Lauderdale County Property Tax

Welcome to an in-depth exploration of the Lauderdale County Property Tax, a vital component of the local economy and an essential consideration for residents and property owners alike. In this comprehensive guide, we'll delve into the intricacies of property taxation in Lauderdale County, offering a detailed analysis of rates, assessment processes, payment options, and the impact of these taxes on the community.

Understanding the Lauderdale County Property Tax Landscape

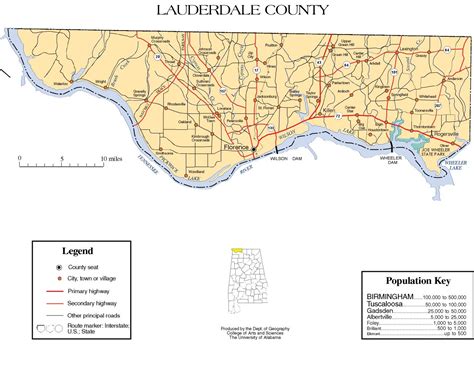

Lauderdale County, nestled in the heart of Alabama, is renowned for its vibrant communities, diverse landscapes, and thriving businesses. At the core of its economic framework lies the property tax system, which plays a pivotal role in funding essential public services and infrastructure projects.

The Lauderdale County Revenue Commissioner's Office is the authority responsible for administering property taxes. This office ensures that all property owners contribute fairly and accurately to the county's financial stability. The tax rates and assessment methodologies are determined by a combination of local, state, and federal regulations, creating a complex yet essential system.

Property Tax Rates in Lauderdale County

Property tax rates in Lauderdale County are expressed as a millage rate, which represents the amount of tax levied per $1,000 of assessed property value. These rates are typically set annually by the county commission, taking into account the budget requirements for the upcoming fiscal year.

For the current fiscal year, the millage rate stands at 15.80 mills. This means that for every $1,000 of assessed property value, the owner will pay $15.80 in property taxes. While this rate is subject to change annually, it provides a consistent and predictable framework for property owners.

| Current Fiscal Year | Millage Rate |

|---|---|

| Lauderdale County | 15.80 Mills |

Property Assessment Process

The assessment process is a critical aspect of the property tax system, determining the value of each property and, subsequently, the amount of tax owed. In Lauderdale County, the Revenue Commissioner’s Office conducts periodic reassessments to ensure that property values remain up-to-date and accurate.

The assessment process involves evaluating various factors, including the property's location, size, age, condition, and recent sales data. This comprehensive approach ensures that the assessed value aligns with the property's true market value. Property owners have the right to appeal their assessments if they believe the value is inaccurate or unfair.

The Revenue Commissioner's Office provides resources and guidelines for property owners to understand the assessment process and their rights. This transparency fosters a fair and equitable system, benefiting both the county and its residents.

Payment Options and Deadlines

Paying property taxes is a critical responsibility for property owners, and Lauderdale County offers a range of convenient payment options to ensure a seamless experience.

Online Payment Portal

The Lauderdale County Revenue Commissioner’s Office has implemented an online payment portal, accessible through their official website. This portal allows property owners to make secure payments using major credit cards or electronic checks. The online system provides real-time updates, allowing taxpayers to track their payments and view their account status.

Online payments are an efficient and convenient option, especially for those who prefer the ease and speed of digital transactions. The portal is user-friendly, guiding taxpayers through the process with clear instructions and a step-by-step approach.

In-Person Payments

For those who prefer a more traditional approach, in-person payments are accepted at the Revenue Commissioner’s Office. This option provides a personal touch, allowing taxpayers to interact directly with staff and address any queries or concerns.

The office accepts payments in the form of cash, checks, and money orders. Taxpayers can visit the office during regular business hours to make their payments and receive immediate receipts as proof of payment.

Payment Deadlines

Property taxes in Lauderdale County are due annually, with a deadline set for each fiscal year. It is crucial for property owners to be aware of these deadlines to avoid late fees and penalties.

The current fiscal year's deadline is set for November 15th. This date is a crucial milestone for property owners, as any payments received after this date will incur additional charges.

| Current Fiscal Year | Payment Deadline |

|---|---|

| Lauderdale County | November 15th |

Impact on the Community

Property taxes are a significant contributor to the economic health and well-being of Lauderdale County. The revenue generated from these taxes funds a wide range of essential services and initiatives that directly benefit the community.

Funding Public Services

The primary role of property taxes is to support the delivery of vital public services. In Lauderdale County, these funds are allocated to various departments and agencies, ensuring the smooth operation of local government.

- Education: A substantial portion of property tax revenue is dedicated to funding public schools, ensuring that students receive quality education and necessary resources.

- Public Safety: Property taxes contribute to the maintenance of law enforcement agencies, fire departments, and emergency services, keeping the community safe and secure.

- Infrastructure: From road maintenance to utility upgrades, property taxes play a crucial role in developing and maintaining the county's infrastructure, benefiting residents and businesses alike.

- Healthcare: Funds are allocated to support local healthcare facilities, ensuring access to quality medical services for all residents.

Economic Development and Growth

Property taxes are not only essential for maintaining existing services but also for driving economic growth and development within Lauderdale County.

The revenue generated from property taxes is often reinvested in initiatives that attract businesses, create jobs, and stimulate economic activity. This includes funding for infrastructure projects, business incentives, and community development programs.

By fostering a robust economy, Lauderdale County ensures a high quality of life for its residents, with access to diverse employment opportunities and a thriving business environment.

Community Engagement and Support

The property tax system in Lauderdale County is designed to promote community engagement and support local initiatives. A portion of the tax revenue is allocated to community organizations, non-profits, and cultural institutions, enabling them to thrive and contribute to the fabric of the county.

From arts and culture to social services and environmental programs, property taxes play a vital role in enriching the lives of residents and enhancing the overall community experience.

Future Implications and Considerations

As Lauderdale County continues to evolve and grow, the property tax system will remain a dynamic and evolving component of its economic framework. Several factors will influence the future of property taxation in the county.

Economic Growth and Development

The county’s ongoing economic growth and development will likely lead to an increase in property values. As the county attracts new businesses and residents, property prices may rise, impacting the overall tax base.

To accommodate this growth, the county may need to adjust tax rates or assessment methodologies to ensure a fair and sustainable system. This could involve periodic reassessments to capture the true value of properties and ensure equitable taxation.

Community Needs and Priorities

The allocation of property tax revenue will continue to be guided by the evolving needs and priorities of the community. As new challenges and opportunities arise, the county may need to reevaluate its funding priorities.

For instance, if there is a growing demand for affordable housing or environmental initiatives, a portion of the tax revenue may be dedicated to addressing these specific community needs. This adaptive approach ensures that the property tax system remains responsive to the changing landscape of Lauderdale County.

Technological Advancements

The integration of technology will play a significant role in the future of property taxation. Lauderdale County is already leveraging digital platforms and online tools to enhance the taxpayer experience, and this trend is expected to continue.

From improved online payment systems to advanced assessment technologies, the county will continue to embrace innovation to streamline processes, increase efficiency, and provide a more transparent and accessible tax system for its residents.

How can I estimate my property tax bill in Lauderdale County?

+To estimate your property tax bill, you can use the millage rate (15.80 mills) and multiply it by your property’s assessed value. For example, if your property is valued at 150,000, your estimated tax bill would be 2,370 (15.80 mills x 150,000 = 2,370). Keep in mind that this is an estimate, and the actual bill may vary based on additional taxes or adjustments.

What happens if I miss the property tax deadline in Lauderdale County?

+Missing the property tax deadline can result in late fees and penalties. It’s important to stay informed about the payment deadline and make timely payments to avoid additional charges. If you encounter financial difficulties, contact the Revenue Commissioner’s Office to discuss potential options and extensions.

How often are property assessments conducted in Lauderdale County?

+Property assessments in Lauderdale County are conducted periodically, typically every four years. However, the Revenue Commissioner’s Office may conduct reassessments more frequently if necessary, especially if there are significant changes in property values or market conditions.

Can I appeal my property assessment in Lauderdale County?

+Yes, property owners have the right to appeal their assessments if they believe the value is inaccurate or unfair. The Revenue Commissioner’s Office provides guidelines and procedures for filing an appeal. It’s important to gather supporting evidence and follow the prescribed process to ensure a successful appeal.

What are the benefits of paying property taxes online in Lauderdale County?

+Paying property taxes online offers several benefits, including convenience, speed, and real-time updates. It allows taxpayers to make payments from the comfort of their homes or offices, eliminating the need for in-person visits. Additionally, online payments provide a secure and transparent process, with immediate confirmation and the ability to track payment status.