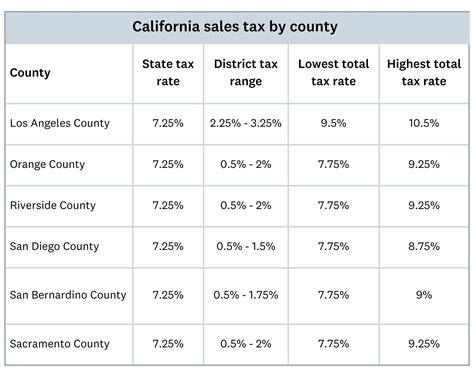

Long Beach California Sales Tax

Long Beach, California, is a vibrant coastal city known for its diverse culture, stunning beaches, and thriving economy. As a bustling hub of commerce, understanding the sales tax landscape is essential for both residents and businesses alike. In this comprehensive guide, we delve into the intricacies of Long Beach's sales tax, exploring its rates, regulations, and impact on the local economy.

The Sales Tax Structure in Long Beach

Long Beach, like many cities in California, operates within a complex sales tax system that comprises both state and local taxes. This layered tax structure can be a bit tricky to navigate, but it plays a crucial role in funding various public services and infrastructure projects.

State Sales Tax

At the state level, California imposes a general sales tax rate of 7.25%. This uniform tax is applied to most retail transactions across the state, including the sale of tangible personal property and certain services. The state sales tax is a significant source of revenue for California, contributing to statewide initiatives and programs.

Local Sales Tax

In addition to the state sales tax, Long Beach levies its own local sales and use tax to support city-specific projects and services. This local tax rate is 1.25%, bringing the total sales tax rate in Long Beach to 8.50%. It’s important to note that this local tax rate can vary across different cities and counties within California.

| Sales Tax Component | Rate |

|---|---|

| State Sales Tax | 7.25% |

| Long Beach Local Tax | 1.25% |

| Total Sales Tax in Long Beach | 8.50% |

The local sales tax in Long Beach is dedicated to funding essential services such as public safety, infrastructure maintenance, and community development projects. It ensures that the city's residents and businesses contribute directly to the upkeep and improvement of their local community.

Special Taxes and Exemptions

While the standard sales tax rates apply to most transactions, there are certain exceptions and exemptions that businesses and consumers should be aware of. For instance, California offers sales tax exemptions for specific goods and services, including:

- Prescription medications

- Certain agricultural equipment

- Educational materials

- Qualifying manufacturing machinery

Additionally, certain categories of sellers, such as nonprofit organizations and government entities, may be eligible for sales tax exemptions or reduced rates. Understanding these exemptions is crucial for businesses to ensure compliance and take advantage of any applicable tax breaks.

Impact on Local Businesses and Consumers

The sales tax structure in Long Beach has a significant impact on both local businesses and consumers. For businesses, especially those in the retail and hospitality sectors, the sales tax is a major consideration in pricing strategies and overall profitability. Businesses must carefully manage their sales tax obligations to avoid penalties and ensure smooth operations.

Consumers, on the other hand, bear the direct burden of sales tax when making purchases. While the tax may be a minor inconvenience for some, it can significantly impact the affordability of goods and services, especially for those on a tight budget. Understanding the sales tax rate can help consumers make more informed purchasing decisions and budget effectively.

Price Transparency and Consumer Awareness

In today’s competitive market, price transparency is essential for businesses to build trust with their customers. Clearly displaying sales tax amounts on price tags and invoices helps consumers understand the true cost of their purchases. This transparency fosters a more positive shopping experience and reduces potential misunderstandings or surprises at the point of sale.

Economic Growth and Investment

The sales tax revenue generated in Long Beach contributes to the city’s economic development and growth. It funds critical infrastructure projects, supports local businesses through incentives and grants, and enhances the overall quality of life for residents. By investing in its community, Long Beach creates an attractive environment for businesses and talent, fostering long-term economic prosperity.

Compliance and Reporting

Navigating the sales tax landscape requires a strong understanding of compliance and reporting requirements. Businesses in Long Beach must register with the California Department of Tax and Fee Administration (CDTFA) and obtain a seller’s permit. This permit authorizes businesses to collect and remit sales tax on behalf of the state and local government.

Sales Tax Registration and Permits

The process of obtaining a seller’s permit involves completing the appropriate forms and providing relevant business information. The CDTFA website offers a step-by-step guide to assist businesses in registering and understanding their sales tax obligations. It’s crucial for businesses to maintain accurate records and report their sales tax collections regularly to avoid penalties and ensure compliance.

Remitting Sales Tax

Businesses are typically required to remit sales tax on a periodic basis, such as monthly or quarterly. The specific schedule depends on the business’s sales volume and other factors. Late or inaccurate remittances can result in penalties and interest charges, so it’s essential for businesses to stay organized and meet their tax obligations promptly.

Future Trends and Considerations

As the economic landscape evolves, so too do sales tax regulations. Staying informed about potential changes is crucial for both businesses and consumers in Long Beach. Here are some key trends and considerations to keep in mind:

Online Sales Tax

With the rise of e-commerce, the collection and remittance of sales tax on online transactions have become increasingly complex. Businesses selling goods online must navigate a web of state and local regulations to ensure compliance. This includes understanding nexus laws, which determine when a business is required to collect sales tax in a particular state or jurisdiction.

Sales Tax Holidays

To stimulate the economy and encourage consumer spending, some states and localities offer sales tax holidays. During these designated periods, certain categories of goods are exempt from sales tax. Long Beach and California may participate in such initiatives, providing a temporary relief for consumers and a boost for local businesses.

Local Tax Initiatives

Local governments, including the city of Long Beach, may propose and implement additional tax measures to fund specific projects or address community needs. These initiatives can include bond measures, special assessments, or dedicated tax districts. Staying informed about local tax proposals is essential for businesses and residents to understand the potential impact on their finances.

Remote Seller Nexus

The concept of remote seller nexus has gained prominence in recent years. It refers to the idea that out-of-state sellers with significant economic presence in a state may be required to collect and remit sales tax on transactions with in-state customers. This has implications for online retailers and businesses with a remote presence, potentially impacting their tax obligations in Long Beach and beyond.

What happens if a business fails to collect or remit sales tax in Long Beach?

+Businesses that fail to collect or remit sales tax as required may face significant penalties and interest charges. The California Department of Tax and Fee Administration (CDTFA) has the authority to audit businesses and impose fines for non-compliance. In severe cases, businesses may even face criminal charges.

Are there any sales tax incentives or discounts available for businesses in Long Beach?

+Long Beach and California offer various incentives and tax breaks to businesses, especially those that contribute to economic development and job creation. These incentives can include tax credits, abatements, or grants. Businesses should explore these opportunities to reduce their tax burden and support their growth.

How can businesses stay updated on sales tax regulations and changes in Long Beach?

+Businesses can stay informed by regularly checking the official websites of the CDTFA and the city of Long Beach. These platforms often provide updates, newsletters, and resources to help businesses navigate the complex sales tax landscape. Additionally, seeking professional tax advice or consulting tax experts can ensure businesses stay compliant and proactive.