Augusta Rule Taxes

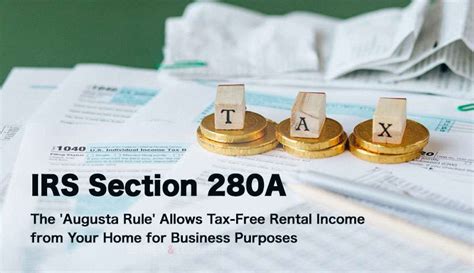

Welcome to an in-depth exploration of the Augusta Rule Taxes, a unique and intriguing aspect of the world-renowned Augusta National Golf Club. This article will delve into the history, purpose, and impact of these taxes, offering a comprehensive understanding of this fascinating topic.

Unveiling the Augusta Rule Taxes: A Historical Perspective

The Augusta National Golf Club, located in Augusta, Georgia, is not just a premier golf destination but also a bastion of tradition and exclusivity. One of the club's most notable traditions is its unique approach to taxation, known as the Augusta Rule Taxes. This practice has been a part of the club's fabric for decades, shaping its financial landscape and contributing to its legendary status.

The origins of the Augusta Rule Taxes can be traced back to the early days of the club's establishment in the 1930s. The founders, including the legendary golfer Bobby Jones and investment banker Clifford Roberts, envisioned a club that would be self-sustaining and financially independent. They aimed to create a membership-based community that would not rely on external funding or traditional revenue streams.

To achieve this financial autonomy, the club implemented a series of innovative measures, one of which was the introduction of the Augusta Rule Taxes. These taxes were designed to be paid by members, and they served multiple purposes. Firstly, they provided a stable source of income for the club, ensuring its financial stability and allowing for the maintenance and improvement of the golf course and facilities.

Additionally, the Augusta Rule Taxes played a crucial role in maintaining the exclusivity and prestige of the club. By imposing a substantial tax on members, the club created a barrier to entry, ensuring that only those with significant financial means could afford membership. This selective membership policy contributed to Augusta National's reputation as one of the most exclusive golf clubs in the world.

The Mechanics of Augusta Rule Taxes

The Augusta Rule Taxes are a complex system that encompasses various aspects of a member's financial dealings within the club. Here's a breakdown of the key components:

- Annual Membership Dues: Members are required to pay an annual fee, which covers the basic costs of maintaining the club's facilities and operations. This fee is subject to periodic adjustments to keep pace with inflation and rising operational costs.

- Food and Beverage Taxes: Augusta National operates its own restaurants and dining facilities. Members and their guests are charged a tax on all food and beverage purchases, which contributes to the club's revenue and helps subsidize the cost of maintaining these services.

- Golf Tournament Taxes: The club hosts several prestigious golf tournaments throughout the year, most notably the Masters Tournament. Members who participate in these events or attend as spectators are subject to additional taxes. These taxes are used to cover the costs associated with hosting such large-scale events and to contribute to the prize funds.

- Capital Improvement Taxes: Whenever the club undertakes significant renovation or expansion projects, members are often required to contribute through capital improvement taxes. These taxes ensure that members share the financial burden of maintaining and enhancing the club's facilities, ensuring its long-term viability.

The Augusta Rule Taxes are carefully structured to ensure fairness and to avoid placing an undue burden on any individual member. The club's leadership, in collaboration with financial experts, regularly reviews and adjusts the tax rates to reflect the club's financial needs and the changing economic landscape.

Impact and Significance

The implementation of the Augusta Rule Taxes has had a profound impact on the club's operations and its standing in the golf community.

Financial Stability

The taxes provide a consistent and reliable source of income for Augusta National. This financial stability has allowed the club to invest in the continuous improvement of its facilities, ensuring that it remains at the forefront of golf course design and member amenities. The club's reputation for excellence in course management and hospitality is, in part, a testament to the success of its taxation system.

Exclusivity and Prestige

The Augusta Rule Taxes have played a pivotal role in maintaining the club's exclusivity. By setting a high bar for membership, the club has cultivated a reputation as a haven for the world's elite. This exclusivity has not only attracted high-profile members but has also contributed to the mystique and allure of the club, making it a coveted destination for golfers and fans alike.

Community Building

Despite the taxes' financial implications, they have also fostered a sense of community among members. The shared responsibility of contributing to the club's financial well-being creates a bond among members, who recognize their collective role in preserving Augusta National's legacy. This sense of community is often cited as one of the club's most cherished aspects.

Future Implications

As Augusta National continues to evolve and adapt to the changing landscape of golf and society, the Augusta Rule Taxes will undoubtedly play a crucial role in shaping its future.

Sustainability and Environmental Initiatives

With a growing emphasis on sustainability and environmental stewardship in the golf industry, Augusta National may explore new avenues for tax revenue generation. This could include initiatives focused on renewable energy, water conservation, and habitat preservation. By incorporating these elements into its taxation system, the club can maintain its financial health while also contributing to global sustainability efforts.

Diversification of Membership

While the Augusta Rule Taxes have traditionally targeted a specific demographic, the club has shown signs of embracing diversity and inclusivity. As it continues to evolve, the club may consider adjusting its taxation system to make membership more accessible to a broader range of individuals, while still maintaining its financial stability and exclusivity.

Digital Innovation

In an increasingly digital world, Augusta National may explore opportunities to leverage technology for tax collection and member engagement. This could involve the implementation of digital payment systems, online platforms for tax-related transactions, and even the development of mobile apps that provide members with convenient access to tax-related information and services.

Frequently Asked Questions

How much are the Augusta Rule Taxes?

+

The exact amount of the Augusta Rule Taxes is not publicly disclosed, as it is considered sensitive financial information. However, it is known that the taxes are substantial and contribute significantly to the club’s financial health. The tax rates are subject to periodic adjustments to reflect the club’s needs and the changing economic landscape.

Are Augusta Rule Taxes applicable to all members equally?

+

While the Augusta Rule Taxes are designed to be fair and equitable, they are not identical for all members. The taxes are structured to take into account factors such as membership type, length of membership, and the member’s financial circumstances. This ensures that the tax burden is shared appropriately among the membership.

How often are the Augusta Rule Taxes reviewed and adjusted?

+

The Augusta National leadership regularly reviews the tax rates to ensure they remain aligned with the club’s financial goals and the broader economic climate. While there is no set timeline for adjustments, the club typically makes changes when there are significant shifts in its financial needs or when external factors, such as inflation, impact its revenue streams.

Can members opt out of paying the Augusta Rule Taxes?

+

No, the Augusta Rule Taxes are a fundamental aspect of membership at Augusta National. All members are expected to contribute to the club’s financial well-being through the payment of these taxes. Failure to comply with the tax obligations may result in disciplinary actions, including potential membership revocation.

How do the Augusta Rule Taxes compare to traditional taxes in the golf industry?

+

The Augusta Rule Taxes are unique to Augusta National and are not comparable to traditional taxes in the golf industry. Most golf clubs rely on a combination of membership fees, green fees, and revenue from food and beverage sales to generate income. Augusta National’s taxation system is more comprehensive and tailored to its specific financial needs and objectives.