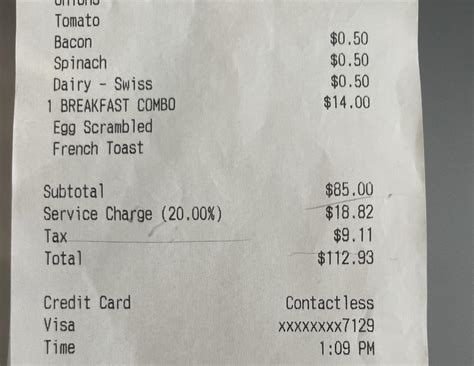

The sales tax in Chicago has a significant impact on both businesses and consumers, shaping the economic landscape of the city. For businesses, the sales tax is a critical consideration in their financial planning and pricing strategies. It influences their operating costs, particularly for retailers, as they must collect and remit the tax on behalf of the city and state.

From a consumer perspective, the sales tax adds a layer of complexity to purchasing decisions. Chicagoans and visitors must navigate the tax rates, ensuring they understand the final cost of goods and services. This transparency is crucial for maintaining consumer trust and ensuring fair pricing practices.

Sales Tax Exemptions and Special Considerations

While the sales tax is a universal aspect of the Chicago economy, certain goods and services are exempt from taxation. These exemptions are designed to support specific industries, promote economic growth, and provide relief to consumers. For instance, groceries, prescription drugs, and certain medical devices are exempt from sales tax, making essential items more affordable for Chicago residents.

Additionally, Chicago has implemented special considerations for certain industries, such as the e-commerce sector. With the rise of online shopping, the city has adapted its sales tax regulations to ensure fair taxation for both online and brick-and-mortar retailers. This includes the requirement for online retailers to collect and remit sales tax, leveling the playing field and ensuring a stable revenue stream for the city.

Enforcement and Compliance

Maintaining compliance with Chicago’s sales tax regulations is a shared responsibility between businesses and the Illinois Department of Revenue. The department is responsible for enforcing tax laws, ensuring businesses accurately collect and remit the tax, and educating taxpayers on their obligations.

For businesses, compliance with sales tax regulations is not only a legal requirement but also a strategic necessity. Accurate tax collection and remittance ensure the city's continued financial health and stability, which in turn supports the business environment. Non-compliance can result in penalties and legal consequences, underscoring the importance of staying informed and up-to-date with the latest tax laws and regulations.

Sales Tax Audits and Support

The Illinois Department of Revenue conducts sales tax audits to verify compliance and ensure the integrity of the tax system. These audits are a routine part of tax administration and are designed to identify any discrepancies or potential tax evasion. Businesses should be prepared for audits and maintain accurate records to facilitate a smooth process.

To assist businesses in navigating the complex world of sales tax, the Department of Revenue offers various resources and support. This includes educational materials, workshops, and online tools to help businesses understand their tax obligations and stay compliant. By providing these resources, the department aims to foster a culture of voluntary compliance and support the growth of Chicago's business community.

The Future of Chicago’s Sales Tax

As we look ahead, the future of Chicago’s sales tax is closely tied to the city’s economic growth and evolving fiscal needs. With a focus on sustainability and innovation, Chicago is exploring new ways to optimize its tax structure, ensuring it remains competitive and adaptable to the dynamic business landscape.

One of the key considerations for the future of Chicago's sales tax is the potential for tax reform. The city is actively engaged in discussions to streamline its tax system, making it more efficient and easier for businesses to navigate. This includes exploring options like simplifying tax rates, reducing administrative burdens, and implementing technology-driven solutions for tax collection and remittance.

Additionally, Chicago is committed to leveraging its sales tax revenue to support critical initiatives. The city recognizes the importance of investing in its infrastructure, education, and social programs, and sales tax revenue plays a pivotal role in funding these essential services. By strategically allocating tax revenue, Chicago aims to create a thriving, inclusive community, where businesses can flourish and residents can thrive.

Innovative Tax Solutions

Chicago is at the forefront of innovative tax solutions, exploring new technologies and strategies to enhance its tax system. One notable initiative is the implementation of a smart city tax, leveraging the city’s advanced infrastructure to track and manage tax collections. This approach not only improves efficiency but also enhances transparency and accountability in tax administration.

Furthermore, Chicago is actively engaging with the e-commerce industry to develop fair and sustainable tax policies. As online shopping continues to grow, the city is committed to ensuring that e-commerce businesses contribute their fair share to the local economy, while also providing a level playing field for traditional retailers. This collaborative approach ensures that Chicago remains a competitive and attractive destination for businesses, both online and offline.

What is the current sales tax rate in Chicago, including all applicable taxes?

+The total sales tax rate in Chicago is 10.25%, which includes the state, county, city, and RTA taxes. This rate is subject to change, so it’s advisable to check for any updates before making significant purchases.

Are there any special sales tax holidays in Chicago?

+Yes, Chicago, along with the rest of Illinois, observes certain sales tax holidays. These holidays typically occur around major shopping events like Back-to-School and offer exemptions on specific items, providing consumers with tax-free purchasing opportunities.

How often does Chicago’s sales tax rate change?

+Sales tax rates can change annually, typically as part of the state and city’s budget processes. It’s important for businesses and consumers to stay updated with any changes to ensure compliance and accurate pricing.

What are the consequences for non-compliance with Chicago’s sales tax regulations?

+Non-compliance with sales tax regulations can result in penalties, interest charges, and even legal action. It’s crucial for businesses to understand their tax obligations and seek professional guidance if needed to avoid these consequences.