Ny Child Tax Credits

The New York Child Tax Credits (CTC) program is a vital financial support system for families in the state, offering much-needed relief to those with children. As a complex yet crucial aspect of New York's tax landscape, the CTC has seen significant changes and expansions over the years, making it an important topic to explore and understand for residents, especially those with growing families.

Understanding the New York Child Tax Credits

The New York Child Tax Credits are a set of tax credits designed to provide financial assistance to families with children, reducing the overall tax burden and promoting economic stability. These credits are an essential part of the state’s tax policy, helping to ensure that families can afford the costs associated with raising children.

The CTC program in New York is unique in its design and application, offering a combination of federal and state-specific credits. It's a dynamic system that adapts to the changing needs of families and the economic landscape, making it a critical tool for financial planning and stability.

The Federal Child Tax Credit: A National Safety Net

The federal Child Tax Credit is a cornerstone of the US tax system, offering a credit of up to $2,000 per qualifying child under the age of 17. This credit is partially refundable, meaning that even those who don’t owe taxes can still benefit from a portion of the credit. This federal support is a crucial safety net for families across the nation.

For instance, consider the Smith family, residing in Buffalo, NY. With three children under the age of 16, they qualify for a substantial federal Child Tax Credit, helping them offset the costs of raising their family. This credit, when combined with other state-specific benefits, can make a significant difference in their financial stability and overall quality of life.

| Federal CTC Qualification | Details |

|---|---|

| Age Requirement | Child must be under 17 years old |

| Refundable Portion | Up to $1,400 (30% of the credit) |

| Maximum Credit | $2,000 per qualifying child |

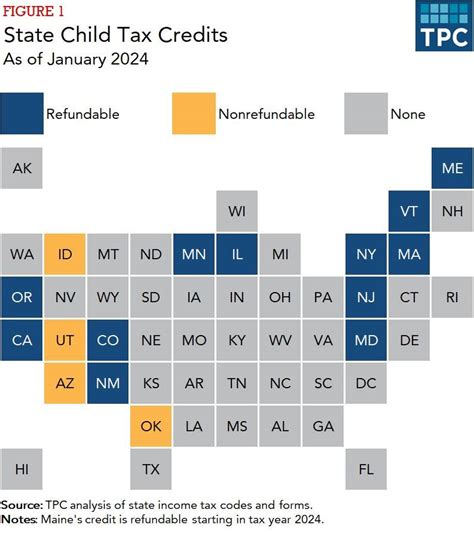

The New York State Child Tax Credits: A Local Boost

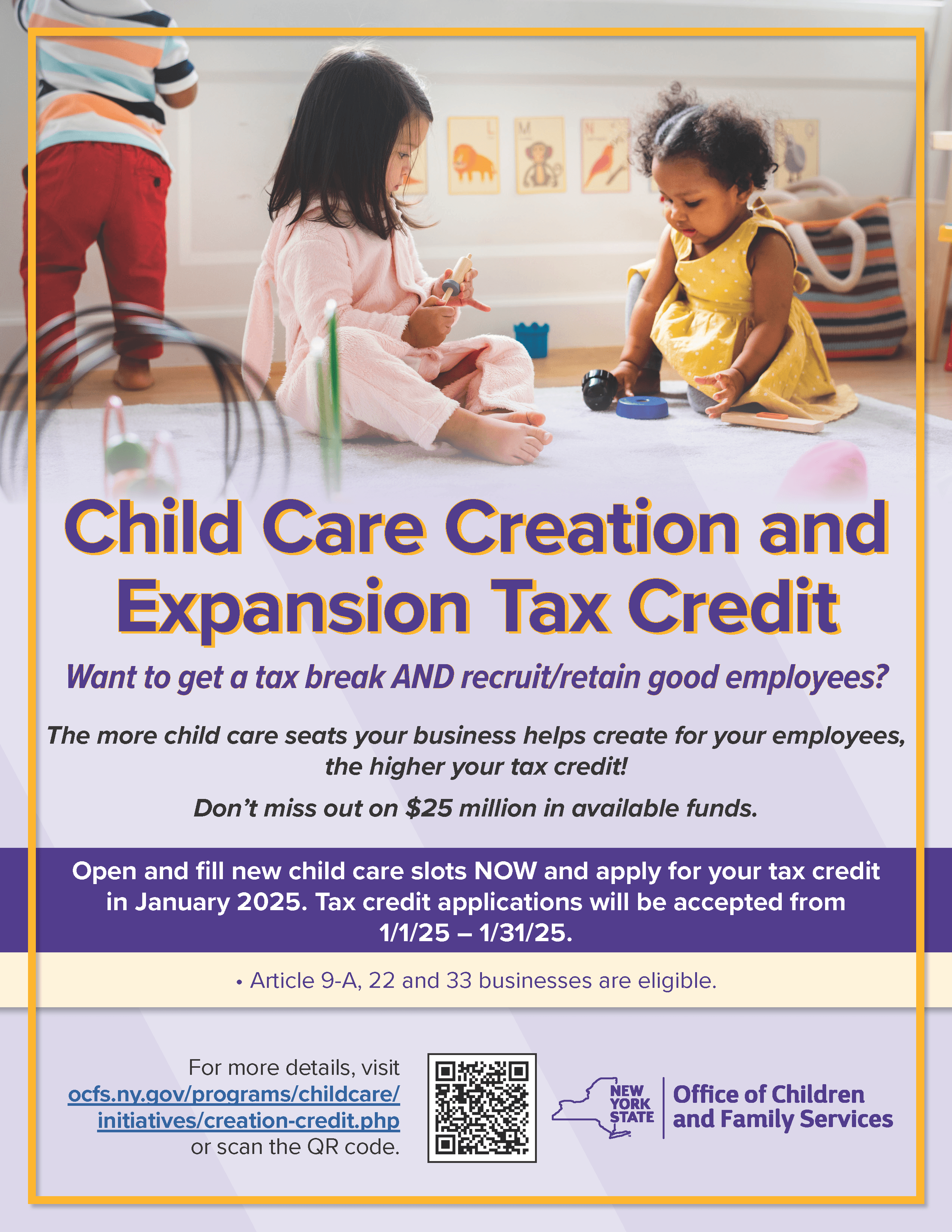

In addition to the federal credit, New York State offers its own set of Child Tax Credits, designed to further support families within the state. These credits include the New York State Child and Dependent Care Credit, the New York State Child Health Plus Premium Assistance Credit, and the New York State Earned Income Tax Credit (EITC), all of which provide additional financial relief to families.

For example, the Jones family, residing in Manhattan, NY, with two children, can benefit from the New York State Child and Dependent Care Credit. This credit helps offset the costs of childcare, a significant expense for many working parents. Combined with the federal CTC, these state-specific credits can provide a substantial financial boost to families like the Joneses.

| New York State CTCs | Details |

|---|---|

| Child and Dependent Care Credit | Up to 35% of childcare expenses, with a maximum credit of $3,000 |

| Child Health Plus Premium Assistance Credit | Up to $500 per child for health insurance premiums |

| Earned Income Tax Credit (EITC) | Varies based on income and number of children, maximum credit is $10,345 |

Eligibility and Application Process

Understanding the eligibility criteria and application process for the New York Child Tax Credits is crucial for families looking to maximize their financial benefits. The criteria can be complex, but with careful planning and attention to detail, families can ensure they receive the credits they’re entitled to.

Eligibility Criteria

The eligibility criteria for the New York Child Tax Credits are multifaceted and depend on various factors, including income, family size, and the specific credit being applied for. For instance, the federal Child Tax Credit has income limits, with the credit starting to phase out for single filers earning more than 200,000 and joint filers earning more than 400,000. On the other hand, the New York State Child and Dependent Care Credit is available to all taxpayers, regardless of income.

Let's consider the Williams family, residing in Rochester, NY. With two children and a combined income of $120,000, they meet the income requirements for the federal Child Tax Credit and the New York State Child Health Plus Premium Assistance Credit. However, they might not qualify for the maximum benefit of the New York State EITC, as this credit has income limits and is designed to support lower-income families.

| Credit | Income Limits |

|---|---|

| Federal Child Tax Credit | Phases out for single filers earning over $200,000 and joint filers earning over $400,000 |

| New York State EITC | Varies based on family size and filing status, maximum income for maximum benefit is $59,000 for a family of four |

Application Process

The application process for the New York Child Tax Credits involves a series of steps, each critical to ensuring a successful claim. The process begins with gathering the necessary documentation, which can include proof of income, proof of residency, and documentation related to the children, such as birth certificates or adoption papers.

Once the documentation is in order, families can proceed to complete the appropriate tax forms. For the federal Child Tax Credit, this involves filling out Form 1040 and attaching Schedule 8812. For the New York State Child Tax Credits, the forms can vary, but often include the NY-220, NY-221, and NY-222. These forms require detailed information about income, family size, and any relevant expenses.

After completing the forms, families must submit them, along with their supporting documentation, to the appropriate tax authorities. This can be done electronically through online filing systems or by mail. It's crucial to ensure that all forms are filled out accurately and completely to avoid any delays or issues with the processing of the credits.

Maximizing Your Benefits

The New York Child Tax Credits offer a significant opportunity for families to reduce their tax burden and improve their financial stability. However, navigating the complex world of tax credits can be challenging. To ensure you’re maximizing your benefits, it’s crucial to stay informed, plan ahead, and seek professional advice when needed.

Stay Informed

The tax landscape is ever-changing, with new laws, regulations, and credits introduced regularly. Staying informed about these changes is crucial to ensuring you’re aware of any updates or improvements to the Child Tax Credits that could benefit your family. This includes keeping an eye on federal and state tax updates, as well as following relevant news and discussions on tax forums or platforms.

For instance, in 2021, the federal Child Tax Credit was temporarily expanded as part of the American Rescue Plan, offering a larger credit and making it fully refundable. Families who were aware of this change could ensure they took advantage of the increased benefit, providing additional financial support during a challenging time.

Plan Ahead

Planning ahead is a crucial aspect of maximizing your Child Tax Credits. This involves not only understanding the current tax year’s credits but also looking ahead to future tax years and planning your financial strategies accordingly. This can include adjusting your income, contributing to tax-advantaged accounts, or considering the impact of major life events, such as having another child or changing jobs.

The Martinez family, for example, planned ahead by contributing to a Health Savings Account (HSA) to reduce their taxable income. This not only helped them save for future medical expenses but also increased their eligibility for the Child Tax Credits, as the credits are often income-based. By taking a proactive approach, they were able to maximize their benefits and ensure a more secure financial future for their family.

Seek Professional Advice

The world of taxes can be complex, and navigating it alone can be challenging. Seeking professional advice from tax experts or financial advisors can provide valuable insights and guidance. These professionals can help you understand the nuances of the Child Tax Credits, ensure you’re claiming all the credits you’re entitled to, and offer strategies to maximize your benefits.

For instance, a financial advisor might suggest that the Johnson family, with a complex financial situation and multiple sources of income, consider forming an LLC to manage their rental properties. This could not only simplify their tax filing but also potentially increase their eligibility for certain tax credits, including the Child Tax Credits, by reducing their overall taxable income.

Future Outlook and Potential Changes

The New York Child Tax Credits, like all tax policies, are subject to change and evolution. As the economic landscape shifts and new priorities emerge, the state and federal governments may adjust these credits to better serve the needs of families. Understanding the potential future changes and their implications can help families prepare and plan effectively.

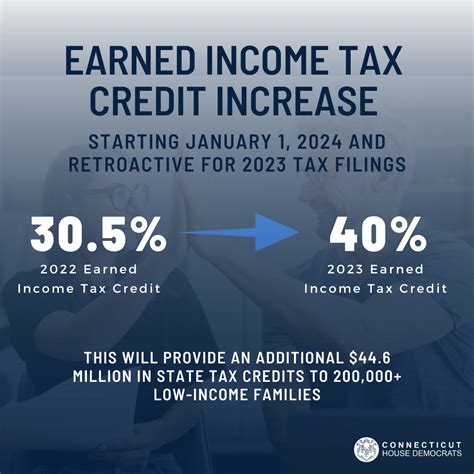

Recent Changes and Their Impact

In recent years, the New York Child Tax Credits have seen several significant changes. For instance, the New York State EITC was expanded in 2021, increasing the maximum credit and making it available to more families. This change was a direct response to the economic challenges faced by many families during the COVID-19 pandemic, providing much-needed financial relief.

Similarly, the federal Child Tax Credit was temporarily expanded as part of the American Rescue Plan, offering a larger credit and making it fully refundable. This change was designed to provide additional support to families during a difficult economic period, helping to offset the costs of raising children.

Potential Future Adjustments

Looking ahead, there are several potential adjustments that could impact the New York Child Tax Credits. These include changes to income limits, credit amounts, and the introduction of new credits or the expansion of existing ones. For instance, there have been discussions about expanding the New York State Child and Dependent Care Credit to cover a broader range of expenses, such as educational costs beyond childcare.

Additionally, with the ongoing debate about universal basic income and child allowances, there could be potential shifts in the structure of the Child Tax Credits. These changes could provide more consistent and predictable financial support to families, helping to reduce financial stress and promote long-term economic stability.

What is the maximum benefit I can receive from the New York Child Tax Credits?

+

The maximum benefit you can receive from the New York Child Tax Credits depends on various factors, including your income, family size, and the specific credits you qualify for. For instance, the federal Child Tax Credit offers a maximum credit of 2,000 per qualifying child, while the New York State EITC can provide a maximum credit of 10,345. It’s important to calculate your eligibility for each credit to determine your maximum benefit.

Are there any income limits for the New York Child Tax Credits?

+

Yes, there are income limits for certain New York Child Tax Credits. For example, the federal Child Tax Credit starts to phase out for single filers earning over 200,000 and joint filers earning over 400,000. The New York State EITC also has income limits, with the maximum benefit available to families with an income below a certain threshold.

Can I receive both the federal and state Child Tax Credits?

+

Yes, you can receive both the federal and state Child Tax Credits if you meet the eligibility criteria for each. These credits are designed to work together to provide maximum financial support to families. However, it’s important to understand the specific requirements and limits of each credit to ensure you’re claiming them correctly.

How often do the New York Child Tax Credits change?

+

The New York Child Tax Credits can change annually, based on state and federal legislation. While some changes may be minor adjustments, others can be significant expansions or contractions of the credits. It’s important to stay informed about any updates to ensure you’re maximizing your benefits each year.