Property Tax Mobile Al

Welcome to this in-depth exploration of the property tax landscape in Mobile, Alabama. This article aims to provide a comprehensive guide for homeowners, investors, and anyone interested in understanding the intricacies of property taxation in this vibrant Gulf Coast city. By delving into the specific regulations, assessment processes, and strategies, we aim to equip you with the knowledge to navigate the property tax system confidently and efficiently.

Understanding the Property Tax System in Mobile, AL

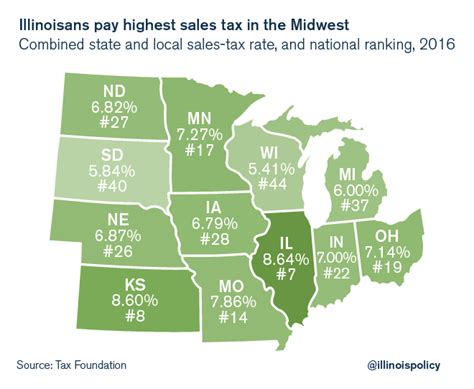

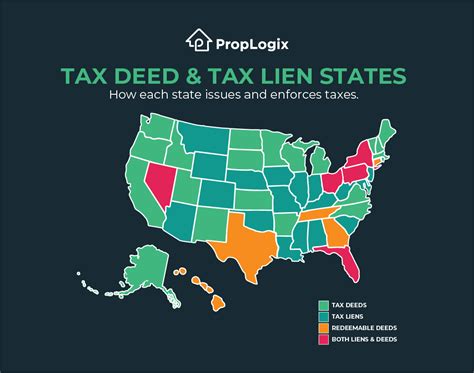

The property tax system in Mobile operates under the guidelines set by the State of Alabama and the local government. Property taxes are a vital source of revenue for the city, funding essential services and infrastructure projects. These taxes are calculated based on the assessed value of a property and are an essential responsibility for homeowners and property owners.

The City of Mobile utilizes a three-tiered tax system, which includes taxes levied by the city itself, the Mobile County Commission, and the Mobile County School Board. Each entity has its own millage rate, which determines the property tax rate for its jurisdiction. This system ensures that the revenue generated from property taxes is allocated efficiently to meet the specific needs of each governing body.

The property tax rate in Mobile is expressed as mills, where one mill represents one-tenth of a cent. For instance, a property tax rate of 30 mills would equate to $3.00 in taxes for every $1,000 of assessed property value. This rate can vary depending on the location of the property within the city, as different areas may fall under different tax jurisdictions.

Property Assessment Process

The process of assessing property values in Mobile is a crucial step in determining the property tax liability. The Mobile County Revenue Commissioner’s Office is responsible for conducting these assessments, which typically occur once every four years. During the assessment period, properties are evaluated based on their market value, taking into account factors such as location, size, age, and recent sales of comparable properties.

Property owners have the right to review their assessment and provide any relevant information that may impact the valuation. This transparency ensures that property owners have an opportunity to understand the assessment process and address any concerns they may have.

Exemptions and Discounts

Mobile, like many other jurisdictions, offers various exemptions and discounts to certain property owners. These provisions aim to provide relief to specific groups and promote community development. Here are some of the exemptions and discounts available in Mobile:

- Homestead Exemption: Mobile County provides a $4,000 homestead exemption for homeowners who use their property as their primary residence. This exemption reduces the assessed value of the property, resulting in lower property taxes.

- Senior Citizen Discount: Property owners who are 65 years or older and meet certain income requirements may qualify for a 25% discount on their property taxes. This incentive encourages seniors to remain in their homes and contribute to the community.

- Disabled Veteran Exemption: Mobile County offers a $10,000 exemption for disabled veterans who own their homes. This exemption is an important recognition of the service and sacrifice made by our veterans.

- Agricultural Use Valuation: Properties designated for agricultural use may be eligible for a special valuation method, which considers the property's income-producing capacity rather than its market value. This provision supports the local agricultural industry and encourages the preservation of farmland.

Strategies for Effective Property Tax Management

Understanding the property tax system and utilizing available exemptions are crucial, but there are additional strategies that property owners can employ to optimize their tax liability.

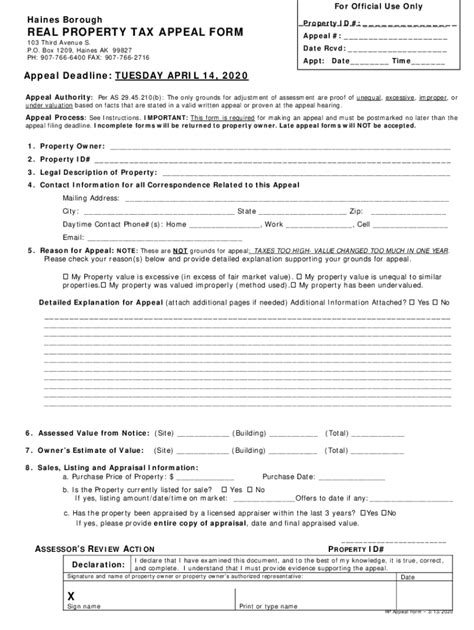

Property Value Appeals

If a property owner believes that their property has been overvalued, they have the right to appeal the assessment. The appeal process in Mobile is designed to be fair and accessible. Property owners can gather evidence, such as recent sales of similar properties or professional appraisals, to support their case. It is essential to understand the appeal timeline and submit the necessary documentation within the specified deadlines.

Tax Planning and Payment Options

Effective tax planning can help property owners manage their tax liability throughout the year. Mobile offers several payment options, including online payments, direct debit, and traditional check or money order methods. Property owners can also consider enrolling in a tax escrow account if they have a mortgage, which ensures that their property taxes are paid on time and in full.

Property Improvements and Maintenance

Regular maintenance and improvements to a property can impact its assessed value. While it is important to keep properties in good condition, certain improvements may increase the property’s value and, consequently, its tax liability. Property owners should be mindful of the potential tax implications when making significant upgrades or renovations.

Future Outlook and Community Impact

The property tax system in Mobile plays a vital role in shaping the city’s future and impacting the community. The revenue generated from property taxes is allocated to various public services and infrastructure projects, which directly benefit residents and businesses.

As Mobile continues to grow and develop, the property tax system will need to adapt to meet the changing needs of the community. This includes addressing issues such as property value fluctuations, the impact of new construction, and ensuring that the tax burden is distributed fairly among property owners.

The City of Mobile is committed to maintaining a transparent and equitable property tax system. Ongoing efforts to streamline the assessment process, enhance communication with property owners, and provide access to resources and information contribute to a positive tax experience for residents.

Community Engagement and Tax Education

Community engagement and tax education are essential components of a successful property tax system. The City of Mobile actively promotes outreach programs and workshops to educate residents about their property tax obligations and rights. By empowering property owners with knowledge, the city fosters a sense of responsibility and understanding, leading to a more cooperative tax environment.

Impact on Economic Development

Property taxes play a significant role in driving economic development in Mobile. The revenue generated supports initiatives such as infrastructure upgrades, business incentives, and community development projects. A well-managed property tax system can attract new businesses, create jobs, and enhance the overall economic vitality of the city.

The City of Mobile recognizes the importance of a business-friendly tax environment and has implemented strategies to support commercial property owners. This includes offering incentives for new construction and rehabilitation projects, as well as providing resources and guidance to businesses navigating the property tax system.

| Property Tax Statistics for Mobile, AL |

|---|

| Average Property Tax Rate: 30 mills |

| Median Property Tax: $800 annually (based on a $200,000 home) |

| Total Property Tax Revenue: $48.7 million (2022 fiscal year) |

| Percentage of City Revenue from Property Taxes: 32% |

Conclusion

Navigating the property tax system in Mobile, Alabama, requires a thorough understanding of the assessment process, available exemptions, and effective tax management strategies. By embracing a proactive approach and staying informed, property owners can ensure that their tax obligations are met efficiently and fairly. The City of Mobile’s commitment to transparency and community engagement further enhances the tax experience, fostering a positive relationship between residents and their local government.

When are property taxes due in Mobile, AL?

+Property taxes in Mobile are due in two installments. The first installment is due on October 1st, and the second installment is due on March 1st of the following year. Property owners have the option to pay their taxes in full by the October 1st deadline to receive a discount.

How can I appeal my property assessment in Mobile?

+To appeal your property assessment in Mobile, you must submit an appeal form to the Mobile County Revenue Commissioner’s Office within 30 days of receiving your assessment notice. You will need to provide evidence supporting your claim, such as recent sales data or professional appraisals. It is recommended to consult with a tax professional for guidance.

Are there any tax incentives for energy-efficient improvements in Mobile?

+Yes, Mobile offers a Green Incentive Program that provides tax incentives for energy-efficient improvements. Property owners who install solar panels, wind turbines, or other renewable energy systems may be eligible for a tax credit. The program aims to promote sustainable practices and reduce carbon footprints.