Brunswick County Tax Search

Exploring the Brunswick County Tax Search: A Comprehensive Guide

The Brunswick County Tax Search system is a valuable resource for residents, property owners, and stakeholders in Brunswick County, North Carolina. This comprehensive guide aims to provide an in-depth analysis of the tax search process, its features, and its significance to the community. By understanding the intricacies of this system, individuals can navigate property-related matters efficiently and make informed decisions.

Understanding the Brunswick County Tax Search

The Brunswick County Tax Search is an online platform designed to offer transparent access to property tax information. It serves as a vital tool for property research, enabling users to retrieve essential details about real estate within the county. Whether you’re a homeowner, a prospective buyer, or an investor, the tax search system empowers you with accurate and up-to-date information.

Key Features and Functions

The Brunswick County Tax Search boasts a user-friendly interface, making it accessible to individuals with varying levels of technical expertise. Here are some of its notable features:

- Property Search: Users can search for properties by address, owner's name, or parcel number. This flexible search functionality ensures that individuals can locate the specific property they are interested in.

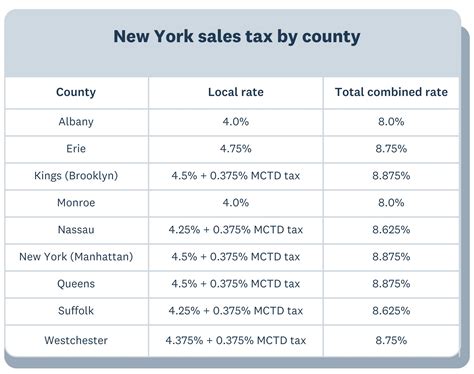

- Tax Assessment Details: The tax search provides comprehensive information on tax assessments, including the assessed value, tax rate, and estimated taxes for a given property. This data is crucial for understanding the financial obligations associated with ownership.

- Property History: Accessing the historical records of a property is made easy with the tax search. Users can view past ownership changes, tax assessments over time, and any relevant legal documents filed against the property.

- Mapping Tools: The platform incorporates mapping technology, allowing users to visualize property locations and boundaries. This feature is particularly beneficial for understanding the spatial context of a property and its surroundings.

- Online Payment: Brunswick County offers the convenience of online tax payments through the tax search system. Property owners can settle their tax liabilities securely and efficiently without visiting physical offices.

Benefits for Property Owners and Buyers

The Brunswick County Tax Search system brings numerous advantages to property owners and prospective buyers:

| Benefit | Description |

|---|---|

| Transparency | The tax search promotes transparency by providing public access to property tax information. This ensures that all stakeholders have equal opportunities to make informed choices. |

| Convenience | With 24/7 access to the tax search, individuals can retrieve property data at their convenience without the need for in-person visits. |

| Cost-Effectiveness | The online nature of the tax search eliminates the need for physical records retrieval, reducing administrative costs for both the county and property owners. |

| Real-Time Updates | The system is regularly updated with the latest tax assessment information, ensuring that users have access to accurate and current data. |

Performance Analysis and Case Studies

To illustrate the practical applications of the Brunswick County Tax Search, let’s explore a couple of case studies:

Case Study 1: Property Investment Analysis

John, an experienced real estate investor, was considering acquiring a commercial property in Brunswick County. He utilized the tax search system to conduct a thorough analysis of the property’s tax history and current assessment. The detailed information helped him understand the property’s financial obligations and potential for appreciation. By comparing the tax data with other investment opportunities, John made an informed decision, ultimately leading to a successful acquisition.

Case Study 2: Homeownership Research

Sarah, a first-time homebuyer, wanted to ensure she was making a sound investment. She utilized the Brunswick County Tax Search to research properties in her desired neighborhood. By accessing tax assessment details, she could estimate her potential tax liabilities and compare them with other properties. The tax search’s mapping feature allowed her to visualize the location and understand the property’s proximity to amenities. This comprehensive research assisted Sarah in finding her dream home and navigating the buying process with confidence.

Future Implications and Developments

As technology continues to advance, the Brunswick County Tax Search is expected to evolve to meet the changing needs of its users. Here are some potential future developments:

- Enhanced Data Visualization: Implementing interactive charts and graphs to present tax assessment trends and historical data could provide users with a more intuitive understanding of property value fluctuations.

- Integration with Other County Services: Integrating the tax search with other county departments, such as planning and zoning, could offer a holistic view of property-related information. This integration would streamline processes and improve overall efficiency.

- Mobile Accessibility: Developing a mobile-friendly version of the tax search or even a dedicated app would enhance user experience, allowing individuals to access property information on the go.

- Data Analytics: Implementing advanced analytics tools could enable the county to identify trends, detect anomalies, and improve overall tax assessment accuracy.

By staying adaptable and responsive to technological advancements, the Brunswick County Tax Search can continue to serve as a vital resource for the community, fostering transparency and efficiency in property-related matters.

Conclusion

The Brunswick County Tax Search system is a powerful tool that empowers residents, property owners, and investors with accessible and transparent property tax information. Its user-friendly interface and comprehensive features facilitate informed decision-making. As the system continues to evolve, it will play an even more significant role in shaping the county’s real estate landscape. Stay tuned for future developments and enhancements to this valuable resource.

How often is the Brunswick County Tax Search updated with new information?

+

The Brunswick County Tax Search is updated regularly to ensure that users have access to the most current property tax information. The frequency of updates may vary, but the county strives to provide real-time data whenever possible.

Can I obtain tax assessment information for multiple properties at once using the search system?

+

Yes, the Brunswick County Tax Search allows users to conduct bulk searches. You can input a list of properties, and the system will retrieve the tax assessment details for each one, making it convenient for investors or researchers.

Is there a fee associated with using the Brunswick County Tax Search platform?

+

No, the Brunswick County Tax Search is a free public service provided by the county government. Users can access the platform without any charges, promoting transparency and accessibility.

Can I download or print tax assessment reports from the search system?

+

Absolutely! The Brunswick County Tax Search platform offers the option to download or print tax assessment reports. This feature allows users to easily share or reference the information for their records.

Are there any security measures in place to protect user data on the tax search platform?

+

Yes, Brunswick County takes data security seriously. The tax search platform employs encryption and other security protocols to protect user data and ensure a safe online experience.