Jefferson Parish Property Tax

The Jefferson Parish Property Tax system is an essential aspect of the local government's revenue generation and a critical consideration for property owners in the area. This article aims to provide an in-depth analysis of the Jefferson Parish Property Tax, covering its assessment process, calculation methods, and the impact it has on the community. By understanding this system, property owners can navigate their tax obligations effectively and contribute to the growth and development of their parish.

Understanding the Jefferson Parish Property Tax Assessment Process

The Jefferson Parish Assessor’s Office plays a pivotal role in determining property values and, consequently, the property taxes owed by residents and businesses. The assessment process is a comprehensive and meticulous procedure designed to ensure fair and equitable taxation.

Here's a breakdown of the key steps involved:

- Property Inspection: Assessors conduct regular inspections of properties to gather data on their physical characteristics, such as size, age, and any improvements or additions.

- Market Analysis: The assessor's office analyzes the real estate market in the parish to determine the current value of similar properties. This data is crucial for setting a fair market value for each property.

- Assessment Notification: After the assessment process, property owners receive a notification of their assessed value. This value serves as the basis for calculating property taxes.

- Appeal Process: Property owners have the right to appeal their assessed value if they believe it is inaccurate or unfair. The appeals process provides an opportunity for a review and potential adjustment.

The Jefferson Parish Assessor's Office strives to maintain transparency and accuracy in its assessments, ensuring that property owners have a clear understanding of their tax obligations.

Key Factors Influencing Property Assessments

Several factors contribute to the assessment of property values in Jefferson Parish. These include:

- Location: The neighborhood and surrounding amenities can significantly impact property values. Proximity to schools, parks, and commercial areas often drives up property assessments.

- Property Improvements: Any additions or renovations made to a property can increase its value. These improvements are taken into account during the assessment process.

- Market Trends: The real estate market's overall performance and trends in the parish influence property assessments. Assessors closely monitor market activity to ensure assessments reflect the current market.

By considering these factors, the Jefferson Parish Assessor's Office aims to provide accurate assessments that reflect the true value of each property.

| Assessment Year | Total Assessed Value | Average Assessment Increase |

|---|---|---|

| 2022 | $10.2 Billion | 3.5% |

| 2021 | $9.8 Billion | 2.8% |

| 2020 | $9.5 Billion | 4.2% |

The above table showcases the total assessed value and the average assessment increase for the past three years. These figures highlight the steady growth in property values in Jefferson Parish.

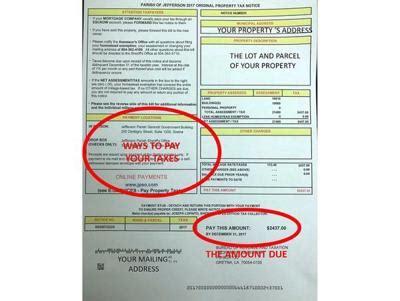

Calculating Jefferson Parish Property Taxes

Once the assessed value of a property is determined, the calculation of property taxes follows a straightforward formula. Jefferson Parish utilizes a millage rate, which is a tax rate expressed in mills (one-thousandth of a dollar), to determine the tax liability.

The formula for calculating property taxes is as follows:

Property Taxes = Assessed Value x Millage Rate

For instance, if a property has an assessed value of $200,000 and the millage rate is 100 mills, the property taxes would be calculated as:

Property Taxes = $200,000 x 0.100 = $2,000

Millage Rates and Tax Distribution

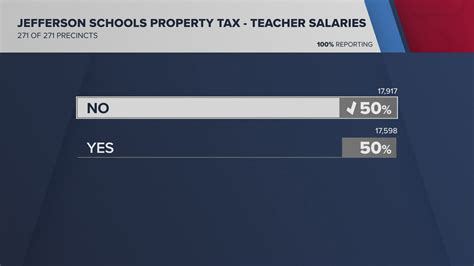

Jefferson Parish sets millage rates for various purposes, including general funds, schools, and special districts. These rates are approved by the parish council and can vary from year to year based on budgetary needs and voter-approved initiatives.

Here's a simplified breakdown of the distribution of property taxes:

- General Funds: A portion of the property taxes goes towards the parish's general operating budget, covering services like public safety, infrastructure maintenance, and administrative costs.

- School Districts: A significant share of property taxes is allocated to local school districts to support education, including teacher salaries, school maintenance, and educational programs.

- Special Districts: These are specific areas within the parish that have unique needs, such as drainage or transportation improvements. Property taxes contribute to the funding of these special districts.

The distribution of property taxes ensures that the parish can provide essential services and maintain a high quality of life for its residents.

Impact of Jefferson Parish Property Taxes on the Community

Jefferson Parish Property Taxes play a vital role in shaping the community’s growth and development. The revenue generated from these taxes is a significant source of funding for essential services and infrastructure projects.

Community Benefits

The funds derived from property taxes contribute to:

- Public Safety: Property taxes support the parish's law enforcement agencies, ensuring a safe and secure environment for residents and businesses.

- Education: A substantial portion of property taxes goes towards improving schools, enhancing educational opportunities, and providing resources for students.

- Infrastructure: Property taxes fund critical infrastructure projects, such as road improvements, bridge maintenance, and utility upgrades, benefiting the entire community.

- Economic Development: These taxes contribute to attracting businesses and creating job opportunities, fostering economic growth in the parish.

By investing in these areas, Jefferson Parish ensures a vibrant and thriving community.

Tax Relief Programs

Recognizing the financial obligations of property ownership, Jefferson Parish offers several tax relief programs to assist eligible homeowners. These programs aim to ease the tax burden and promote homeownership.

- Homestead Exemption: This program provides a reduction in the assessed value of a homeowner's primary residence, resulting in lower property taxes. To qualify, homeowners must meet certain residency and income criteria.

- Senior Citizen Exemption: Seniors who meet age and income requirements may be eligible for a reduction in their property taxes, making it more affordable to remain in their homes.

- Veterans' Exemption: Jefferson Parish offers property tax exemptions to honorably discharged veterans, providing financial relief for their service.

These tax relief programs demonstrate the parish's commitment to supporting its residents and ensuring that property ownership remains accessible.

Conclusion: Navigating the Jefferson Parish Property Tax System

Understanding the Jefferson Parish Property Tax system is crucial for property owners to manage their financial obligations effectively. By staying informed about assessment processes, calculation methods, and available tax relief programs, homeowners can ensure they are contributing to the community’s growth while maintaining their financial well-being.

The Jefferson Parish Assessor's Office and local government work diligently to ensure a fair and transparent tax system, providing resources and assistance to property owners. With a clear understanding of the property tax landscape, residents can actively participate in the parish's development and enjoy the benefits of a thriving community.

What is the deadline for paying Jefferson Parish Property Taxes?

+

The deadline for paying Jefferson Parish Property Taxes is typically set for January 31st of each year. However, it’s important to note that there may be extensions or grace periods in certain circumstances. It’s recommended to stay updated with the parish’s official website or contact the tax assessor’s office for the most accurate and current information.

How can I appeal my property assessment if I believe it is inaccurate?

+

If you believe your property assessment is inaccurate, you have the right to appeal. The process typically involves submitting an appeal form within a specified timeframe, often 30 to 60 days after receiving the assessment notice. It’s crucial to provide supporting evidence, such as recent sales data or professional appraisals, to strengthen your case. The assessor’s office will review your appeal, and you may be invited to a hearing to present your case. It’s advisable to consult the assessor’s website or seek professional advice for a detailed understanding of the appeal process.

Are there any online resources available to estimate my property taxes in Jefferson Parish?

+

Yes, the Jefferson Parish Assessor’s Office provides an online property tax estimator tool on its official website. This tool allows property owners to input their assessed value and millage rate to estimate their annual property taxes. It’s a convenient way to get a rough estimate and plan for your tax obligations. However, it’s important to note that this estimator is for informational purposes only, and the actual tax amount may vary based on final assessments and any changes in millage rates.