Mississippi Tax Refund Status

For residents of Mississippi, understanding the status of their tax refunds is an important aspect of financial planning. This article aims to provide an in-depth guide on how to track the Mississippi Tax Refund Status, offering valuable insights and practical steps to ensure a smooth and efficient process. With the right information, taxpayers can effectively manage their financial affairs and make informed decisions.

Understanding the Mississippi Tax Refund Process

The Mississippi Department of Revenue plays a crucial role in managing the state’s tax system. It is responsible for processing tax returns and issuing refunds to eligible taxpayers. To gain a comprehensive understanding of the tax refund process in Mississippi, it is essential to delve into the various stages and factors that influence the timeline.

The tax refund journey typically begins with the submission of a completed tax return. This return serves as a detailed record of an individual's or business's financial transactions throughout the year. It includes vital information such as income sources, deductions, and credits, which are essential for calculating the tax liability.

Once the tax return is filed, the Department of Revenue meticulously reviews and processes the information. This stage involves a thorough examination of the provided data to ensure accuracy and compliance with state tax laws. It is during this phase that any discrepancies or errors are identified and addressed.

Factors Influencing Refund Timelines

Several factors can impact the time it takes for a Mississippi tax refund to be issued. One significant factor is the method of filing. Taxpayers who opt for electronic filing, also known as e-filing, often experience faster processing times compared to those who choose traditional paper filing. E-filing streamlines the process, allowing for quicker data verification and refund disbursement.

Another crucial factor is the complexity of the tax return. Returns that are straightforward and require minimal adjustments tend to be processed more rapidly. On the other hand, complex returns with numerous deductions, credits, or business-related transactions may take longer to review and assess.

Additionally, the volume of tax returns received by the Department of Revenue during a particular period can influence processing times. Peak filing seasons, such as the months immediately following the tax deadline, often result in increased workload and potential delays. Taxpayers should be mindful of these seasonal variations and plan their refund expectations accordingly.

Tracking Your Mississippi Tax Refund

To stay informed about the status of your Mississippi tax refund, the Mississippi Department of Revenue offers several convenient options. These options provide taxpayers with real-time updates and peace of mind during the refund process.

Online Tracking Tools

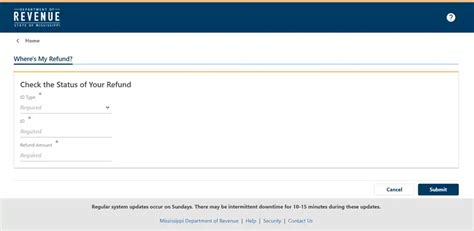

The Mississippi Department of Revenue has developed an online platform specifically designed for tracking tax refund status. This user-friendly interface allows taxpayers to access their account information and view the current status of their refund. By logging in with their unique credentials, individuals can quickly determine whether their refund has been approved, is in the processing stage, or has encountered any delays.

The online tracking system provides a transparent and efficient way to monitor the progress of the refund. Taxpayers can check the status regularly, receiving updates as their refund moves through the various stages of processing. This feature is particularly beneficial for those who prefer the convenience and accessibility of online services.

Telephone Hotline

For taxpayers who prefer a more personalized approach, the Mississippi Department of Revenue maintains a dedicated telephone hotline. Trained representatives are available to assist callers with their refund inquiries. By providing relevant details, such as their social security number and tax return information, taxpayers can receive real-time updates and clarification on the status of their refund.

The telephone hotline serves as a valuable resource, especially for individuals who may face challenges with online access or prefer verbal communication. It ensures that taxpayers have access to accurate and timely information, regardless of their preferred method of inquiry.

Common Refund Issues and Solutions

While the Mississippi tax refund process is designed to be efficient, there may be instances where refunds are delayed or face complications. Understanding these potential issues and their solutions is crucial for taxpayers to navigate the process successfully.

Delays and Resolution Strategies

Delays in refund processing can occur for various reasons. One common cause is discrepancies or errors in the tax return. In such cases, the Department of Revenue may require additional information or documentation to verify the accuracy of the return. Taxpayers should promptly respond to any requests for information to expedite the resolution process.

Another potential cause of delay is the need for further review or audit. While audits are relatively rare, they may be triggered by specific criteria or random selection. During an audit, the Department of Revenue conducts a thorough examination of the tax return to ensure compliance. Taxpayers undergoing an audit should cooperate fully and provide the necessary documentation to facilitate the process.

To minimize delays, taxpayers are advised to carefully review their tax returns before submission and ensure the accuracy of the provided information. Additionally, maintaining organized records and promptly responding to any requests from the Department of Revenue can significantly contribute to a smoother refund process.

Addressing Refund Errors

Occasionally, taxpayers may encounter errors in their refund amount or status. These errors can range from simple calculation mistakes to more complex issues related to deductions or credits. In such situations, it is crucial for taxpayers to take immediate action to rectify the error and ensure they receive the correct refund amount.

The first step in addressing refund errors is to thoroughly review the tax return and compare it with the refund amount received. Taxpayers should carefully examine each line item, ensuring that all deductions, credits, and income sources are accurately reflected. Any discrepancies should be identified and addressed promptly.

If an error is identified, taxpayers should contact the Mississippi Department of Revenue through the designated channels, such as the online platform or telephone hotline. Providing detailed information about the error and supporting documentation can help expedite the resolution process. The Department of Revenue will work with taxpayers to rectify the error and ensure they receive the correct refund amount.

Maximizing Your Refund Potential

Beyond understanding the refund process and tracking its status, taxpayers can take proactive steps to maximize their refund potential. By leveraging various deductions, credits, and tax-saving strategies, individuals can optimize their financial situation and potentially increase their refund amount.

Exploring Deductions and Credits

Mississippi offers a range of deductions and credits that can reduce the tax liability and increase the refund amount. These deductions and credits are designed to provide relief to taxpayers based on their specific circumstances. For instance, individuals with dependent children may be eligible for the Child Tax Credit, while homeowners can benefit from deductions related to mortgage interest and property taxes.

Taxpayers should thoroughly research and understand the available deductions and credits that align with their situation. Consulting with tax professionals or utilizing reliable tax preparation software can help identify these opportunities and ensure accurate claiming of deductions and credits.

Tax-Saving Strategies for Long-Term Planning

Maximizing tax refunds is not solely focused on the immediate return, but also on long-term financial planning. Taxpayers can implement various strategies to optimize their tax situation and potentially reduce their overall tax liability.

One effective strategy is to contribute to tax-advantaged retirement accounts, such as IRAs or 401(k) plans. These accounts offer tax benefits, including deductions for contributions and potential tax-free growth of investments. By maximizing contributions within the allowable limits, taxpayers can reduce their taxable income and potentially increase their refund.

Additionally, taxpayers should explore opportunities for tax-efficient investments. This may include investing in tax-exempt bonds, which generate income that is exempt from federal and state taxes. By diversifying their investment portfolio with tax-efficient assets, individuals can further optimize their tax situation and potentially increase their refund.

Future Outlook and Potential Changes

The Mississippi tax refund process is subject to continuous improvement and potential changes. As the Department of Revenue strives to enhance efficiency and taxpayer experience, it is essential to stay informed about any upcoming developments or updates.

Upcoming Improvements and Initiatives

The Mississippi Department of Revenue is committed to implementing measures that streamline the tax refund process and improve overall taxpayer satisfaction. One notable initiative is the ongoing enhancement of the online tracking platform. By investing in technology and user experience, the Department aims to provide taxpayers with a more intuitive and efficient way to monitor their refund status.

Additionally, the Department is exploring ways to reduce processing times through automation and improved data analysis. By leveraging advanced technologies, such as artificial intelligence and machine learning, the Department aims to identify patterns and potential errors more efficiently, resulting in faster refund processing and improved accuracy.

Potential Policy Changes

Tax policies and regulations are subject to change, and taxpayers should remain vigilant about any upcoming modifications that may impact their refund status. The Mississippi Department of Revenue regularly reviews and assesses the state’s tax system to ensure fairness and efficiency.

While specific policy changes cannot be predicted with certainty, taxpayers can stay informed by monitoring official announcements and updates from the Department of Revenue. By staying aware of any changes, taxpayers can adapt their tax planning strategies accordingly and ensure compliance with the latest regulations.

Conclusion

Understanding and effectively managing the Mississippi tax refund process is an essential aspect of financial well-being. By leveraging the tools and resources provided by the Mississippi Department of Revenue, taxpayers can track their refund status, address potential issues, and maximize their refund potential. With a proactive approach and a solid understanding of the tax landscape, individuals can make informed decisions and optimize their financial situation.

As the tax landscape continues to evolve, staying informed about upcoming improvements and potential policy changes is crucial. By adapting to these changes and leveraging available resources, taxpayers can navigate the Mississippi tax refund process with confidence and ensure a positive financial outcome.

How long does it typically take to receive a Mississippi tax refund?

+The processing time for Mississippi tax refunds can vary depending on several factors. On average, taxpayers can expect to receive their refund within 4 to 6 weeks after filing their return. However, factors such as the filing method, complexity of the return, and the volume of returns received during peak filing seasons can influence the processing time.

Can I check the status of my Mississippi tax refund online?

+Yes, the Mississippi Department of Revenue provides an online platform for taxpayers to track the status of their refund. By accessing the official website and logging in with their unique credentials, individuals can view real-time updates on the progress of their refund.

What should I do if my Mississippi tax refund is delayed?

+If your Mississippi tax refund is delayed, it is important to stay patient and verify the status through the online tracking platform or by contacting the Department of Revenue’s telephone hotline. Delays can occur due to various reasons, such as discrepancies in the return or further review. Promptly responding to any requests for information can help expedite the resolution process.

Are there any deductions or credits available to maximize my Mississippi tax refund?

+Yes, Mississippi offers a range of deductions and credits that can reduce tax liability and increase refund amounts. These include deductions for mortgage interest, property taxes, and certain expenses related to education and healthcare. Additionally, credits such as the Child Tax Credit and Earned Income Tax Credit can provide significant relief for eligible taxpayers. It is advisable to consult with a tax professional or utilize reliable tax preparation software to identify and claim these deductions and credits accurately.