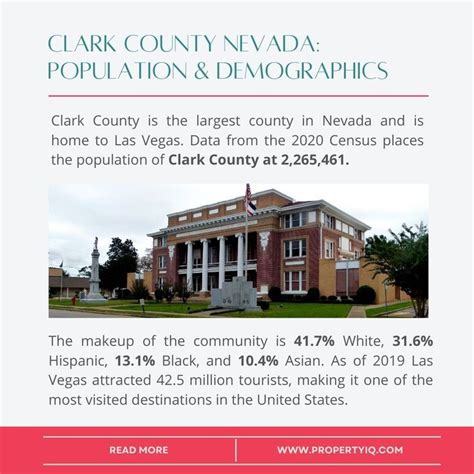

Clark County Nevada Tax Collector

Welcome to this in-depth exploration of the Clark County Nevada Tax Collector, an essential department within the county's government, responsible for managing and collecting taxes to fund various public services and initiatives. This article aims to provide a comprehensive understanding of the department's role, functions, and impact on the local community.

The Role and Responsibilities of the Clark County Nevada Tax Collector

The Clark County Nevada Tax Collector’s Office is a crucial entity within the county’s administrative framework. It is tasked with the efficient and effective management of various taxes and fees levied by the county, ensuring that these revenues are collected and allocated as per the established regulations and policies.

At its core, the department's primary responsibility is the collection of property taxes. In Clark County, property taxes are a significant source of revenue for the county government, funding essential services like public schools, emergency services, and infrastructure development. The Tax Collector's Office is responsible for assessing property values, issuing tax bills, and collecting these taxes from property owners.

In addition to property taxes, the department also handles other forms of taxation and fees. This includes business taxes, vehicle registration fees, and special assessments for services like flood control and fire protection. Each of these revenue streams is carefully managed to ensure compliance with state and local tax laws, and to provide a stable financial base for the county's operations.

The Clark County Nevada Tax Collector's Office is also responsible for maintaining accurate records of all tax-related transactions. This includes tracking property ownership changes, updating tax records when properties are sold or transferred, and ensuring that all tax payments are properly accounted for. Accurate record-keeping is essential for ensuring transparency and accountability in the tax collection process, and for providing reliable data for future planning and decision-making.

Furthermore, the department plays a vital role in taxpayer education and outreach. They provide resources and information to help taxpayers understand their obligations, answer questions about tax rates and assessment processes, and offer assistance to those who may be facing financial hardship or have complex tax situations. This proactive approach to taxpayer service helps to build trust and ensure a fair and equitable tax system.

Key Responsibilities and Functions

- Property Tax Assessment and Collection: The department assesses the value of all taxable properties within Clark County and issues tax bills accordingly. They also manage the collection process, offering various payment options and enforcing collection actions when necessary.

- Business Tax Administration: They oversee the registration and taxation of businesses operating within the county. This includes collecting business license fees, sales taxes, and other applicable taxes.

- Vehicle Registration and Fees: The Tax Collector’s Office is responsible for registering vehicles, collecting registration fees, and issuing license plates and registration certificates.

- Special Assessments and Fees: In addition to general taxes, they also manage special assessments for specific services or infrastructure projects, such as storm water management or transportation improvements.

- Taxpayer Assistance and Education: The department provides resources and guidance to help taxpayers understand their obligations, offering online tools, walk-in assistance, and informational workshops.

Impact on the Community

The work of the Clark County Nevada Tax Collector’s Office has a profound impact on the community it serves. Property taxes, for instance, are a primary source of funding for local schools, ensuring that every child in the county has access to quality education. These taxes also support public safety services, such as police and fire departments, which are essential for maintaining a safe and secure community.

The department's efficient management of taxes and fees also contributes to the county's economic health. By providing a stable and predictable tax environment, the Tax Collector's Office helps foster economic growth and development, attracting businesses and creating jobs. This, in turn, generates more tax revenue, creating a positive feedback loop that benefits the entire community.

In addition to its core tax collection functions, the department also plays a vital role in community outreach and engagement. They actively participate in local events, host educational workshops, and maintain an open door policy, ensuring that taxpayers have access to the information and support they need to fulfill their tax obligations. This commitment to community involvement helps build trust and understanding between the government and its citizens.

The Clark County Nevada Tax Collector's Office is also at the forefront of innovation, continually seeking ways to improve its services and streamline its operations. This includes implementing online payment systems, offering convenient drop-off locations for tax documents, and exploring digital solutions to enhance transparency and efficiency. By embracing technology and best practices, the department is able to provide faster, more efficient service to taxpayers, while also reducing its own administrative burdens.

The Tax Collection Process: A Step-by-Step Guide

Understanding the tax collection process is essential for taxpayers and businesses operating within Clark County. Here, we provide a detailed breakdown of the steps involved, from the initial assessment to the final payment.

Property Tax Assessment

The process begins with the assessment of property values. The Clark County Assessor’s Office is responsible for determining the fair market value of each taxable property within the county. This value is based on various factors, including recent sales of similar properties, the property’s location, and its physical characteristics.

Once the value is determined, the Assessor's Office sends a notice of assessed value to the property owner. This notice includes the property's assessed value, the tax rate, and the estimated annual tax amount. Property owners have the right to appeal their assessed value if they believe it is inaccurate.

Tax Bill Issuance

After the assessment process is complete, the Clark County Nevada Tax Collector’s Office takes over. They use the assessed values provided by the Assessor’s Office to calculate the property taxes owed. The tax rate is set by the county and is applied to the assessed value to determine the total tax amount.

The Tax Collector's Office then issues a tax bill to the property owner. This bill includes the property's legal description, the assessed value, the tax rate, and the total tax amount due. It also provides information on the due dates and payment options available.

Payment Options and Due Dates

The Clark County Nevada Tax Collector’s Office offers several payment options to accommodate different taxpayer preferences and needs. These options include:

- Online Payment: Taxpayers can pay their taxes securely online through the department’s website. This method offers the convenience of paying from anywhere at any time.

- Mail-in Payment: Taxpayers can send their payment by mail. The Tax Collector’s Office provides pre-addressed envelopes for this purpose, and taxpayers can use personal checks, money orders, or cashier’s checks.

- Walk-in Payment: For those who prefer in-person transactions, the department has multiple walk-in locations where taxpayers can pay their taxes. These locations accept cash, checks, and credit/debit cards.

- Automatic Payment Plans: The department offers automatic payment plans, which allow taxpayers to have their tax payments automatically deducted from their bank account on the due date.

It's important for taxpayers to be aware of the due dates for their tax payments. Clark County typically has two due dates for property taxes: a first installment due in November and a second installment due in April. Failure to pay by the due date may result in penalties and interest charges.

Enforcement and Delinquent Taxes

In cases where taxpayers fail to pay their taxes by the due date, the Clark County Nevada Tax Collector’s Office has the authority to take enforcement actions. These actions may include:

- Penalty and Interest Charges: Late payments are subject to penalty charges and interest, which accumulate over time.

- Lien Placement: If taxes remain unpaid, the department may place a lien on the property. This lien acts as a legal claim against the property, and it must be satisfied before the property can be sold or transferred.

- Property Seizure: In extreme cases of delinquency, the department may initiate legal proceedings to seize the property and sell it at a public auction to recover the outstanding taxes.

The Tax Collector's Office understands that taxpayers may face financial difficulties and is committed to working with them to resolve delinquent tax issues. They offer payment plans and other assistance to help taxpayers get back on track with their tax obligations.

Resources and Services Offered by the Clark County Nevada Tax Collector

The Clark County Nevada Tax Collector’s Office is dedicated to providing a range of resources and services to assist taxpayers and businesses. These resources are designed to make the tax process more transparent, efficient, and accessible.

Online Tax Payment and Account Management

One of the most convenient services offered by the department is the ability to pay taxes online. Taxpayers can access their account information and make payments securely through the Clark County website. This service is available 24⁄7, allowing taxpayers to manage their taxes at their own pace and convenience.

Online account management also provides taxpayers with real-time updates on their tax status. They can view their current balance, payment history, and any outstanding taxes or penalties. This transparency helps taxpayers stay informed and ensures they can address any issues promptly.

Taxpayer Assistance and Education Programs

The Clark County Nevada Tax Collector’s Office recognizes that taxes can be complex and confusing, especially for those who are new to the county or have unique tax situations. To address this, the department offers a variety of taxpayer assistance and education programs.

These programs include:

- Taxpayer Workshops: The department hosts workshops throughout the year to provide taxpayers with detailed information about their tax obligations, including property tax assessments, business taxes, and vehicle registration fees. These workshops are open to the public and offer an opportunity for taxpayers to ask questions and receive personalized guidance.

- Online Resources: The Clark County website provides a wealth of online resources, including tax guides, frequently asked questions, and step-by-step instructions for various tax-related processes. These resources are designed to be easily accessible and user-friendly, ensuring that taxpayers can find the information they need quickly.

- Personalized Assistance: Taxpayers who require more personalized assistance can schedule appointments with tax professionals at the department's offices. These professionals are trained to provide guidance on a wide range of tax issues, from property tax appeals to business tax registration.

Community Outreach and Engagement

The Clark County Nevada Tax Collector's Office believes in building strong relationships with the community it serves. As such, they actively participate in community events, town hall meetings, and other public forums to engage with taxpayers and address their concerns.

By attending these events, the department can provide real-time updates on tax-related matters, answer questions, and gather feedback from taxpayers. This direct engagement helps the department better understand the needs and challenges of the community, allowing them to improve their services and better serve the public.

In addition to these direct interactions, the department also utilizes various communication channels, such as social media and email newsletters, to keep taxpayers informed about important tax deadlines, changes in tax laws, and new initiatives. This proactive approach to communication ensures that taxpayers are well-informed and can plan their tax obligations accordingly.

The Future of Tax Collection in Clark County: Innovations and Trends

As technology continues to advance and taxpayer expectations evolve, the Clark County Nevada Tax Collector’s Office is committed to staying at the forefront of innovation in tax collection and management. Here, we explore some of the key trends and initiatives that are shaping the future of tax collection in the county.

Digital Transformation

The department is embracing digital technologies to enhance the efficiency and convenience of tax collection. This includes the implementation of online platforms for tax payment, registration, and account management. By leveraging digital tools, the Tax Collector’s Office aims to provide taxpayers with a seamless, user-friendly experience, reducing the time and effort required to fulfill their tax obligations.

In addition to online payment portals, the department is also exploring the use of mobile apps and text message notifications to provide real-time updates and reminders to taxpayers. These digital channels not only improve convenience but also help the department reach a wider audience, including those who may not have regular access to a computer or the internet.

Data Analytics and Insights

The Tax Collector’s Office is harnessing the power of data analytics to gain deeper insights into tax collection trends and patterns. By analyzing historical data and taxpayer behavior, the department can identify areas where processes can be streamlined, taxes can be collected more efficiently, and taxpayer service can be improved.

Data analytics also plays a crucial role in identifying potential issues or irregularities in tax collection. For instance, by analyzing payment patterns, the department can detect potential fraud or identify taxpayers who may be facing financial hardship and require additional support or payment plans.

Collaborative Partnerships

Recognizing that effective tax collection is a collaborative effort, the Clark County Nevada Tax Collector’s Office is fostering partnerships with various stakeholders, including other government agencies, community organizations, and businesses. These partnerships aim to enhance taxpayer education, improve compliance, and streamline tax collection processes.

For example, the department may collaborate with local businesses to promote tax awareness and compliance among their employees. This could involve hosting educational seminars, distributing tax guides, or providing direct support to employees with tax-related queries. By working together, the Tax Collector's Office and local businesses can ensure that taxpayers are well-informed and compliant, which benefits both the community and the economy.

Sustainable and Responsible Tax Collection

The Clark County Nevada Tax Collector’s Office is committed to sustainable and responsible tax collection practices. This involves not only ensuring that taxes are collected efficiently and fairly, but also that the tax revenue is used responsibly to benefit the community.

To achieve this, the department is implementing initiatives to improve transparency and accountability in tax collection and allocation. This includes providing detailed reports on tax revenue usage, hosting public forums to discuss budget proposals, and seeking input from the community on how tax revenue should be allocated to address local needs and priorities.

FAQs

What is the due date for property tax payments in Clark County, Nevada?

+

Property tax payments in Clark County, Nevada are due in two installments. The first installment is due on November 1st and the second installment is due on April 1st. It’s important to note that if the due date falls on a weekend or holiday, the payment is considered timely if received on the next business day.

How can I pay my taxes online in Clark County, Nevada?

+

To pay your taxes online in Clark County, Nevada, you can visit the official Clark County website and navigate to the Tax Collector’s Office section. There, you’ll find a secure online payment portal where you can enter your account information and make a payment using a credit/debit card or an electronic check. This method offers a convenient and secure way to pay your taxes from the comfort of your home.

What happens if I don’t pay my taxes on time in Clark County, Nevada?

+

If you fail to pay your taxes on time in Clark County, Nevada, you may be subject to penalty charges and interest. The exact amount of the penalty and interest will depend on the length of time the payment is overdue. Additionally, if taxes remain unpaid, the Clark County Nevada Tax Collector’s Office may place a lien on your property, which can lead to further legal action and potential property seizure.

How can I appeal my property tax assessment in Clark County, Nevada?

+

If you believe your property tax assessment in Clark County, Nevada is inaccurate or unfair, you have the right to appeal. The process typically involves submitting an appeal application to the Clark County Assessor’s Office, providing evidence and documentation to support your claim, and attending a hearing to present your case. It’s advisable to consult with a tax professional or seek legal advice to ensure your appeal is well-prepared and presented.

Where can I find more information about business taxes in Clark County, Nevada?

+

For detailed information about business taxes in Clark County, Nevada, you can visit the Clark County website and navigate to the Business Tax section. There, you’ll find resources and guides on business tax registration, tax rates, and payment options. Additionally, you can contact the Clark County Nevada Tax Collector’s Office directly for personalized assistance and guidance on your specific business tax obligations.