Property Tax Baltimore City

Welcome to our comprehensive guide on Property Tax in Baltimore City. In this in-depth article, we will explore the intricacies of property taxation in this vibrant city, providing you with valuable insights and information to navigate the process with ease. From understanding the assessment system to exploring strategies for effective tax management, we aim to equip you with the knowledge needed to make informed decisions regarding your property tax obligations.

Understanding Property Tax in Baltimore City

Property tax is an essential component of Baltimore City’s revenue system, playing a vital role in funding various public services and infrastructure projects. It is a local tax levied on the assessed value of real estate properties, including residential homes, commercial buildings, and vacant land. Understanding the property tax system is crucial for property owners to ensure compliance and optimize their financial planning.

Baltimore City's property tax system operates under the jurisdiction of the Baltimore City Department of Finance, which is responsible for assessing property values, collecting taxes, and enforcing compliance. The department employs a team of professionals who specialize in real estate valuation and taxation, ensuring a fair and equitable assessment process.

The Assessment Process

The assessment process in Baltimore City is a systematic evaluation of property values, conducted to determine the taxable base for each property. Assessors take into account various factors such as the property’s location, size, condition, and recent sales data of comparable properties. This data-driven approach aims to provide an accurate reflection of the property’s market value, which forms the basis for calculating the property tax liability.

Property owners in Baltimore City receive an annual assessment notice, which details the assessed value of their property. This notice serves as a critical document, allowing property owners to review and understand the basis of their tax obligations. It is essential to carefully review the assessment to ensure accuracy and identify any potential discrepancies.

| Assessment Year | Average Assessment Increase |

|---|---|

| 2022 | 3.5% |

| 2021 | 2.8% |

| 2020 | 4.2% |

Tax Rates and Calculations

The property tax rate in Baltimore City is determined by the city’s governing bodies and can vary based on the property’s classification and location. Generally, residential properties have a lower tax rate compared to commercial properties. The tax rate is applied to the assessed value of the property, resulting in the property tax liability for the year.

To calculate the property tax, the assessed value is multiplied by the applicable tax rate. For instance, if a residential property has an assessed value of $200,000 and the tax rate is 1.2%, the property tax liability would be $2,400 for the year.

It is important to note that the tax rate may change annually, so property owners should stay updated on any rate adjustments to accurately estimate their tax obligations.

Tax Due Dates and Payment Options

Property taxes in Baltimore City are typically due in two installments, with specific due dates set by the Department of Finance. Late payments may incur penalties and interest charges, so it is crucial to stay informed about the payment deadlines.

Baltimore City offers various payment options to accommodate different preferences and needs. Property owners can choose to pay their taxes online, through a secure payment portal, or by mail using the provided remittance voucher. Additionally, payment by phone or in person at designated locations is also available.

To ensure timely payment, property owners should mark their calendars with the due dates and choose the payment method that best suits their convenience.

Strategies for Effective Property Tax Management

Effective property tax management is crucial for property owners to optimize their financial strategies and minimize tax burdens. Here are some strategies to consider:

Understanding the Appeal Process

If a property owner believes that their property’s assessed value is inaccurate, they have the right to appeal the assessment. The appeal process provides an opportunity to challenge the assessment and potentially reduce the taxable value, resulting in lower property taxes. It is essential to understand the appeal process and gather relevant evidence to support your case.

Baltimore City offers a comprehensive appeals process, which typically involves submitting an appeal application, providing supporting documentation, and attending a hearing before the Property Tax Assessment Appeals Board. It is advisable to consult with a tax professional or legal advisor to navigate the appeals process effectively.

Exploring Tax Incentives and Exemptions

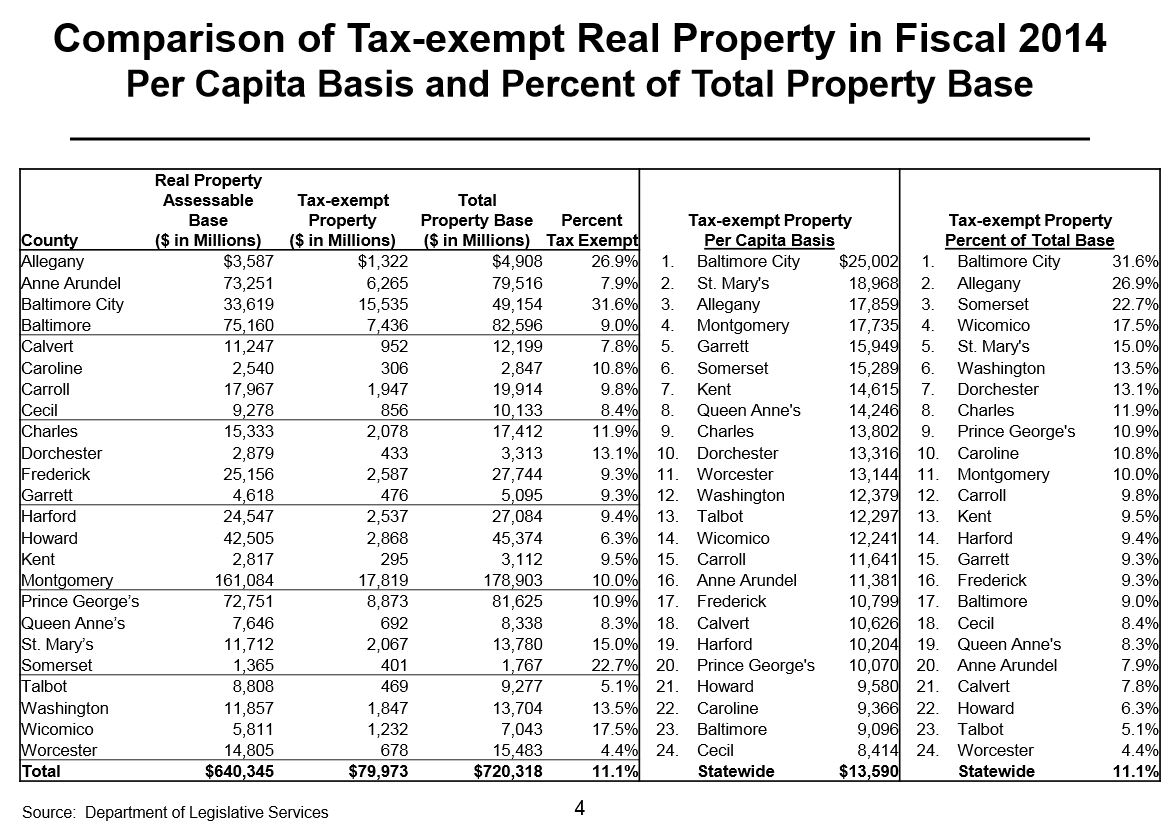

Baltimore City offers various tax incentives and exemptions to eligible property owners, aimed at promoting economic development, affordable housing, and community revitalization. These incentives can significantly reduce property tax liabilities, making them an attractive option for property owners.

Some common tax incentives include the Homesteader's Tax Credit, which provides a reduction in property taxes for owner-occupied residential properties, and the Commercial Tax Abatement Program, which offers tax relief for eligible commercial developments. Additionally, certain properties, such as those owned by religious organizations or used for charitable purposes, may qualify for tax exemptions.

Optimizing Property Value through Improvements

Strategic improvements to your property can potentially increase its value, which may lead to higher property tax assessments. However, by carefully planning and executing improvements, property owners can optimize their property’s value while managing the potential impact on taxes.

When considering improvements, it is essential to assess the cost-benefit analysis and understand how the changes may affect the property's assessed value. Some improvements, such as energy-efficient upgrades or landscaping enhancements, may provide a better return on investment and minimize the impact on property taxes.

Staying Informed and Engaged

Staying informed about property tax regulations, assessment trends, and available resources is crucial for effective tax management. Property owners should actively seek information from reliable sources, such as the Baltimore City Department of Finance’s website, local tax professionals, and community forums.

Additionally, engaging with local government officials and participating in community meetings can provide valuable insights into tax policies and potential changes. By staying informed and engaged, property owners can anticipate challenges, seize opportunities, and make well-informed decisions regarding their property tax obligations.

The Impact of Property Taxes on Baltimore City’s Economy

Property taxes play a significant role in shaping Baltimore City’s economy and its overall development. The revenue generated from property taxes contributes to funding essential public services, infrastructure projects, and community initiatives, directly impacting the city’s growth and prosperity.

Funding Public Services

Property tax revenue is a major source of funding for various public services in Baltimore City. These services include education, public safety, healthcare, transportation, and social programs. By investing in these critical areas, property taxes help create a robust and vibrant community, benefiting both residents and businesses.

For instance, property tax revenue supports the city's public school system, ensuring access to quality education for all students. It also funds public safety initiatives, such as law enforcement and emergency response services, contributing to a safer and more secure community.

Investing in Infrastructure

Property taxes are a vital source of funding for infrastructure development and maintenance in Baltimore City. These funds are utilized to improve roads, bridges, public transportation systems, and other essential infrastructure projects. Well-maintained infrastructure not only enhances the city’s functionality but also attracts businesses and promotes economic growth.

By investing in infrastructure, Baltimore City can create a more attractive and competitive business environment, encouraging investment and job creation. Additionally, improved infrastructure enhances the overall quality of life for residents, making the city a desirable place to live and work.

Supporting Community Initiatives

Property tax revenue extends beyond public services and infrastructure, contributing to various community initiatives and programs. These initiatives aim to address social issues, promote cultural diversity, and enhance the overall well-being of Baltimore City’s residents.

For example, property tax funds support programs focused on affordable housing, community development, and neighborhood revitalization. These initiatives help create inclusive and thriving communities, fostering a sense of belonging and social cohesion.

Future Outlook and Potential Changes

As Baltimore City continues to evolve and adapt to changing economic and social landscapes, the property tax system may undergo modifications to address emerging challenges and opportunities. Staying informed about potential changes is crucial for property owners to navigate the evolving tax landscape effectively.

Potential Tax Reform Initiatives

Baltimore City may explore tax reform initiatives to enhance the fairness and efficiency of the property tax system. These initiatives could involve reevaluating assessment methodologies, adjusting tax rates, or introducing new incentives and exemptions. By implementing reforms, the city aims to create a more equitable and sustainable tax structure.

Property owners should closely monitor any proposed tax reforms and engage in public consultations to provide valuable input and feedback. By actively participating in the decision-making process, property owners can ensure that their interests are considered and contribute to shaping a tax system that aligns with the city's goals and their own financial well-being.

Economic Development Strategies

Baltimore City’s leadership recognizes the importance of fostering economic growth and attracting investment. As part of its economic development strategies, the city may explore tax incentives and policies to encourage business expansion and job creation. These initiatives could include tax abatements, tax credits, or targeted investments in specific industries.

Property owners should stay updated on these economic development strategies, as they may present opportunities for business growth and community enhancement. By aligning their property tax strategies with the city's vision, property owners can contribute to the overall prosperity and resilience of Baltimore City.

Community Engagement and Collaboration

Effective property tax management is not solely the responsibility of individual property owners but also involves collaboration with the local community and government. By fostering open communication and engagement, property owners can contribute to shaping tax policies that benefit the entire community.

Baltimore City encourages community engagement through various platforms, such as public forums, town hall meetings, and online feedback channels. Property owners should actively participate in these initiatives, share their insights and concerns, and work collaboratively with local leaders to create a tax system that promotes fairness, transparency, and economic prosperity.

Conclusion

Property tax in Baltimore City is a critical component of the city’s revenue system, impacting both property owners and the overall economic development. By understanding the assessment process, tax rates, and available strategies, property owners can effectively manage their tax obligations and contribute to the city’s growth. Additionally, staying informed about potential changes and engaging with the community allows property owners to shape the future of Baltimore City’s tax landscape.

We hope this comprehensive guide has provided you with valuable insights and knowledge to navigate the world of property tax in Baltimore City. Remember, effective tax management is a continuous process, and staying informed is key to making informed decisions. For further assistance and expert advice, consider consulting with tax professionals or legal advisors who specialize in property taxation.

How often are property assessments conducted in Baltimore City?

+Property assessments in Baltimore City are conducted annually. The Department of Finance assesses the value of properties to determine the taxable base for each property.

What are the tax rates for residential and commercial properties in Baltimore City?

+The tax rates can vary depending on the property’s classification and location. As of my last update, the residential tax rate was 1.2%, while the commercial tax rate was 1.4%. It is advisable to check with the Baltimore City Department of Finance for the most current tax rates.

Can property owners appeal their assessed value?

+Yes, property owners have the right to appeal their assessed value if they believe it is inaccurate. The appeal process involves submitting an application, providing supporting documentation, and attending a hearing before the Property Tax Assessment Appeals Board.

What payment options are available for property taxes in Baltimore City?

+Baltimore City offers various payment options, including online payments through a secure portal, payment by mail using a remittance voucher, payment by phone, and in-person payments at designated locations.

How do property taxes impact the local economy and community development in Baltimore City?

+Property taxes play a significant role in funding public services, infrastructure projects, and community initiatives. The revenue generated contributes to the overall economic growth, attracts investment, and enhances the quality of life for residents and businesses in Baltimore City.