Tax Rates In Ohio By County

Taxes in Ohio are a complex system, and understanding the rates and variations across the state's counties is essential for both individuals and businesses. Ohio's tax structure comprises a mix of state, local, and municipal taxes, with counties and municipalities often levying additional taxes. This article delves into the intricacies of tax rates in Ohio, offering a comprehensive guide to help navigate the fiscal landscape of the Buckeye State.

The Ohio Tax Landscape: An Overview

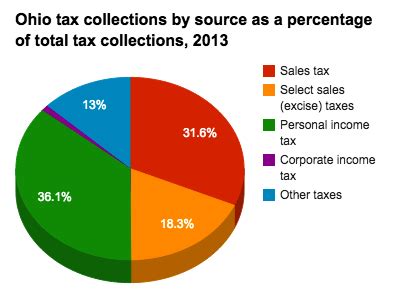

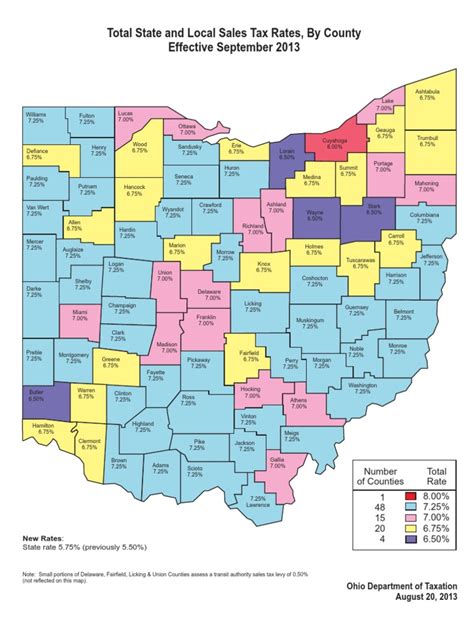

Ohio’s tax system is characterized by a blend of sales taxes, income taxes, and property taxes, each playing a significant role in the state’s revenue generation. The state levies a 5.75% sales tax rate on most goods and services, which can be higher in certain localities due to local add-ons. Additionally, Ohio imposes a state income tax, with rates ranging from 0.4% to 4.797% based on taxable income. Property taxes, however, are primarily a local affair, with rates varying significantly across counties and municipalities.

County-by-County Analysis of Tax Rates

Ohio’s 88 counties each have their own unique tax rates, which can create a patchwork of varying fiscal policies across the state. Here’s a detailed breakdown of some key counties and their tax structures:

Franklin County

Home to the state capital, Columbus, Franklin County boasts a diverse economy and a population of over 1.3 million people. The county’s tax rate is currently set at 2.5%, which is levied on top of the state sales tax rate. This additional tax contributes significantly to the county’s revenue, supporting essential services and infrastructure projects.

| Tax Type | Rate |

|---|---|

| Sales Tax | 2.5% |

| Income Tax | 2.25% |

Franklin County also imposes an income tax, which stands at 2.25% for residents and businesses operating within the county. This tax is utilized to fund various public services, including education, public safety, and healthcare initiatives.

Cuyahoga County

Cuyahoga County, encompassing the city of Cleveland, is another major economic hub in Ohio. With a population of over 1.2 million, the county plays a crucial role in the state’s economy. Cuyahoga County’s tax structure includes a sales tax rate of 1.5%, which is added to the state sales tax, resulting in a total sales tax of 7.25% within the county.

| Tax Type | Rate |

|---|---|

| Sales Tax | 1.5% |

| Income Tax | 1.75% |

Additionally, Cuyahoga County levies an income tax of 1.75%, which is among the highest in the state. This tax is used to support vital services, including public transportation, healthcare, and social services, ensuring the well-being of its diverse population.

Hamilton County

Hamilton County, located in the southwestern part of Ohio, is home to Cincinnati, the state’s third-largest city. With a population of over 800,000, the county’s tax structure includes a sales tax rate of 1.5%, bringing the total sales tax within the county to 7.25%. Hamilton County also imposes an income tax of 2.1%, which is applied to both residents and businesses.

| Tax Type | Rate |

|---|---|

| Sales Tax | 1.5% |

| Income Tax | 2.1% |

The county's income tax is utilized to fund essential services, such as public safety, education, and infrastructure development, ensuring the continued growth and prosperity of the region.

Montgomery County

Montgomery County, located in the western part of Ohio, includes the city of Dayton. With a population of over 500,000, the county’s tax structure is designed to support its diverse population and economy. Montgomery County’s sales tax rate is set at 1%, which is combined with the state sales tax to make a total sales tax of 6.75% within the county.

| Tax Type | Rate |

|---|---|

| Sales Tax | 1% |

| Income Tax | 2% |

The county also imposes an income tax of 2%, which is applied to residents and businesses operating within Montgomery County. This tax revenue is crucial for funding essential services, including healthcare, education, and social services, ensuring the well-being of the county's residents.

The Impact of Local Taxes

The varying tax rates across Ohio’s counties have a significant impact on the cost of living and doing business in the state. For instance, higher sales tax rates can influence consumer behavior, potentially driving consumers to make purchases in lower-tax counties or online. Similarly, income tax rates can influence where businesses choose to locate, with lower rates potentially attracting more businesses and job opportunities.

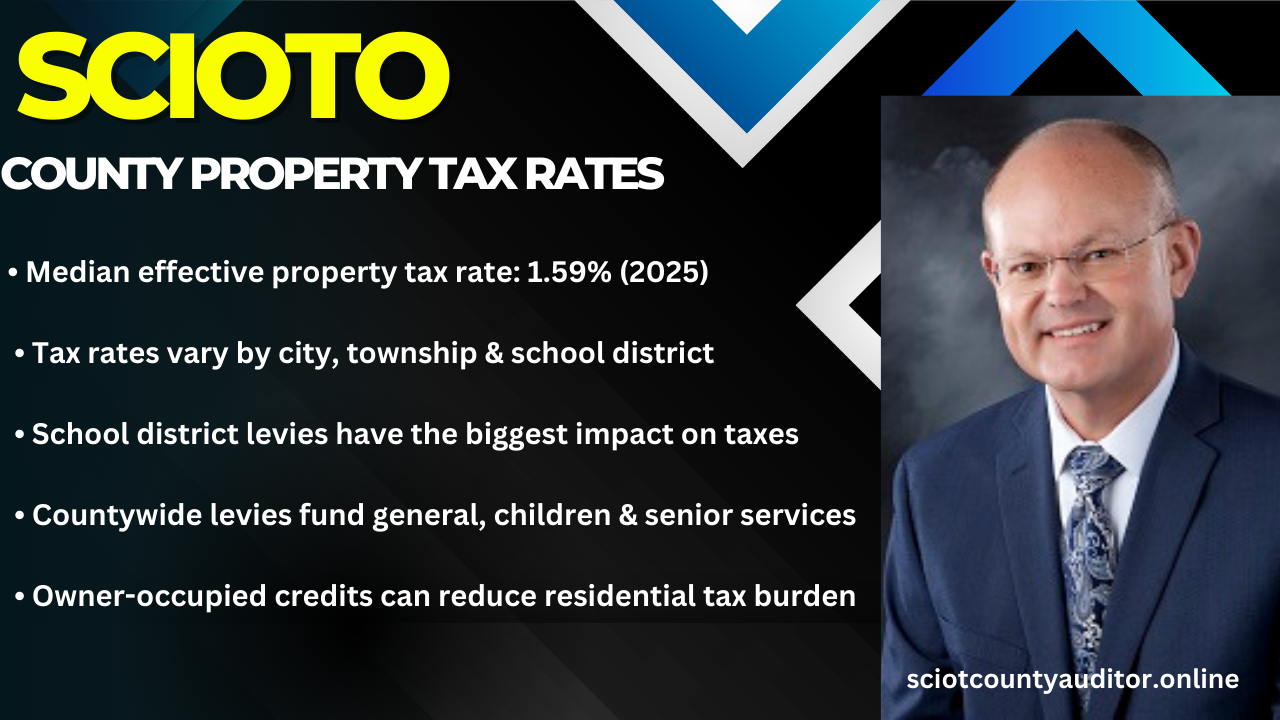

Additionally, property taxes, which are primarily levied at the local level, can vary significantly across Ohio's counties and municipalities. These taxes are often used to fund local schools, infrastructure projects, and other essential services. As a result, property owners in different counties may face vastly different tax burdens, influencing their financial planning and investment decisions.

Conclusion

Ohio’s tax system, with its varying county-level rates, presents a complex but crucial aspect of the state’s economy and fiscal policy. From sales taxes to income taxes, each county has its own unique approach to generating revenue. This comprehensive guide offers a detailed analysis of tax rates across some of Ohio’s key counties, providing valuable insights into the state’s fiscal landscape. As Ohio continues to evolve, its tax system will remain a critical factor in shaping the state’s economic future.

Frequently Asked Questions

How do Ohio’s county tax rates compare to other states?

+Ohio’s tax rates, particularly its sales and income tax rates, are relatively moderate compared to many other states. However, the variation in tax rates across counties can create a more complex landscape, with some counties having higher tax burdens than others.

What factors influence county tax rates in Ohio?

+Several factors influence county tax rates in Ohio, including the cost of providing essential services, infrastructure needs, and the economic climate of the county. Additionally, local governments often consider the impact of tax rates on economic growth and development when setting their tax policies.

Are there any tax incentives or rebates available in Ohio counties?

+Yes, some Ohio counties offer tax incentives or rebates to attract businesses and stimulate economic growth. These incentives can include tax abatements, tax credits, or other forms of financial assistance. It’s essential to research specific county programs for more details.