State Of Hawaii Tax

The State of Hawaii, known for its breathtaking landscapes and vibrant culture, has a unique tax system that reflects its diverse economy and the challenges of governing an archipelago. Understanding the intricacies of Hawaii's tax landscape is crucial for both residents and businesses, as it directly impacts financial planning and economic decisions. This comprehensive guide aims to delve into the specific details of Hawaii's tax structure, providing an in-depth analysis of its various components and their implications.

Unraveling Hawaii’s Tax System: A Comprehensive Guide

Hawaii’s tax system is a multifaceted framework designed to support the state’s public services, infrastructure, and economic development. It encompasses a range of taxes, each with its own set of rules and rates, which collectively contribute to the state’s revenue stream. This section serves as an introductory overview, setting the stage for a deeper exploration of Hawaii’s tax landscape.

Income Tax: A Pillar of Hawaii’s Revenue

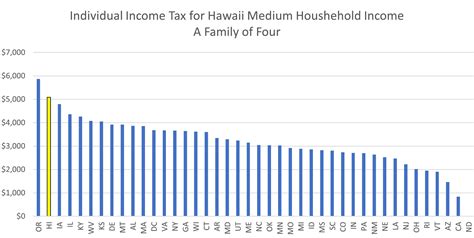

Income tax is a significant component of Hawaii’s revenue generation. The state imposes an individual income tax on residents and nonresidents earning income within Hawaii. The tax rate structure is progressive, meaning that higher income levels are taxed at a higher percentage rate. This progressive nature ensures that the tax burden is distributed fairly across different income brackets.

For the tax year 2023, Hawaii’s income tax rates range from 1.4% to 11.0%, depending on the taxpayer’s filing status and income level. These rates are subject to change annually, influenced by legislative decisions and economic considerations.

To illustrate, a single taxpayer with an annual income of 50,000 would fall into the <strong>6.4%</strong> tax bracket, while a married couple filing jointly with an income of 100,000 would be taxed at 8.25% on their income.

The state also offers various tax credits and deductions to alleviate the tax burden for specific segments of the population. These include credits for low-income earners, elderly individuals, and those with qualifying dependents.

General Excise Tax: Hawaii’s Broad-Based Levy

The General Excise Tax (GET) is a fundamental component of Hawaii’s tax system, applying to a wide range of goods and services. It is a consumption tax, levied on the privilege of doing business in Hawaii, and is often passed on to consumers as a component of the sale price.

The standard GET rate is currently set at 4.0%, but it is important to note that certain industries and transactions are subject to additional surcharges and special rates. For instance, the transient accommodations tax, often referred to as the hotel room tax, is an additional levy on the rental of hotel rooms and other transient accommodations, with rates varying across the islands.

To provide a practical example, consider a restaurant in Honolulu. The restaurant charges a customer 50 for a meal. The GET of <strong>4.0%</strong> would add 2 to the bill, resulting in a total charge of $52. Additionally, if the customer stays in a hotel room in Waikiki, they would pay an additional transient accommodations tax, which could increase their bill further.

Businesses are responsible for collecting and remitting GET to the state, with periodic filings and payments due based on their revenue and industry.

Real Property Taxes: Assessing Hawaii’s Land and Buildings

Real property taxes are an essential source of revenue for Hawaii’s counties, used to fund local services and infrastructure. These taxes are assessed on the value of real estate, including land and buildings.

The property tax rate in Hawaii varies by county, reflecting the diverse needs and costs of each island. For instance, the rate in Honolulu County is 0.276%, while in Maui County, it stands at 0.346% of the property’s assessed value.

To calculate the annual property tax, the assessed value is multiplied by the applicable tax rate. For a residential property in Honolulu with an assessed value of 500,000, the annual property tax would amount to 1,380.

Property owners are responsible for paying these taxes, which are typically due in two installments, with the specific due dates varying by county.

Vehicle Registration and Excise Taxes: Mobility Costs in Hawaii

Vehicle-related taxes in Hawaii include registration fees and excise taxes, which contribute to the state’s transportation infrastructure and services.

Vehicle registration fees in Hawaii vary based on the type of vehicle and its weight. For instance, the registration fee for a standard passenger vehicle is 28.75</strong>, while heavier vehicles, such as trucks, may incur higher fees.</p> <p>Additionally, Hawaii imposes an excise tax on the purchase or lease of motor vehicles, with rates dependent on the vehicle's value. This tax is typically paid at the time of purchase or lease initiation.</p> <p>For example, if an individual purchases a new car valued at 30,000, they would pay an excise tax of 4.0% of the vehicle’s value, amounting to $1,200.

Other Taxes: A Diverse Revenue Stream

In addition to the aforementioned taxes, Hawaii’s revenue stream includes a variety of other levies, each targeting specific economic activities or transactions.

-

Use Tax: Hawaii imposes a use tax on goods purchased from out-of-state vendors and brought into Hawaii for use. This tax ensures that Hawaii residents pay taxes on goods regardless of where they are purchased.

-

Hotel Room Tax: As mentioned earlier, this tax is levied on the rental of transient accommodations, providing a significant revenue stream for the state’s tourism industry.

-

Fuel Tax: Hawaii imposes a tax on gasoline and other fuels, with rates varying based on the type of fuel. This tax contributes to the maintenance and improvement of Hawaii’s road network.

-

Alcohol and Tobacco Taxes: Taxes on alcohol and tobacco products are set at specific rates, with the revenue often dedicated to public health initiatives.

These taxes, while less prominent than income or excise taxes, collectively contribute to Hawaii’s diverse revenue portfolio, ensuring a stable financial foundation for the state’s operations.

Analyzing Hawaii’s Tax Performance and Future Outlook

Hawaii’s tax system, while complex, has proven effective in generating revenue to support the state’s operations and public services. The state’s fiscal health is largely dependent on the performance of its tax base, which is influenced by economic conditions and policy decisions.

Tax Revenue Trends and Economic Impact

Hawaii’s tax revenue has demonstrated a consistent upward trend over the past decade, with a notable surge in the post-pandemic period as economic activities resumed. This growth can be attributed to a combination of factors, including an expanding tax base, increased economic activity, and targeted tax policy adjustments.

The impact of Hawaii’s tax system on the economy is multifaceted. While taxes can impose a burden on businesses and individuals, they also contribute to the state’s economic stability by funding critical public services and infrastructure. The progressive nature of Hawaii’s income tax, for instance, ensures that higher-income earners contribute a larger share, promoting economic equality.

Furthermore, the state’s reliance on broad-based taxes, such as the General Excise Tax, helps distribute the tax burden across a wide range of economic activities, minimizing the impact on any single sector.

Policy Considerations and Future Prospects

As Hawaii looks to the future, tax policy will continue to be a critical area of focus for policymakers. The state’s unique geographic and economic characteristics present both opportunities and challenges in tax administration and revenue generation.

One key consideration is the state’s reliance on tourism-related taxes. While these taxes have been a significant source of revenue, the volatility of the tourism industry, as evidenced by the pandemic’s impact, underscores the need for a diversified revenue base.

Hawaii’s tax system is also facing increasing pressure to address social and economic disparities. Policy discussions are underway to explore the potential for tax reforms that could alleviate the tax burden on lower-income earners and promote economic equality.

Additionally, the state is exploring ways to enhance tax compliance and collection, particularly in the context of e-commerce and digital transactions, to ensure that all economic activities contribute fairly to the state’s revenue stream.

Conclusion: A Balancing Act

Hawaii’s tax system is a complex yet effective mechanism for generating revenue to support the state’s operations and public services. The system’s progressive nature and reliance on broad-based taxes contribute to economic stability and fairness. As Hawaii navigates the post-pandemic economic landscape, the state’s tax policies will continue to evolve, balancing the need for revenue generation with the imperative of promoting economic growth and equality.

How often do I need to file my taxes in Hawaii?

+Individuals and businesses in Hawaii are generally required to file tax returns annually. The specific due dates depend on the type of tax and the taxpayer’s status. For income taxes, the deadline is typically April 20th of the following year. However, businesses with certain types of activities may have quarterly or monthly filing requirements.

Are there any tax incentives for businesses in Hawaii?

+Yes, Hawaii offers a range of tax incentives to attract and support businesses. These include tax credits for research and development, film production, and renewable energy projects. Additionally, certain industries, such as agriculture and aquaculture, may be eligible for specific tax benefits.

How does Hawaii’s tax system compare to other states?

+Hawaii’s tax system is unique among states due to its reliance on broad-based taxes like the General Excise Tax. While this system can provide a stable revenue stream, it may be less favorable for businesses compared to states with more targeted taxes. However, Hawaii’s progressive income tax structure aligns with many other states, ensuring a fair distribution of the tax burden.