Is Social Security Disability Taxed

The taxation of Social Security Disability benefits (SSDI) is a complex topic that requires a detailed understanding of the U.S. tax system and the specific circumstances of each beneficiary. While Social Security Disability benefits are intended to provide financial support to individuals with disabilities, the Internal Revenue Service (IRS) treats these benefits as taxable income under certain conditions.

It's important to note that not all Social Security Disability beneficiaries will have their benefits taxed. The taxability of SSDI depends on various factors, including the beneficiary's total income, marital status, and other sources of income.

Understanding the Taxability of SSDI

The IRS considers Social Security Disability benefits as taxable income when the beneficiary's combined income exceeds certain thresholds. Combined income, in this context, includes not only SSDI payments but also other sources of income, such as wages, pensions, interest, and dividends.

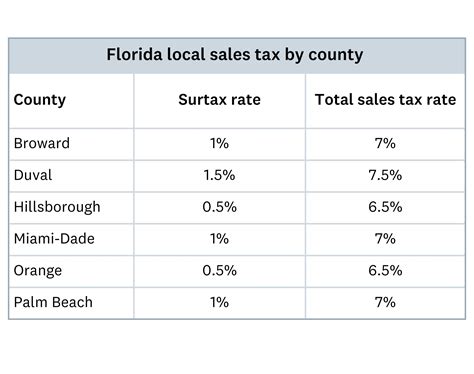

There are two key thresholds to consider: the base amount and the additional amount. The base amount is $25,000 for single filers, $32,000 for married couples filing jointly, and $0 for married couples filing separately.

| Filing Status | Base Amount |

|---|---|

| Single | $25,000 |

| Married Filing Jointly | $32,000 |

| Married Filing Separately | $0 |

If a beneficiary's combined income exceeds the base amount, up to 50% of their SSDI benefits may become taxable. However, if the combined income surpasses the additional amount, up to 85% of the SSDI benefits can be subject to taxation.

| Additional Amount |

|---|

| $34,000 (Single) |

| $44,000 (Married Filing Jointly) |

It's crucial to understand that the taxation of SSDI benefits is not automatic. Beneficiaries must meet the aforementioned income thresholds and then calculate their taxable SSDI benefits using IRS guidelines.

Calculating Taxable SSDI Benefits

To determine the taxable portion of their SSDI benefits, beneficiaries can use the following formula provided by the IRS:

Taxable SSDI Benefits = (Combined Income - Base Amount) x 50% + 85%

For example, consider a single filer with a combined income of $30,000, including SSDI benefits. The taxable portion of their SSDI benefits would be calculated as follows:

Taxable SSDI Benefits = ($30,000 - $25,000) x 50% + 85% of SSDI benefits

This calculation helps beneficiaries understand the potential tax implications of their SSDI benefits and plan their finances accordingly.

Strategies to Minimize Taxable SSDI Benefits

While the taxability of SSDI benefits is determined by the IRS, there are strategies beneficiaries can employ to potentially reduce the taxable portion of their benefits. These strategies include:

- Income Management: Beneficiaries can strategically manage their income sources to stay below the base and additional income thresholds. This may involve adjusting the timing of other income, such as capital gains or retirement withdrawals.

- Tax Planning: Working with a tax professional can help beneficiaries optimize their tax strategies. This may include utilizing tax-efficient investment vehicles or exploring tax deductions and credits to reduce their overall taxable income.

- Spousal Benefits: In some cases, married couples can strategically time their Social Security claiming decisions to minimize the tax impact on SSDI benefits. This may involve one spouse delaying their Social Security retirement benefits to increase their own benefits and reduce the taxable portion of the SSDI benefits.

It's important to note that tax laws and regulations can change over time, so beneficiaries should stay informed and consult with tax professionals to ensure they are taking advantage of the most up-to-date strategies.

Tax Implications for Dependent SSDI Beneficiaries

It's worth mentioning that Social Security Disability benefits received by a beneficiary's dependent or spouse may also have tax implications. These benefits, known as auxiliary benefits, are typically taxable under the same rules as the beneficiary's own SSDI benefits.

Auxiliary benefits are added to the beneficiary's combined income when calculating the taxable portion of their SSDI benefits. This means that the higher the auxiliary benefits, the more likely it is that a portion of the SSDI benefits will be taxable.

Strategies for Dependent Beneficiaries

Dependent beneficiaries can also take steps to potentially reduce the tax impact of their auxiliary benefits. Some strategies include:

- Income Distribution: If possible, beneficiaries can distribute their income across multiple family members to stay below the base and additional income thresholds. This may involve optimizing investment strategies or exploring tax-efficient ways to provide financial support to other family members.

- Estate Planning: For beneficiaries with substantial assets, estate planning can help minimize the tax burden on their heirs. This may involve setting up trusts, gifting assets, or exploring other estate planning strategies to reduce the taxable value of their estate.

It's essential for dependent beneficiaries to consult with tax professionals and financial advisors to develop a comprehensive plan that aligns with their specific circumstances and goals.

Navigating the Complexity of SSDI Taxation

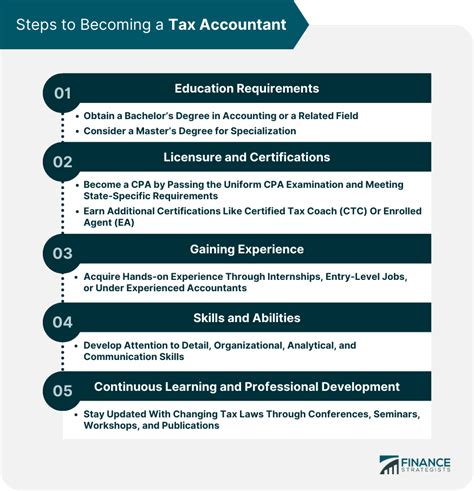

The taxability of Social Security Disability benefits can be a complex and nuanced topic. While the IRS provides guidelines and resources to help beneficiaries understand their tax obligations, seeking professional advice is often beneficial.

Tax professionals, such as certified public accountants (CPAs) or enrolled agents (EAs), can provide personalized guidance based on a beneficiary's unique financial situation. They can help with tax planning, strategy development, and ensuring compliance with tax laws and regulations.

Additionally, staying informed about changes in tax laws and Social Security benefits is crucial. The IRS and the Social Security Administration regularly update their websites with the latest information, and beneficiaries should consult these resources to stay current.

Resources for Further Information

For more detailed information on the taxability of Social Security Disability benefits, beneficiaries can refer to the following resources:

- Social Security Administration: Benefits Planner - Retirement

- Social Security Administration: Benefits Planner - Disability

- IRS Publication 915: Social Security and Equivalent Railroad Retirement Benefits

- IRS: Social Security and Equivalent Railroad Retirement Benefits

These resources provide in-depth explanations, examples, and calculations to help beneficiaries understand the tax implications of their SSDI benefits.

Conclusion

The taxability of Social Security Disability benefits is a critical aspect of financial planning for beneficiaries. While the IRS treats SSDI benefits as taxable income under certain conditions, there are strategies beneficiaries can employ to potentially minimize the taxable portion of their benefits.

By understanding the income thresholds, calculating taxable benefits accurately, and exploring tax planning strategies, beneficiaries can make informed decisions to optimize their financial situation. Seeking professional advice and staying informed about tax laws and regulations is essential for navigating the complexities of SSDI taxation.

How do I know if my SSDI benefits are taxable?

+

Your SSDI benefits may be taxable if your combined income, including SSDI payments and other sources of income, exceeds certain thresholds. The base amount for single filers is 25,000, 32,000 for married couples filing jointly, and $0 for married couples filing separately. If your combined income surpasses these thresholds, a portion of your SSDI benefits may become taxable.

Can I reduce the taxable portion of my SSDI benefits?

+

Yes, there are strategies to potentially reduce the taxable portion of your SSDI benefits. These include managing your income sources to stay below the income thresholds, exploring tax-efficient investment options, and working with a tax professional to optimize your tax planning.

What happens if I don’t report my SSDI benefits as taxable income?

+

Failing to report taxable SSDI benefits can result in penalties and interest from the IRS. It’s important to accurately calculate and report your taxable SSDI benefits to avoid potential legal and financial consequences.

Are auxiliary benefits for dependents taxable?

+

Yes, auxiliary benefits received by a beneficiary’s dependent or spouse are typically taxable under the same rules as the beneficiary’s own SSDI benefits. These benefits are added to the beneficiary’s combined income when calculating the taxable portion of their SSDI benefits.

Can I claim tax deductions or credits related to my disability?

+

Yes, there are tax deductions and credits available for individuals with disabilities. These include the medical expense deduction, the disability access credit, and the disabled access credit. Consult with a tax professional to explore the options available to you.