Durham County Tax Bill Search

In the world of property ownership, understanding the intricacies of tax obligations is crucial. For residents and property owners in Durham County, North Carolina, navigating the process of searching and accessing tax-related information can be a complex task. This comprehensive guide aims to demystify the Durham County Tax Bill Search, providing an in-depth analysis of the system, its features, and its significance for property owners and the community.

Understanding the Durham County Tax Bill Search System

The Durham County Tax Bill Search is an online platform designed to provide transparent access to property tax information. It serves as a vital resource for property owners, allowing them to retrieve detailed records and stay informed about their tax obligations.

This system is an essential tool for both residential and commercial property owners, offering a convenient way to access and manage their tax-related affairs. By utilizing this platform, individuals can efficiently search for tax bills, understand the assessment process, and stay up-to-date with the latest tax regulations.

Key Features and Benefits

The Durham County Tax Bill Search boasts several features that enhance its usability and effectiveness:

- User-Friendly Interface: The platform is designed with simplicity in mind, ensuring that users of all technical backgrounds can easily navigate and find the information they need.

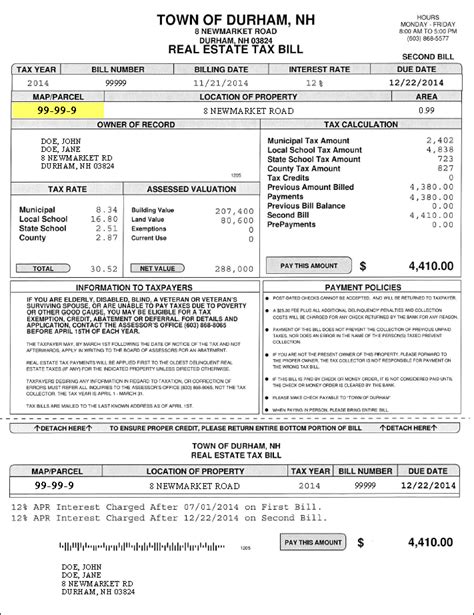

- Real-Time Updates: Property owners can access the most current tax bill information, including assessment details, tax rates, and payment due dates.

- Online Payment Options: For added convenience, the system often offers secure online payment methods, allowing users to settle their tax obligations promptly.

- Historical Data Access: Beyond current tax bills, the search tool provides access to historical tax records, enabling users to track changes and patterns over time.

- Customizable Search Parameters: Users can refine their searches using various criteria, such as property address, owner name, or tax ID, making it easy to locate specific information.

By leveraging these features, property owners can efficiently manage their tax affairs, plan their finances, and ensure compliance with local tax regulations.

Target Audience and Relevance

The Durham County Tax Bill Search is of utmost importance to a diverse range of individuals and entities:

- Property Owners: Whether residential homeowners or commercial property investors, the system empowers them to stay informed and organized regarding their tax obligations.

- Real Estate Professionals: Agents, brokers, and developers can utilize the platform to access critical tax information for their clients, aiding in property valuation and transaction processes.

- Local Businesses: Businesses operating in Durham County can leverage the system to understand their tax liabilities, ensuring smooth operations and compliance with local tax laws.

- Community Members: The platform fosters transparency, allowing community members to access tax-related data, understand local revenue streams, and actively participate in civic discussions.

By catering to these diverse stakeholders, the Durham County Tax Bill Search plays a pivotal role in fostering transparency, efficiency, and community engagement.

Navigating the Search Process

Embarking on a Durham County Tax Bill Search is a straightforward process, but it’s essential to follow the right steps to ensure accuracy and efficiency.

Step-by-Step Guide

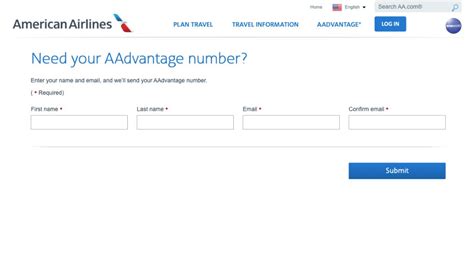

- Access the Platform: Begin by visiting the official Durham County Tax Office website, where the search tool is typically located.

- Select Search Criteria: Choose the appropriate search option, whether by property address, owner name, or tax ID. This step ensures precision in your search results.

- Enter Details: Input the specific information requested, ensuring accuracy. This could include the full property address, owner’s name, or the tax identification number.

- Submit and Review: After entering the details, submit the search request. The system will process the request, and you’ll be presented with the relevant tax bill information.

- Review and Download: Carefully review the retrieved tax bill, ensuring all details are accurate and up-to-date. If needed, you can often download the bill for future reference or record-keeping.

By following these steps, users can efficiently navigate the Durham County Tax Bill Search, ensuring they have the necessary information to manage their tax obligations effectively.

Common Challenges and Troubleshooting

While the search process is generally straightforward, users may encounter challenges. Here are some common issues and their potential solutions:

- Incorrect Search Results: If the search yields unexpected or incorrect results, double-check the entered details. Misspelled names or addresses are common causes for inaccurate results.

- Missing Information: In some cases, certain tax bill details might be missing. Contact the Durham County Tax Office directly to request the missing information or clarify any discrepancies.

- Technical Issues: If the platform is experiencing technical difficulties, try accessing it at a different time or using an alternate browser. Clearing your browser's cache can also resolve certain technical glitches.

By being aware of these potential challenges and having a troubleshooting strategy, users can navigate the Durham County Tax Bill Search with ease and confidence.

Impact and Benefits for Durham County

The implementation and accessibility of the Durham County Tax Bill Search system have far-reaching implications for the county and its residents.

Transparency and Accountability

One of the primary benefits is the enhanced transparency it brings to the tax assessment and billing process. Property owners can now access their tax information readily, fostering a sense of trust and accountability.

With easy access to tax records, property owners can verify assessments, understand tax calculations, and identify any potential errors or discrepancies. This transparency promotes fairness and ensures that tax obligations are distributed equitably across the community.

Efficiency and Time Savings

The online search platform streamlines the process of accessing tax information, eliminating the need for in-person visits or lengthy phone calls. Property owners can quickly retrieve their tax bills and related details, saving valuable time and effort.

This efficiency not only benefits individual property owners but also reduces the administrative burden on the Durham County Tax Office, allowing staff to focus on more complex tasks and provide improved services.

Community Engagement and Education

The availability of the Durham County Tax Bill Search encourages community engagement and empowers residents to take an active role in understanding their local government’s finances.

By accessing tax information, community members can gain insights into how their tax dollars are allocated, fostering a sense of civic responsibility and encouraging participation in local governance. This transparency and education can lead to more informed discussions and decisions regarding tax policies and community development.

Future Implications and Innovations

As technology continues to evolve, the Durham County Tax Bill Search system is poised for further enhancements and innovations.

Potential Developments

Here are some potential future developments that could further improve the system:

- Mobile Accessibility: Developing a mobile-friendly version or an app could make the search tool even more accessible, allowing users to access tax information on the go.

- Integration with Other Services: Integrating the tax bill search with other online services, such as property records or permitting systems, could provide a more holistic view of property-related information.

- Enhanced Security Measures: As cyber threats evolve, implementing advanced security protocols can ensure the protection of sensitive tax data and user information.

- Real-Time Alerts and Notifications: Implementing a notification system could keep users informed about upcoming tax deadlines, changes in tax rates, or other critical updates.

Long-Term Impact and Sustainability

The Durham County Tax Bill Search system has the potential to significantly impact the long-term sustainability and efficiency of the county’s tax administration.

By providing accurate and timely tax information, the system can contribute to improved tax compliance and collection rates. This, in turn, can lead to more stable revenue streams for the county, enabling better planning and allocation of resources for essential services and community development projects.

Furthermore, the system's transparency and accessibility can foster a positive relationship between the government and its citizens, encouraging collaboration and participation in shaping the future of Durham County.

Conclusion

The Durham County Tax Bill Search system is a powerful tool that empowers property owners, real estate professionals, and community members alike. By providing transparent access to tax information, it fosters a culture of accountability, efficiency, and community engagement.

As the system continues to evolve and innovate, its impact on the county's tax administration and community development is poised to grow, ensuring a brighter and more sustainable future for all.

How often are tax bills updated on the Durham County Tax Bill Search platform?

+Tax bills are typically updated in real-time or on a regular basis, ensuring that users have access to the most current information. However, it’s advisable to verify the frequency of updates with the Durham County Tax Office to ensure accuracy.

Can I pay my tax bill online through the Durham County Tax Bill Search platform?

+Yes, many tax bill search platforms, including the one for Durham County, often offer secure online payment options. However, it’s essential to check the specific platform’s capabilities and follow the instructions provided to ensure a smooth payment process.

What should I do if I notice an error or discrepancy in my tax bill information?

+If you identify any errors or discrepancies in your tax bill, it’s crucial to contact the Durham County Tax Office directly. They can guide you through the process of resolving the issue and ensure that your tax information is accurate and up-to-date.