South Carolina Income Tax Rate

Income taxes are an essential component of a state's revenue generation system, providing funding for critical public services and infrastructure. The income tax rate structure varies across states, offering unique advantages and considerations for taxpayers. This article aims to delve into the specifics of South Carolina's income tax rate, its implications, and how it compares to other states, offering valuable insights for taxpayers and investors alike.

Understanding South Carolina’s Income Tax Structure

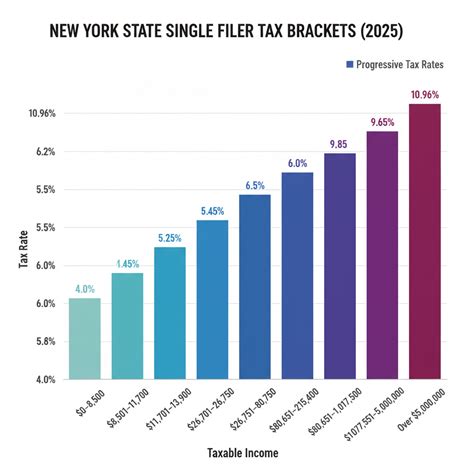

South Carolina employs a graduated income tax system, which means that the tax rate increases as taxable income rises. This progressive tax structure aims to ensure that higher-income earners contribute a larger share of their income to the state’s revenue. As of the latest tax year, South Carolina’s income tax rates range from 0% to 7% and are categorized into six brackets, each with its own threshold and corresponding tax rate.

| Tax Bracket | Taxable Income Range | Tax Rate |

|---|---|---|

| 1 | Up to $2,999 | 0% |

| 2 | $3,000 - $5,999 | 2% |

| 3 | $6,000 - $9,999 | 3% |

| 4 | $10,000 - $12,499 | 4% |

| 5 | $12,500 - $15,999 | 5% |

| 6 | $16,000 and above | 7% |

For instance, if an individual's taxable income falls within the $6,000 to $9,999 range, they would be subject to a tax rate of 3%. This means that they would pay 3% of their taxable income as state income tax. The thresholds and rates are subject to periodic review and adjustment by the state legislature to maintain a balanced tax system.

Impact of South Carolina’s Income Tax Rates

South Carolina’s income tax rates have a significant impact on the state’s economy and the financial planning of its residents. The progressive nature of the tax system ensures that the state can generate sufficient revenue to support its operations while also providing incentives for economic growth and investment.

For taxpayers, understanding these tax rates is crucial for effective financial management. It allows individuals to estimate their tax liabilities accurately and plan their finances accordingly. Additionally, the graduated structure means that taxpayers can assess the impact of their income growth on their tax obligations, making it easier to budget and plan for the future.

Comparing South Carolina to Other States

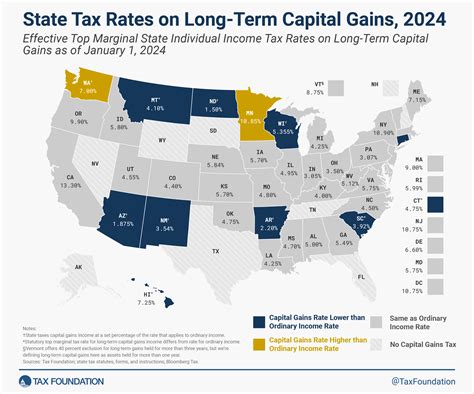

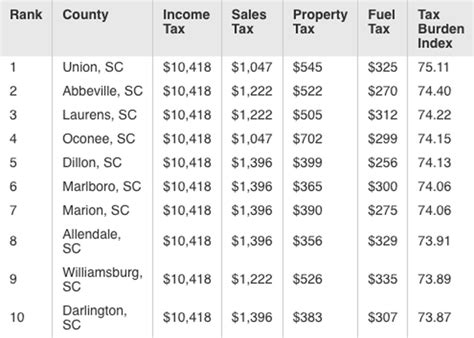

When it comes to income tax rates, South Carolina stands out as one of the states with the lowest income tax burden. Only a handful of states, including Alaska, Florida, Nevada, New Hampshire, Tennessee, Texas, Washington, and Wyoming, have no personal income tax at all. South Carolina’s maximum income tax rate of 7% is lower than the rates in many other states, including neighboring North Carolina with a top rate of 5.25% and Georgia with a top rate of 5.75%.

The absence of a personal income tax in some states might seem appealing at first glance, but it's important to consider the overall tax structure and the state's revenue needs. States without personal income tax often make up for the revenue shortfall through other taxes, such as higher sales taxes or property taxes. Therefore, a thorough analysis of the state's entire tax system is necessary to understand the true tax burden.

State Tax Incentives and Credits

South Carolina, like many other states, offers various tax incentives and credits to promote economic development, attract businesses, and support specific industries. These incentives can significantly reduce a taxpayer’s overall tax liability and make the state more attractive for business operations.

For example, South Carolina offers a variety of tax credits, including the Job Tax Credit, which provides incentives for companies creating new jobs in the state. The state also has a variety of industry-specific tax credits, such as the Film Industry Tax Credit and the Data Center Investment Tax Credit. Additionally, there are credits for research and development, renewable energy, and historic preservation projects.

These incentives are designed to encourage investment, job creation, and innovation, ultimately contributing to the state's economic growth and development. Understanding these incentives is crucial for businesses considering South Carolina as a location for expansion or relocation.

South Carolina’s Tax Filing Process

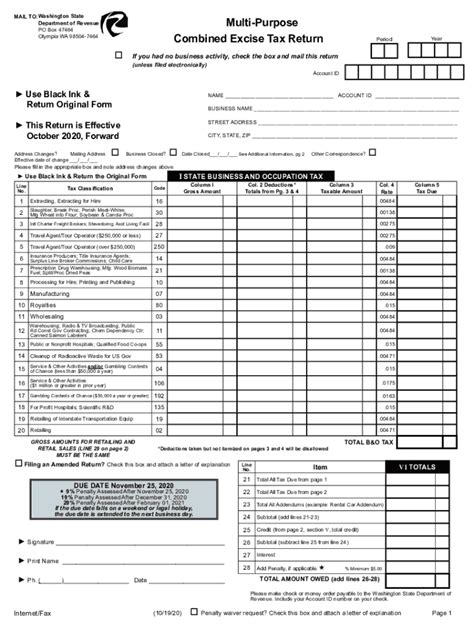

Filing income taxes in South Carolina is a straightforward process, made even more convenient with the availability of online filing options. The South Carolina Department of Revenue provides a user-friendly platform for taxpayers to file their returns electronically, offering a secure and efficient method of tax filing.

For taxpayers who prefer traditional methods, the state also accepts paper returns. However, it's important to note that electronic filing often provides faster refunds and is generally more secure. Regardless of the filing method, taxpayers are encouraged to ensure the accuracy of their returns to avoid potential penalties and delays.

Tax Deadlines and Payment Options

The tax filing deadline in South Carolina aligns with the federal tax deadline, typically falling on April 15th of each year. However, it’s crucial to stay updated with any potential changes or extensions, as these can vary from year to year. The state also offers various payment options, including direct debit, credit/debit card, and electronic check, providing taxpayers with flexibility in managing their tax obligations.

For taxpayers who are unable to pay their tax liability in full by the deadline, South Carolina offers payment plans and installment agreements. These options allow taxpayers to pay their taxes over an extended period, helping to manage cash flow and ensure compliance with tax regulations.

Conclusion: Navigating South Carolina’s Income Tax Landscape

South Carolina’s income tax system is a critical component of the state’s economic framework, providing revenue for essential public services while also offering incentives for economic growth. The state’s graduated tax rates, competitive compared to other states, are designed to promote fairness and balance. Understanding these rates, along with the state’s tax incentives and filing processes, is essential for effective financial planning and business strategy.

As South Carolina continues to evolve and adapt its tax policies, taxpayers and investors must stay informed about any changes that may impact their financial obligations. By staying updated and proactive, individuals and businesses can navigate South Carolina's tax landscape with confidence, ensuring compliance and optimizing their financial strategies.

How often are South Carolina’s income tax rates updated or adjusted?

+South Carolina’s income tax rates are subject to periodic review and adjustment by the state legislature. These adjustments are typically made based on economic factors, revenue needs, and the state’s fiscal policies. While there is no set frequency for these changes, they are generally made in response to changing economic conditions or to address specific policy objectives.

What are the tax implications for remote workers in South Carolina?

+The tax implications for remote workers in South Carolina depend on their residency status and the location of their employer. If a remote worker is a resident of South Carolina, they are generally subject to South Carolina income tax on all income earned, regardless of where the work is performed. However, if the worker is a non-resident, they may only be taxed on income earned within the state.

Are there any tax incentives for renewable energy projects in South Carolina?

+Yes, South Carolina offers a variety of tax incentives for renewable energy projects. These incentives include tax credits for the production and use of renewable energy, as well as property tax exemptions for certain renewable energy equipment. These incentives aim to encourage the adoption of clean energy technologies and support the state’s transition to a more sustainable energy landscape.