How To Become A Tax Accountant

Becoming a tax accountant is an excellent career choice for those with a keen eye for detail, a passion for numbers, and a desire to navigate the complex world of taxation. Tax accountants play a vital role in helping individuals, businesses, and organizations manage their financial obligations and optimize their tax strategies. If you're considering a career in tax accounting, this guide will provide you with the insights and steps needed to embark on this rewarding journey.

Understanding the Role of a Tax Accountant

A tax accountant is a financial professional specializing in tax preparation, planning, and compliance. They are responsible for ensuring that their clients meet their tax obligations accurately and efficiently. Tax accountants work with a diverse range of clients, including sole proprietors, partnerships, corporations, and high-net-worth individuals.

The primary duties of a tax accountant include preparing and filing tax returns, offering tax planning advice to minimize tax liabilities, and staying updated with the ever-changing tax laws and regulations. They must possess strong analytical skills to interpret complex tax codes and regulations and apply them to specific client scenarios. Additionally, tax accountants often assist clients with financial planning, budgeting, and strategic tax management.

Educational Pathways to Becoming a Tax Accountant

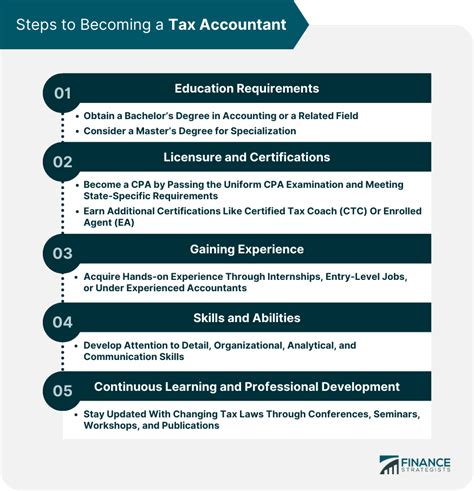

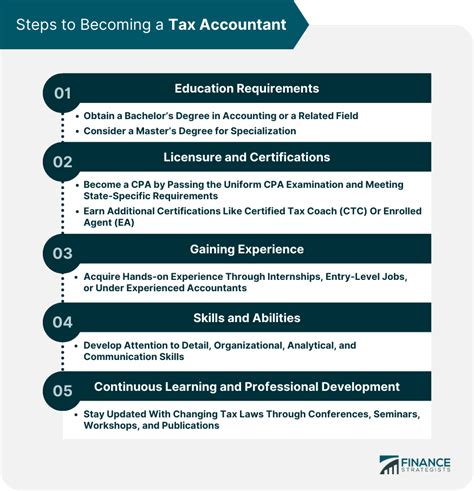

To embark on a career in tax accounting, a solid educational foundation is essential. Here are the typical steps and qualifications required:

Bachelor’s Degree

The minimum educational requirement for tax accountants is a bachelor’s degree in accounting, finance, or a related field. During your undergraduate studies, focus on courses that cover financial accounting, taxation, auditing, and business law. These foundational courses will provide you with a strong understanding of the principles and practices relevant to tax accounting.

Consider pursuing a degree from an accredited institution that offers a comprehensive curriculum in accounting. Many universities offer specialized accounting programs with a tax concentration, providing in-depth knowledge of tax regulations and practices. Additionally, seek out opportunities to gain practical experience through internships or part-time jobs in accounting firms or tax departments.

Master’s Degree (Optional)

While a bachelor’s degree is sufficient for entry-level tax accounting positions, pursuing a master’s degree can significantly enhance your career prospects. A Master of Science in Taxation or a Master of Accountancy with a taxation focus can provide advanced knowledge and specialized skills in tax accounting.

These graduate programs typically cover topics such as advanced tax research, international taxation, estate planning, and tax strategies for specific industries. Obtaining a master's degree not only deepens your expertise but also opens doors to senior-level positions and leadership roles in tax accounting.

Professional Certifications

Obtaining professional certifications is a crucial step towards establishing yourself as a reputable tax accountant. The most recognized and highly regarded certification for tax professionals is the Certified Public Accountant (CPA) designation. To become a CPA, you must meet the education and experience requirements set by your state’s Board of Accountancy and pass the Uniform CPA Examination.

In addition to the CPA designation, you may consider pursuing other specialized certifications such as the Enrolled Agent (EA) certification from the Internal Revenue Service (IRS) or the Certified Financial Planner (CFP) certification. These certifications demonstrate your expertise and commitment to the field, making you a more attractive candidate for tax accounting roles.

Gaining Practical Experience

While education provides a strong theoretical foundation, practical experience is invaluable in the field of tax accounting. Here are some ways to gain hands-on experience:

Internships and Entry-Level Positions

Seek out internships or entry-level positions at accounting firms, tax consulting firms, or even within the tax departments of larger corporations. These opportunities allow you to apply your classroom knowledge in real-world scenarios and gain exposure to a variety of tax-related tasks. You’ll learn from experienced professionals and develop crucial skills such as tax research, client communication, and project management.

Continuing Education and Professional Development

The field of tax accounting is constantly evolving, with new laws, regulations, and tax strategies emerging regularly. To stay relevant and competitive, tax accountants must commit to ongoing professional development. Attend conferences, workshops, and seminars focused on tax accounting to stay updated with the latest trends and best practices. Many professional organizations, such as the American Institute of Certified Public Accountants (AICPA), offer continuing education courses and resources specifically designed for tax professionals.

Developing Essential Skills

In addition to academic qualifications and practical experience, tax accountants must possess a unique set of skills to excel in their roles. Here are some key skills to develop:

Analytical and Critical Thinking

Tax accountants must be able to analyze complex financial data and tax codes to identify potential tax savings, optimize tax strategies, and ensure compliance. Developing strong analytical skills will enable you to provide accurate and insightful advice to your clients.

Attention to Detail

Tax accounting requires an exceptional level of precision and attention to detail. A single mistake or oversight can have significant financial implications for your clients. Cultivate your ability to review and analyze financial documents, tax forms, and regulations meticulously to ensure accuracy and avoid errors.

Communication and Interpersonal Skills

Tax accountants often work closely with clients, providing them with tax advice and guidance. Effective communication skills are essential to explain complex tax concepts and strategies in a clear and concise manner. Additionally, building strong interpersonal skills will help you establish trust and rapport with clients, fostering long-term professional relationships.

Time Management and Organization

Tax accounting involves managing multiple clients and projects with tight deadlines. Developing excellent time management and organizational skills will enable you to prioritize tasks, meet deadlines, and provide timely services to your clients. Utilize project management tools and techniques to stay organized and ensure a smooth workflow.

Building a Professional Network

Networking is an invaluable aspect of building a successful career in tax accounting. Here’s how you can expand your professional network:

Join Professional Organizations

Becoming a member of professional organizations such as the AICPA, the National Association of Tax Professionals (NATP), or the National Society of Accountants (NSA) provides numerous benefits. These organizations offer networking opportunities, access to industry resources, and continuing education programs. Attend conferences, seminars, and social events organized by these associations to connect with fellow tax professionals and industry leaders.

Online Communities and Social Media

Leverage online platforms and social media to connect with tax professionals and stay updated with industry news and trends. Join tax-focused groups and communities on LinkedIn, Facebook, or specialized forums. Engage in discussions, share insights, and build your online presence as a tax accounting expert.

Mentorship Programs

Seek out mentorship opportunities with experienced tax accountants. A mentor can provide valuable guidance, share industry insights, and offer support as you navigate your career path. Many professional organizations and accounting firms offer mentorship programs, connecting aspiring tax professionals with seasoned experts.

Future Outlook and Career Growth

The demand for skilled tax accountants is expected to remain strong in the coming years. As businesses and individuals continue to seek tax optimization strategies and compliance solutions, the role of tax accountants becomes increasingly crucial. Here are some career paths and growth opportunities within the field of tax accounting:

Specialization

Tax accounting offers numerous specialization opportunities, allowing you to focus on specific areas of interest. Some common specializations include international tax, estate and gift tax, corporate tax, and individual tax planning. By developing expertise in a particular niche, you can become a trusted advisor to clients within that domain.

Leadership and Management Roles

With experience and a solid reputation, you can advance into leadership and management positions within accounting firms or tax departments. As a senior tax accountant or tax manager, you’ll oversee a team of professionals, mentor junior staff, and provide strategic tax advice to high-profile clients.

Consulting and Advisory Services

Many tax accountants transition into consulting roles, offering their expertise and advice to a diverse range of clients. As a tax consultant, you can provide specialized services such as tax planning, tax strategy development, and compliance assessments. This career path allows for greater flexibility and the opportunity to work with multiple clients across various industries.

Academic and Research Opportunities

For those passionate about research and academia, pursuing a career in tax accounting research or academia is an option. You can contribute to the development of tax policies, influence tax regulations, and share your knowledge through publications and teaching.

Conclusion

Becoming a tax accountant requires a combination of education, practical experience, and the development of essential skills. With a solid foundation in accounting, specialized knowledge in taxation, and a commitment to professional development, you can embark on a rewarding career path. Remember, the field of tax accounting offers diverse opportunities for growth, specialization, and leadership, making it an exciting and dynamic profession to pursue.

What are the average salaries for tax accountants?

+Salaries for tax accountants can vary based on factors such as experience, location, and industry. On average, entry-level tax accountants can expect to earn around 50,000 to 65,000 per year. However, with experience and specialization, salaries can increase significantly. Senior tax accountants and tax managers often earn six-figure salaries, with the potential to reach $150,000 or more.

What are some common challenges faced by tax accountants?

+Tax accountants often face challenges such as keeping up with constantly changing tax laws and regulations, managing tight deadlines during tax season, and ensuring accurate and compliant tax filings. Additionally, they must navigate complex tax scenarios and provide strategic advice to clients while maintaining ethical standards.

How can I stay updated with tax law changes?

+To stay current with tax law changes, subscribe to reputable tax publications and newsletters, attend continuing education courses and seminars, and join professional organizations that provide access to industry resources and updates. Regularly reviewing tax code updates and staying connected with the tax community will help you stay informed.

What are some common tax software tools used by tax accountants?

+Tax accountants often utilize specialized tax software tools to streamline their work and ensure accuracy. Some popular software options include Intuit ProConnect Tax Online, Drake Software, Thomson Reuters CS Professional Suite, and UltraTax CS. These tools offer features such as tax form preparation, e-filing capabilities, and tax research databases.

Are there any alternative career paths within the tax accounting field?

+Yes, there are alternative career paths within the tax accounting field. Some professionals choose to specialize in tax research and analysis, working for government agencies or think tanks. Others may pursue roles in tax policy development, tax technology, or even tax litigation. These paths offer unique opportunities to contribute to the field of tax accounting in different ways.