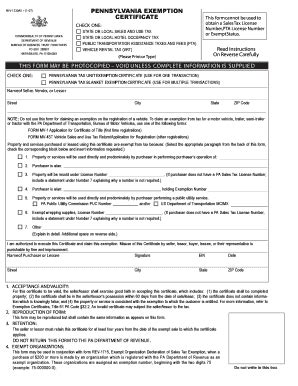

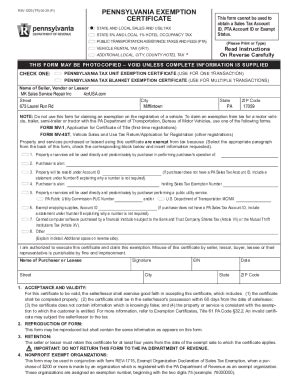

Pa Sales Tax Exemption Form

The Pennsylvania Sales Tax Exemption Form is a crucial document for businesses and individuals in the state of Pennsylvania. This form plays a significant role in the taxation process, allowing eligible entities to claim exemptions from certain sales and use taxes. Understanding the intricacies of this form and its proper usage is essential for anyone navigating the complex world of Pennsylvania taxation.

Understanding the Pennsylvania Sales Tax Exemption Form

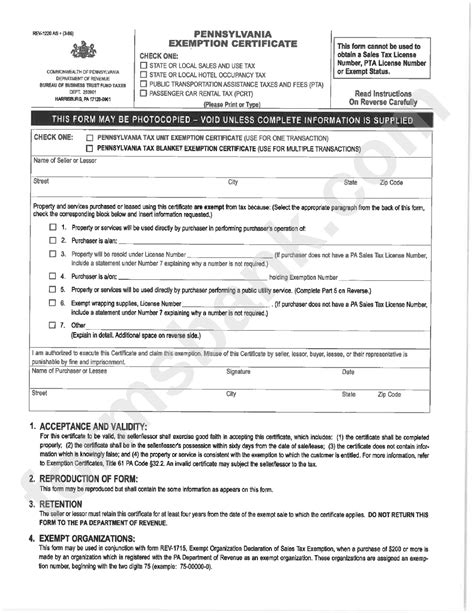

The Sales Tax Exemption Form, officially known as the Pennsylvania Department of Revenue Form REV-1203, is a legal document that serves as proof of eligibility for specific tax exemptions. These exemptions are granted under various circumstances, including but not limited to, sales to tax-exempt organizations, government entities, or purchases made for resale.

The form itself is relatively straightforward, consisting of sections that require information such as the exempt entity's name, address, tax identification number, and the nature of the exemption being claimed. However, the process of completing and submitting the form can be intricate, especially when considering the different types of exemptions and the specific requirements associated with each.

Types of Exemptions and Eligibility Criteria

Pennsylvania offers a range of sales tax exemptions, each with its own set of eligibility criteria. Some common types of exemptions include:

- Resale Exemption: Businesses that purchase goods for the purpose of resale can claim this exemption. This exemption applies to the purchase of tangible personal property, provided it is intended for resale in the regular course of business.

- Manufacturing Exemption: Manufacturers often qualify for this exemption when purchasing equipment, machinery, or supplies directly related to their manufacturing process. This exemption encourages investment in manufacturing infrastructure.

- Governmental Exemption: The state of Pennsylvania exempts governmental entities, such as federal, state, and local governments, from sales and use taxes. This exemption extends to purchases made by government agencies for official use.

- Nonprofit Exemption: Certain nonprofit organizations, such as charitable, religious, or educational entities, may be eligible for sales tax exemptions on purchases made in furtherance of their nonprofit purposes.

It's important to note that each type of exemption comes with specific requirements and documentation. For instance, to claim the resale exemption, businesses must maintain proper records and invoices to demonstrate that the purchased items were indeed resold.

The Process of Obtaining and Filing the Form

Obtaining the Pennsylvania Sales Tax Exemption Form is a straightforward process. The form is readily available on the Pennsylvania Department of Revenue’s website. It can be downloaded, filled out electronically, or printed and completed manually.

Once the form is completed, it must be submitted to the appropriate authority. For most exemptions, the form is submitted directly to the Pennsylvania Department of Revenue. However, for certain specialized exemptions, such as those related to specific industries or programs, the form might need to be submitted to a different state agency or even a local authority.

It's crucial to ensure that the form is filled out accurately and that all required documentation is attached. Inaccurate or incomplete forms can lead to delays in processing or even rejection of the exemption claim.

Real-World Examples and Case Studies

Let’s delve into some real-world scenarios to better understand the application of the Pennsylvania Sales Tax Exemption Form.

Case Study 1: Resale Exemption for a Retail Business

Consider a small retail business in Philadelphia that specializes in selling electronic gadgets. To stock their shelves, they purchase a variety of smartphones and tablets from a wholesale supplier. By obtaining the Sales Tax Exemption Form and claiming the resale exemption, the business can avoid paying sales tax on these purchases. This exemption allows them to pass on the tax savings to their customers, making their products more competitive in the market.

Case Study 2: Manufacturing Exemption for a Steel Mill

A steel mill in Pittsburgh requires a significant amount of machinery and equipment to produce steel products. By acquiring the Sales Tax Exemption Form and successfully claiming the manufacturing exemption, the mill can reduce its operational costs. This exemption allows the mill to invest more in research and development, enhancing its competitiveness in the global steel market.

Case Study 3: Nonprofit Exemption for a Community Center

A community center in Harrisburg provides various services to the local population, including educational programs, sports activities, and cultural events. By applying for and receiving the Sales Tax Exemption Form, the center can purchase supplies and equipment necessary for its operations without incurring sales tax. This exemption helps the center allocate its limited resources more efficiently, allowing it to expand its services and reach a wider audience.

Performance Analysis and Comparative Insights

The Pennsylvania Sales Tax Exemption Form plays a vital role in the state’s taxation landscape, impacting both businesses and nonprofit organizations. To gain a deeper understanding of its effectiveness, let’s analyze some key performance metrics and compare them with other states’ tax exemption systems.

| Metric | Pennsylvania | National Average |

|---|---|---|

| Number of Exemptions Granted | Over 100,000 (annually) | Varies widely by state |

| Exemption Claim Processing Time | Approximately 2-4 weeks | Ranges from 1 week to several months |

| Compliance Rate | Estimated at 95% | Varies, but typically above 90% |

| Revenue Impact | Potential loss of millions in tax revenue annually | Varies significantly based on state policies |

Pennsylvania's Sales Tax Exemption Form process is relatively efficient, with a high compliance rate and a timely processing time. However, the potential revenue impact of these exemptions is substantial, highlighting the need for careful monitoring and evaluation to ensure the system remains fair and effective.

In comparison to other states, Pennsylvania's exemption system is relatively straightforward and accessible. Some states have more complex processes, with additional layers of verification and documentation requirements. Others may have more restrictive eligibility criteria, limiting the number of entities that can benefit from tax exemptions.

Future Implications and Recommendations

As the economic landscape evolves, the role of the Pennsylvania Sales Tax Exemption Form may need to adapt to meet changing needs. Here are some potential future implications and recommendations for policymakers and businesses alike:

- Streamlined Digital Process: With the increasing adoption of digital technologies, the state could consider developing a fully digital platform for the Sales Tax Exemption Form, making the process more efficient and accessible.

- Regular Review and Update: The eligibility criteria and requirements for exemptions should be regularly reviewed and updated to ensure they remain relevant and effective in supporting businesses and organizations.

- Enhanced Education and Outreach: Providing clear and comprehensive guidance on the Sales Tax Exemption Form and its proper usage can help reduce errors and increase compliance. The state could invest in educational resources and outreach programs to achieve this.

- Consideration of New Exemptions: As the economy evolves, certain sectors or industries may require additional support. The state could explore the possibility of introducing new exemptions or modifying existing ones to adapt to changing economic realities.

Conclusion

The Pennsylvania Sales Tax Exemption Form is a powerful tool for businesses and organizations to manage their tax obligations effectively. By understanding the different types of exemptions, the eligibility criteria, and the proper procedures for obtaining and filing the form, entities can navigate the taxation landscape with confidence. As Pennsylvania’s economy continues to evolve, so too must the policies and systems that support it, ensuring a fair and sustainable taxation environment for all.

How often should I renew my Sales Tax Exemption?

+The renewal process for the Sales Tax Exemption varies based on the type of exemption and the specific circumstances. Some exemptions are permanent, while others may require periodic renewal. It’s essential to review the terms of your exemption and consult with a tax professional to ensure you’re complying with the renewal requirements.

What happens if I submit an inaccurate or incomplete Sales Tax Exemption Form?

+Submitting an inaccurate or incomplete form can lead to significant issues. The Pennsylvania Department of Revenue may reject your exemption claim, resulting in potential penalties and interest charges. It’s crucial to ensure all information is accurate and to attach all required documentation to avoid such complications.

Are there any online resources to help me understand the Sales Tax Exemption process better?

+Absolutely! The Pennsylvania Department of Revenue provides a wealth of online resources, including guides, tutorials, and frequently asked questions. These resources can help you navigate the Sales Tax Exemption process more effectively. Additionally, there are various tax professional services and organizations that offer guidance and support.