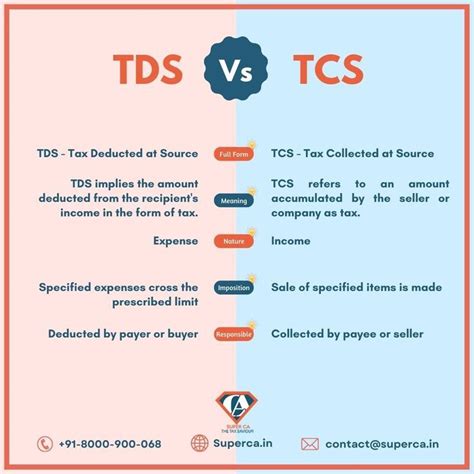

Tax Collected At Source Meaning

Tax collection at source, often referred to as withholding tax or pay-as-you-earn (PAYE) tax, is a fundamental aspect of the global tax system. This method of tax collection involves the deduction of tax at the very point of payment, typically by the payer, who acts as a collection agent for the tax authority. In this comprehensive guide, we will delve into the intricacies of tax collected at source, exploring its definition, purpose, and its significance in modern tax systems.

Understanding Tax Collection at Source

Tax collection at source is a mechanism designed to ensure that taxes are collected in a timely and efficient manner. It is a crucial component of any taxation system, as it simplifies the tax payment process for both individuals and businesses. The concept is straightforward: when a payer makes a payment to a recipient, a certain percentage of the payment is withheld and remitted to the tax authority, thus “collecting the tax at the source” of the income.

This method of tax collection is widely used across various forms of income, including wages, salaries, interest, dividends, royalties, and certain types of contracts. By collecting tax at the source, governments aim to enhance tax compliance, reduce tax evasion, and provide a steady stream of revenue for public services and infrastructure development.

The Role of Withholding Agents

In the tax collection at source system, a crucial role is played by withholding agents. These are individuals or entities responsible for deducting the tax from the payments they make and remitting it to the tax authority. Withholding agents can include employers, banks, financial institutions, and businesses paying contractors or suppliers.

For instance, consider an employer paying salaries to its employees. The employer, acting as a withholding agent, deducts a certain percentage of the salary as tax and remits it to the tax authority on behalf of the employee. This process ensures that the employee's tax liability is met promptly and that the government receives the revenue it is due.

| Withholding Agent Type | Responsibilities |

|---|---|

| Employers | Deduct tax from employees' salaries and remit to tax authority. |

| Financial Institutions | Withhold tax on interest and dividends paid to account holders. |

| Businesses | Deduct tax from payments to contractors or suppliers. |

The Importance of Tax Collected at Source

Tax collection at source is a critical tool for governments to maintain a stable and sustainable revenue stream. It offers several advantages, making it a preferred method of tax collection in many jurisdictions.

Enhancing Tax Compliance

By collecting tax at the source, governments encourage voluntary tax compliance. This method ensures that individuals and businesses pay their taxes as they earn or receive income, reducing the likelihood of tax evasion or non-compliance. The process is streamlined, with tax deductions happening automatically, which simplifies the tax payment process for taxpayers.

Preventing Tax Evasion

Tax collection at source acts as a deterrent to tax evasion. With tax being deducted at the point of payment, it becomes challenging for individuals or businesses to avoid paying taxes. This method ensures that even those who might otherwise find ways to evade taxes are brought into the tax net, promoting fairness and equity in the tax system.

Providing Stable Revenue for Governments

Tax collected at source provides governments with a steady and predictable income stream. This revenue is vital for funding public services, infrastructure projects, social welfare programs, and other essential government functions. By collecting tax as income is earned or received, governments can plan their budgets and allocate resources effectively.

Tax Rates and Calculations

The tax rates applied in tax collection at source vary depending on the jurisdiction and the type of income. Governments often use progressive tax rates, where the tax rate increases as the income level rises. This approach ensures that higher-income earners contribute a larger proportion of their income to taxes, promoting a more equitable distribution of tax burden.

For instance, in a country with a progressive income tax system, an individual earning a low income might have a tax rate of 10%, while someone with a higher income might face a tax rate of 25%. This progressive structure aims to balance the tax burden across different income levels.

| Income Range | Tax Rate |

|---|---|

| $0 - $30,000 | 10% |

| $30,001 - $60,000 | 15% |

| $60,001 - $100,000 | 20% |

| $100,001 and above | 25% |

Adjustments and Exemptions

While tax collection at source is a straightforward process, it may require adjustments for certain circumstances. For example, taxpayers might be eligible for deductions, allowances, or exemptions based on their personal situation or the nature of their income. These adjustments can be made through tax returns or by providing relevant documentation to the withholding agent.

Additionally, some jurisdictions have specific tax treaties or agreements with other countries to avoid double taxation. These treaties ensure that individuals or businesses operating across borders are not taxed twice on the same income. Withholding agents must be aware of these treaties to apply the correct tax rates and avoid over-withholding.

Future Implications and Developments

As the world of finance and taxation continues to evolve, tax collection at source is likely to remain a cornerstone of tax systems worldwide. However, several trends and developments are shaping the future of this method of tax collection.

Digitalization and Automation

The increasing digitalization of financial transactions and record-keeping is streamlining the tax collection at source process. Online payment platforms, digital banking, and electronic record systems make it easier for withholding agents to deduct and remit taxes accurately. This automation reduces the risk of errors and simplifies tax administration for both taxpayers and tax authorities.

Expanding Scope of Withholding

Governments are continually exploring ways to broaden the scope of tax collection at source. This includes extending withholding requirements to new types of income, such as digital services or remote work arrangements. By expanding the reach of withholding tax, governments can capture a larger portion of the tax base and improve tax compliance.

International Cooperation

With the global nature of business and finance, international cooperation is becoming increasingly important in tax collection. Countries are working together to combat tax evasion and ensure fair taxation for cross-border transactions. Tax collection at source plays a crucial role in these efforts, as it helps identify and track income earned by individuals and businesses across borders.

Conclusion

Tax collection at source is a vital component of modern tax systems, offering numerous benefits to governments, taxpayers, and the overall economy. By understanding the purpose, process, and implications of this method, individuals and businesses can navigate the tax landscape more effectively and contribute to a robust and equitable tax system.

How often should withholding agents remit taxes to the tax authority?

+The frequency of tax remittances depends on the jurisdiction and the type of income. In many cases, withholding agents are required to remit taxes on a monthly or quarterly basis. However, for certain types of income, such as wages, remittances might be due more frequently, often on a weekly or bi-weekly basis.

Can individuals claim refunds for over-withheld taxes?

+Yes, individuals have the right to claim refunds for over-withheld taxes. If a taxpayer believes that too much tax has been deducted at source, they can file a tax return or contact the tax authority to request a refund. The refund process may vary depending on the jurisdiction’s tax laws.

What are the penalties for non-compliance with tax collection at source requirements?

+Non-compliance with tax collection at source requirements can result in penalties, including fines and interest charges. The severity of the penalty depends on the jurisdiction and the nature of the non-compliance. Tax authorities may also pursue legal action against individuals or businesses who deliberately evade their tax obligations.