Tax Bandit Scandal Reveals 60% of Tax Evasion Cases Involving Fraud

Amid the labyrinthine corridors of financial misconduct, the recent Tax Bandit Scandal has thrust into the spotlight a startling statistic: approximately 60% of confirmed tax evasion cases are linked to sophisticated forms of fraud. This revelation not only underscores the pervasive nature of fraudulent schemes within tax avoidance but also illuminates the urgent necessity for enhanced detection methodologies, robust legal frameworks, and targeted deterrence strategies. The intersection of technological advancements, global financial complexities, and evolving criminal tactics has rendered traditional enforcement approaches insufficient, prompting a reevaluation of how authorities combat the clandestine world of tax fraud.

Understanding the Tax Bandit Scandal: Scope and Significance

The Tax Bandit Scandal is not an isolated incident but a reflection of systemic vulnerabilities within tax administration systems worldwide. Central to this crisis is the alarming data indicating that over half of all tax evasion cases involve organized fraud, including identity theft, false invoicing, offshore concealment, and transactional misrepresentation. Extending beyond mere arithmetic discrepancies, these schemes involve intricate layers of deception designed to evade detection and apprehension.

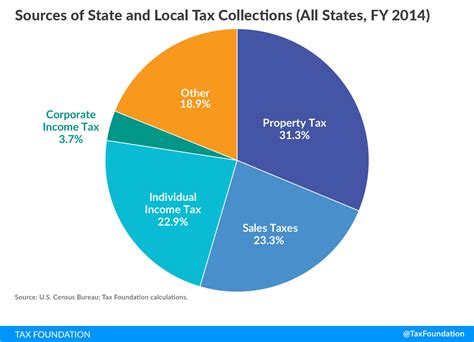

Financial misconduct of this magnitude exerts substantial economic consequences, estimated to amount to trillions of dollars annually in lost revenues globally. For governments, this translates into diminished public service funding, reduced infrastructure investments, and increased tax burdens on compliant citizens and businesses. Economic instability, rising inequality, and erosion of public trust are ongoing collateral damages inflicted by these fraudulent practices.

Analyzing historical trends, it becomes evident that tax fraud has evolved from isolated acts of evasion to organized operations often perpetrated by transnational networks. The advent of digital banking, cryptocurrency, and opaque offshore accounts has exponentially increased the complexity of investigations, requiring authorities to deploy innovative tools and international collaborations.

Root Causes and Facilitating Factors of Tax Fraud

To craft effective solutions, it is imperative to understand the root causes that enable such high levels of fraud. Several interrelated factors contribute significantly:

- Technological Loopholes: The rapid proliferation of financial technology platforms and digital currencies offers criminals novel means to obscure income trails. Virtual assets, private wallets, and decentralized exchanges complicate audit trails.

- Jurisdictional Challenges: Weak regulatory environments and lack of international information sharing hinder the ability to track illicit flows across borders.

- Resource Constraints: Many tax authorities are underfunded and lack the staffing or technological infrastructure to proactively identify complex fraud schemes.

- Legal and Procedural Gaps: Outdated legislation and procedural bottlenecks can delay investigations and reduce penalties, weakening deterrence.

- Motivational Factors: High perceived risk of detection coupled with low likelihood of prosecution embolden tax criminals.

Advanced Detection and Prevention Strategies

Addressing such a sophisticated problem requires a multi-layered approach that combines technological innovation, policy reforms, and international cooperation. The following are the key pillars of an effective response:

Harnessing Data Analytics and Artificial Intelligence

The integration of Big Data analytics and AI algorithms has transformed how tax authorities identify suspicious activities. Machine learning models can analyze vast datasets, flag anomalies, and predict potential fraud based on behavioral patterns.

For example, neural networks trained on historical fraud cases can detect subtle inconsistencies in taxpayer declarations, transactional patterns, or offshore entity structures. This approach shortens investigation cycles and increases detection accuracy, serving as a force multiplier in resource-limited environments.Implementing Blockchain for Transparency

Blockchain technology offers promising applications in ensuring transaction transparency and reducing fraud. Immutable ledgers can record all taxable activities, providing auditors with tamper-proof logs accessible in real time.

In practice, this can be employed for cross-border trade, digital asset transactions, and public subsidies, facilitating traceability and accountability. Adoption requires regulatory adaptations but can significantly hinder fraudulent concealment.Strengthening International Collaboration

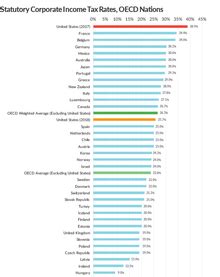

Tax evasion and fraud often transcend national borders, demanding coordinated efforts. Initiatives such as the OECD’s Common Reporting Standard (CRS) and the Global Forum promote data sharing among countries. Enhancing mutual legal assistance treaties and establishing dedicated international task forces consolidate investigative powers.

Shared intelligence accelerates apprehension of fraud rings, especially those operating via offshore accounts or shell companies.Reforming Legal Frameworks and Enhancing Penalties

Legal reforms should aim to close loopholes and streamline prosecution procedures. Higher penalties, including substantial fines and imprisonment, act as deterrents, especially when coupled with public disclosure of enforcement actions.

Moreover, incentivizing voluntary disclosure through amnesty programs can recover significant revenue while promoting compliance.Case Studies: Successful Interventions and Lessons Learned

Examining successful fraud reduction initiatives offers valuable insights. Notably, the IRS’s crackdown on offshore tax evasion through the use of FATCA (Foreign Account Tax Compliance Act) has yielded billions in recovered assets. Similarly, Australia’s use of AI-driven analytics uncovered widespread GST fraud, leading to legislative amendments and resource reallocation.

| Initiative | Outcome |

|---|---|

| OECD CRS Implementation | Over 100 countries sharing financial data, increasing detection rates |

| IRS Offshore Voluntary Disclosure Program | Recovered over $10 billion since inception |

| Australian AI Analytics | Identified $2 billion in impostor claims and fraud |

Challenges and Limitations Facing Enforcement Agencies

Despite technological advancements, obstacles remain. Privacy concerns, sovereignty issues, and resource limitations create hurdles to enforcement. Additionally, sophisticated fraudsters often adapt rapidly, deploying evasion techniques such as micro-structuring transactions or exploiting legal ambiguities.

Furthermore, balancing rigorous enforcement with respect for individual rights remains delicate. Overzealous measures risk undermining public trust or infringing on privacy rights, which, if lost, could diminish compliance over time.

Path Forward: Building Resilient and Adaptive Systems

Long-term solutions demand an integrated ecosystem where legal, technological, and collaborative elements reinforce each other. Priorities include continuous data modernization, capacity building within tax authorities, and fostering international treaty frameworks capable of rapid response.

Investing in ongoing research on emerging fraud typologies ensures enforcement measures remain nimble. Moreover, public education campaigns can promote voluntary compliance and discourage participation in fraudulent schemes.

Key Points

- Technological innovations such as AI and blockchain are transforming fraud detection capabilities.

- International cooperation accelerates the tracing and extradition of global tax fraud networks.

- Legislative reforms with stricter penalties serve as effective deterrents.

- Balancing enforcement and individual rights is crucial for sustainable compliance.

- Continuous adaptation ensures resilience against evolving criminal tactics.

How do digital currencies facilitate tax evasion?

+Digital currencies like cryptocurrencies enable anonymous or pseudonymous transfers across borders, making it challenging for authorities to trace illicit funds. Their decentralized nature often lacks regulatory oversight, creating avenues for hidden income and unreported gains.

What role does international law play in combating tax fraud?

+International law facilitates cooperation through treaties, data sharing agreements, and joint investigations. Frameworks like the OECD’s CRS help synchronize efforts and ensure that cross-border tax evasion activities are detected and prosecuted effectively.

What technological tools are most effective today in detecting tax fraud?

+Advanced analytics platforms, machine learning algorithms, AI-based anomaly detection, and blockchain-based transaction monitoring are among the most effective tools. They enable authorities to handle vast datasets, identify suspicious patterns, and trace illicit transfers swiftly.