Virginia Property Tax Car

Welcome to this comprehensive guide on understanding and navigating the property tax landscape in the state of Virginia. The Commonwealth of Virginia, known for its rich history and diverse landscapes, also has a unique approach to property taxation. In this article, we will delve into the specifics of property tax assessments, rates, and exemptions, with a special focus on the "property tax car" program. By the end of this article, you will have a thorough understanding of how property taxes work in Virginia and the potential benefits and implications for homeowners.

The Virginia Property Tax System: An Overview

Virginia operates a real property tax system, which means that taxes are levied on the value of real estate properties within the state. This includes residential, commercial, and industrial properties. The property tax system is a significant source of revenue for local governments, including cities, counties, and towns, allowing them to fund essential services and infrastructure.

The property tax system in Virginia is decentralized, with each locality having the authority to set its own tax rates and assessment methodologies. This means that property tax rates and assessment practices can vary significantly across the state, leading to a complex and diverse taxation landscape.

Assessment Process

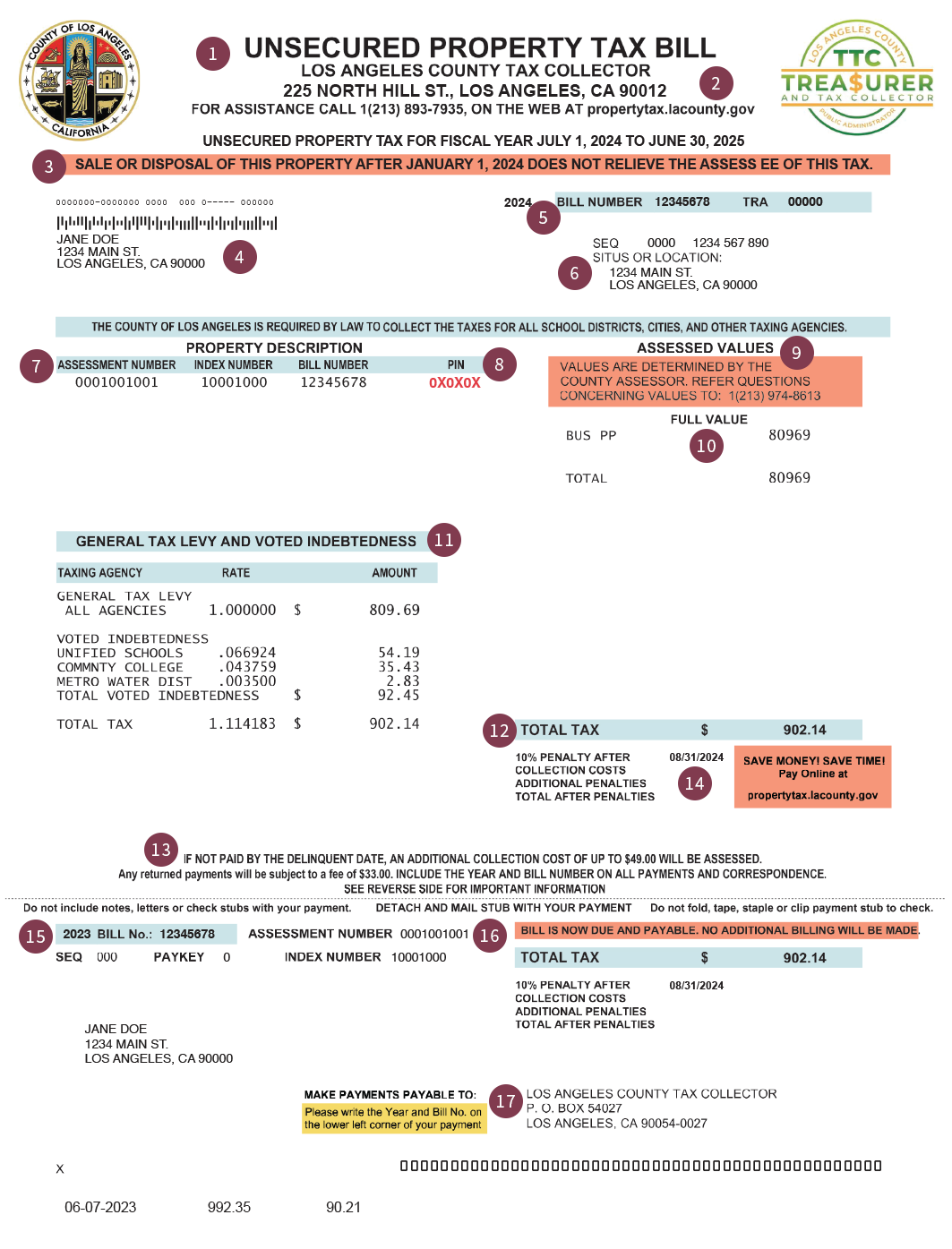

Property assessments are typically conducted by local assessment offices, which are responsible for determining the fair market value of properties. Assessments are based on factors such as location, size, age, condition, and recent sales data of comparable properties. These assessments are then used as the basis for calculating property taxes.

Assessments are generally performed every year, but in some localities, assessments may occur less frequently. The assessment process aims to ensure that property values are accurately reflected, allowing for fair and equitable taxation.

Tax Rates and Calculations

Property tax rates in Virginia are expressed as a dollar amount per 100 of assessed value. These rates are set by local governing bodies, such as city councils or county boards, and can vary significantly. For instance, the tax rate in Arlington County for the fiscal year 2023-2024 is 0.988 per 100 of assessed value, while in Fairfax County, it is 1.139 per $100.

To calculate the property tax owed, the assessed value of the property is multiplied by the applicable tax rate. This calculation provides the annual tax liability for the property owner. It's important to note that tax rates can change from year to year, and property owners should stay informed about any rate adjustments in their locality.

| Locality | Tax Rate per $100 of Assessed Value |

|---|---|

| Arlington County | $0.988 |

| Fairfax County | $1.139 |

| Loudoun County | $1.220 |

| Prince William County | $1.175 |

| City of Alexandria | $1.152 |

The Property Tax Car Program: A Unique Virginia Initiative

One of the most distinctive features of Virginia’s property tax system is the “property tax car” program, officially known as the Vehicle for Deeds Program. This innovative initiative was established to help low- and moderate-income homeowners struggling to keep up with rising property taxes.

How the Property Tax Car Program Works

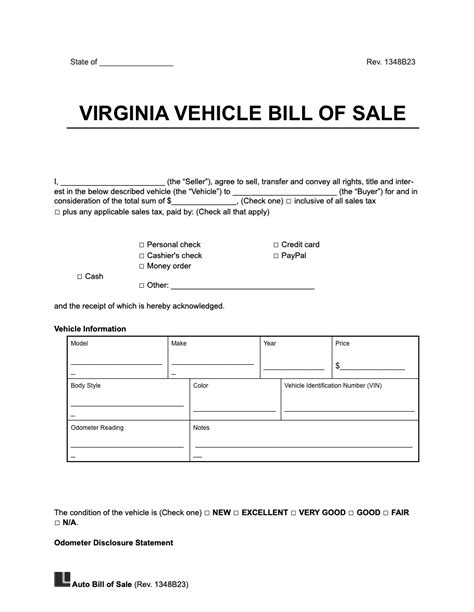

The property tax car program allows eligible homeowners to “trade in” their property tax liability for a new or used vehicle. This program is designed to provide a practical solution for homeowners who may not have the financial means to pay their property taxes in full.

Here's a simplified breakdown of the process:

- Eligibility Criteria: Homeowners must meet specific income requirements and have a valid driver's license. They should also be current on their property taxes, with no outstanding liens or judgments against their property.

- Application Process: Eligible homeowners can apply for the program by submitting an application to their local government. The application typically requires details about the homeowner's income, property value, and tax liability.

- Vehicle Selection: Once approved, homeowners can choose a vehicle from a selection provided by the program. The vehicle options may include new or used cars, trucks, or SUVs, depending on the locality's offerings.

- Property Tax Payment: Instead of paying their property taxes in cash, the homeowner agrees to surrender the title of their selected vehicle to the local government. The vehicle's value is then applied towards their property tax liability.

- Title Transfer: After the vehicle is selected and the title is transferred to the local government, the homeowner receives a certificate of participation in the program. This certificate serves as proof that their property tax obligation has been met.

Benefits and Considerations

The property tax car program provides several advantages for eligible homeowners:

- Reduced Financial Burden: For homeowners struggling with high property tax bills, this program offers a way to fulfill their tax obligations without a significant cash outlay.

- Access to Transportation: The program ensures that participants have access to a vehicle, which can be crucial for commuting to work, running errands, and accessing essential services.

- Fair Assessment: The value of the vehicle is assessed based on market rates, ensuring a fair and equitable trade-off for both the homeowner and the local government.

However, there are also considerations to keep in mind:

- Eligibility Requirements: Not all homeowners will qualify for the program due to income restrictions and other criteria. It's important to understand the eligibility criteria before applying.

- Vehicle Selection: The program's vehicle options may be limited, and participants may not have the flexibility to choose a vehicle that perfectly suits their preferences.

- Long-Term Financial Planning: While the program provides immediate relief, homeowners should consider the long-term implications of their tax obligations. It may be beneficial to explore other financial strategies to manage property taxes sustainably.

Property Tax Exemptions and Relief Programs

In addition to the property tax car program, Virginia offers various other exemptions and relief programs to assist homeowners with their property tax obligations.

Homestead Exemption

The Homestead Exemption is a valuable tool for Virginia homeowners. It allows eligible homeowners to protect a portion of their home’s value from property taxes, up to a maximum of $6,000. This exemption ensures that homeowners retain a certain amount of equity in their property, even if property values rise significantly.

Land Preservation Tax Relief

Virginia’s Land Preservation Tax Relief program aims to encourage landowners to preserve open spaces and natural areas. Landowners who voluntarily place their property under a conservation easement can receive significant tax benefits. This program helps protect the state’s natural resources and promotes sustainable land use practices.

Other Relief Programs

Virginia also offers several other relief programs, such as the Senior Citizen Real Estate Tax Relief Grant and the Disabled Veterans’ Exemption. These programs provide additional support to specific groups of homeowners, ensuring that property taxes remain manageable for those who may face financial challenges.

Performance Analysis and Future Implications

The property tax system in Virginia, with its decentralized nature and unique programs like the property tax car initiative, has both strengths and challenges.

Strengths

- Local Control: The decentralized nature of the system allows localities to tailor tax rates and assessment practices to their specific needs, promoting fiscal autonomy and responsiveness to local conditions.

- Innovation: Programs like the property tax car initiative showcase Virginia’s willingness to explore innovative solutions to address the financial challenges faced by homeowners.

- Equitable Assessment: The assessment process, while complex, aims to ensure that property values are accurately reflected, leading to fair and equitable taxation.

Challenges

- Variation in Tax Rates: The significant variations in tax rates across localities can create complexities for homeowners, especially those who move frequently or own properties in multiple localities.

- Program Access: While the property tax car program is innovative, it may not be accessible to all homeowners due to eligibility criteria and the availability of vehicles through the program.

- Long-Term Sustainability: The effectiveness of relief programs in the long term depends on various factors, including economic conditions, population growth, and local government budgets.

Looking Ahead

As Virginia continues to evolve and address the changing needs of its residents, the property tax system will likely undergo further refinements and adaptations. The state’s willingness to explore innovative solutions, such as the property tax car program, is a testament to its commitment to finding practical and equitable approaches to property taxation.

For homeowners, staying informed about property tax assessments, rates, and available relief programs is crucial. By understanding the intricacies of the system and exploring the options available, homeowners can navigate the property tax landscape more effectively and ensure that their financial obligations are manageable.

How often are property assessments conducted in Virginia?

+Property assessments in Virginia are generally conducted annually, but some localities may have different assessment cycles. It’s important to check with your local assessment office for specific details.

Are there any income restrictions for the property tax car program?

+Yes, income restrictions apply to the property tax car program. Eligibility is typically based on household income, with specific guidelines varying by locality. It’s advisable to review the program’s criteria for your specific area.

Can I choose any vehicle through the property tax car program?

+The vehicle selection process may vary by locality. While some programs offer a wide range of vehicles, others may have more limited options. It’s recommended to inquire about the available vehicles before applying.

Are there alternative relief programs for homeowners in Virginia?

+Absolutely! Virginia offers various relief programs, including the Homestead Exemption, Land Preservation Tax Relief, and grants for senior citizens and disabled veterans. These programs provide additional support to homeowners facing financial challenges.