Ms Income Tax

Welcome to an in-depth exploration of the world of taxation, specifically delving into the intricacies of income tax and its impact on individuals and businesses. This article aims to provide an expert-level analysis, shedding light on the complex yet vital topic of income tax and its evolving landscape.

Understanding the Basics of Income Tax

Income tax is a cornerstone of modern economic systems, playing a pivotal role in funding government initiatives and services. It is a tax levied on the income earned by individuals, businesses, or other entities, and its structure varies significantly across jurisdictions.

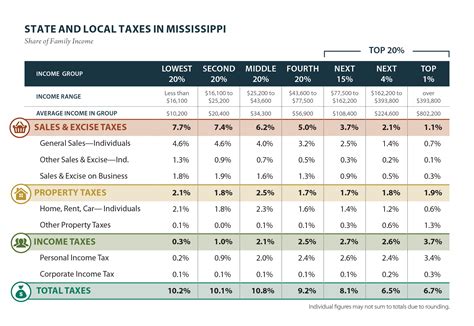

In most countries, income tax is calculated based on the principle of progressive taxation, where higher income levels are taxed at progressively higher rates. This ensures a fair distribution of the tax burden and contributes to the concept of social equity.

For individuals, income tax is often calculated based on various factors such as salary, wages, dividends, rental income, and capital gains. Businesses, on the other hand, are subject to corporate income tax, which can be influenced by factors like revenue, profits, and the nature of the business.

Key Components of Income Tax

Let’s break down the essential elements that make up the income tax system:

- Taxable Income: This is the portion of an individual’s or entity’s income that is subject to taxation. It is calculated after deductions and exemptions, which can vary depending on the jurisdiction and the taxpayer’s circumstances.

- Tax Rates: Tax rates determine the percentage of taxable income that needs to be paid as tax. These rates are often structured in brackets, with higher income levels facing higher tax rates.

- Deductions and Exemptions: Taxpayers can often reduce their taxable income by claiming deductions for expenses related to their income-generating activities. Additionally, certain types of income or taxpayers may be eligible for exemptions, reducing the overall tax liability.

- Tax Credits: Tax credits are amounts that can be directly subtracted from the total tax liability. These credits can be used to offset taxes owed and are often provided for specific purposes, such as childcare or education expenses.

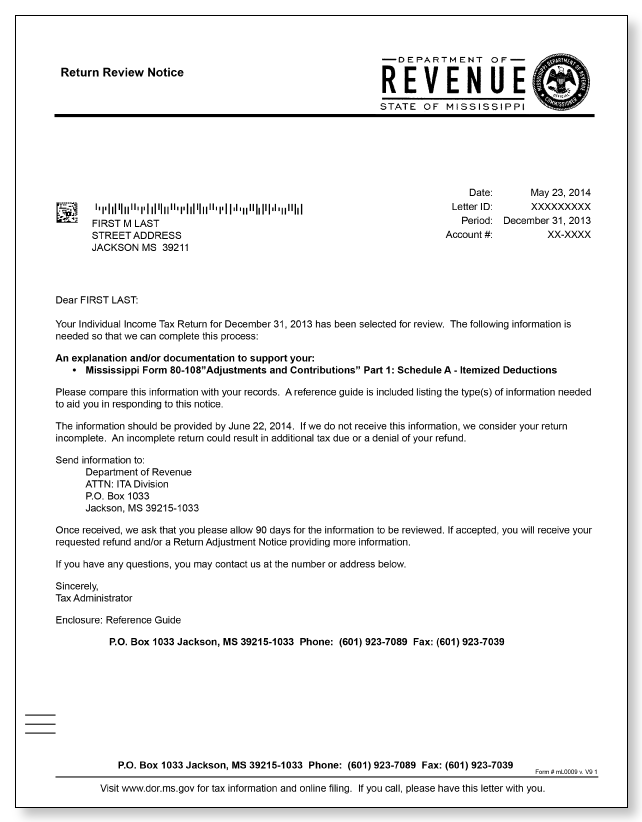

- Tax Filing and Payment: Taxpayers are typically required to file tax returns annually, declaring their income and calculating their tax liability. Payment of taxes is then due by a specified deadline.

The income tax system is designed to be complex, ensuring fairness and accounting for the diverse circumstances of taxpayers. It is a critical component of economic policy, influencing investment decisions, income distribution, and overall economic growth.

The Impact of Income Tax on Individuals and Businesses

Income tax has a profound influence on the lives of individuals and the operations of businesses, shaping financial strategies and long-term planning.

Effects on Individuals

For individuals, income tax is a significant consideration when making financial decisions. It affects the disposable income available for personal use, savings, and investments. Here’s a closer look at some of its impacts:

- Disposable Income: Income tax directly impacts the amount of money individuals have left after paying taxes, which can influence their spending habits and savings.

- Investment Decisions: Tax rates and incentives can encourage or discourage individuals from making certain investments, such as contributing to retirement accounts or investing in real estate.

- Wealth Accumulation: Over time, income tax can significantly impact an individual’s wealth accumulation, especially when combined with investment strategies that are tax-efficient.

- Tax Planning: Understanding income tax laws and regulations allows individuals to engage in tax planning, which can help minimize their tax liability and maximize their after-tax income.

Impact on Businesses

Businesses also feel the effects of income tax, which can influence their profitability, investment strategies, and overall growth prospects. Here are some key ways income tax impacts businesses:

- Profitability: Corporate income tax directly affects a business’s bottom line, reducing the profits available for reinvestment, expansion, or distribution to shareholders.

- Investment Decisions: Similar to individuals, businesses consider tax implications when making investment decisions. Tax-efficient strategies can enhance a company’s financial position and competitiveness.

- International Operations: For businesses operating across multiple jurisdictions, income tax can be a complex and critical factor in deciding where to establish operations, as tax rates and regulations vary significantly between countries.

- Tax Planning and Compliance: Businesses must navigate complex tax laws and regulations to ensure compliance and minimize their tax liability. Effective tax planning can result in substantial savings and enhance a company’s financial health.

Income tax is a powerful tool for governments to influence economic behavior and promote social welfare. Its careful design and implementation can encourage desirable behaviors and deter undesirable ones, shaping the economic landscape.

The Evolution of Income Tax: Past, Present, and Future

Income tax has undergone significant transformations over the years, adapting to changing economic landscapes and societal needs. Understanding its historical context, current trends, and potential future developments provides valuable insights into its ongoing relevance and impact.

Historical Perspective

The concept of income tax has ancient roots, dating back to the Roman Empire and even earlier civilizations. However, it was in the 18th and 19th centuries that modern income tax systems began to take shape, with countries like the United Kingdom and the United States implementing income tax laws.

The introduction of income tax was often driven by the need to fund major initiatives, such as wars or large-scale public projects. Over time, income tax became a cornerstone of government revenue, allowing for the financing of essential services and infrastructure.

Current Trends

In today’s globalized world, income tax systems continue to evolve in response to economic and social changes. Some key trends include:

- Digitalization: The rise of digital technologies has led to the development of more efficient tax collection systems, with online filing and payment options becoming widespread.

- Tax Competition: Countries are increasingly engaged in tax competition, offering attractive tax rates and incentives to attract businesses and high-net-worth individuals. This can lead to a race to the bottom, with countries reducing tax rates to remain competitive.

- Tax Reform: Many countries are undergoing tax reform to simplify their systems, improve fairness, and enhance revenue collection. This often involves broadening the tax base and reducing tax evasion.

- International Cooperation: With the rise of multinational corporations and global trade, international cooperation on tax matters has become crucial. Initiatives like the Base Erosion and Profit Shifting (BEPS) project aim to combat tax avoidance and ensure a level playing field.

Future Prospects

Looking ahead, income tax is likely to continue evolving to meet the challenges and opportunities of the future. Some potential developments include:

- Artificial Intelligence and Automation: The use of AI and automation in tax administration could further streamline processes, reduce errors, and enhance tax compliance.

- Digital Economy Taxation: As the digital economy continues to grow, finding effective ways to tax digital businesses and transactions will be a key challenge. This may involve the development of new tax categories and international agreements.

- Environmental Considerations: Income tax systems may increasingly incorporate environmental considerations, with incentives or disincentives for environmentally friendly behaviors.

- Global Tax Harmonization: While challenging, efforts to harmonize tax systems internationally could lead to greater fairness and cooperation, especially in addressing tax avoidance and evasion.

The future of income tax is likely to be shaped by technological advancements, global economic trends, and changing societal needs. Adapting to these changes will be crucial for maintaining the effectiveness and fairness of tax systems.

Expert Insights: Maximizing Tax Efficiency and Minimizing Burden

For individuals and businesses alike, navigating the complexities of income tax can be a daunting task. However, with the right strategies and understanding, it is possible to optimize tax efficiency and minimize the tax burden.

Tax Planning Strategies for Individuals

Individuals can employ various strategies to reduce their tax liability and maximize their after-tax income. Here are some expert tips:

- Take Advantage of Deductions: Familiarize yourself with the deductions you are eligible for and ensure you claim them. Common deductions include contributions to retirement accounts, medical expenses, and charitable donations.

- Strategic Investment: Consider investing in tax-efficient assets or utilizing tax-advantaged investment vehicles. This can help reduce your taxable income and provide long-term benefits.

- Tax Loss Harvesting: If you have investments that have incurred losses, you can sell them to offset gains from other investments, reducing your overall tax liability.

- Educate Yourself: Stay informed about changes in tax laws and regulations. Understanding how these changes affect your personal situation can help you make informed financial decisions.

Tax Optimization for Businesses

Businesses have a range of strategies at their disposal to optimize their tax position and enhance their financial health. Some key considerations include:

- Corporate Structure: The legal structure of your business can have significant tax implications. Consulting with tax professionals can help you choose the most tax-efficient structure for your specific circumstances.

- Tax Incentives: Many jurisdictions offer tax incentives to encourage certain behaviors, such as investing in research and development or hiring from underrepresented groups. Understanding these incentives can lead to substantial tax savings.

- Transfer Pricing: For multinational corporations, transfer pricing strategies can be crucial in optimizing tax efficiency. This involves setting prices for transactions between different entities within the corporate group to minimize tax liability.

- International Tax Planning: If your business operates across borders, careful international tax planning is essential. This includes understanding the tax treaties between countries and structuring your operations to take advantage of tax incentives and minimize double taxation.

Conclusion: Income Tax’s Role in Shaping the Economic Landscape

Income tax is an indispensable component of modern economic systems, influencing individual financial decisions, business strategies, and government policies. Its evolution over time has been a response to changing economic realities and societal needs, and its future development will continue to be shaped by technological advancements and global economic trends.

Understanding income tax and its implications is crucial for individuals and businesses to make informed financial decisions and optimize their tax positions. By staying informed and engaging with tax professionals, individuals and businesses can navigate the complexities of income tax and contribute to a fair and efficient tax system.

As we move forward, the ongoing dialogue and collaboration between governments, taxpayers, and tax professionals will be key to ensuring that income tax remains a tool for promoting economic growth, social welfare, and a fair distribution of resources.

How often do individuals need to file income tax returns?

+In most countries, individuals are required to file income tax returns annually. The specific deadline for filing tax returns varies depending on the jurisdiction. For example, in the United States, the deadline is typically April 15th, while in the United Kingdom, it’s January 31st.

What are some common deductions available to individuals when filing income tax returns?

+Common deductions available to individuals include contributions to retirement accounts, medical expenses, charitable donations, mortgage interest, state and local taxes, and certain education expenses. It’s important to consult with a tax professional to understand which deductions you may be eligible for.

How do businesses minimize their tax liability while remaining compliant with tax laws?

+Businesses can minimize their tax liability by carefully considering their corporate structure, taking advantage of tax incentives and credits, and engaging in strategic tax planning. It’s crucial to consult with tax professionals to ensure compliance and optimize tax efficiency.