California Franchise Tax

The California Franchise Tax is a crucial aspect of the state's revenue system, impacting businesses and individuals alike. This comprehensive guide delves into the intricacies of this tax, providing an expert analysis of its implications, mechanisms, and potential strategies for compliance and optimization.

Understanding the California Franchise Tax

The California Franchise Tax, officially known as the California Franchise and Income Tax Law, is a state-level tax levied on corporations, partnerships, limited liability companies (LLCs), and individuals conducting business in California. It is a significant source of revenue for the state, contributing to the funding of essential services and infrastructure development.

This tax is unique in its application, as it is not solely based on traditional income tax models. Instead, it takes into account various factors, including the nature of business operations, the duration of presence in the state, and the specific legal entity conducting business. This complexity arises from California's diverse economy and the need to cater to a wide range of business structures.

For corporations and LLCs, the tax is calculated based on the entity's net income, often involving a progressive tax rate structure. Partnerships and individuals, on the other hand, are subject to a flat tax rate, which can vary depending on the nature of their business activities and the extent of their California-based operations.

| Entity Type | Tax Rate Structure |

|---|---|

| Corporations | Progressive rates based on net income |

| Partnerships | Flat rate, subject to change annually |

| Individuals | Flat rate, dependent on business activities |

Historical Perspective and Evolution

The history of the California Franchise Tax dates back to the early 20th century, with its roots in the state’s efforts to fund public works and social programs. Over the years, the tax has undergone numerous revisions and amendments, adapting to the changing economic landscape and the evolving needs of the state.

One of the most significant changes occurred in the 1980s, when California introduced a progressive tax rate for corporations, aiming to align with federal tax policies and promote fairness in taxation. This move had a profound impact on the state's revenue generation and its ability to support various economic sectors.

Compliance and Filing Processes

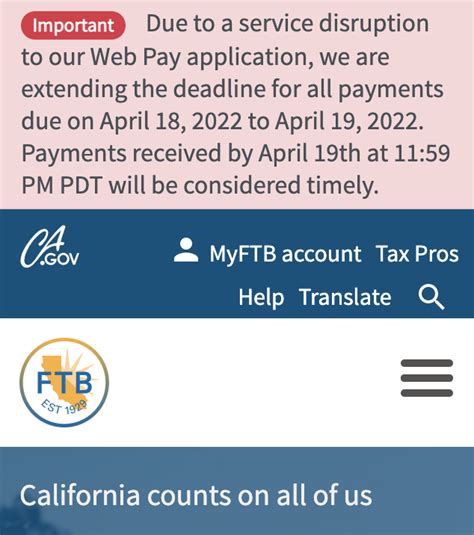

Navigating the compliance and filing processes for the California Franchise Tax can be intricate, especially for businesses new to the state or those with complex structures. The California Franchise Tax Board (FTB) provides extensive guidelines and resources to assist taxpayers in understanding their obligations and ensuring accurate reporting.

Registration and Entity Classification

The first step for any business looking to operate in California is to register with the FTB. This process involves providing detailed information about the entity, including its legal structure, ownership, and the nature of its business activities. Proper classification is crucial, as it determines the applicable tax rates and filing requirements.

For instance, a sole proprietorship, despite being a simple business structure, may have different tax implications compared to a limited liability partnership (LLP) or a corporation. Each entity type has its own set of advantages and tax obligations, which must be carefully considered during the registration process.

Tax Return Preparation and Filing Deadlines

Preparing and filing tax returns for the California Franchise Tax involves a meticulous process. Businesses must gather all relevant financial data, including income statements, balance sheets, and any supporting documentation. The complexity of this task often necessitates the involvement of tax professionals or accounting firms with expertise in state-level taxation.

The filing deadlines vary depending on the entity type and the fiscal year-end. For instance, C-corporations typically have a due date of 15th of the fourth month following the fiscal year-end, while S-corporations and partnerships have a slightly later deadline. It's essential to stay informed about these deadlines to avoid late filing penalties.

| Entity Type | Filing Deadline |

|---|---|

| C-Corporations | 15th of the 4th month after fiscal year-end |

| S-Corporations | 15th of the 3rd month after fiscal year-end |

| Partnerships | 15th of the 4th month after fiscal year-end |

Tax Optimization Strategies

Optimizing tax liabilities is a strategic aspect of financial management for businesses operating in California. While the California Franchise Tax has specific rates and structures, there are avenues for potential savings and efficient tax management.

Tax Credits and Incentives

California offers a range of tax credits and incentives to encourage business growth and investment. These incentives can significantly reduce a business’s tax liability and promote economic development within the state. From research and development credits to hiring incentives, understanding and utilizing these opportunities can provide substantial benefits.

For instance, the Research and Development Tax Credit allows businesses to claim a credit against their franchise tax liability for qualified research expenses. This credit can be particularly advantageous for tech startups and innovative enterprises, providing a boost to their financial health and encouraging further investment in R&D.

Tax Planning and Consulting

Engaging tax professionals or consulting firms with expertise in California’s tax landscape can be a strategic move for businesses. These experts can provide tailored advice, ensuring that businesses are not only compliant but also taking advantage of all available opportunities to minimize their tax burden.

Tax planning strategies may involve optimizing business structures, strategic timing of transactions, or leveraging specific tax laws and regulations to the business's advantage. For instance, a consulting firm might advise a business to consider forming an LLC instead of a corporation, given the potential tax benefits and flexibility offered by this entity type.

Challenges and Controversies

Despite its importance, the California Franchise Tax has faced its share of challenges and controversies. From debates over tax rates and fairness to complex compliance issues, understanding these challenges provides insight into the ongoing discussions and potential future reforms.

Tax Rate Debates and Fairness

The progressive tax rate structure for corporations has been a subject of debate, with critics arguing that it may discourage business growth and investment. On the other hand, proponents highlight the fairness and revenue-generating potential of this system, especially in comparison to flat tax rate models.

The discussion often revolves around finding a balance between encouraging economic activity and ensuring that larger corporations contribute proportionally to the state's revenue. This balance is delicate, as it can impact the state's competitiveness in attracting and retaining businesses.

Compliance and Administrative Challenges

The complexity of the California Franchise Tax system can pose significant challenges for businesses, especially those with limited resources or those new to the state. The registration process, tax return preparation, and ongoing compliance can be time-consuming and resource-intensive.

Additionally, the state's frequent updates and amendments to tax laws can make it challenging for businesses to stay informed and compliant. This highlights the importance of ongoing education and access to reliable resources for taxpayers.

Future Implications and Potential Reforms

Looking ahead, the future of the California Franchise Tax is likely to be shaped by ongoing economic trends, technological advancements, and changing political landscapes. Potential reforms and adjustments to the tax system could have significant implications for businesses and the state’s economy.

Potential Reforms and Simplification

There have been ongoing discussions about simplifying the tax system, making it more accessible and understandable for taxpayers. This could involve streamlining registration processes, standardizing filing requirements, and providing clearer guidelines for businesses of all sizes and structures.

Simplification efforts may also focus on digitalizing tax processes, leveraging technology to make filing and compliance more efficient and less time-consuming. This could involve the development of user-friendly online platforms and the integration of advanced data analytics to improve tax administration.

Impact of Economic Trends and Policy Changes

The economic landscape of California is dynamic, influenced by global trends, technological advancements, and policy decisions. These factors can significantly impact the state’s revenue generation and the effectiveness of the Franchise Tax.

For instance, the rise of remote work and digital nomadism could affect the tax base, as businesses and individuals may have more flexibility in choosing their tax residency. Policy changes, such as adjustments to corporate tax rates or incentives for specific industries, can also have a profound impact on the state's revenue and its ability to support public services.

Conclusion

The California Franchise Tax is a complex yet vital component of the state’s revenue system. Understanding its intricacies, from compliance processes to optimization strategies, is essential for businesses looking to thrive in California’s dynamic economy. As the state continues to evolve, so too will its tax system, requiring ongoing education and strategic planning to navigate this complex landscape successfully.

What is the difference between the California Franchise Tax and the federal income tax?

+

The California Franchise Tax is a state-level tax levied on businesses and individuals conducting activities in California. It has its own set of rates, structures, and compliance requirements. In contrast, the federal income tax is a national tax administered by the Internal Revenue Service (IRS) and applies to all taxpayers across the United States. While both taxes are based on income, they have distinct rates, deductions, and filing processes.

Are there any tax breaks or incentives for small businesses under the California Franchise Tax system?

+

Yes, California offers a range of tax incentives and credits specifically designed to support small businesses. These include the Small Business Tax Credit, which provides a credit against the franchise tax liability for qualified small businesses, and the Research and Development Tax Credit, which encourages innovation and R&D activities. Additionally, certain industries, such as manufacturing or renewable energy, may qualify for sector-specific incentives.

How can businesses stay updated with changes in the California Franchise Tax laws and regulations?

+

Businesses can stay informed about changes in the California Franchise Tax laws by regularly checking the official website of the California Franchise Tax Board (FTB). The FTB provides updates, announcements, and educational resources to help taxpayers understand and comply with the latest tax regulations. Additionally, subscribing to tax newsletters, attending industry conferences, and consulting with tax professionals can provide valuable insights into emerging trends and potential reforms.