Calculate Tax On Ira Withdrawal

Withdrawing funds from an Individual Retirement Account (IRA) is a significant financial decision that requires careful consideration of tax implications. Understanding how to calculate the tax on IRA withdrawals is crucial to avoid surprises and ensure compliance with tax regulations. In this comprehensive guide, we will delve into the intricacies of IRA tax calculations, providing a step-by-step breakdown and valuable insights to help you navigate this process with confidence.

Understanding IRA Withdrawals and Tax Considerations

An IRA, or Individual Retirement Account, is a tax-advantaged retirement savings account that offers various benefits to individuals planning for their financial future. When it comes to withdrawing funds from an IRA, the tax implications can vary based on factors such as the type of IRA, the timing of the withdrawal, and the purpose for which the funds are being withdrawn.

One of the key distinctions in IRA withdrawals is between qualified distributions and early withdrawals. Qualified distributions occur when an individual withdraws funds from a traditional IRA after reaching the age of 59½ or meets certain other criteria, such as using the funds for higher education expenses or medical emergencies. These qualified distributions are generally subject to income tax, but the tax rate can vary based on the individual's tax bracket.

On the other hand, early withdrawals refer to taking money out of an IRA before reaching the age of 59½. These early withdrawals are subject to additional penalties and taxes, including a 10% early withdrawal penalty, unless specific exemptions apply. The tax rate for early withdrawals is determined by the individual's tax bracket, similar to qualified distributions.

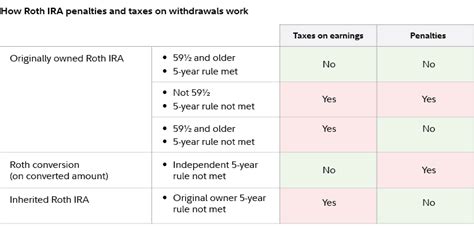

It's important to note that Roth IRAs have different tax considerations compared to traditional IRAs. While contributions to a Roth IRA are made with after-tax dollars, withdrawals during retirement are typically tax-free if certain conditions are met. This makes Roth IRAs an attractive option for tax-efficient retirement planning.

Calculating Tax on IRA Withdrawals

Calculating the tax on IRA withdrawals involves several steps to ensure accuracy and compliance with tax regulations. Here’s a step-by-step guide to help you navigate this process:

Step 1: Determine the Type of IRA

The first step is to identify the type of IRA from which you are withdrawing funds. This is crucial as it determines the applicable tax rules and potential exemptions.

- Traditional IRA: Contributions to a traditional IRA are typically tax-deductible, and the earnings grow tax-free until withdrawal. Withdrawals are taxed as ordinary income.

- Roth IRA: Roth IRAs offer tax-free withdrawals during retirement if certain conditions are met, making them a popular choice for tax-efficient retirement planning.

Step 2: Assess the Timing of the Withdrawal

The timing of your IRA withdrawal plays a significant role in determining the tax implications. Consider the following:

- Qualified Distributions: If you meet the age requirement (59½ or older) or qualify for certain exemptions, your withdrawal is considered a qualified distribution and is generally subject to income tax only.

- Early Withdrawals: Withdrawing funds before age 59½ triggers additional penalties and taxes. You may incur a 10% early withdrawal penalty, and the distribution is taxed as ordinary income.

Step 3: Calculate the Taxable Amount

To calculate the taxable amount of your IRA withdrawal, you need to determine the portion that is subject to tax. This can be done using the following formula:

Taxable Amount = (Distribution Amount - Contribution Amount)

Here, the distribution amount refers to the total amount you are withdrawing, while the contribution amount represents the portion of your contributions that was made with pre-tax dollars.

Step 4: Determine Your Tax Bracket

Your tax bracket, or marginal tax rate, is crucial in calculating the tax on your IRA withdrawal. The IRS provides tax rate schedules that outline the tax rates for different income levels. You can find these schedules on the IRS website or consult a tax professional for assistance.

Step 5: Apply the Tax Rate

Once you have determined your tax bracket, apply the corresponding tax rate to the taxable amount calculated in Step 3. This will give you the tax liability associated with your IRA withdrawal.

Step 6: Consider Additional Penalties (if applicable)

If your IRA withdrawal qualifies as an early withdrawal, you may be subject to the 10% early withdrawal penalty mentioned earlier. This penalty is in addition to the regular income tax and is calculated as a percentage of the taxable amount.

Real-World Example

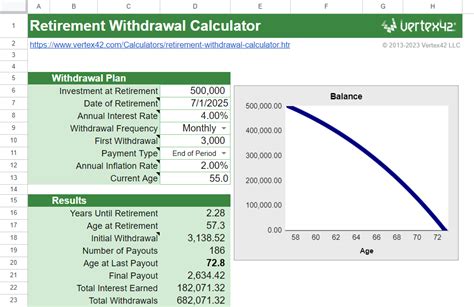

Let’s consider a practical example to illustrate the tax calculation process for an IRA withdrawal. Imagine you have a traditional IRA and plan to make a withdrawal of $10,000 at the age of 55.

| Distribution Amount | $10,000 |

|---|---|

| Contribution Amount (Pre-tax) | $7,000 |

| Taxable Amount | $3,000 (Distribution - Contribution) |

Since this withdrawal occurs before the age of 59½, it is considered an early withdrawal and is subject to the 10% early withdrawal penalty. In this case, the penalty would be calculated as follows:

Early Withdrawal Penalty = $3,000 (Taxable Amount) x 10% = $300

The total tax liability for this early withdrawal would include both the income tax and the early withdrawal penalty. The income tax rate would depend on your tax bracket and could range from 10% to 37% for federal income tax, depending on your taxable income for the year.

Strategies for Minimizing Tax Implications

While calculating the tax on IRA withdrawals is essential, it’s equally important to explore strategies that can help minimize the tax burden. Here are some approaches to consider:

- Qualified Distributions: If possible, plan your withdrawals to occur after you reach the age of 59½ or meet other qualified distribution criteria to avoid early withdrawal penalties.

- Roth IRA Conversions: Converting a portion of your traditional IRA to a Roth IRA can provide tax-free withdrawals during retirement, offering a potential long-term tax benefit.

- Tax-Loss Harvesting: Offset capital gains taxes by selling losing investments and using the losses to reduce your taxable income. This strategy can be particularly beneficial when withdrawing from a traditional IRA.

- Strategic Withdrawal Timing: Consider spreading your withdrawals over multiple tax years to stay within lower tax brackets and minimize the overall tax impact.

Frequently Asked Questions

Are there any exceptions to the 10% early withdrawal penalty for IRAs?

+

Yes, there are several exceptions to the 10% early withdrawal penalty for IRAs. These exceptions include withdrawals for higher education expenses, first-time home purchases, medical expenses exceeding 7.5% of your adjusted gross income, and more. It’s important to consult a tax professional to determine if your specific situation qualifies for an exception.

Can I avoid taxes on my IRA withdrawals if I use the funds for a specific purpose, such as a down payment on a house?

+

While certain exceptions exist for early IRA withdrawals, using the funds for a down payment on a house may not automatically exempt you from taxes or penalties. It’s best to consult a tax advisor to understand the specific rules and potential tax implications for your situation.

How do I calculate the tax on my Roth IRA withdrawal if I’m eligible for tax-free distributions during retirement?

+

Calculating taxes on Roth IRA withdrawals during retirement depends on your specific circumstances. Generally, if you meet the 5-year holding period and have reached age 59½, withdrawals are tax-free. However, there may be scenarios where a portion of the distribution is taxable. Consult a tax professional for guidance on your specific situation.

What happens if I make a mistake in calculating my IRA withdrawal taxes and underpay or overpay my taxes?

+

If you underpay your taxes on IRA withdrawals, you may be subject to penalties and interest by the IRS. Conversely, if you overpay, you can file an amended tax return to claim a refund. It’s essential to consult a tax professional to ensure accuracy and avoid potential penalties.