Car Sales Tax By State

Welcome to our comprehensive guide on car sales tax by state. Navigating the world of automotive sales taxes can be a complex journey, especially when considering the diverse tax landscapes across the United States. Each state has its own set of regulations, rates, and exemptions, making it crucial for car buyers and sellers to have a clear understanding of these nuances. In this expert-driven article, we'll delve into the intricacies of car sales taxes, offering valuable insights and practical tips to ensure a smooth and financially savvy transaction.

The Complex Landscape of Car Sales Tax

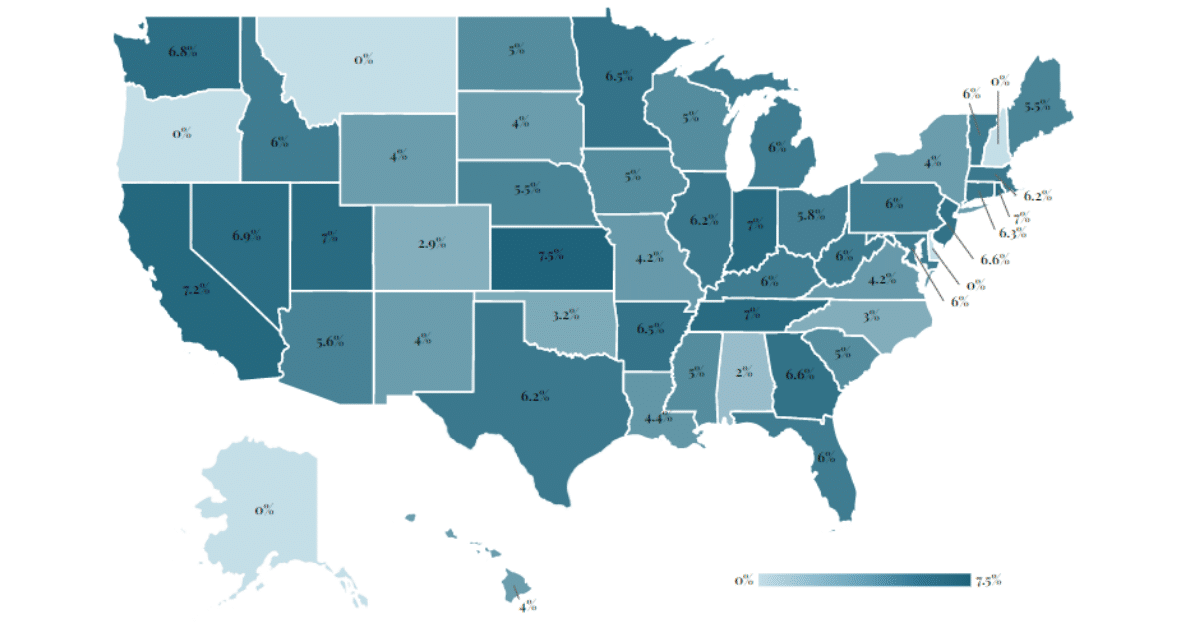

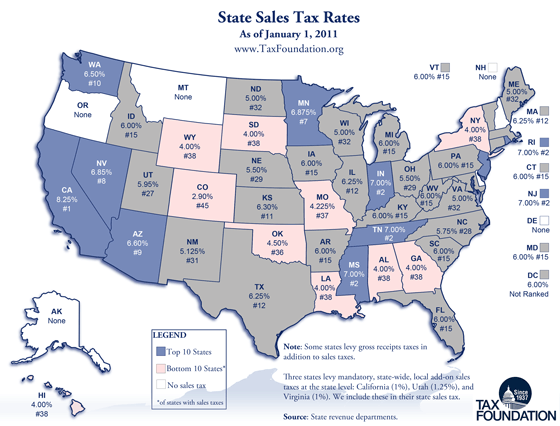

When it comes to car sales tax, the United States presents a varied landscape. While some states impose a straightforward sales tax rate on vehicle purchases, others have a more intricate system with additional fees and exemptions. This complexity arises from the fact that states have the autonomy to establish their own tax structures, leading to significant variations across the country.

For instance, consider the state of Texas, which applies a sales tax rate of 6.25% on vehicle purchases. However, this is not the whole story. Texas also imposes additional taxes, such as a Tires Fee of $0.70 per tire and a Motor Vehicle Inspection Fee of $5.50. These extra fees can significantly impact the overall cost of purchasing a vehicle, making it crucial for buyers to be aware of these additional charges.

On the other hand, states like Delaware offer a more favorable environment for car buyers. Delaware is one of the few states with no sales tax on vehicle purchases, making it an attractive destination for car shoppers looking to save on taxes. However, it's important to note that while there is no sales tax, there are other fees and costs associated with vehicle registration and ownership in Delaware.

Breaking Down the Sales Tax Structure

The sales tax structure for cars varies significantly from state to state. While some states, like Texas, have a uniform sales tax rate, others employ a more nuanced approach with different tax rates for new and used vehicles. For instance, in California, the sales tax rate for new cars is 7.25%, while the rate for used cars can vary depending on the county, ranging from 7.25% to 9.5%.

In addition to sales tax, many states also impose other fees and surcharges on vehicle purchases. These can include registration fees, title transfer fees, and even emission testing fees. For example, in New York, car buyers can expect to pay a registration fee of $25, a title transfer fee of $50, and an emission testing fee of $10 for certain vehicles.

| State | Sales Tax Rate | Additional Fees |

|---|---|---|

| Texas | 6.25% | Tires Fee, Motor Vehicle Inspection Fee |

| California | 7.25% (new), 7.25-9.5% (used) | Registration Fee, Title Transfer Fee |

| New York | Varies by county | Registration Fee, Title Transfer Fee, Emission Testing Fee |

| ... | ... | ... |

Understanding Exemptions and Discounts

While sales taxes can be a significant expense when purchasing a car, there are exemptions and discounts available in certain situations. For example, many states offer tax exemptions for vehicles purchased by individuals with disabilities or for vehicles used primarily for agricultural or business purposes.

Additionally, some states provide sales tax discounts for certain types of vehicles. In Illinois, for instance, buyers of alternative fuel vehicles, such as electric or hybrid cars, can benefit from a sales tax discount of up to $4,000. These incentives aim to promote the adoption of environmentally friendly vehicles and reduce the overall cost of ownership.

Calculating Your Sales Tax Liability

Calculating your sales tax liability is a crucial step in understanding the true cost of purchasing a car. While the process can vary slightly from state to state, the general principle remains the same. You’ll need to consider the sales tax rate, any applicable additional fees, and the total purchase price of the vehicle.

Let's take the example of a car buyer in Florida. Florida has a sales tax rate of 6% on vehicle purchases, but it also imposes a Discretionary Sales Surtax of 1.5% in certain counties. To calculate the sales tax liability for a car purchase in Florida, you would multiply the total purchase price by the combined sales tax rate (6% + 1.5% = 7.5%) to find the sales tax amount.

Using Sales Tax Calculators

To simplify the process of calculating sales tax, many online resources offer sales tax calculators. These calculators can provide an estimate of your sales tax liability based on your state, county, and the purchase price of the vehicle. While these tools are a convenient way to get a quick estimate, it’s important to note that they may not account for all the nuances of your specific situation, so it’s always advisable to consult official state tax resources for accurate information.

Tips for Minimizing Sales Tax Burden

While sales taxes are a necessary part of vehicle purchases, there are strategies you can employ to minimize your tax burden. Here are some expert tips to consider:

- Research State Tax Laws: Familiarize yourself with the tax laws and regulations in your state and the state where you plan to purchase the vehicle. Understanding the nuances can help you make informed decisions and potentially save money.

- Explore Tax Exemptions: Check if you qualify for any tax exemptions or discounts. These can significantly reduce your sales tax liability, especially if you're purchasing a vehicle for specific purposes like business or agriculture.

- Consider Buying in a Different State: In some cases, purchasing a car in a state with lower sales tax rates can be beneficial. However, it's important to consider the overall cost, including transportation fees, to ensure it's a financially sound decision.

- Negotiate with Dealers: Don't be afraid to negotiate with car dealers. While the sales tax rate is fixed, you may be able to negotiate a better deal on the overall purchase price, which can indirectly reduce your sales tax liability.

The Impact of Sales Tax on Used Car Sales

The sales tax landscape becomes even more complex when it comes to used car sales. While new car sales often have a fixed sales tax rate, used car sales can be subject to varying tax rates and additional fees. This is because used cars are often sold through a variety of channels, including private sales, dealerships, and auctions, each with its own set of tax implications.

For instance, when purchasing a used car from a private seller, the sales tax rate is typically the same as that for new cars. However, when buying from a dealership, the sales tax rate may be different, as dealerships often have specific tax arrangements with the state. Additionally, auctions may have their own tax rules, especially if they are held across state lines.

Avoiding Sales Tax Traps in Used Car Sales

When purchasing a used car, it’s crucial to be aware of potential sales tax traps. One common pitfall is failing to account for the proper sales tax rate when buying a car from an out-of-state dealer or private seller. In such cases, you may be liable for paying sales tax in both the state of purchase and the state of registration, which can result in double taxation.

To avoid this, it's essential to research the sales tax laws in both states and understand the tax implications before finalizing the purchase. This can help you budget accurately and ensure you're not caught off guard by unexpected tax expenses.

The Future of Car Sales Tax: Trends and Predictions

The landscape of car sales tax is constantly evolving, and several trends and predictions can shape the future of automotive sales taxes.

Trends in Sales Tax Rates

One notable trend is the increasing number of states considering or implementing tax increases on vehicle purchases. This is driven by the need to generate additional revenue for infrastructure projects, education, and other public services. While this can lead to higher sales tax burdens for car buyers, it also highlights the importance of staying informed about potential tax changes in your state.

The Rise of Online Car Sales

The growth of online car sales platforms has the potential to impact the sales tax landscape. As more car buyers turn to online marketplaces, states may need to adapt their tax regulations to account for these transactions. This could lead to new tax policies and collection methods, ensuring that sales taxes are collected and distributed appropriately.

Alternative Fuel Vehicles and Tax Incentives

The increasing popularity of alternative fuel vehicles, such as electric and hybrid cars, has led to a rise in tax incentives for these vehicles. Many states offer sales tax discounts, rebates, or other incentives to encourage the adoption of environmentally friendly vehicles. As this trend continues, we can expect to see more states offering such incentives, making alternative fuel vehicles a more affordable option for consumers.

How do I calculate sales tax on a car purchase?

+To calculate sales tax on a car purchase, you need to know the sales tax rate in your state and county. Multiply the total purchase price of the vehicle by the sales tax rate to find the sales tax amount. Additionally, consider any extra fees or surcharges that may apply in your state.

Are there any tax exemptions for car purchases?

+Yes, there are tax exemptions available in certain situations. These may include purchases by individuals with disabilities, vehicles used primarily for business or agricultural purposes, and alternative fuel vehicles. Check your state’s tax laws for specific exemptions and requirements.

Can I negotiate the sales tax rate on a car purchase?

+The sales tax rate is typically fixed and determined by state law. However, you can negotiate the overall purchase price of the vehicle, which can indirectly impact your sales tax liability. Negotiating with dealers can help you get a better deal and potentially save on sales tax.