California Taxes Pay

California, known for its diverse landscapes, thriving industries, and iconic landmarks, is a state that plays a significant role in the economic landscape of the United States. With its bustling cities, innovative tech hubs, and vibrant culture, it attracts residents and businesses alike. However, along with its many attractions, California is also known for its tax system, which can be complex and often a subject of discussion and debate. Understanding how taxes work in California is essential for both individuals and businesses, as it directly impacts their financial planning and decision-making.

In this comprehensive guide, we delve into the world of California taxes, shedding light on the various aspects that affect taxpayers in the Golden State. From income taxes to sales taxes, property taxes, and more, we aim to provide a clear and detailed understanding of the tax landscape in California. By exploring the unique features of California's tax system, we can help taxpayers navigate the complexities and make informed choices regarding their financial obligations and strategies.

Unraveling the California Tax System: A Comprehensive Overview

The tax system in California is designed to support the state's diverse needs and initiatives, from funding education and healthcare to maintaining infrastructure and public services. While the system may seem intricate, understanding its components is crucial for taxpayers to ensure compliance and optimize their financial strategies.

Income Taxes: Navigating California's Progressive Tax Structure

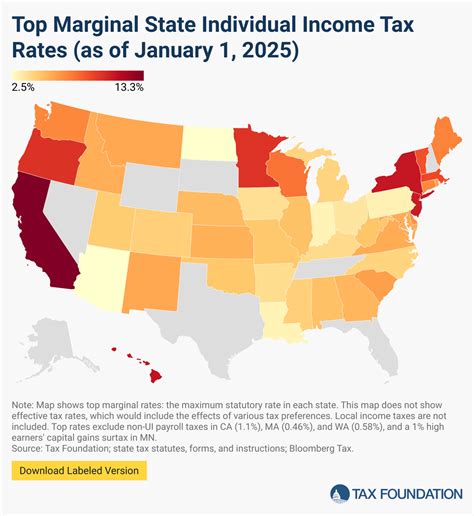

California employs a progressive income tax system, meaning that higher incomes are taxed at higher rates. This approach aims to distribute the tax burden fairly across different income levels. The state's income tax rates range from 1% to 13.3%, with brackets based on taxable income. For the tax year 2022, the brackets are as follows:

| Taxable Income Range | Single Filers | Married Filing Jointly |

|---|---|---|

| $0 - $9,499 | 1% | 1% |

| $9,500 - $35,649 | 2% | 2% |

| $35,650 - $56,149 | 4% | 4% |

| $56,150 - $81,649 | 6% | 6% |

| $81,650 - $134,149 | 8% | 8% |

| $134,150 - $289,249 | 9.3% | 9.3% |

| $289,250 - $497,449 | 10.3% | 10.3% |

| $497,450 - $728,649 | 11.3% | 11.3% |

| $728,650 and above | 12.3% | 12.3% |

It's important to note that these rates are for state income taxes only and do not include federal income taxes or local taxes. Additionally, California offers various deductions and credits that can reduce the taxable income and the overall tax liability.

Sales and Use Taxes: A Key Revenue Source

Sales and use taxes are another significant source of revenue for California. The state imposes a 7.25% sales and use tax rate, which is applied to the sale or purchase of tangible personal property and certain services. However, this rate can vary depending on the county and city where the transaction occurs, as local jurisdictions may add additional sales tax rates.

For example, in the city of San Francisco, the total sales tax rate is 8.75%, consisting of the state rate plus a 0.25% county transportation excise tax and a 1.25% city tax. It's crucial for businesses and consumers to be aware of these variations when planning their purchases or assessing their tax obligations.

Property Taxes: Assessing California's Assessment Base

Property taxes in California are determined based on the assessed value of real property, which includes land and improvements such as buildings. The state employs a unique system known as Proposition 13, which limits the annual increase in the assessed value of a property to 2% or the inflation rate, whichever is lower. This proposition aims to provide stability and predictability for property owners.

However, it's important to note that when a property changes ownership, it is reassessed at its current fair market value, which can result in a significant increase in property taxes. Additionally, there are various exemptions and reductions available for specific property types and situations, such as the Homeowners' Property Tax Exemption for qualifying veterans.

Other California Taxes: A Comprehensive Breakdown

Beyond income, sales, and property taxes, California has a range of other taxes that contribute to its overall tax landscape. These include:

- Vehicle License Fee: This is an annual fee paid by vehicle owners based on the value of their vehicle. The fee ranges from 0.65% to 2% of the vehicle's value, with lower rates for older vehicles.

- Fuel Taxes: California imposes taxes on gasoline and diesel fuel, with rates varying depending on the fuel type and the location of purchase. The state's gasoline tax is $0.415 per gallon, while the diesel tax is $0.385 per gallon.

- Inheritance and Gift Taxes: California does not have a state inheritance tax, but it does impose a gift tax on gifts exceeding $15,000 per recipient per year. The tax rate is 8% for gifts exceeding this threshold.

- Corporate Taxes: Corporations doing business in California are subject to a 8.84% franchise tax on their net income. Additionally, there are various other taxes and fees applicable to specific business activities and industries.

Strategies for Tax Planning and Compliance in California

Navigating the complexities of California's tax system can be challenging, but with the right strategies and knowledge, taxpayers can optimize their financial situations and ensure compliance with state regulations. Here are some key strategies and considerations for effective tax planning in California.

Maximizing Deductions and Credits

California offers a range of deductions and credits that can reduce the taxable income and the overall tax liability. Some of the notable deductions and credits include:

- Personal Exemptions: California allows personal exemptions for taxpayers and their dependents, reducing taxable income. For tax year 2022, the personal exemption amount is $345.

- Standard Deduction: Taxpayers can choose to claim a standard deduction, which is a fixed amount that reduces taxable income. For tax year 2022, the standard deduction amounts are $4,829 for single filers and $9,658 for married filing jointly.

- Itemized Deductions: Taxpayers can opt for itemized deductions if their total itemized expenses exceed the standard deduction. Common itemized deductions include mortgage interest, state and local taxes, charitable contributions, and medical expenses.

- Tax Credits: California provides various tax credits, such as the Earned Income Tax Credit (EITC), Child and Dependent Care Credit, and the California Education Credit. These credits can directly reduce the tax liability.

Efficient Record-Keeping and Tax Preparation

Maintaining accurate and organized financial records is essential for effective tax planning and preparation. Taxpayers should keep track of income, expenses, deductions, and credits throughout the year to simplify the tax filing process. Additionally, seeking the assistance of tax professionals or utilizing reputable tax preparation software can ensure accuracy and optimize the tax return.

Understanding Residency and Non-Residency Status

California has a unique residency-based tax system, where residents are taxed on their worldwide income, while non-residents are taxed only on income sourced within California. Understanding residency status is crucial, as it determines the scope of a taxpayer's obligations. California considers an individual a resident if they maintain a permanent home in the state or spend more than 183 days in the state during the tax year.

Staying Informed About Tax Changes and Updates

California's tax laws and regulations can evolve over time, and taxpayers should stay informed about any changes that may impact their financial strategies. The California Franchise Tax Board (FTB) provides regular updates and guidance on its website, including tax rate changes, new deductions and credits, and important deadlines. Staying abreast of these updates ensures compliance and helps taxpayers take advantage of any new benefits or incentives.

Exploring Tax Planning Opportunities

Tax planning is an essential aspect of financial management, and California taxpayers can explore various strategies to optimize their tax obligations. Some potential opportunities include:

- Maximizing Retirement Contributions: Contributing to tax-advantaged retirement accounts, such as 401(k)s or IRAs, can reduce taxable income and provide long-term growth potential.

- Charitable Contributions: Donating to qualified charitable organizations can provide tax benefits, as charitable contributions are often deductible.

- Business Structuring and Tax Strategies: Businesses operating in California can explore various tax-efficient structures and strategies, such as forming a corporation or LLC, utilizing tax-exempt bonds, or taking advantage of research and development tax credits.

California's Tax Landscape: A Dynamic and Impactful Force

California's tax system plays a pivotal role in shaping the state's economic landscape and funding vital public services. The state's progressive income tax structure, sales and use taxes, property taxes, and various other levies contribute significantly to California's revenue base. These funds support essential programs and infrastructure, including education, healthcare, transportation, and public safety.

However, the impact of California's tax system extends beyond revenue generation. It influences investment decisions, business operations, and the overall economic climate of the state. The state's tax policies can attract or deter businesses and investors, shaping the economic growth and development of different regions within California.

Economic Impact and Investment Decisions

California's tax policies can have a significant impact on the state's economic growth and investment attractiveness. High tax rates or complex tax structures may deter businesses from establishing or expanding operations in the state, leading to potential job losses and reduced economic activity. Conversely, tax incentives and favorable tax treatments can encourage investment, create jobs, and boost economic development.

For example, California offers various tax incentives for businesses engaged in research and development, film and television production, and renewable energy projects. These incentives aim to promote innovation, job creation, and the development of strategic industries. Additionally, the state's tax policies, such as the franchise tax rate, can impact the decision-making of businesses considering relocation or expansion.

Funding Public Services and Infrastructure

The revenue generated through California's tax system is a vital source of funding for essential public services and infrastructure projects. Income taxes, sales taxes, and property taxes contribute significantly to the state's budget, enabling the provision of quality education, healthcare, and social services to residents.

For instance, income taxes are a major source of funding for California's public schools and universities, ensuring access to quality education for students across the state. Sales taxes support the maintenance and development of transportation infrastructure, including roads, bridges, and public transit systems. Property taxes play a crucial role in funding local governments and services, such as police and fire departments, parks, and community facilities.

Policy Changes and Their Effects

California's tax system is not static, and policy changes can have far-reaching effects on taxpayers, businesses, and the overall economy. Tax reforms, adjustments to tax rates or brackets, or the introduction of new taxes can impact the financial planning and decision-making of individuals and businesses.

For instance, the recent adoption of Proposition 19, which changed the property tax assessment rules for inherited properties, has significant implications for property owners and investors. This policy change can affect estate planning strategies, tax obligations, and the overall real estate market in California.

Conclusion

California's tax system is a multifaceted and intricate web of regulations and policies that shape the financial landscape of the state. From income taxes to sales taxes, property taxes, and various other levies, understanding these components is essential for taxpayers to optimize their financial strategies and ensure compliance.

By unraveling the complexities of California's tax system, taxpayers can make informed decisions regarding their financial obligations and take advantage of the various deductions, credits, and incentives available. Effective tax planning, efficient record-keeping, and staying informed about tax updates are key strategies for navigating the state's tax landscape.

Moreover, California's tax policies have a profound impact on the state's economy, investment climate, and the provision of public services. Policy changes and reforms can influence business operations, economic growth, and the overall financial well-being of residents. As such, taxpayers and businesses must stay abreast of these changes to adapt their financial strategies accordingly.

In conclusion, California's tax system is a dynamic force that requires careful consideration and understanding. By delving into its intricacies and staying informed about evolving policies, taxpayers can navigate the complexities and make the most of their financial opportunities within the Golden State.

What are the current income tax rates in California for 2023?

+For the tax year 2023, California’s income tax rates range from 1% to 13.3%. The brackets are adjusted annually based on inflation. It’s important to note that these rates are subject to change, so it’s advisable to refer to the latest official sources for the most accurate information.

Are there any sales tax holidays in California?

+California does not have designated sales tax holidays like some other states. However, certain items may be exempt from sales tax during specific periods, such as back-to-school sales tax exemptions for school supplies. It’s recommended to check with the California Franchise Tax Board for any temporary sales tax exemptions or promotions.

How often are property taxes reassessed in California?

+Property taxes in California are generally reassessed when there is a change in ownership or new construction. Under Proposition 13, the assessed value of a property is limited to a 2% annual increase or the inflation rate, whichever is lower. However, when a property changes ownership, it is reassessed at its current fair market value, which can result in a significant increase in property taxes.