Texas Franchise Tax Report

The Texas Franchise Tax, also known as the margin tax, is a unique state-level levy imposed on certain businesses operating in Texas. Introduced in 2006, this tax replaced the previous franchise tax and has since been a significant source of revenue for the state. Understanding the intricacies of the Texas Franchise Tax is crucial for businesses looking to comply with state regulations and minimize their tax liabilities.

Understanding the Texas Franchise Tax

The Texas Franchise Tax is a privilege tax, meaning it is levied on businesses for the privilege of doing business in the state. Unlike sales tax, which is directly passed on to consumers, the franchise tax is a tax on business entities themselves. The tax is calculated based on a company’s taxable margin, which is a measure of the business’s profitability.

The taxable margin is determined using one of three methods: the total revenue method, the modified gross receipts method, or the compensation method. Each method calculates the taxable margin differently, and businesses must choose the method that results in the lowest tax liability. This choice is often a strategic decision, as it can significantly impact the tax amount.

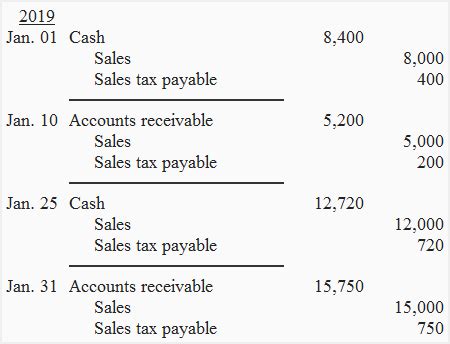

Total Revenue Method

The total revenue method is straightforward and applicable to most businesses. It calculates taxable margin as total revenue minus compensation (employee salaries and benefits) and certain cost of goods sold (COGS). This method is suitable for businesses with high revenue and low costs relative to revenue.

| Total Revenue | Compensation | COGS | Taxable Margin |

|---|---|---|---|

| $1,000,000 | $300,000 | $400,000 | $300,000 |

Modified Gross Receipts Method

The modified gross receipts method is an alternative for businesses that have high costs relative to their revenue. It calculates taxable margin as gross receipts minus certain deductions, including cost of goods sold, interest, and certain taxes. This method is advantageous for businesses with high operating costs.

| Gross Receipts | Deductions | Taxable Margin |

|---|---|---|

| $800,000 | $300,000 | $500,000 |

Compensation Method

The compensation method is designed for businesses with a small number of highly compensated employees. It calculates taxable margin as total compensation minus certain deductions, including compensation for non-Texas employees and certain taxes. This method can be beneficial for businesses with a small number of high-earning executives.

| Total Compensation | Deductions | Taxable Margin |

|---|---|---|

| $500,000 | $100,000 | $400,000 |

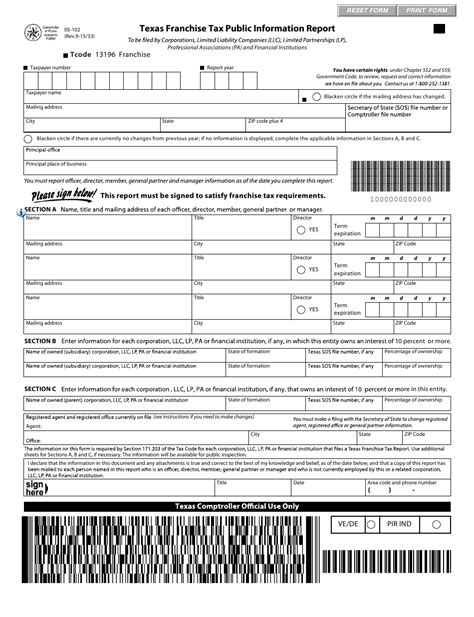

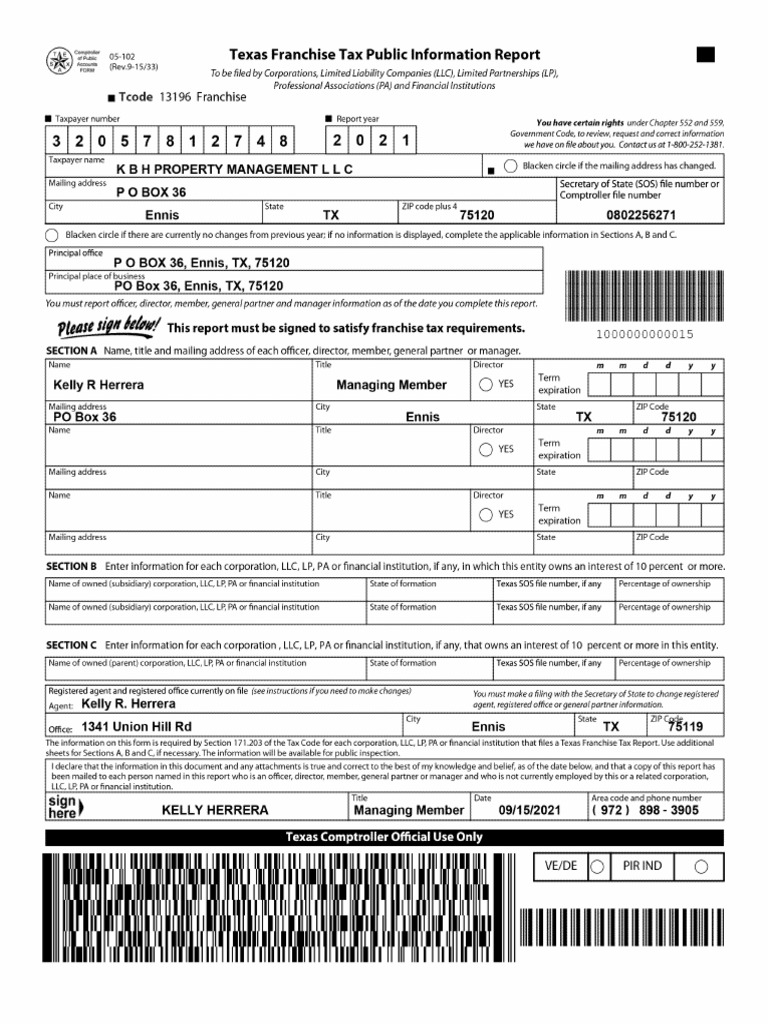

Franchise Tax Report Requirements

The Texas Franchise Tax Report is an annual filing requirement for businesses subject to the franchise tax. The report details the calculations used to determine the taxable margin and the resulting tax liability. It is crucial to accurately complete this report to avoid penalties and ensure compliance with state regulations.

Required Information

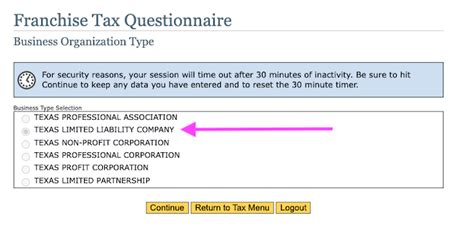

- Business Entity Information: Details about the business, including name, entity type, and EIN.

- Taxable Margin Calculation: A breakdown of the calculations used to determine the taxable margin, including revenue, compensation, and cost of goods sold.

- Tax Liability: The amount of franchise tax owed, based on the taxable margin and applicable tax rate.

- Payments and Credits: Any payments made or credits applied towards the franchise tax liability.

- Signatory Information: Details about the person signing the report, including name, title, and contact information.

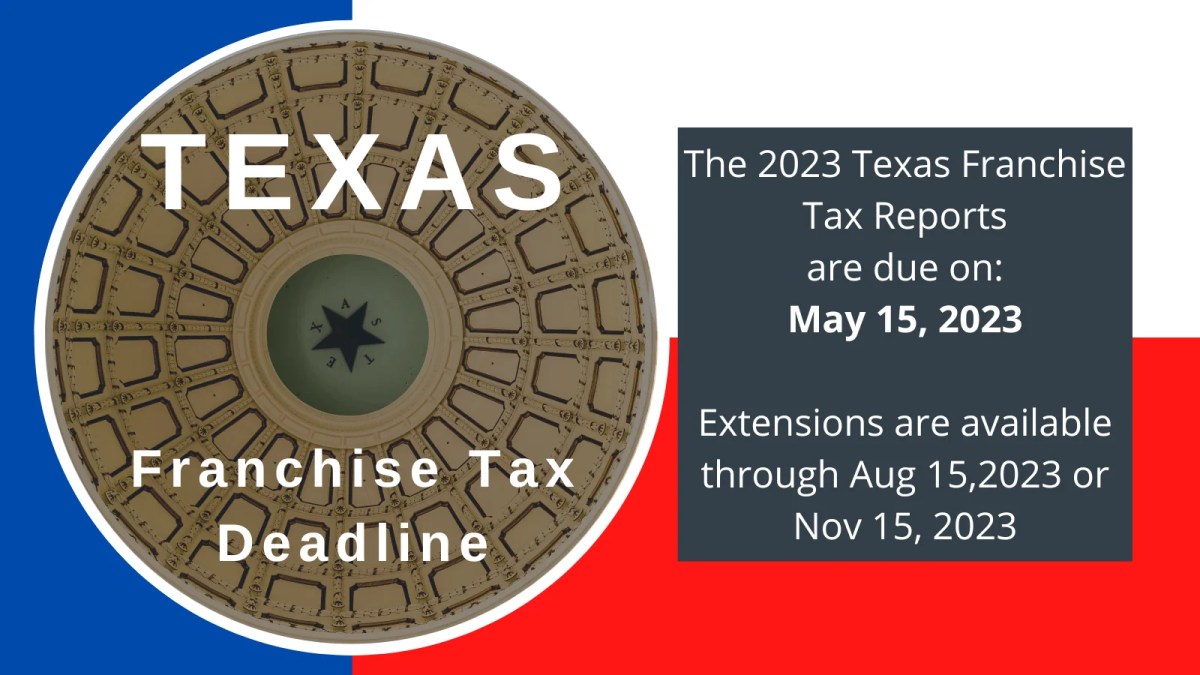

Filing Deadlines

The franchise tax report is due on May 15 of each year. However, if the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is important to note that filing extensions are not available for the franchise tax report, so timely submission is crucial.

Compliance and Penalties

Compliance with the Texas Franchise Tax is essential to avoid penalties and ensure smooth business operations. Failure to file the franchise tax report on time can result in significant penalties, including a $500 late filing fee and an additional 5% penalty for each month the report is late, up to a maximum of 25%. Interest may also accrue on the unpaid tax liability.

Additionally, businesses that intentionally fail to file or underreport their taxable margin may be subject to criminal charges and significant fines. It is always best to consult a tax professional to ensure accurate reporting and compliance with state regulations.

Future Implications and Tax Strategies

The Texas Franchise Tax is an ever-evolving aspect of state tax law, with potential changes and updates in the future. Staying informed about any amendments or new regulations is crucial for businesses to adapt their tax strategies accordingly.

Potential Tax Rate Changes

The franchise tax rate is currently set at 0.75% of the taxable margin, with a minimum tax of $1,500 for most entities. However, this rate could be subject to change in the future, impacting the tax liability of businesses. Monitoring any proposed changes and understanding their potential impact is essential for effective tax planning.

Tax Planning Strategies

Businesses can employ various tax planning strategies to minimize their franchise tax liability. These strategies may include:

- Optimizing Taxable Margin Calculation: Reviewing the applicable methods and choosing the one that results in the lowest tax liability.

- Utilizing Deductions and Credits: Maximizing eligible deductions and applying for applicable tax credits to reduce the taxable margin.

- Structuring Business Operations: Considering the impact of business structure and operations on tax liability, such as the number of employees and compensation levels.

- Seeking Professional Guidance: Consulting tax professionals who can provide tailored advice and ensure compliance with state regulations.

Conclusion

The Texas Franchise Tax is a complex aspect of doing business in the state, requiring careful consideration and strategic planning. By understanding the different methods for calculating taxable margin, complying with reporting requirements, and staying informed about potential changes, businesses can effectively manage their franchise tax obligations. Consulting tax professionals can provide valuable guidance and ensure compliance with evolving state regulations.

Are all businesses subject to the Texas Franchise Tax?

+No, only certain types of businesses are subject to the Texas Franchise Tax. Entities such as sole proprietorships, partnerships, LLCs, and corporations with gross receipts over 1,180,000 are generally subject to the tax. However, there are specific exemptions and exclusions, so it's important to consult the official guidelines or a tax professional for your specific situation.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>What happens if I miss the filing deadline for the Franchise Tax Report?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>Missing the filing deadline can result in significant penalties, including a late filing fee of 500 and a 5% penalty for each month the report is late, up to a maximum of 25%. It’s important to note that extensions are not available for the franchise tax report, so timely submission is crucial to avoid these penalties.

Can I apply for a refund if I overpay my franchise tax?

+Yes, you can apply for a refund if you overpay your franchise tax. The process involves submitting a refund claim form along with supporting documentation. It’s important to keep accurate records and consult the official guidelines or a tax professional for specific instructions and requirements.