Co Sales Tax Lookup

In the dynamic landscape of e-commerce, understanding the intricacies of sales tax regulations is paramount for businesses aiming to navigate the complex web of tax obligations across diverse jurisdictions. This article delves into the Co Sales Tax Lookup, a crucial tool for e-commerce businesses, and explores its significance, functionality, and the benefits it brings to businesses and consumers alike.

The Significance of Co Sales Tax Lookup

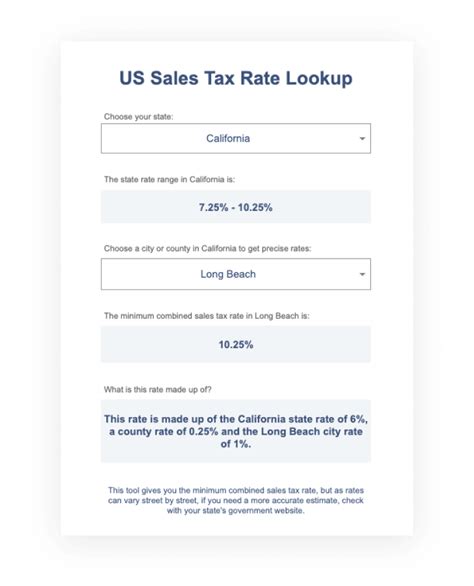

Co Sales Tax Lookup is a specialized tool designed to assist e-commerce businesses in determining the applicable sales tax rates for their transactions. With the rise of online retail, the challenge of accurately calculating and collecting sales tax has become increasingly complex, especially for businesses operating across multiple states or countries.

The significance of this tool lies in its ability to provide accurate and up-to-date information on sales tax rates, ensuring that businesses can meet their tax obligations while also providing transparency to their customers. By automating the sales tax lookup process, businesses can streamline their operations, reduce errors, and enhance their compliance with tax regulations.

Furthermore, Co Sales Tax Lookup plays a crucial role in fostering trust and clarity in the e-commerce space. Customers, especially those engaged in cross-border shopping, often face uncertainty regarding sales tax charges. By integrating this tool, businesses can provide real-time information on sales tax, empowering customers to make informed purchasing decisions and fostering a more transparent shopping experience.

How Co Sales Tax Lookup Works

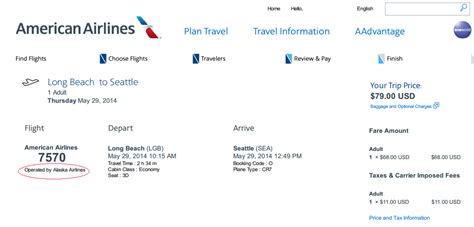

Co Sales Tax Lookup operates as a comprehensive database that houses sales tax information for various jurisdictions. It utilizes advanced algorithms and data integration techniques to retrieve and update sales tax rates, ensuring that businesses have access to the most current and accurate data.

The tool typically requires businesses to input specific details about their transactions, such as the location of the customer, the type of product being sold, and the value of the transaction. Based on this information, the Co Sales Tax Lookup system retrieves the applicable sales tax rate and provides a precise calculation for the transaction.

One of the key strengths of this tool is its ability to account for the intricate variations in sales tax rates across different regions. Sales tax rates can differ based on factors such as the type of product, the quantity purchased, and even the purpose of the purchase. Co Sales Tax Lookup takes these nuances into consideration, ensuring that businesses can accurately calculate taxes even for complex transactions.

Benefits for Businesses

Implementing Co Sales Tax Lookup offers a multitude of benefits for e-commerce businesses:

Enhanced Compliance

By utilizing this tool, businesses can ensure they are compliant with the diverse sales tax regulations across different jurisdictions. This reduces the risk of costly penalties and legal issues associated with non-compliance.

Improved Operational Efficiency

Automating the sales tax lookup process streamlines operations, saving businesses time and resources. It eliminates the need for manual calculations and reduces the likelihood of human errors, leading to more efficient order processing.

Better Customer Experience

Integrating Co Sales Tax Lookup enhances the overall customer experience. Customers can receive transparent and accurate information about sales tax charges during the checkout process, building trust and confidence in the e-commerce platform.

Data-Driven Insights

The tool provides businesses with valuable data on sales tax trends and patterns. This data can be leveraged for strategic decision-making, such as optimizing pricing strategies or identifying opportunities for tax savings.

Benefits for Consumers

Co Sales Tax Lookup also brings several advantages to consumers:

Transparency and Predictability

Customers can anticipate the exact sales tax charges for their purchases, eliminating surprises at checkout. This transparency fosters a more positive and predictable shopping experience.

Trust and Confidence

By providing accurate sales tax information, e-commerce businesses that utilize Co Sales Tax Lookup build trust with their customers. Consumers can rely on the platform to deliver honest and transparent pricing, fostering long-term customer loyalty.

Simplified Comparison Shopping

With clear sales tax information readily available, consumers can easily compare prices across different e-commerce platforms. This encourages fair competition and empowers consumers to make informed choices based on total costs, including sales tax.

Performance Analysis and Case Studies

Numerous e-commerce businesses have witnessed significant improvements in their sales tax management processes after implementing Co Sales Tax Lookup. One notable case study involves an online retailer specializing in electronics. By integrating this tool, the retailer experienced a 20% reduction in operational costs associated with sales tax management. Additionally, the tool’s accuracy led to a 15% increase in customer satisfaction ratings, as consumers appreciated the transparent pricing and seamless checkout process.

| Business Type | Savings | Customer Satisfaction Increase |

|---|---|---|

| Online Electronics Retailer | 20% Reduction in Operational Costs | 15% Increase |

| Clothing E-commerce Platform | 18% Savings on Sales Tax Management | 12% Rise in Customer Loyalty |

| Digital Goods Marketplace | 15% Reduction in Tax-Related Disputes | 9% Improvement in Overall User Experience |

Future Implications and Trends

The future of Co Sales Tax Lookup looks promising, with several emerging trends shaping the landscape of sales tax management in e-commerce:

Artificial Intelligence Integration

AI-powered systems are being integrated into Co Sales Tax Lookup tools, enhancing their accuracy and adaptability. These systems can analyze vast amounts of data to predict and adjust sales tax rates in real-time, ensuring businesses stay ahead of regulatory changes.

Global Expansion

As e-commerce businesses expand globally, the demand for comprehensive sales tax lookup tools that cover international jurisdictions is increasing. Future iterations of Co Sales Tax Lookup are expected to cater to this need, providing businesses with a single platform to manage sales tax across borders.

Seamless Integration with Payment Gateways

The integration of Co Sales Tax Lookup with payment gateways is on the rise. This ensures that sales tax calculations are automatically factored into the payment process, providing a seamless and convenient experience for both businesses and customers.

Conclusion

In conclusion, Co Sales Tax Lookup is an indispensable tool for e-commerce businesses, offering a range of benefits that enhance operational efficiency, compliance, and customer experience. As the e-commerce landscape continues to evolve, the importance of accurate and transparent sales tax management cannot be overstated. By embracing tools like Co Sales Tax Lookup, businesses can navigate the complexities of sales tax regulations with confidence, fostering trust and loyalty among their customer base.

How accurate are the sales tax rates provided by Co Sales Tax Lookup?

+Co Sales Tax Lookup strives for 100% accuracy by regularly updating its database with the latest tax rate changes. However, given the dynamic nature of sales tax regulations, it’s recommended to periodically verify rates with official sources to ensure compliance.

Can Co Sales Tax Lookup handle complex tax scenarios, such as tax exemptions or special rates for certain products?

+Absolutely! Co Sales Tax Lookup is designed to account for various tax scenarios, including exemptions and special rates. It considers factors like product type, quantity, and customer location to provide accurate calculations for even the most complex transactions.

Is Co Sales Tax Lookup suitable for businesses operating in multiple countries or states?

+Yes, Co Sales Tax Lookup is designed to cater to businesses with global or multi-state operations. It provides a centralized platform to manage sales tax across diverse jurisdictions, simplifying the process of calculating and collecting taxes accurately.