State Of Michigan Income Tax

The State of Michigan income tax is an important component of the state's revenue system, playing a vital role in funding essential public services and infrastructure. As an integral part of the state's fiscal policy, understanding the nuances of Michigan's income tax system is crucial for residents, businesses, and anyone with an interest in the state's economic landscape.

Unraveling the State of Michigan Income Tax

The Michigan income tax is a personal and corporate income tax, levied on the taxable income of individuals, estates, trusts, and corporations. The tax rate and applicable exemptions vary based on the taxpayer’s status and income level. This article delves into the specifics of the Michigan income tax, offering an in-depth analysis of its structure, rates, deductions, and implications for taxpayers.

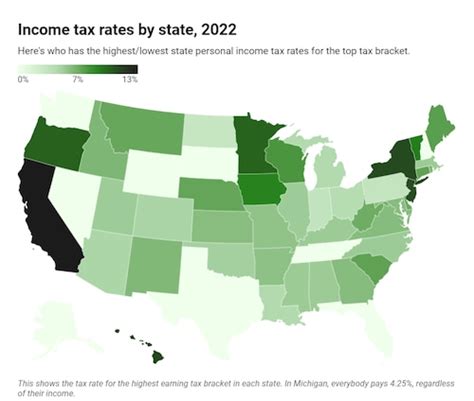

Tax Rates and Brackets

Michigan operates on a flat tax rate system, which means that all taxpayers, regardless of income level, are subject to the same tax rate. As of 2023, the flat tax rate for Michigan residents is 4.25%. This rate applies to all taxable income, including wages, salaries, interest, dividends, and capital gains.

While the flat rate simplifies the tax system, it's important to note that Michigan also offers tax credits and deductions that can reduce the effective tax rate for many taxpayers. These provisions are designed to ease the tax burden on lower- and middle-income households and encourage certain activities, such as investing in renewable energy or contributing to college savings plans.

| Tax Year | Tax Rate |

|---|---|

| 2023 | 4.25% |

| 2022 | 4.25% |

| 2021 | 4.25% |

Taxable Income and Deductions

Michigan defines taxable income as the total income from all sources, minus certain deductions and exemptions. Some common deductions include federal income tax paid, contributions to certain retirement plans, and charitable contributions. The state also offers a standard deduction, which reduces taxable income by a set amount, or taxpayers can opt to itemize their deductions, claiming specific expenses such as medical costs and property taxes.

One unique aspect of Michigan's tax system is the Homestead Property Tax Credit, which provides a credit against income tax for eligible homeowners and renters. This credit can significantly reduce the tax liability for many Michigan residents, making it a key incentive for homeownership.

Tax Filing and Payment

Taxpayers in Michigan typically file their income tax returns by April 15th each year. The state offers both paper and electronic filing options, with the latter being the preferred method due to its convenience and faster processing time. Payments can be made through various methods, including direct withdrawal, credit or debit card, or by mailing a check.

For taxpayers who are unable to pay their taxes in full by the deadline, Michigan offers payment plans and penalty abatement programs. These provisions can help taxpayers manage their tax obligations without incurring significant penalties or interest charges.

Economic Impact and Future Considerations

The State of Michigan income tax is a critical source of revenue for the state, funding vital services like education, healthcare, infrastructure development, and public safety. The flat tax rate and various deductions make the tax system relatively straightforward and fair, ensuring that all taxpayers contribute to the state’s economy.

Looking ahead, the Michigan Department of Treasury is focused on modernizing the tax system to enhance efficiency and security. This includes initiatives to streamline the tax filing process, improve taxpayer services, and implement measures to prevent tax fraud and identity theft. Additionally, the state is exploring ways to encourage economic growth and investment, potentially through tax incentives for businesses and entrepreneurs.

Frequently Asked Questions

What is the income tax rate in Michigan for 2023?

+

The Michigan income tax rate for 2023 is 4.25%.

Are there any tax credits or deductions available in Michigan?

+

Yes, Michigan offers various tax credits and deductions, including the Homestead Property Tax Credit, retirement plan contributions, and charitable donations. Taxpayers can also choose between the standard deduction and itemized deductions.

When are Michigan income tax returns due?

+

Michigan income tax returns are typically due by April 15th each year. However, if this date falls on a weekend or holiday, the deadline is extended to the next business day.

What happens if I can’t pay my Michigan income taxes by the deadline?

+

If you’re unable to pay your Michigan income taxes by the deadline, you can apply for a payment plan or request a penalty abatement. These options can help you manage your tax obligations without incurring significant penalties or interest charges.

How does Michigan’s flat tax rate compare to other states?

+

Michigan’s flat tax rate of 4.25% is among the lowest in the nation, making it an attractive feature for businesses and individuals considering a move to the state. Many states have higher income tax rates or use a progressive tax system, where the tax rate increases as income levels rise.