State Tax In Colorado

Welcome to our comprehensive guide on Colorado's State Tax, an essential topic for residents and businesses alike. Understanding the intricacies of state taxes is crucial for effective financial planning and compliance with the law. In this article, we delve into the specifics of Colorado's tax system, providing you with a detailed breakdown of its components, rates, and implications.

Unraveling Colorado’s State Tax Landscape

Colorado’s tax system is designed to support the state’s diverse economy and unique geographical features. With a focus on fairness and economic growth, the state’s tax policies play a pivotal role in shaping its financial landscape.

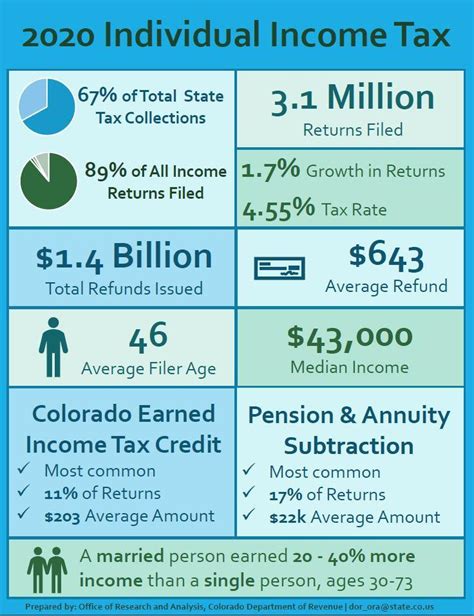

The Colorado Income Tax: A Key Component

Colorado imposes an income tax on individuals and businesses, contributing significantly to the state’s revenue. The income tax is a progressive tax, meaning that higher income earners pay a larger proportion of their income in taxes. This structure aims to ensure a balanced approach to taxation.

For individual taxpayers, Colorado offers five income tax brackets, each with its own tax rate. These brackets are adjusted annually to account for inflation. As of the current tax year, the income tax rates in Colorado are as follows:

| Income Bracket | Tax Rate |

|---|---|

| $0 - $5,750 | 2.55% |

| $5,751 - $28,750 | 3.3% |

| $28,751 - $57,500 | 4.45% |

| $57,501 - $206,250 | 5.0% |

| Above $206,250 | 5.3% |

It's important to note that these rates are applicable to Colorado residents and part-year residents. Non-residents with income sourced from Colorado may also be subject to taxation, depending on the nature of their income.

Sales and Use Tax: A Consumer Perspective

Colorado also levies a sales and use tax on the sale of tangible personal property and certain services. The sales tax is applied at the point of sale and is typically included in the displayed price of goods. The use tax, on the other hand, applies to purchases made outside the state but used within Colorado, ensuring that all consumers contribute to the state’s revenue.

The statewide sales and use tax rate in Colorado is set at 2.9%, which is relatively low compared to many other states. However, it's important to consider that local governments and special districts may impose additional sales and use taxes, resulting in a higher overall tax burden in certain areas.

For example, the city of Denver imposes a 3.62% sales and use tax on top of the state rate, bringing the total tax to 6.52%. Similarly, Boulder has a 3.5% local sales and use tax, making the total tax 6.4%. These variations highlight the importance of understanding the specific tax rates applicable to your location within Colorado.

Property Tax: Assessing Real Estate

Colorado’s property tax system is based on the assessed value of real estate properties. This tax is primarily used to fund local services and infrastructure, with a portion also allocated to state-level expenses.

The assessment rate for residential properties in Colorado is 7.2%, while for commercial and industrial properties, it's 29%. However, the effective tax rate can vary significantly depending on the location and specific tax policies of the county or municipality.

For instance, in the city of Colorado Springs, the effective property tax rate is approximately 0.65% of the assessed value, which is relatively low compared to other major cities in the state. In contrast, the city of Aurora has an effective rate of around 0.72%, reflecting the differences in local tax policies.

| City | Assessment Rate | Effective Property Tax Rate |

|---|---|---|

| Colorado Springs | 7.2% | 0.65% |

| Aurora | 7.2% | 0.72% |

Other Taxes: A Comprehensive Overview

In addition to the taxes mentioned above, Colorado imposes various other taxes to support specific industries and initiatives.

- Motor Vehicle Taxes: Colorado levies taxes on the purchase and ownership of vehicles, including registration fees and excise taxes.

- Tobacco and Cigarette Taxes: A significant portion of revenue is generated through taxes on tobacco products, contributing to healthcare and tobacco control programs.

- Lodging Taxes: Hotels and other lodging establishments are subject to a state tax of 11.25%, with additional local taxes varying by jurisdiction.

- Severance Taxes: Natural resource extraction, such as oil and gas production, is taxed at a rate of 5%, providing revenue for state funds and local governments.

Colorado’s Tax Climate: A Competitive Advantage

Colorado’s tax system is designed to foster economic growth and competitiveness. The state’s relatively low sales tax rate and diverse tax structure create a favorable environment for businesses and consumers.

For businesses, Colorado offers a corporate income tax rate of 4.63%, which is competitive when compared to other states. This, coupled with the state's progressive individual income tax system, encourages entrepreneurship and attracts a diverse range of industries.

Furthermore, Colorado's tax policies support innovation and technology-driven industries. The state offers tax incentives for research and development, as well as tax credits for renewable energy and clean technology investments. These initiatives not only stimulate economic growth but also align with Colorado's commitment to sustainability.

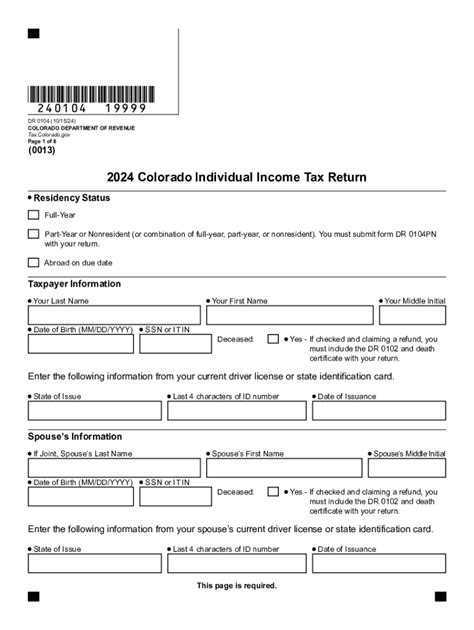

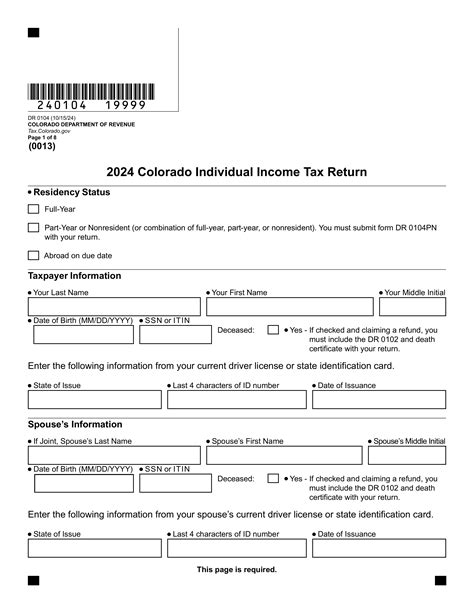

Tax Compliance and Support

Navigating Colorado’s tax system can be complex, especially for new residents and businesses. The Colorado Department of Revenue provides comprehensive resources and guidance to ensure compliance and facilitate tax understanding.

The department offers online tools, tax guides, and workshops to assist taxpayers in calculating their tax liabilities accurately. Additionally, taxpayer services are available to address specific queries and provide personalized support.

For businesses, Colorado's tax structure offers clarity and predictability. The state's commitment to transparency and streamlined tax processes enhances the overall business environment, making it an attractive destination for investment and growth.

Conclusion: Embracing Colorado’s Tax Landscape

Colorado’s state tax system is a dynamic and essential component of the state’s economy. By understanding the various taxes, rates, and implications, residents and businesses can make informed financial decisions and contribute effectively to the state’s prosperity.

As we've explored, Colorado's tax policies are designed to support fairness, economic growth, and sustainability. With a competitive tax climate and a commitment to transparency, Colorado continues to thrive as a vibrant economic hub.

FAQ

How does Colorado’s income tax system compare to other states?

+

Colorado’s income tax system is considered relatively progressive, with five tax brackets and rates ranging from 2.55% to 5.3%. This structure ensures that higher income earners contribute a larger proportion of their income in taxes. In comparison, some states have flatter tax systems with a single rate, while others have more brackets and higher top rates. Colorado’s system aims to strike a balance between fairness and revenue generation.

Are there any tax incentives or deductions available for residents or businesses in Colorado?

+

Yes, Colorado offers various tax incentives and deductions to promote economic growth and support specific industries. For residents, there are deductions for dependent care expenses, retirement savings, and certain medical expenses. Businesses can benefit from tax credits for research and development, renewable energy investments, and job creation. Additionally, Colorado provides tax incentives for film and television productions, attracting media industries to the state.

How does Colorado’s sales tax rate compare to neighboring states?

+

Colorado’s statewide sales tax rate of 2.9% is lower compared to many neighboring states. For instance, Wyoming has a sales tax rate of 5%, while New Mexico’s rate is 5.125%. However, it’s important to consider that local governments in Colorado can impose additional sales taxes, leading to higher overall rates in certain areas. Overall, Colorado’s sales tax structure provides a competitive advantage for businesses and consumers.