Dallas County Tax Office Near Me

Navigating the world of property taxes and tax offices can be a complex task, especially when you're new to an area or seeking specific services. This guide aims to provide an in-depth analysis of the Dallas County Tax Office, offering a comprehensive overview of its services, locations, and the impact it has on the local community. By the end of this article, you'll have a clear understanding of how the Dallas County Tax Office operates and how to make the most of its services.

Understanding the Dallas County Tax Office: A Comprehensive Overview

The Dallas County Tax Office is an essential governmental body responsible for assessing and collecting property taxes within Dallas County, Texas. It plays a crucial role in the local economy and community, ensuring the smooth operation of the county’s financial infrastructure. With a dedicated team of professionals, the office provides a range of services to property owners, offering assistance with property tax payments, appeals, and other related matters.

Services Offered by the Dallas County Tax Office

The Dallas County Tax Office provides a comprehensive suite of services designed to cater to the diverse needs of property owners. These services include, but are not limited to:

- Property Tax Assessment: The office assesses the value of properties within the county, ensuring fair and accurate tax assessments for each property owner.

- Tax Payment Options: Property owners have access to a variety of payment methods, including online payments, e-checks, credit cards, and in-person payments at designated locations.

- Tax Bill Information: The tax office provides detailed tax bill information, including due dates, payment options, and itemized breakdowns of tax assessments.

- Property Ownership Records: Property owners can access and update their ownership records, ensuring accurate information is maintained by the tax office.

- Tax Exemptions and Discounts: The office offers information and guidance on various tax exemptions and discounts available to eligible property owners, such as the Homestead Exemption and Over-65 Exemption.

- Appeals and Protests: Property owners who disagree with their tax assessments have the right to appeal and protest, and the tax office provides the necessary information and guidance to navigate this process.

- Property Tax Information for Businesses: The office offers specialized services for businesses, including commercial property tax assessments and payment options.

- Vehicle Registration and Title Transfers: In addition to property taxes, the Dallas County Tax Office also handles vehicle registration and title transfers, providing a one-stop shop for residents’ vehicle-related needs.

These services are delivered through a combination of online platforms, physical office locations, and dedicated customer support, ensuring that property owners have multiple avenues to access the assistance they need.

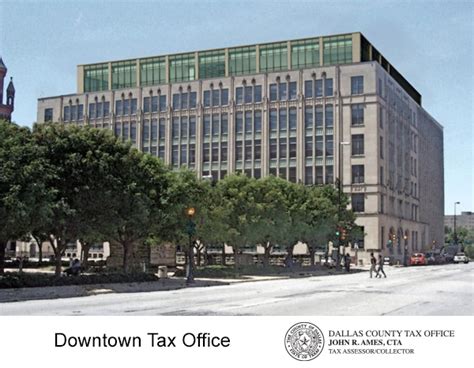

Dallas County Tax Office Locations: A Guide to Finding the Nearest Office

The Dallas County Tax Office operates multiple locations throughout the county to ensure convenient access for residents. Here’s a detailed breakdown of the office locations and the services they provide:

| Office Location | Address | Services Offered |

|---|---|---|

| Main Office - Downtown Dallas | John Wiley Price Government Center 100 S. Houston St., 3rd Floor Dallas, TX 75202 |

Full range of services, including property tax assessments, payments, appeals, and vehicle registration. |

| North Dallas Office | 9100 Jupiter Rd., Suite 100 Dallas, TX 75208 |

Offers a wide range of services, with a focus on property tax assessments and payments for residents in the northern regions of Dallas County. |

| South Dallas Office | 3929 S. Buckner Blvd., Suite 101 Dallas, TX 75227 |

Provides similar services to the North Dallas Office, catering to residents in the southern regions of the county. |

| Irving Office | 4200 N. Beltline Rd., Suite 100 Irving, TX 75038 |

Offers a comprehensive suite of services, including property tax assessments, payments, and vehicle registration for residents in Irving and the surrounding areas. |

| Mesquite Office | 3500 E. Davis St., Suite 100 Mesquite, TX 75149 |

Specializes in property tax assessments and payments, serving residents in Mesquite and nearby communities. |

| Duncanville Office | 4110 S. Polk St., Suite 100 Duncanville, TX 75116 |

Focuses on property tax assessments and payments, ensuring convenient access for residents in Duncanville and the surrounding areas. |

Each office is equipped with knowledgeable staff who are ready to assist residents with their tax-related inquiries and transactions. Additionally, the Dallas County Tax Office website provides an interactive map that allows users to find the nearest office based on their location, making it easier for residents to access the services they need.

Impact of the Dallas County Tax Office on the Local Community

The Dallas County Tax Office plays a vital role in the local community, impacting residents’ lives in several significant ways. Here’s an overview of its impact:

- Economic Stability: The tax office ensures the collection of property taxes, which are a significant source of revenue for the county. This revenue is used to fund essential public services such as schools, emergency services, infrastructure development, and social programs, contributing to the overall economic stability and growth of Dallas County.

- Community Engagement: The office’s presence in multiple locations throughout the county fosters community engagement. Residents have the opportunity to interact with tax office staff, seek assistance, and participate in various programs and initiatives, fostering a sense of community and collaboration.

- Fair Taxation: The tax office’s commitment to fair and accurate property tax assessments ensures that property owners are treated equitably. This promotes trust in the local government and fosters a sense of fairness and transparency within the community.

- Support for Property Owners: The range of services offered by the Dallas County Tax Office provides valuable support to property owners. Whether it’s guidance on tax exemptions, assistance with appeals, or convenient payment options, the office helps property owners manage their tax obligations effectively, reducing stress and potential financial burdens.

- Education and Awareness: The tax office also plays a role in educating residents about property taxes, their rights, and responsibilities. This includes providing information on tax assessments, payment deadlines, and available exemptions, ensuring that residents are well-informed and can make informed decisions regarding their property tax obligations.

In conclusion, the Dallas County Tax Office is a vital component of the local governmental infrastructure, offering a range of services that impact the lives of residents in significant ways. By understanding the services offered, locating the nearest office, and recognizing the office's impact on the community, residents can navigate their property tax obligations with confidence and ease.

How often do property tax assessments occur in Dallas County?

+Property tax assessments in Dallas County occur annually. The Dallas Central Appraisal District (DCAD) is responsible for appraising properties and determining their value for tax purposes. This process typically takes place between January and April each year.

Can I pay my property taxes online through the Dallas County Tax Office website?

+Yes, the Dallas County Tax Office provides an online payment portal on its official website. Property owners can access their account, view their tax bill, and make payments using a credit card, e-check, or electronic funds transfer. This offers a convenient and efficient way to manage property tax payments.

What should I do if I disagree with my property tax assessment?

+If you believe your property tax assessment is incorrect or unfair, you have the right to protest. The Dallas County Tax Office provides detailed information on the protest process, including deadlines and required documentation. It’s important to act promptly and follow the specified procedures to ensure your appeal is considered.

Are there any tax exemptions or discounts available for property owners in Dallas County?

+Yes, Dallas County offers various tax exemptions and discounts to eligible property owners. These include the Homestead Exemption, which reduces the taxable value of your primary residence, and the Over-65 Exemption, which provides a partial or full exemption for property taxes based on age and income. Other exemptions may be available for disabled veterans, surviving spouses, and more. It’s advisable to check with the Dallas County Tax Office or a tax professional to determine your eligibility.

Can I access my property tax information and pay my taxes using a mobile device?

+Absolutely! The Dallas County Tax Office has developed a mobile app to provide convenient access to property tax information and payment services. The app allows users to view their tax bills, make payments, and receive notifications about important tax-related deadlines. It’s available for download on both iOS and Android devices.