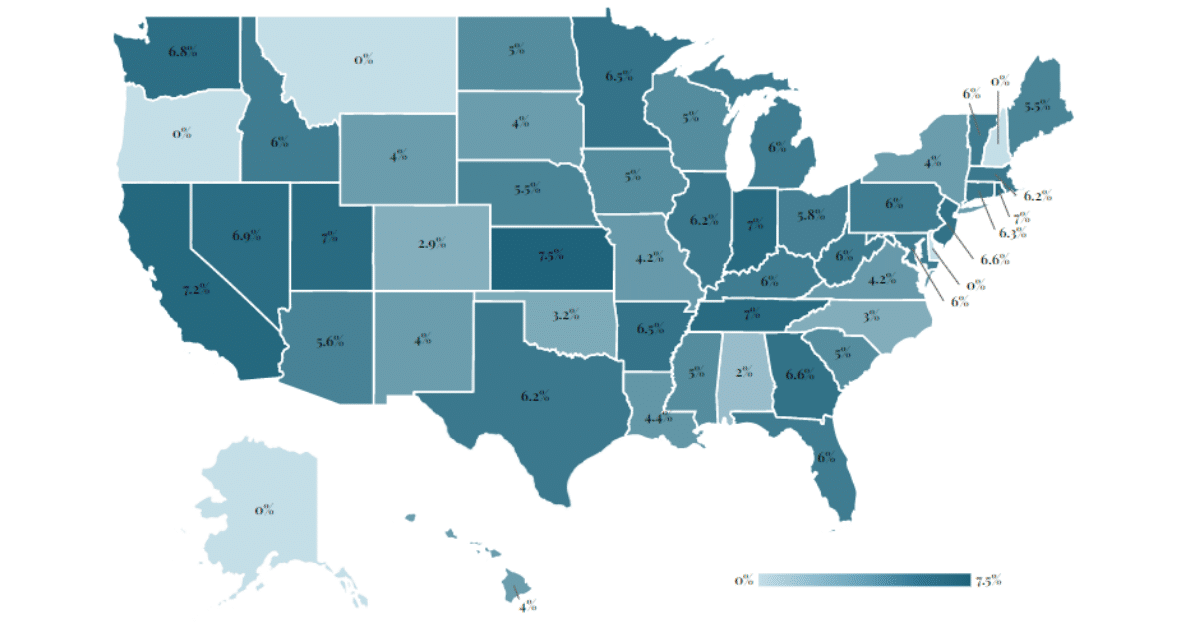

Tax Return Agi Line Number

Welcome to a comprehensive guide on understanding the AGI line number on your tax return. The Adjusted Gross Income (AGI) is a crucial figure in the US tax system, and its position on your tax forms is essential for various tax-related processes. This article will delve into the details of the AGI line number, its significance, and how it impacts your tax obligations and potential refunds.

Unraveling the AGI Line Number Mystery

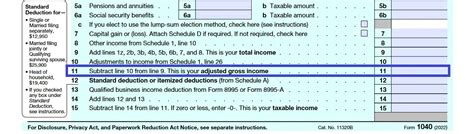

The AGI line number can be found on different tax forms, depending on your filing status and the type of return you’re submitting. For the most common tax forms, such as the Form 1040, the AGI is typically located near the top of the second page, in the “Income” section. However, its precise location may vary slightly from year to year due to IRS form updates.

For instance, on the 2022 Form 1040, the AGI is entered on line 11, while on the 2021 Form 1040, it was on line 8b. It's essential to pay close attention to the instructions and labels on your specific tax form to ensure you're entering your AGI in the correct location.

The AGI line number serves as a critical reference point for various tax calculations and deductions. It's the starting point for determining your taxable income and is used in several tax formulas, such as the calculation for the Standard Deduction and certain Itemized Deductions. Understanding where to find your AGI is vital for accurate tax filing and for claiming the deductions and credits you're entitled to.

AGI on Different Tax Forms

While the Form 1040 is the most commonly used tax form, other forms may be required depending on your specific tax situation. Here's a breakdown of where to find the AGI on some other common tax forms:

- Form 1040-SR (US Tax Return for Seniors): AGI is entered on line 10.

- Form 1040-NR (US Nonresident Alien Income Tax Return): AGI is located on line 41.

- Form 1040-X (Amended U.S. Individual Income Tax Return): AGI is reported on line 1 of the amended return.

- Schedule 1 (Additional Income and Adjustments to Income): AGI is calculated on this schedule and then transferred to the appropriate line on Form 1040.

It's worth noting that for certain tax forms, such as the Form 1040-EZ, which is simpler and designed for taxpayers with no dependents and a straightforward filing situation, the AGI is not required to be reported separately. In such cases, the form itself calculates the AGI based on the income information provided.

AGI and Tax Refunds

The AGI plays a significant role in determining your tax refund or liability. When filing your taxes, the IRS uses your AGI to calculate your tax liability and any potential refunds. A higher AGI may result in a larger tax bill, while a lower AGI could lead to a more substantial refund, assuming all other factors remain constant.

For instance, if you have a higher AGI due to increased income, you might be pushed into a higher tax bracket, which could result in a larger tax obligation. Conversely, if you have deductions or credits that reduce your AGI, it could lower your tax liability and potentially increase your refund.

Understanding the relationship between your AGI and tax refunds is crucial for financial planning and tax strategy. By keeping track of your AGI and how it changes from year to year, you can make informed decisions about tax-saving strategies and ensure you're maximizing your refund potential.

Calculating AGI: A Step-by-Step Guide

Calculating your Adjusted Gross Income (AGI) involves a series of steps to account for various types of income and adjustments. Here's a step-by-step guide to help you calculate your AGI accurately:

- Identify Your Gross Income: Start by adding up all your sources of income, including wages, salaries, tips, interest, dividends, capital gains, business income, rental income, and any other taxable income. This is your Gross Income.

- Subtract Adjustments: From your Gross Income, subtract any adjustments allowed by the IRS. These adjustments include contributions to certain retirement accounts (such as IRAs or 401(k)s), student loan interest, moving expenses, and alimony paid. These deductions are known as Above-the-Line Deductions and are subtracted from your Gross Income to calculate your AGI.

- Determine Your AGI: The result of subtracting your Above-the-Line Deductions from your Gross Income is your Adjusted Gross Income (AGI). This figure represents your income after accounting for specific deductions, and it serves as a critical reference point for various tax calculations and deductions.

It's important to note that the specific adjustments you can take and the amounts you can deduct may vary depending on your individual circumstances and the tax laws in effect for the tax year you're filing for. Always refer to the IRS guidelines and consult a tax professional if you're unsure about which adjustments apply to your situation.

| Income Sources | Adjustments |

|---|---|

| Wages, Salaries, Tips | Retirement Account Contributions |

| Interest, Dividends | Student Loan Interest |

| Capital Gains | Moving Expenses |

| Business Income | Alimony Paid |

| Rental Income | ... |

Common AGI Mistakes to Avoid

Mistakes in calculating or reporting your AGI can have significant tax implications. Here are some common errors to watch out for:

- Forgetting Adjustments: Failing to account for all eligible adjustments can lead to an inflated AGI, potentially resulting in a higher tax liability than necessary.

- Confusing AGI with Taxable Income: AGI is not the same as taxable income. Taxable income is calculated after applying various deductions and credits, while AGI is a starting point for these calculations.

- Misreading Tax Forms: Always double-check the instructions and labels on your tax forms to ensure you're entering your AGI in the correct location. Misreading or misunderstanding form instructions can lead to errors.

- Rushing Through Calculations: Tax calculations can be complex, and rushing through them may result in errors. Take your time and carefully review your calculations to ensure accuracy.

By being mindful of these common pitfalls, you can ensure that your AGI is calculated and reported accurately, helping you avoid unnecessary tax complications and ensuring you receive the full benefits of any deductions or credits you're eligible for.

The Future of AGI: Trends and Predictions

The concept of Adjusted Gross Income (AGI) is a fundamental component of the US tax system, and while the basic principles remain consistent, there are trends and potential changes on the horizon that could impact how AGI is calculated and used in the future.

One notable trend is the increasing focus on simplifying the tax system and making it more accessible to taxpayers. The IRS and tax policy experts have been exploring ways to streamline tax forms and processes, potentially reducing the complexity of calculating and reporting AGI. This could involve consolidating or eliminating certain adjustments, simplifying tax brackets, or introducing new forms to accommodate different taxpayer profiles.

Additionally, there is ongoing discussion about expanding the role of AGI in determining eligibility for various tax credits and benefits. Currently, AGI is a key factor in determining eligibility for certain tax credits, such as the Earned Income Tax Credit (EITC) and the Child Tax Credit. However, there are proposals to use AGI as a primary eligibility criterion for a wider range of tax benefits, including healthcare subsidies and educational grants.

From a technical perspective, the IRS is investing in modernizing its technology infrastructure to improve data processing and tax form processing capabilities. This modernization effort aims to enhance the accuracy and efficiency of tax calculations, including those involving AGI. By leveraging advanced data analytics and machine learning, the IRS aims to identify errors and anomalies more effectively, reducing the likelihood of mistakes in AGI calculations.

Furthermore, the evolving nature of the digital economy and the rise of gig work and remote employment present new challenges and opportunities for AGI calculations. As more income streams become digital and decentralized, the IRS is exploring ways to capture and integrate this income into AGI calculations accurately. This includes exploring partnerships with fintech companies and developing new reporting standards for digital income sources.

Looking ahead, the future of AGI is likely to be shaped by a combination of these trends and ongoing tax policy discussions. While the fundamental principles of AGI calculation are unlikely to change drastically, taxpayers can expect a more streamlined and accessible tax system, with AGI playing an even more central role in determining tax obligations and eligibility for a wider range of benefits.

Frequently Asked Questions (FAQ)

What is the purpose of the AGI line on tax forms?

+

The AGI line serves as a critical reference point for various tax calculations and deductions. It helps determine your taxable income and is used in formulas for the Standard Deduction and Itemized Deductions.

How does AGI impact my tax refund or liability?

+

A higher AGI may result in a larger tax bill, while a lower AGI could lead to a more substantial refund. It’s crucial for financial planning and tax strategy.

Where can I find my AGI on my tax return?

+

On the Form 1040, the AGI is typically on line 11 (for 2022) or line 8b (for 2021). For other forms, refer to the specific instructions and labels.

What adjustments should I consider when calculating my AGI?

+

Adjustments include retirement account contributions, student loan interest, moving expenses, and alimony paid. Refer to IRS guidelines for a comprehensive list.

Can I change my AGI after filing my tax return?

+

Yes, if you discover an error in your AGI calculation, you can amend your tax return using Form 1040-X. It’s important to correct any errors to avoid potential tax complications.