What Is the HST Tax? Quick Guide to Understanding the Tax Explanation

In an increasingly complex fiscal landscape, understanding the nuances of local taxation, such as the Harmonized Sales Tax (HST), becomes vital for consumers, small business owners, and policy analysts alike. The HST, implemented in select Canadian provinces, exemplifies a modern approach to harmonized consumption taxes—combining federal and provincial tax components into a single, streamlined rate. Its design aims to simplify compliance, broaden tax bases, and foster economic integration across jurisdictions. Yet, beneath its apparent simplicity lie intricate differences, benefits, and potential drawbacks that merit detailed exploration.

HST Explained: A Comparative View of Harmonized Sales Tax vs. Separate Provincial and Federal Taxes

The core premise of the HST involves merging provincial sales tax (PST) and federal goods and services tax (GST) into one unified tax rate. This “harmonization” reduces administrative redundancy and minimizes confusion for consumers and businesses. Specifically, the HST applies in provinces such as Ontario, Nova Scotia, New Brunswick, Newfoundland and Labrador, and Prince Edward Island. It encompasses a combined rate—currently ranging between 13% and 15%—that replaces the separate taxes that previously operated independently.

In contrast, regions not participating in HST—like Alberta or Quebec—maintain their distinct tax regimes, which involve combinations of GST, PST, or Quebec Sales Tax (QST). Comparing these approaches reveals key differences in compliance complexity, revenue collection, and economic impacts.

Historical Context and Evolution of Harmonized Taxation

To appreciate the HST’s current framework, it is instructive to understand its historical development. Canada’s tax system historically consisted of multiple layers of federal and provincial taxes, often leading to confusion and administrative burden. The early 2000s saw a push toward tax harmonization, with the federally administered Goods and Services Tax (GST) introduced in 1991 as a broad-based consumption tax. Provinces seeking to reduce compliance costs and improve revenue collection collaborated with the federal government, culminating in the first HST pilot programs during the mid-2000s.

Eventually, the provinces of Ontario, New Brunswick, Newfoundland and Labrador, Nova Scotia, and Prince Edward Island formally adopted the HST, integrating the tax into their revenue frameworks and easing cross-border commerce. This effectiveness has sparked debates on its long-term impacts, leading to contrasting evaluations and policy adjustments over time.

| Aspect | HST | Separate GST and PST/QST |

|---|---|---|

| Administrative Efficiency | High — Single return, reduced paperwork | Lower — Multiple filings, complex compliance |

| Consumer Transparency | Moderate — One rate, but less visible breakdown | High — Clear separation of federal and provincial taxes |

| Revenue Stability | Robust — Easier collection across sectors | Variable — Different compliance challenges |

| Economic Impact | Potentially higher consumption due to simplified process | Variable — Possibly more resistance in differentiated regions |

Advantages and Disadvantages of the HST Compared to Separate Provincial and Federal Taxes

The debate surrounding HST revolves around its tangible benefits against potential drawbacks. On the advantage side, the unified nature of the tax simplifies procedures, reduces costs for businesses, and creates a more predictable revenue stream for governments. For instance, small businesses no longer need to file multiple returns, saving time and administrative expenses. The streamlined collection process also fosters compliance, minimizing evasion and boosting revenue intake.

Additionally, the HST’s broad base captures more consumption, possibly leading to increased tax revenues which governments can channel into critical public services. According to recent federal reports, the provinces with HST have seen notable revenue upticks—Ontario, for example, reported an increase in sales tax revenue of approximately 8% within the first two years of adopting the tax.

However, drawbacks include the obscured tax component for consumers and debates over fairness. Many argue that harmonized taxes obscure the true cost of goods and services at point-of-sale, making it difficult for consumers to compare prices or understand their tax burden. For low-income groups, the perception of increased tax burden can be significant, especially in regions where the HST consolidates multiple former taxes into one rate without explicit breakdowns.

Impact on Business Dynamics and Market Competition

From an enterprise perspective, the HST’s reduction in compliance costs can foster a more competitive environment, especially for small- and medium-sized enterprises crossing provincial boundaries. Conversely, industries heavily reliant on inter-provincial trade may face transitional challenges related to adjusting pricing strategies or tax remittance systems. For instance, retail and hospitality sectors report a smoother operational flow but express concern over the initial administrative setup costs and recalibration of point-of-sale systems.

Furthermore, the fiscal redistribution of HST revenue can influence regional economic disparities, as provinces with lower economic activity might struggle to implement their fiscal priorities under the harmonized structure. The federalequalization mechanisms tend to compensate for such disparities, but the long-term effects of tax harmonization on regional development remain a subject of scholarly inquiry.

| Factor | Benefit | Drawback |

|---|---|---|

| Compliance | Simplified process; lower costs | Initial setup costs; technological upgrades needed |

| Tax Visibility | Less confusion in day-to-day transactions | Regressive perception among low-income earners |

| Revenue Predictability | Steady income stream for government | Potentially less regional autonomy |

| Cross-Border Trade | Smoother transactions, harmonized rates | Regional disparities in economic impact |

Policy Implications and Future Outlook

The ongoing evaluation of HST’s effectiveness underscores a broader trend toward unified tax regimes aiming for economic integration and administrative efficiency. Nonetheless, critics emphasize that the one-size-fits-all model may overlook regional economic nuances and socioeconomic disparities. Policymakers face the challenge of refining harmonization mechanisms to preserve regional fiscal sovereignty while benefitting from simplified tax administration.

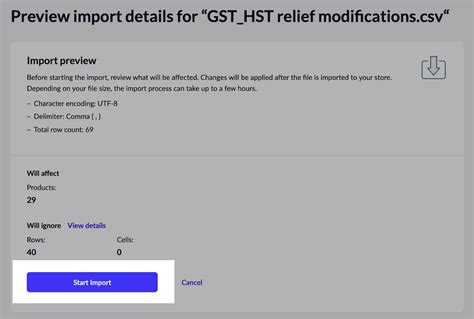

Looking ahead, a potential shift involves leveraging digital technology and data analytics to further optimize tax collection. Artificial intelligence-based systems can predict compliance patterns, minimize evasion, and tailor regional adjustments. Meanwhile, debates surrounding digital goods, online services, and international trade are prompting calls to modernize tax frameworks to reflect the evolving marketplace.

Emerging trends suggest that some provinces may revisit their tax strategies, either by adjusting the HST rate, modifying exemptions, or exploring partial exemptions to protect vulnerable populations. Simultaneously, advancements in blockchain and transparency initiatives may foster even greater taxpayer trust and compliance in the coming decades.

Thus, understanding the core principles, benefits, and pitfalls of the HST not only informs current fiscal policy but also shapes the trajectory toward more adaptive and resilient tax systems. As regional economies evolve and technological integration deepens, the HST’s role within Canada’s broader fiscal architecture will likely remain a focal point of policy debate and scholarly analysis.