Sales Tax For Philadelphia Pa

Sales tax is an essential aspect of commerce and consumer spending, and it plays a crucial role in the economic landscape of Philadelphia, Pennsylvania. In this comprehensive article, we will delve into the specifics of sales tax in Philadelphia, exploring its rates, regulations, and implications for businesses and consumers alike. By understanding the sales tax structure, we can gain valuable insights into the economic dynamics of this vibrant city.

Understanding Sales Tax in Philadelphia

Philadelphia, often referred to as the “City of Brotherly Love,” is not only a historic and cultural hub but also a significant economic center in the United States. With a diverse range of industries and a thriving business environment, the sales tax system in Philadelphia is an intricate component of its economic framework.

Sales tax in Philadelphia, like many other jurisdictions, is a tax levied on the sale of goods and services. It is a consumption tax, meaning it is incurred by the end consumer and is typically added to the retail price of an item or service. The revenue generated from sales tax contributes to the city's budget, funding essential services and infrastructure projects.

Sales Tax Rates in Philadelphia

The sales tax rate in Philadelphia consists of several components, each with its own unique purpose and allocation. Understanding these rates is crucial for businesses and consumers alike, as it directly impacts the overall cost of goods and services.

| Tax Type | Rate | Description |

|---|---|---|

| Philadelphia Sales Tax | 1.5% | The city of Philadelphia imposes a sales tax on most goods and services sold within its boundaries. This tax is in addition to other state and local taxes. |

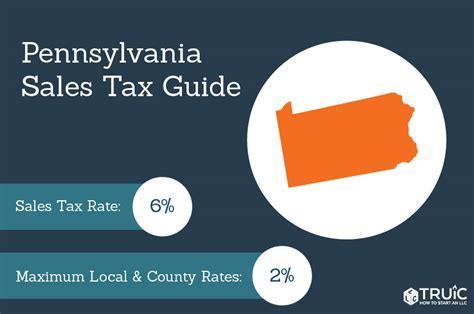

| Pennsylvania State Sales Tax | 6% | The state of Pennsylvania levies a sales tax across the entire state, which applies to a wide range of transactions. |

| Mercantile Tax | 2.48% | Philadelphia also imposes a mercantile tax on businesses based on their gross receipts. This tax is separate from the sales tax and is an additional obligation for businesses. |

| Additional Local Taxes | Varies | Certain municipalities within Philadelphia County may impose additional local sales taxes, which can vary depending on the specific location. These taxes are often used to fund local initiatives and projects. |

It's important to note that the sales tax rates mentioned above are subject to change, and businesses should stay updated with the latest regulations to ensure compliance. The complex nature of sales tax laws requires businesses to carefully navigate these rates to avoid any legal or financial implications.

Sales Tax Exemptions and Special Considerations

While the sales tax is applicable to a broad range of goods and services, there are certain exemptions and special considerations that businesses and consumers should be aware of. These exemptions can significantly impact the overall tax liability and should be carefully considered.

- Food and beverages: In Philadelphia, prepared food and beverages are subject to sales tax. However, groceries and non-prepared food items are typically exempt, providing some relief to consumers' grocery budgets.

- Clothing and footwear: Sales tax is generally applicable to clothing and footwear purchases. However, there are specific exemptions for certain items, such as children's clothing and footwear, which can vary based on the purchase price.

- Prescription medications: Philadelphia exempts the sale of prescription medications from sales tax, providing a crucial benefit to individuals with medical needs.

- Certain services: Some services, such as legal services, accounting services, and certain healthcare services, are exempt from sales tax in Philadelphia. This exemption encourages the growth of these industries and provides cost savings for consumers.

- Homestead Exemption: Philadelphia offers a homestead exemption for homeowners who qualify based on income and other criteria. This exemption reduces the property tax burden for eligible homeowners.

Businesses should stay informed about these exemptions and special considerations to ensure they are applying the correct tax rates to their transactions. Misapplication of sales tax can lead to legal issues and financial penalties.

Compliance and Reporting for Businesses

For businesses operating in Philadelphia, compliance with sales tax regulations is a critical aspect of their financial operations. Accurate reporting and remittance of sales tax are essential to maintain a positive relationship with tax authorities and avoid penalties.

Registration and Licensing

Before engaging in taxable sales, businesses must obtain the necessary licenses and registrations. In Philadelphia, businesses are required to register with the Pennsylvania Department of Revenue and obtain a Sales and Use Tax License. This license allows businesses to collect and remit sales tax on behalf of the government.

The registration process involves providing detailed information about the business, such as its legal name, address, and contact information. Businesses must also designate a responsible person who will be accountable for sales tax compliance and reporting.

Sales Tax Collection and Remittance

Businesses are responsible for collecting sales tax from customers at the point of sale. This tax is added to the retail price of the goods or services, and the business acts as a trustee for the government, holding the collected tax until it is remitted.

The frequency of sales tax remittance varies depending on the business's sales volume and tax liability. Some businesses may be required to remit sales tax on a monthly, quarterly, or annual basis. It is crucial for businesses to adhere to these deadlines to avoid late payment penalties.

Sales Tax Returns and Reporting

In addition to remitting sales tax, businesses must also file sales tax returns. These returns provide a detailed breakdown of the sales tax collected during a specific period. The information required includes the total taxable sales, the amount of sales tax collected, and any applicable exemptions or deductions.

Businesses typically file their sales tax returns electronically, using the online systems provided by the Pennsylvania Department of Revenue. These returns must be filed within the specified deadlines to ensure timely compliance.

Impact on Consumer Spending and Economic Growth

Sales tax has a direct impact on consumer spending patterns and, consequently, the economic growth of Philadelphia. Understanding how sales tax influences consumer behavior is crucial for businesses and policymakers alike.

Consumer Behavior and Sales Tax

Sales tax can significantly affect consumers’ purchasing decisions and overall spending habits. Higher sales tax rates can discourage consumers from making certain purchases, especially for non-essential items. This behavior can lead to a shift in consumer spending towards neighboring jurisdictions with lower tax rates.

However, sales tax also provides an incentive for consumers to support local businesses and economies. By shopping locally, consumers contribute to the growth of their community and help generate revenue for essential services and infrastructure.

Economic Growth and Sales Tax Revenue

The revenue generated from sales tax is a vital source of funding for Philadelphia’s government and its various initiatives. This revenue is used to support public services, infrastructure projects, and economic development programs.

A healthy and vibrant economy attracts businesses and investors, leading to increased tax revenue and job opportunities. As the city's economic growth continues, the sales tax base expands, providing a positive feedback loop that benefits both businesses and residents.

Future Outlook and Potential Changes

The sales tax landscape is dynamic, and changes in tax rates or regulations are not uncommon. As Philadelphia continues to evolve economically, there may be proposals for adjustments to the current sales tax structure.

Potential Sales Tax Reforms

Some policymakers and economists advocate for a simplification of the sales tax system. This could involve consolidating various taxes, such as the sales tax and the mercantile tax, into a single, more streamlined tax structure. Such reforms aim to reduce administrative burdens for businesses and improve overall tax compliance.

Additionally, there may be discussions around adjusting tax rates to address specific economic needs or concerns. For example, lowering sales tax rates during economic downturns can provide a boost to consumer spending and stimulate economic activity.

Impact on E-commerce and Remote Sales

The rise of e-commerce and remote sales presents unique challenges for sales tax collection. With the increasing popularity of online shopping, ensuring compliance and collecting sales tax from remote sellers can be complex. Philadelphia, like many other jurisdictions, is exploring ways to effectively tax these transactions to maintain a level playing field for local businesses.

As technology advances and consumer behavior evolves, the sales tax system must adapt to ensure fair and efficient tax collection.

Conclusion

Sales tax in Philadelphia is a multifaceted aspect of the city’s economic ecosystem. From the intricate web of tax rates and exemptions to the impact on consumer behavior and economic growth, understanding sales tax is crucial for businesses, consumers, and policymakers alike.

By staying informed about sales tax regulations and their implications, businesses can navigate the complex tax landscape with confidence. Consumers, too, can make more informed purchasing decisions, knowing how sales tax affects their overall spending. Ultimately, a well-managed and efficient sales tax system contributes to the prosperity and sustainability of Philadelphia's vibrant economy.

What is the current sales tax rate in Philadelphia, PA?

+

The current sales tax rate in Philadelphia, PA, is 8.5% as of 2024. This rate includes the Pennsylvania state sales tax of 6%, the Philadelphia city sales tax of 1.5%, and the Additional Philadelphia County tax of 1%.

Are there any sales tax holidays in Philadelphia?

+

No, there are currently no sales tax holidays in Philadelphia. However, certain items like clothing and footwear below a specific price threshold may be exempt from sales tax during certain periods.

Do online purchases made in Philadelphia incur sales tax?

+

Yes, online purchases made from businesses located in Philadelphia are generally subject to sales tax. The sales tax applies to the total purchase amount, including shipping and handling fees.

Are there any special sales tax rates for certain industries in Philadelphia?

+

No, Philadelphia does not have special sales tax rates for specific industries. The sales tax rate is consistent across all industries, except for certain exemptions like food and prescription medications.

How often do sales tax rates change in Philadelphia?

+

Sales tax rates in Philadelphia are subject to change by the city government and can be adjusted annually or as needed to meet budgetary requirements. It’s important for businesses and consumers to stay updated with the latest rates.