California Sales Tax Return

The process of filing a California Sales Tax Return is an important task for businesses operating within the state. California, known for its vibrant economy and diverse business landscape, requires all businesses engaged in taxable sales to remit sales tax to the California Department of Tax and Fee Administration (CDTFA). This article aims to provide an in-depth guide to navigating the California Sales Tax Return process, offering valuable insights and practical tips to ensure compliance and streamline the filing procedure.

Understanding the California Sales Tax Landscape

California’s sales tax system is a complex yet crucial component of the state’s revenue generation. With a general sales and use tax rate of 7.25%, it is important to note that this rate can vary depending on the location of the sale and any applicable local taxes. The state’s sales tax system encompasses a wide range of goods and services, making it essential for businesses to understand their tax obligations.

The California Department of Tax and Fee Administration (CDTFA) plays a pivotal role in overseeing sales tax collection and enforcement. Their website provides a wealth of resources, including registration forms, tax rate lookup tools, and detailed guidelines for businesses to navigate the sales tax landscape effectively.

Eligibility and Registration for Sales Tax

Not all businesses are required to collect and remit sales tax in California. The state’s sales tax regulations dictate that businesses must register for a Seller’s Permit if they meet certain criteria. These criteria include:

- Engaging in taxable sales of tangible personal property.

- Providing certain taxable services.

- Renting or leasing tangible personal property.

- Selling gift certificates, gift cards, or store value cards.

- Making sales as a telemarketer or mail-order seller.

Businesses that meet these criteria are required to obtain a Seller's Permit, which serves as authorization to collect and remit sales tax. The permit is specific to each business location, meaning that businesses with multiple locations in California may need separate permits.

The Sales Tax Return Process

Filing a California Sales Tax Return involves several key steps, each of which is critical to ensuring compliance and accurate reporting.

Step 1: Determine Your Filing Frequency

California offers businesses flexibility in terms of filing frequency. Depending on the volume of sales, businesses can choose to file returns monthly, quarterly, or annually. The CDTFA assesses each business’s sales volume and revenue to determine the appropriate filing frequency. It is important to note that businesses can request a change in filing frequency if their sales patterns change significantly.

Step 2: Calculate Your Tax Liability

Calculating sales tax liability involves a comprehensive process. Businesses must first identify the total sales revenue for the filing period, including any applicable discounts or exemptions. Then, they must apply the appropriate tax rate, which may vary based on the location of the sale and any local taxes. Finally, any credits or deductions must be factored in to arrive at the final tax liability.

It is crucial for businesses to maintain accurate records of their sales transactions, as these records will be essential for verifying tax calculations and responding to any audits.

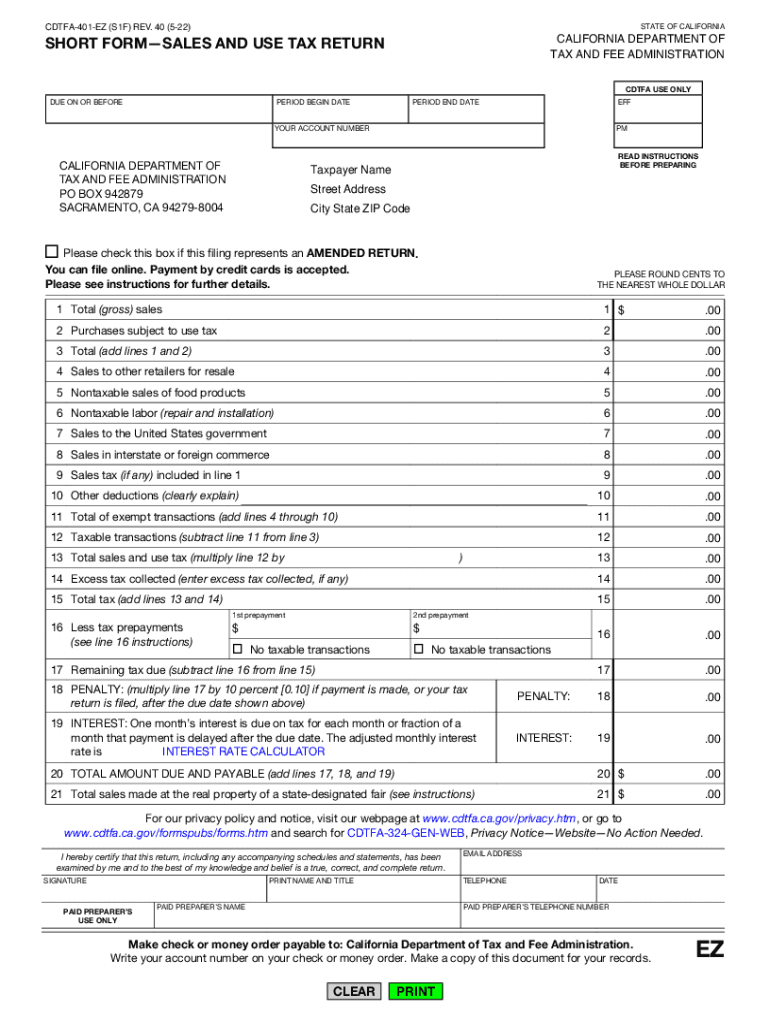

Step 3: File Your Return

Filing a California Sales Tax Return can be done online through the CDTFA’s website or by mail using the appropriate form. The CDTFA provides detailed instructions and a user-friendly interface for online filing. For paper filing, businesses must ensure they use the correct form and include all required information.

The return must include the total taxable sales for the period, the applicable tax rate, and the calculated tax liability. It is essential to file the return by the due date to avoid late fees and penalties.

Step 4: Remit Your Payment

Once the return is filed, the next step is to remit the calculated sales tax payment. Businesses can make payments online, by mail, or through electronic funds transfer. The CDTFA provides various payment options to accommodate different business needs.

It is important to note that businesses must remit the full amount of tax liability by the due date. Late payments may incur penalties and interest, so it is crucial to plan and manage cash flow accordingly.

Common Challenges and Solutions

Navigating the California Sales Tax Return process can present certain challenges. Some common issues businesses face include:

Complex Tax Rates

California’s sales tax system can be complex due to varying tax rates across different jurisdictions. To address this challenge, businesses can utilize tax rate lookup tools provided by the CDTFA. These tools help businesses determine the correct tax rate for each sale, ensuring accurate reporting.

Record-Keeping and Documentation

Maintaining accurate and organized sales records is essential for compliance. Businesses should implement robust record-keeping systems to track sales, exemptions, and refunds. Regular reviews of sales records can help identify potential errors and ensure timely corrections.

Audits and Compliance

Audits are a normal part of the sales tax process, and businesses should be prepared for them. The CDTFA conducts audits to ensure compliance and accuracy in sales tax reporting. By maintaining thorough records and staying informed about audit procedures, businesses can effectively navigate audits and resolve any discrepancies.

Future Implications and Industry Trends

The California sales tax landscape is evolving, and businesses need to stay informed about potential changes. Recent trends and future implications include:

Online Sales Tax Collection

With the growth of e-commerce, California has implemented laws to ensure online sellers collect and remit sales tax. This trend is expected to continue, with a focus on streamlining the process for online sellers.

Sales Tax Holiday

California has periodically offered sales tax holidays, during which certain items are exempt from sales tax. These holidays can provide significant savings for consumers and businesses alike. Staying informed about these events can help businesses plan their sales strategies accordingly.

Sales Tax Simplification Efforts

Efforts are underway to simplify the sales tax system in California, aiming to reduce complexity and improve compliance. These efforts may include updated guidelines, streamlined processes, and enhanced technology to support businesses in their sales tax obligations.

Conclusion: Staying Compliant and Streamlined

Filing a California Sales Tax Return is a critical task for businesses operating within the state. By understanding the sales tax landscape, registering for a Seller’s Permit, and following the step-by-step process outlined above, businesses can ensure compliance and avoid penalties. Staying informed about industry trends and future implications will further enable businesses to adapt and thrive in California’s dynamic sales tax environment.

How often should I file my California Sales Tax Return?

+The filing frequency depends on your sales volume. The CDTFA will determine your filing frequency based on your business’s sales. However, you can request a change in filing frequency if your sales patterns change significantly.

What happens if I miss the filing deadline for my Sales Tax Return?

+Missing the filing deadline can result in late fees and penalties. It is important to plan ahead and ensure you file your return by the due date to avoid these additional charges.

Are there any exemptions or discounts available for Sales Tax in California?

+Yes, certain items and transactions may be exempt from sales tax. Additionally, businesses may be eligible for credits or deductions. It is important to review the CDTFA’s guidelines and consult with tax professionals to identify any applicable exemptions or discounts.

What should I do if I receive a notice for an audit?

+If you receive a notice for an audit, it is crucial to respond promptly and cooperate with the CDTFA. Prepare your sales records and be ready to provide any necessary documentation. Consult with tax professionals to guide you through the audit process and resolve any discrepancies.