Sales Tax Car Alabama

In the United States, sales tax is a consumption tax levied on the sale of goods and services, and it varies from state to state. Alabama, like many other states, has its own sales tax regulations and rates. Understanding the sales tax landscape in Alabama is crucial for businesses and consumers alike, especially when it comes to significant purchases like a car. In this comprehensive guide, we will delve into the intricacies of sales tax on car purchases in Alabama, providing valuable insights and expert analysis.

Sales Tax Rates in Alabama

Alabama’s sales tax system is relatively straightforward, with a state-level sales tax rate that applies uniformly across the state. As of my last update in January 2023, the general state sales tax rate in Alabama stands at 4%. However, it’s important to note that local jurisdictions within Alabama have the authority to levy additional sales taxes, creating a unique tax environment that can vary from one county or city to another.

Local Sales Tax Rates

Alabama’s local sales tax rates can significantly impact the overall sales tax burden on car purchases. These local rates are typically imposed by counties and municipalities and are added on top of the state sales tax. The local sales tax rates in Alabama can range from 0% to 7%, depending on the specific jurisdiction. For instance, the city of Birmingham has a local sales tax rate of 4%, while the county of Mobile imposes an additional 3% local sales tax.

To provide a clearer picture, let's take a look at a real-world example. If you were to purchase a car in Birmingham, Alabama, you would be subject to a combined sales tax rate of 8% - the state sales tax rate of 4% plus the local sales tax rate of 4%. This means that for every $1,000 spent on the car, you would pay an additional $80 in sales tax.

| County or City | Local Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|

| Birmingham | 4% | 8% |

| Mobile County | 3% | 7% |

| Huntsville | 5% | 9% |

| Montgomery | 2% | 6% |

| Tuscaloosa | 6% | 10% |

Sales Tax on Cars in Alabama

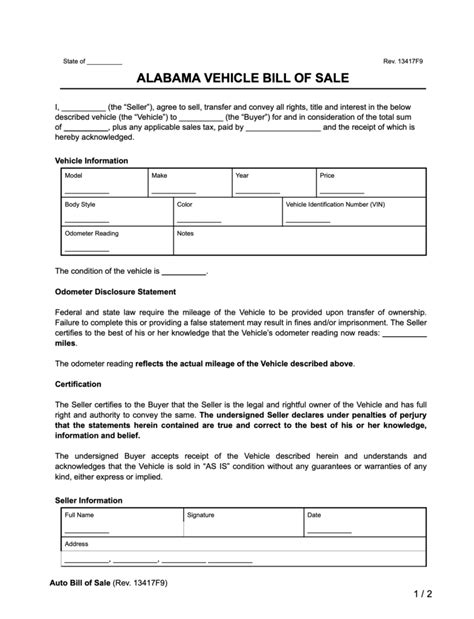

When it comes to purchasing a car in Alabama, the sales tax is calculated based on the purchase price of the vehicle. The tax is typically applied to the total cost of the car, including any additional fees, such as dealer preparation charges and destination fees. However, it’s important to note that certain exemptions and special considerations may apply to specific types of vehicles or under certain circumstances.

Vehicle Purchase Exemptions

Alabama offers sales tax exemptions for specific types of vehicles, which can significantly reduce the overall tax burden. These exemptions are typically granted for vehicles used for specific purposes, such as:

- Farm Vehicles: Agricultural vehicles used primarily for farming purposes are exempt from sales tax in Alabama.

- Disabled Individuals: Vehicles modified for the use of disabled individuals may be eligible for a sales tax exemption.

- Military Personnel: Active-duty military personnel may be exempt from paying sales tax on certain vehicle purchases.

- Government Entities: Vehicles purchased by government agencies or municipalities are often exempt from sales tax.

It's important to consult with the Alabama Department of Revenue or a tax professional to determine if your specific vehicle purchase qualifies for any of these exemptions.

Special Considerations

In addition to the general sales tax rates and exemptions, there are a few special considerations to keep in mind when purchasing a car in Alabama:

- Trade-Ins: If you trade in your old vehicle as part of the purchase, the sales tax is typically calculated based on the difference between the trade-in value and the purchase price of the new car.

- Lease-to-Own: If you opt for a lease-to-own arrangement, the sales tax may be calculated differently, and you may be required to pay it upfront or in installments.

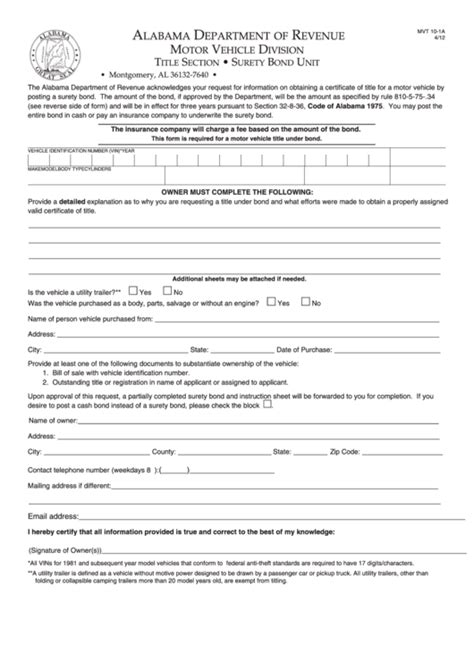

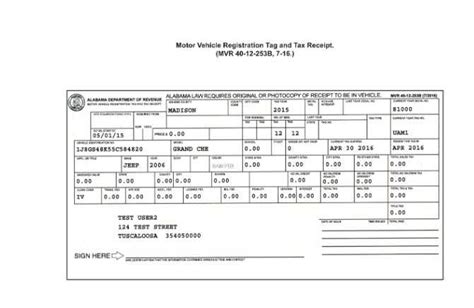

- Vehicle Registration: Sales tax on a vehicle purchase is often tied to the registration process. Make sure to understand the timing and requirements for registering your new car to avoid any penalties or delays.

Sales Tax Calculation and Payment

When purchasing a car in Alabama, the sales tax is typically calculated and included in the final price presented to you by the dealer. The dealer will calculate the sales tax based on the total purchase price and the applicable tax rates. It’s important to carefully review the final purchase agreement to ensure the sales tax is accurately calculated.

Upon completion of the purchase, the dealer will collect the sales tax and remit it to the appropriate tax authorities. As a buyer, you are responsible for ensuring that the sales tax is paid in full. Failure to pay sales tax can result in penalties and interest charges, so it's essential to stay informed and compliant.

Online Car Purchases

If you choose to purchase a car online or from an out-of-state dealer, the sales tax calculation and payment process may differ. In such cases, you may be required to pay the sales tax directly to the Alabama Department of Revenue or the appropriate tax authority. It’s crucial to understand the specific regulations and procedures for online or out-of-state car purchases to avoid any complications.

Sales Tax and Used Cars

The sales tax implications for used car purchases in Alabama are similar to those for new cars. The tax is calculated based on the purchase price, and the applicable rates and exemptions remain the same. However, there are a few additional considerations to keep in mind:

- Private Sales: If you purchase a used car from a private seller, you are responsible for paying the sales tax directly to the Alabama Department of Revenue. The tax is calculated based on the purchase price, and you must register the vehicle and provide proof of payment within a specified timeframe.

- Dealer Sales: When purchasing a used car from a dealer, the sales tax is typically included in the final price. The dealer will handle the tax payment process, but it's important to review the purchase agreement to ensure accuracy.

Future Implications and Considerations

Sales tax rates and regulations in Alabama, like in many other states, are subject to change. It’s crucial to stay updated on any legislative or regulatory changes that may impact the sales tax landscape. Additionally, as technology advances and the automotive industry evolves, new considerations may arise, such as sales tax implications for electric vehicles or autonomous cars.

Staying informed about sales tax laws and keeping track of any changes can help both businesses and consumers make more informed decisions when purchasing vehicles in Alabama. It's always advisable to consult with tax professionals or legal experts to ensure compliance and maximize potential savings.

What happens if I don’t pay sales tax on my car purchase in Alabama?

+Failing to pay sales tax on a car purchase in Alabama can result in significant penalties and interest charges. It’s important to understand that sales tax is a legal obligation, and non-compliance can lead to serious consequences. If you fail to pay the sales tax, you may be subject to fines, additional fees, and even legal action. To avoid these issues, ensure that the sales tax is accurately calculated and paid in full at the time of purchase.

Are there any sales tax incentives for electric or hybrid vehicles in Alabama?

+As of my knowledge cutoff in January 2023, Alabama does not offer specific sales tax incentives for electric or hybrid vehicles. However, it’s important to stay updated on any changes or new initiatives that may arise. Some states have implemented sales tax exemptions or credits for environmentally friendly vehicles, so it’s worth researching any potential benefits before purchasing an electric or hybrid car in Alabama.

How can I calculate the sales tax on my car purchase accurately in Alabama?

+To calculate the sales tax on your car purchase in Alabama, you’ll need to know the total purchase price of the vehicle and the applicable sales tax rates. The general state sales tax rate is 4%, and local rates may vary. You can use an online sales tax calculator or consult with a tax professional to ensure an accurate calculation. It’s important to consider any potential exemptions or special circumstances that may apply to your specific purchase.