Ohio Tax Refund

The Ohio tax refund process is a crucial aspect of the state's tax system, offering relief to taxpayers and providing a boost to the economy. Ohio, known for its diverse economy and vibrant communities, understands the importance of efficient tax refund management. This comprehensive guide aims to shed light on the intricacies of Ohio tax refunds, ensuring taxpayers have the knowledge to navigate the process with ease and confidence.

Understanding the Ohio Tax Refund System

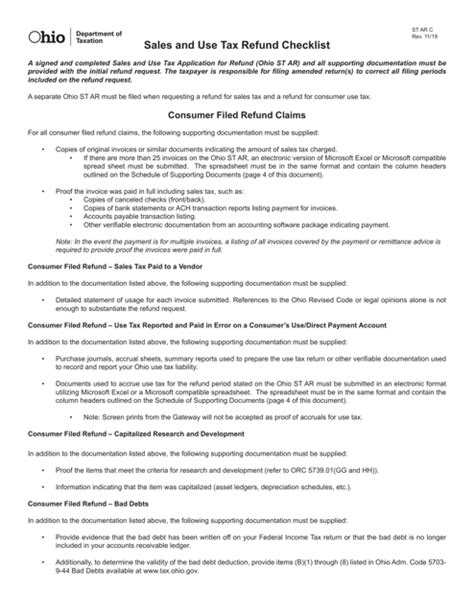

The Ohio Department of Taxation administers the state’s tax refund program, ensuring a fair and efficient process for all taxpayers. The system is designed to provide refunds to those who have overpaid their taxes, whether through income tax, sales tax, or other applicable levies. Understanding the key components of this system is essential for taxpayers to make the most of their refunds.

Eligibility and Types of Refunds

Not all taxpayers are eligible for a refund, and the type of refund can vary based on several factors. Ohio offers various types of refunds, including income tax refunds, sales tax refunds, and even specific refunds for certain programs or incentives. For instance, taxpayers who qualify for the Homestead Exemption may receive a refund or credit on their property taxes, which is a significant benefit for many Ohio residents.

Additionally, Ohio's Earned Income Tax Credit (EITC) program provides a refundable tax credit for low- to moderate-income working individuals and families. This credit can result in a substantial refund, helping to alleviate financial burdens for eligible taxpayers.

| Refund Type | Description |

|---|---|

| Income Tax Refund | Refunds overpaid income taxes. |

| Sales Tax Refund | Refunds overpaid sales taxes. |

| Homestead Exemption Refund | Property tax relief for eligible homeowners. |

| EITC Refund | Earned Income Tax Credit for low-income taxpayers. |

The Tax Refund Process

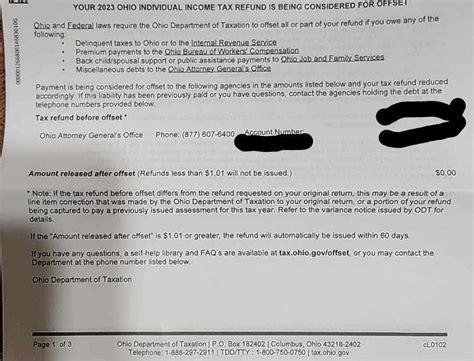

The process of claiming an Ohio tax refund begins with the accurate filing of tax returns. Taxpayers can file their returns electronically or by mail, with the option to choose direct deposit or a paper check for their refund. The state aims to process refunds within a specific timeframe, typically within 45 days of filing for electronic returns and slightly longer for paper returns.

During the processing period, the Ohio Department of Taxation verifies the information provided, ensures compliance with state tax laws, and calculates the exact refund amount. Taxpayers can track the status of their refund online, providing convenience and transparency throughout the process.

Common Challenges and Solutions

While the Ohio tax refund system is designed to be straightforward, taxpayers may encounter challenges. Delayed refunds, incorrect calculations, or missing information can cause concerns. In such cases, taxpayers should reach out to the Ohio Department of Taxation’s helpline for assistance. They offer personalized support to resolve issues, ensuring taxpayers receive their rightful refunds.

Furthermore, taxpayers should be vigilant about potential scams or fraudulent activities. The Department of Taxation will never ask for personal information or payments via unexpected methods. Educating taxpayers about these risks is crucial to maintaining a secure and efficient refund process.

Maximizing Your Ohio Tax Refund

For many Ohio residents, tax refunds can provide a significant financial boost. By understanding the strategies to maximize their refunds, taxpayers can make the most of their hard-earned money. Here are some expert tips to consider:

Take Advantage of Tax Credits

Ohio offers various tax credits that can significantly reduce tax liabilities or even result in a refund. Apart from the Earned Income Tax Credit, taxpayers should explore credits like the Child and Dependent Care Credit, which can help offset the cost of childcare, or the Credit for the Elderly or Disabled, providing relief to those who qualify.

Additionally, taxpayers should stay updated on any new credits or incentives introduced by the state. These credits can offer substantial benefits and should not be overlooked.

Consider Professional Tax Preparation

For those who find tax filing complex or time-consuming, professional tax preparation services can be a valuable investment. Tax professionals can ensure all eligible credits and deductions are claimed, maximizing the refund potential. They can also provide guidance on tax planning strategies to minimize future tax liabilities.

Moreover, professional preparers can handle the complexity of tax laws and regulations, ensuring compliance and reducing the risk of errors. This can provide taxpayers with peace of mind and the confidence that they are getting the maximum refund possible.

Strategic Tax Planning

Tax planning is an essential strategy to consider throughout the year, not just during tax season. By understanding tax laws and regulations, taxpayers can make informed financial decisions to optimize their tax situation. For instance, contributing to a retirement account can provide tax benefits, potentially reducing taxable income and increasing the refund.

Additionally, taxpayers should stay informed about any changes to Ohio's tax laws. The state may introduce new incentives, deductions, or credits that can impact tax liabilities. Staying updated can ensure taxpayers take advantage of these opportunities.

The Impact of Ohio Tax Refunds

Ohio tax refunds have a significant impact on the state’s economy and the well-being of its residents. For many Ohioans, tax refunds provide a much-needed financial cushion, helping them meet essential needs or achieve financial goals. The economic boost from these refunds can stimulate local businesses and contribute to the overall prosperity of the state.

Economic Stimulation

When Ohio residents receive their tax refunds, they often spend a portion of it on various goods and services. This spending can create a ripple effect, stimulating the local economy. From retail stores to restaurants and service providers, businesses benefit from the increased spending, leading to job creation and economic growth.

Moreover, tax refunds can encourage investment in the local community. Residents may use their refunds to improve their homes, start small businesses, or contribute to community development projects, further strengthening the local economy.

Financial Well-being and Community Impact

For low- and middle-income households, tax refunds can be a vital source of financial relief. These refunds can help families cover essential expenses, pay off debts, or save for future needs. The financial security provided by tax refunds can reduce stress and improve overall well-being.

Additionally, tax refunds can have a positive impact on community initiatives. Many Ohio residents use their refunds to support local charities, donate to causes they believe in, or contribute to community development funds. This demonstrates the power of tax refunds to foster social good and strengthen community bonds.

Looking Ahead: Future Developments in Ohio Tax Refunds

As Ohio continues to evolve and adapt to economic changes, the tax refund system is also expected to undergo advancements. Here’s a glimpse into the potential future of Ohio tax refunds:

Digital Transformation

With the increasing trend towards digital services, Ohio is likely to further enhance its online tax refund system. This may include improved online portals for tax filing and refund tracking, providing taxpayers with real-time updates and a more seamless experience. Additionally, the state may explore mobile applications to make tax-related services more accessible and convenient.

Enhanced Tax Credits and Incentives

Ohio may introduce new tax credits and incentives to encourage economic growth and support specific industries or demographics. For instance, the state could offer credits for green initiatives, small business investments, or educational pursuits. These incentives can not only benefit taxpayers but also contribute to the state’s long-term development.

Simplified Tax Laws

To make the tax system more taxpayer-friendly, Ohio could consider simplifying certain tax laws and regulations. This could involve streamlining the tax code, reducing complexity, and providing clearer guidelines. Such an initiative would make tax filing and understanding tax liabilities easier for all Ohio residents.

Conclusion

Ohio’s tax refund system is a vital component of the state’s tax framework, providing financial relief to taxpayers and stimulating the local economy. By understanding the process, maximizing refund opportunities, and staying informed about potential changes, taxpayers can make the most of their refunds. As Ohio continues to evolve, the tax refund system is expected to adapt, offering even more benefits and convenience to taxpayers.

When can I expect my Ohio tax refund?

+Ohio aims to process tax refunds within 45 days for electronic returns and slightly longer for paper returns. However, delays can occur due to high volumes or issues with the return. Tracking your refund online can provide accurate updates.

How can I track the status of my Ohio tax refund?

+You can track your Ohio tax refund status online through the Ohio Department of Taxation’s website. You’ll need your Social Security Number and either your driver’s license number or the last four digits of your bank account number for verification.

What if my Ohio tax refund is delayed or I have issues with my refund?

+If your Ohio tax refund is delayed or you encounter issues, you should contact the Ohio Department of Taxation’s helpline. They can provide personalized assistance to resolve your refund concerns.

Are there any tax credits or incentives I should be aware of in Ohio?

+Yes, Ohio offers various tax credits and incentives, such as the Earned Income Tax Credit (EITC), Child and Dependent Care Credit, and credits for the elderly or disabled. Staying updated on these credits can help you maximize your refund.

Can I receive my Ohio tax refund via direct deposit or check?

+Yes, you have the option to choose direct deposit or a paper check when filing your Ohio tax return. Direct deposit is often faster and more convenient, but a paper check provides flexibility for those without banking accounts.