Vancouver Canada Sales Tax

The sales tax system in Vancouver, Canada, is a crucial aspect of the city's economy and daily life. Understanding the intricacies of this tax structure is essential for both residents and businesses operating in the region. This comprehensive guide aims to demystify the Vancouver sales tax, offering a detailed breakdown of its components, rates, and implications.

The Sales Tax Landscape in Vancouver

Vancouver, nestled in the picturesque province of British Columbia, boasts a unique sales tax system. Unlike some other Canadian provinces, BC employs a single sales tax, known as the Provincial Sales Tax (PST), which is levied on most goods and certain services.

A Historical Perspective

The evolution of sales tax in Vancouver is an interesting narrative. Prior to 2013, the city operated under a dual tax system, with the PST and the Goods and Services Tax (GST). However, a significant tax reform unified these into a single tax, the Harmonized Sales Tax (HST). This change aimed to simplify the tax structure, but it was short-lived. In 2013, the province opted out of the HST, reverting to the original PST model, but with some key differences.

Key Differences Post-HST

The current PST regime in Vancouver differs from its pre-HST counterpart in several ways. Notably, the PST now exempts certain goods and services that were previously taxable. For instance, residential rents, certain financial services, and legal services are now exempt from the tax.

Understanding the Provincial Sales Tax (PST)

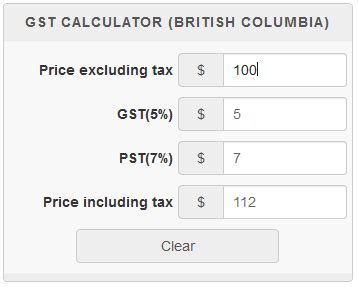

The Provincial Sales Tax is a critical component of Vancouver’s sales tax system. Here’s a detailed breakdown:

Tax Rate and Applicability

As of the latest updates, the PST rate stands at 7%, which is applied to a wide range of goods and services. This tax is collected by the businesses selling these goods and services and subsequently remitted to the government.

| Category | PST Rate |

|---|---|

| Most Goods | 7% |

| Select Services | 7% |

Exemptions and Zero-Rated Items

Not all goods and services are subject to the PST. The tax system in Vancouver exempts a range of items, including:

- Grocery items

- Prescription drugs

- Residential rents

- Legal and financial services

- Educational and medical services

Input Tax Credits

For businesses, the PST system offers an Input Tax Credit (ITC) mechanism. This allows businesses to recover the PST they pay on purchases made for their business activities. The ITC ensures that the tax burden is not passed on to the consumer for goods or services that are used in the production of other taxable goods or services.

The Impact of PST on Vancouver’s Economy

The Provincial Sales Tax plays a significant role in Vancouver’s economic landscape. Here’s a deeper look at its implications:

Revenue Generation

The PST is a substantial source of revenue for the provincial government. In the fiscal year 2022⁄23, the PST generated over CA$3.7 billion in revenue, contributing significantly to the province’s overall tax income.

Consumer Behavior

The tax rate directly influences consumer spending habits. A higher tax rate can discourage spending, while a lower rate may stimulate consumption. The current 7% PST rate is seen as a balance, encouraging economic activity without overburdening consumers.

Business Operations

For businesses, the PST adds a layer of complexity to their operations. They must ensure accurate tax collection and remittance, which can be a challenge, especially for small businesses. The ITC mechanism, however, provides a level of relief by allowing businesses to reclaim taxes paid on business inputs.

Future Outlook and Potential Changes

The sales tax landscape in Vancouver is not static. Here’s a glimpse into what the future might hold:

Tax Rate Adjustments

While the current PST rate of 7% is considered stable, economic conditions and political decisions can lead to rate changes. Historically, the PST rate has fluctuated, with the highest rate reaching 8% in the past. Future economic scenarios might prompt similar adjustments.

Exemption Expansions or Contractions

The list of exempt goods and services could see additions or subtractions in the future. For instance, the recent exemption of residential rents was a significant change. Future policies could further expand or contract this list, impacting both consumers and businesses.

Technology Integration

As technology advances, the tax collection and remittance process could become more streamlined. The government might explore digital solutions to make tax compliance easier for businesses and more efficient for revenue collection.

How often is the PST rate reviewed and adjusted?

+The PST rate is typically reviewed annually, and adjustments are made based on economic indicators and the government’s fiscal goals. However, extraordinary circumstances, such as economic downturns or budgetary constraints, might prompt unscheduled rate changes.

Are there any special considerations for online businesses regarding PST?

+Yes, online businesses selling goods to customers in BC must collect and remit PST. The rules for online sales are similar to those for traditional retail businesses, with some specific guidelines for remote sellers.

What happens if a business fails to remit PST to the government?

+Businesses are legally obligated to remit PST to the government. Failure to do so can result in penalties, interest charges, and even legal action. It’s crucial for businesses to stay compliant with PST regulations.