St. Louis County Property Tax

Understanding property taxes in St. Louis County is essential for homeowners and prospective buyers alike. This comprehensive guide delves into the intricacies of St. Louis County's property tax system, providing valuable insights and practical information to help navigate this complex topic.

The Fundamentals of St. Louis County Property Tax

Property taxes are a significant source of revenue for local governments in the United States, and St. Louis County is no exception. These taxes are used to fund essential services such as schools, roads, emergency services, and public facilities. The property tax system in St. Louis County is governed by state laws and regulations, which outline the assessment, valuation, and collection processes.

The property tax cycle in St. Louis County typically follows a yearly schedule. It begins with the assessment phase, where the county assesses the value of all taxable properties within its jurisdiction. This valuation process is critical, as it determines the basis for calculating property taxes. Assessors take into account various factors, including the property's location, size, improvements, and market conditions, to arrive at a fair assessment.

Assessed Value and Tax Rates

Once the assessment is complete, the assessed value of a property is determined. This value is then used to calculate the property tax liability. The tax rate, expressed as a percentage, is set by local taxing authorities, such as the county government, school districts, and special taxing districts. These rates can vary depending on the services provided and the financial needs of the respective taxing entities.

For instance, consider a residential property in St. Louis County with an assessed value of $250,000. If the tax rate for the county is 1.5% and the school district's rate is 1.2%, the property owner would owe a total tax of $5,500 ($250,000 x 0.015) for county taxes and $3,000 ($250,000 x 0.012) for school district taxes, resulting in a combined tax liability of $8,500.

| Taxing Authority | Tax Rate |

|---|---|

| St. Louis County | 1.5% |

| School District | 1.2% |

| Special Taxing District | 0.8% |

Tax Bill and Payment Schedule

After the assessment and valuation processes are complete, property owners receive their tax bills. In St. Louis County, these bills typically outline the assessed value of the property, the applicable tax rates, and the total tax due. Property owners are responsible for paying their taxes by the due date to avoid penalties and interest charges.

The county offers various payment options, including online payments, direct debit, and traditional mail-in payments. Property owners should carefully review their tax bills and ensure timely payments to avoid any late fees or other complications.

Appealing Property Tax Assessments

Property owners in St. Louis County have the right to appeal their property tax assessments if they believe the assessed value is inaccurate or unfair. The appeals process provides a mechanism for taxpayers to challenge the county's valuation and potentially reduce their tax liability.

Reasons for Appeals

There are several common reasons why property owners may choose to appeal their assessments. These include:

- Discrepancies in Valuation: If the assessed value of a property differs significantly from its actual market value, an appeal may be warranted.

- Changes in Property Condition: Improvements or damages to a property after the assessment date can impact its value and potentially justify an appeal.

- Comparison with Similar Properties: If a property's assessment is higher than similar properties in the area, it may indicate an unfair valuation.

- Errors in Assessment: Clerical or assessment errors can lead to incorrect valuations, which can be grounds for an appeal.

The Appeals Process

The appeals process in St. Louis County typically involves the following steps:

- Review and Research: Property owners should carefully review their assessment notices and compare them with recent sales data and market trends. Researching similar properties and their assessed values can provide valuable evidence for the appeal.

- File an Appeal: If a property owner decides to appeal, they must file a formal appeal with the St. Louis County Board of Equalization within a specified timeframe. The appeal should include detailed information and supporting documentation to justify the request for a reduced assessment.

- Hearing: The Board of Equalization will schedule a hearing to review the appeal. Property owners have the opportunity to present their case, often with the assistance of a tax professional or attorney. The board will consider the evidence and make a decision regarding the appeal.

- Decision and Notification: The Board of Equalization will issue a written decision, typically within a few months of the hearing. If the appeal is successful, the assessed value will be adjusted, leading to a reduction in property taxes. If the appeal is denied, property owners have the option to pursue further legal avenues, although these are generally more complex and costly.

Understanding Property Tax Exemptions

St. Louis County offers various property tax exemptions that can reduce the tax burden for eligible property owners. These exemptions are designed to provide relief to specific groups and promote certain social or economic goals.

Common Property Tax Exemptions

- Homestead Exemption: This exemption provides a reduction in the assessed value of a property for homeowners who use it as their primary residence. It aims to ease the tax burden on homeowners and encourage homeownership.

- Senior Citizen Exemption: St. Louis County offers tax relief to senior citizens who meet certain age and income criteria. This exemption can provide a significant reduction in property taxes for eligible seniors.

- Military Exemption: Active-duty military personnel and veterans may be eligible for property tax exemptions or reduced tax rates. These exemptions honor the service and sacrifice of military members and their families.

- Agricultural Exemption: Properties used for agricultural purposes may qualify for special assessment rates or exemptions. This exemption supports the local farming community and encourages the preservation of agricultural land.

Applying for Exemptions

Property owners interested in applying for tax exemptions should consult the St. Louis County Assessor's Office for specific requirements and application processes. Each exemption has unique eligibility criteria and documentation requirements. It is essential to review these carefully to ensure a successful application.

Property Tax Abatements and Incentives

In addition to tax exemptions, St. Louis County offers various tax abatement programs and incentives to promote economic development and attract new businesses. These initiatives provide temporary or permanent tax relief to encourage investment and job creation.

Common Tax Abatement Programs

- Enterprise Zones: Designated areas within St. Louis County may be eligible for tax abatements to encourage economic growth and job creation. Businesses operating within these zones may benefit from reduced property taxes for a specified period.

- Brownfield Redevelopment: St. Louis County may offer tax abatements to encourage the redevelopment of contaminated or underutilized properties, known as brownfields. These abatements can provide significant financial incentives for developers and investors.

- Historic Preservation: Property owners who restore and preserve historic buildings may qualify for tax abatements. These incentives promote the preservation of St. Louis County's rich architectural heritage.

Qualifications and Application Process

Property owners and businesses interested in tax abatement programs should contact the St. Louis County Economic Development Office or the relevant local government agency. Each program has specific eligibility criteria and application procedures. It is essential to understand the terms and conditions of these abatements, including any performance requirements or obligations.

Conclusion

Navigating the St. Louis County property tax system requires a thorough understanding of assessment processes, tax rates, and available exemptions and incentives. Property owners should stay informed about their rights and responsibilities and take advantage of the opportunities to reduce their tax burden. By staying engaged with the local government and tax authorities, property owners can ensure they are treated fairly and receive the benefits they are entitled to.

FAQ

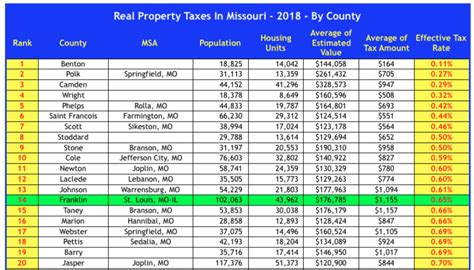

What is the average property tax rate in St. Louis County?

+

The average property tax rate in St. Louis County can vary depending on the specific taxing district. However, as of [most recent data available], the average effective property tax rate for the county is approximately [average rate]%. This rate is calculated based on the total tax revenue collected divided by the total assessed property value.

Are there any online tools to estimate property taxes in St. Louis County?

+

Yes, St. Louis County provides an online property tax estimator tool on its official website. This tool allows property owners to estimate their annual tax liability based on the assessed value of their property and the applicable tax rates. It’s a convenient way to get an approximate idea of your tax obligations.

Can I pay my property taxes online in St. Louis County?

+

Absolutely! St. Louis County offers online payment options for property taxes. You can visit the county’s official website or use the designated online payment portal to make secure payments. This option is convenient and provides a receipt for your records.

Are there any penalties for late property tax payments in St. Louis County?

+

Yes, St. Louis County imposes penalties and interest charges for late property tax payments. The specific penalties and interest rates may vary depending on the amount of the payment and the length of the delay. It’s essential to pay your taxes on time to avoid additional costs and potential legal consequences.

How often are property assessments conducted in St. Louis County?

+

Property assessments in St. Louis County are typically conducted on a biennial basis, meaning they occur every two years. However, certain circumstances, such as significant improvements or changes to a property, may trigger a reassessment outside of the regular cycle.