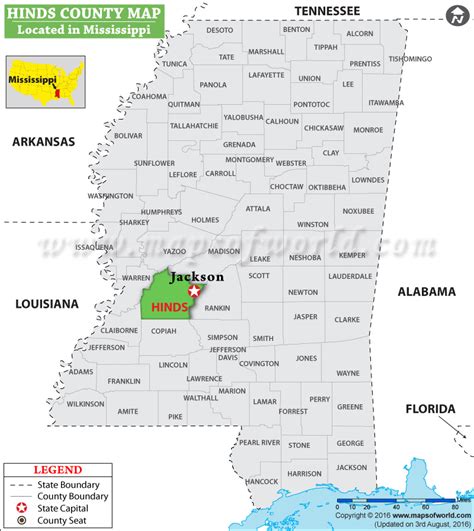

Hinds Co Ms Tax Collector

Welcome to a comprehensive exploration of the Hinds County Tax Collector's Office, an essential entity in the state of Mississippi. In this article, we delve into the workings of this crucial governmental department, uncovering its history, services, and impact on the community. With a focus on providing an in-depth understanding of the tax collection process and its significance, this piece aims to shed light on a vital aspect of local governance.

A Legacy of Service: The Hinds County Tax Collector’s Office

Nestled in the heart of Mississippi, Hinds County boasts a rich history intertwined with the diligent efforts of its tax collectors. The Hinds County Tax Collector’s Office stands as a testament to the county’s commitment to efficient and transparent tax administration. This office, with its dedicated team, plays a pivotal role in ensuring the smooth functioning of local governance and the well-being of the community.

The history of the Hinds County Tax Collector's Office can be traced back to the early 19th century when the county was established. Over the years, the office has evolved to adapt to the changing needs of the community and the complexities of modern tax systems. Today, it serves as a vital hub, offering a range of services and support to taxpayers, property owners, and businesses across the county.

Key Responsibilities and Services

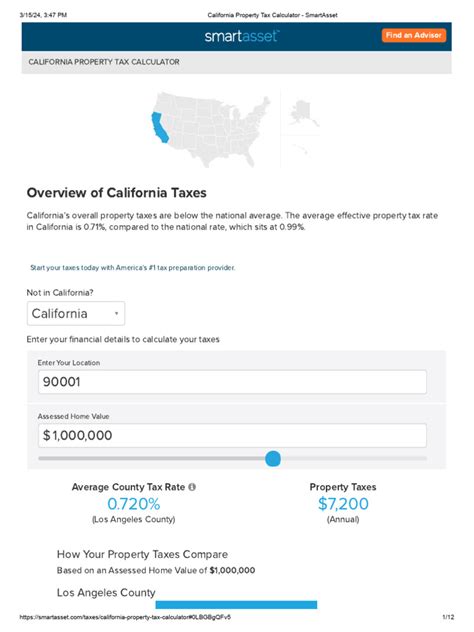

The primary responsibility of the Hinds County Tax Collector is to collect and manage property taxes, ensuring that the county’s financial obligations are met. This process involves a meticulous assessment of property values, billing, and the timely collection of taxes. The office also handles vehicle registration and title transfers, providing a one-stop shop for citizens to manage their vehicular documentation.

Furthermore, the tax collector's office plays a crucial role in supporting local initiatives and infrastructure development. A significant portion of the collected taxes goes towards funding essential services such as education, public safety, and community development projects. By efficiently managing these funds, the office contributes directly to the betterment of the county and its residents.

| Service Category | Description |

|---|---|

| Property Tax Collection | Assess and collect property taxes to fund county operations and services. |

| Vehicle Registration | Process vehicle registrations, title transfers, and related documentation. |

| Tax Payment Assistance | Offer guidance and support to taxpayers, ensuring compliance with tax laws. |

| Community Outreach | Engage with the community through educational programs and awareness campaigns. |

A Community-Centric Approach

Beyond its administrative duties, the Hinds County Tax Collector’s Office adopts a community-centric approach, actively engaging with residents to foster a culture of transparency and accountability. The office regularly organizes outreach programs, providing educational workshops on tax-related matters and offering personalized assistance to taxpayers.

Through these initiatives, the tax collector's office aims to demystify the tax process, ensuring that residents understand their rights and responsibilities. By fostering an environment of open communication, the office builds trust and strengthens the bond between the government and the community it serves.

Innovations and Technological Advancements

In recent years, the Hinds County Tax Collector’s Office has embraced technological advancements to enhance its services and improve efficiency. The introduction of an online tax payment portal has revolutionized the way taxpayers interact with the office, offering a convenient and secure method to settle their tax obligations.

Additionally, the office has implemented a robust digital record-keeping system, ensuring the security and accessibility of tax-related documents. This move not only streamlines internal processes but also provides taxpayers with quick access to their records, fostering a more efficient and transparent tax environment.

| Innovation | Impact |

|---|---|

| Online Payment Portal | Enhanced convenience and security for taxpayers, reducing physical interactions. |

| Digital Record-Keeping | Improved data management, accessibility, and security for tax-related documents. |

| Mobile App Integration | Provided on-the-go access to tax information and services, increasing engagement. |

Future Outlook and Continuous Improvement

Looking ahead, the Hinds County Tax Collector’s Office is committed to staying at the forefront of tax administration practices. The office plans to further enhance its technological infrastructure, exploring blockchain and artificial intelligence to streamline processes and improve accuracy.

Furthermore, the office aims to expand its community engagement initiatives, focusing on financial literacy programs for youth and senior citizens. By empowering residents with financial knowledge, the tax collector's office aims to create a more financially aware and responsible community.

In conclusion, the Hinds County Tax Collector's Office stands as a beacon of efficient governance, serving the community with dedication and innovation. Through its history of service, technological advancements, and community-centric approach, the office continues to play a vital role in the growth and prosperity of Hinds County.

What are the office hours for the Hinds County Tax Collector’s Office?

+The office is open from Monday to Friday, 8:00 AM to 5:00 PM, except on public holidays. However, it is advisable to check the official website for any temporary changes or special hours.

How can I make a tax payment online?

+To make an online tax payment, you can visit the official website of the Hinds County Tax Collector’s Office and follow the step-by-step instructions provided. You will need your account details and a valid form of payment.

What happens if I miss the property tax deadline?

+Missing the property tax deadline may result in penalties and interest charges. It is advisable to contact the Hinds County Tax Collector’s Office to understand the specific consequences and explore options for late payment.