Horry County Real Estate Taxes

Understanding the intricacies of property taxes is essential for any homeowner or prospective buyer. This article delves into the world of real estate taxes in Horry County, providing a comprehensive guide to help residents and investors navigate this important aspect of homeownership.

Unraveling the Basics of Horry County Real Estate Taxes

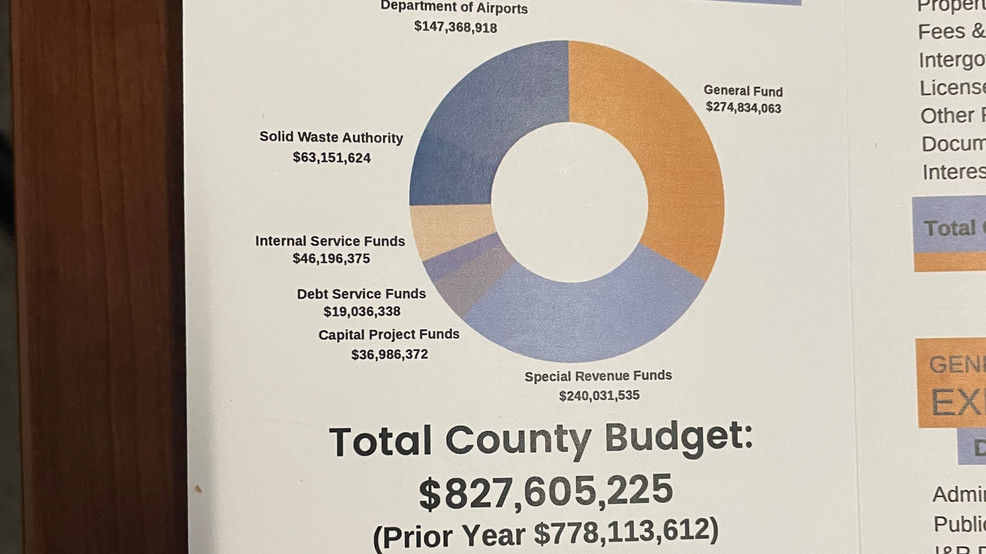

Real estate taxes, often referred to as property taxes, are a crucial component of homeownership in Horry County, South Carolina. These taxes are levied on the value of real property, which includes land and any structures permanently affixed to it. The primary purpose of these taxes is to fund local government services, such as schools, emergency services, infrastructure, and other community amenities.

In Horry County, the real estate tax system is designed to ensure that property owners contribute fairly to the community's upkeep and development. The tax rate is set annually by the Horry County Council, taking into consideration the county's budgetary needs and the assessed value of properties.

The Assessment Process

The journey towards understanding your real estate tax liability begins with the assessment process. In Horry County, the county assessor’s office is responsible for determining the fair market value of each property. This value is based on various factors, including the property’s location, size, improvements, and recent sales data of comparable properties in the area.

Once the assessor's office has determined the fair market value, it applies an assessment ratio to calculate the assessed value. In South Carolina, the assessment ratio is set at 4% of the fair market value for residential properties. This means that for every $100,000 of a property's fair market value, the assessed value is $4,000.

For example, if a residential property in Horry County is valued at $250,000 by the assessor, its assessed value would be $10,000 (4% of $250,000). This assessed value is then used to calculate the real estate tax liability.

| Property Type | Assessment Ratio |

|---|---|

| Residential | 4% |

| Commercial | 5% |

| Industrial | 5% |

| Agricultural | 4% |

Calculating Real Estate Taxes

To calculate the real estate tax liability, the assessed value of the property is multiplied by the tax rate set by the county. The tax rate, expressed as a millage rate, is the amount of tax per 1,000 of assessed value. For instance, if the millage rate is 100 mills (0.10 per 1,000), and a property's assessed value is 10,000, the tax liability would be 1,000 (10,000 x 0.10). This calculation provides the annual tax amount owed by the property owner.

It's important to note that the millage rate can change annually based on the county's budgetary requirements. Therefore, it's advisable for property owners to stay updated on the current tax rate to accurately estimate their tax liability.

Payment Options and Due Dates

In Horry County, real estate taxes are typically due in two installments: a semi-annual payment in January and July. However, taxpayers have the flexibility to pay their taxes in full by January 15th, providing some financial planning options. The county offers several payment methods, including online payments, credit card payments, and traditional mail-in checks.

Failure to pay real estate taxes by the due date can result in penalties and interest charges. It's crucial for property owners to stay informed about the payment schedule and ensure timely payments to avoid additional costs and potential legal complications.

Real Estate Tax Exemptions and Relief Programs

Horry County recognizes the financial burden that real estate taxes can place on certain individuals and offers a range of exemptions and relief programs to provide relief. These initiatives are designed to support specific groups, such as seniors, veterans, and individuals with disabilities, as well as encourage economic development in the county.

Senior Citizen Exemption

The Senior Citizen Exemption is a notable program that provides relief to homeowners aged 65 and older. To qualify, seniors must meet specific income and residency requirements. This exemption reduces the assessed value of the property for tax purposes, resulting in a lower tax liability. The amount of the exemption is determined by the county and can significantly reduce the tax burden for eligible seniors.

Veteran’s Exemption

Horry County extends its gratitude to veterans by offering a property tax exemption program. Veterans who meet certain criteria, including a disability rating of at least 100% or receipt of a Purple Heart, are eligible for this exemption. The program reduces the assessed value of the property, resulting in lower real estate taxes. This initiative is a testament to the county’s commitment to supporting those who have served our country.

Disability Exemption

For individuals with disabilities, Horry County provides a disability exemption program. This exemption is available to those who meet specific disability criteria and can demonstrate financial need. The program reduces the assessed value of the property, providing much-needed relief for those facing financial challenges due to their disability.

Homestead Exemption

The Homestead Exemption is a valuable program that offers property tax relief to homeowners who use their property as their primary residence. To qualify, homeowners must meet certain residency and ownership requirements. This exemption reduces the assessed value of the property, resulting in lower real estate taxes. The Homestead Exemption is a popular choice for many Horry County residents, providing a significant financial benefit.

Stay Informed, Stay Prepared

Navigating the complexities of real estate taxes is an essential aspect of homeownership. By understanding the assessment process, calculation methods, payment options, and available exemptions, property owners in Horry County can make informed decisions and plan their finances effectively. Staying updated on tax rates, due dates, and eligibility criteria for relief programs ensures a smoother experience when it comes to paying real estate taxes.

For further information and detailed guidelines, it's advisable to refer to the official resources provided by Horry County. These resources offer comprehensive insights into the tax system, assessment processes, and exemption programs, ensuring that property owners have access to accurate and up-to-date information.

How often are real estate tax assessments conducted in Horry County?

+

Real estate tax assessments in Horry County are typically conducted every five years. However, certain factors, such as significant property improvements or changes in market value, may trigger a reassessment outside of this cycle.

Can I appeal my property’s assessed value if I believe it is inaccurate?

+

Yes, property owners have the right to appeal their assessed value if they believe it is incorrect. The appeals process involves submitting evidence and supporting documentation to the county assessor’s office. It’s important to note that the appeal deadline is typically shortly after the assessment notices are mailed out.

Are there any tax relief programs for low-income homeowners in Horry County?

+

Yes, Horry County offers a Low-Income Homestead Exemption program. This program provides tax relief to homeowners who meet specific income requirements and use their property as their primary residence. The exemption reduces the assessed value of the property, resulting in lower real estate taxes. Eligibility criteria and application procedures can be found on the county’s official website.

What happens if I fail to pay my real estate taxes on time?

+

Failure to pay real estate taxes by the due date can result in penalties and interest charges. The county may also place a tax lien on the property, which can impact the homeowner’s credit score and ability to sell the property. It’s crucial to stay informed about payment deadlines and explore options for tax relief or payment plans if needed.

Can I deduct my real estate taxes on my federal income tax return?

+

Yes, real estate taxes are often deductible on federal income tax returns. However, the deductibility depends on various factors, including the taxpayer’s income level and the type of ownership. It’s advisable to consult with a tax professional or refer to IRS guidelines for detailed information on deducting real estate taxes.