Colorado State Income Tax Refund

For residents of the state of Colorado, understanding the intricacies of the state's income tax system is essential for proper financial planning. This includes navigating the process of claiming refunds, which can be a source of relief for many taxpayers. In this comprehensive guide, we will delve into the specifics of the Colorado State Income Tax Refund, covering everything from eligibility criteria to the practical steps involved in claiming your refund.

Understanding Colorado’s Income Tax Structure

Colorado’s income tax system operates on a flat rate basis, with a state income tax rate of 4.55% applicable to all taxable income. This is in contrast to many other states that employ a progressive tax structure, where higher income levels are taxed at progressively higher rates. Despite the flat rate, Colorado offers a range of tax credits and deductions that can significantly reduce the amount of tax owed, making the state’s tax system more favorable for certain taxpayers.

The state's tax year aligns with the federal tax year, running from January 1st to December 31st. Taxpayers are required to file their state income tax returns annually, typically by the April 15th deadline, unless an extension is granted. It's important to note that Colorado does not allow electronic filing for individuals, so returns must be filed on paper or through a tax professional.

Taxable Income and Exemptions

Colorado defines taxable income as all income earned or received by a taxpayer during the tax year, with certain exemptions and deductions allowed. These exemptions can significantly reduce the tax liability for individuals and families. For instance, the state offers a standard deduction of 7,550 for single filers and 15,100 for joint filers, which can be claimed in lieu of itemized deductions.

In addition, Colorado provides specific tax credits that can further reduce the tax burden. These include credits for the elderly, the disabled, and those with dependent children. The state also offers a Child Care Contribution Tax Credit, which can offset a portion of the cost of child care expenses.

Eligibility for a Colorado State Income Tax Refund

Not all taxpayers will be eligible for a refund, as it depends on various factors such as income level, tax credits claimed, and the amount of tax withheld or paid during the year. Here’s a breakdown of the key eligibility criteria:

- Taxpayers must have overpaid their taxes during the tax year, either through withholding from wages or estimated tax payments.

- They must have filed a complete and accurate tax return, reporting all income and claiming all applicable deductions and credits.

- Taxpayers should have paid at least some state income tax during the year. If no tax was paid, a refund is not possible.

- Certain eligibility requirements must be met to claim specific tax credits. For example, the Child Care Contribution Tax Credit requires that the taxpayer has paid for qualifying child care expenses.

Calculating Your Potential Refund

The amount of your potential refund depends on several factors, including your taxable income, the tax credits and deductions you’re eligible for, and the amount of tax you’ve already paid. Here’s a simplified example to illustrate the calculation:

| Taxable Income | Tax Owed | Withheld/Paid Taxes | Potential Refund |

|---|---|---|---|

| $50,000 | $2,275 (4.55% of taxable income) | $3,000 (Estimated Tax Payments) | $725 (Withheld/Paid - Tax Owed) |

In this example, the taxpayer is entitled to a refund of $725, as they have overpaid their taxes by this amount.

The Process of Claiming Your Refund

Claiming your Colorado State Income Tax Refund involves several steps, from gathering the necessary documents to filing your return and tracking the status of your refund. Here’s a step-by-step guide to help you through the process:

Step 1: Gather Your Documents

Before you begin, make sure you have all the necessary documents and information to complete your tax return accurately. This includes:

- Your Social Security Number and those of your dependents.

- All W-2 forms and other income statements, such as 1099 forms.

- Records of any deductible expenses, such as medical expenses, charitable contributions, and interest paid on student loans.

- Information on any tax credits you may be eligible for, such as the Child Care Contribution Tax Credit.

- Records of any state tax payments or withholdings you've made during the year.

Step 2: Complete and File Your Tax Return

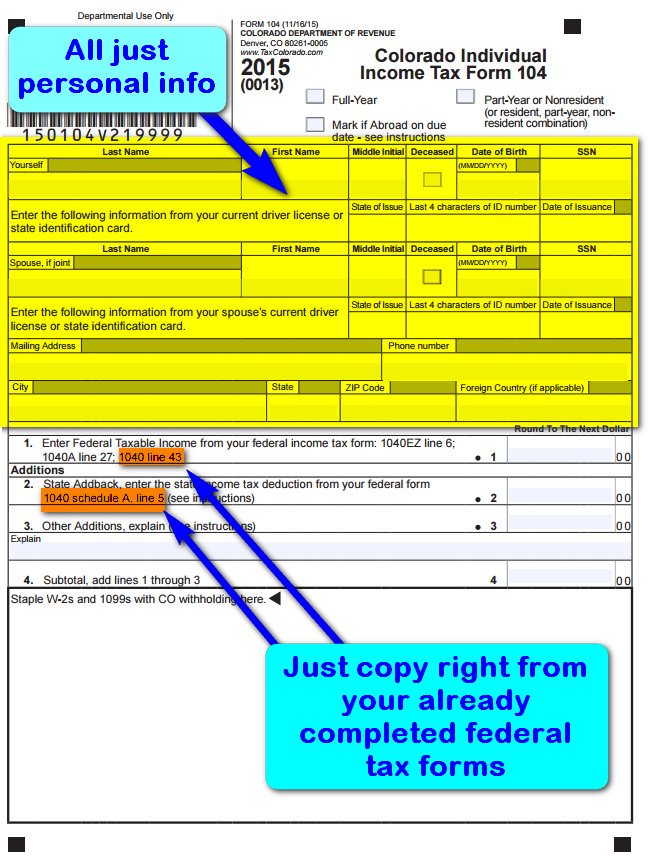

Once you have gathered all the necessary information, you can begin completing your tax return. The state of Colorado provides a Form 104 for individual income tax returns, which you can download from the Colorado Department of Revenue’s website. Here are some key points to keep in mind:

- Make sure to claim all applicable deductions and credits to reduce your tax liability.

- If you're claiming the Child Care Contribution Tax Credit, you'll need to complete Form CC and attach it to your return.

- Review your return carefully for accuracy before submitting it.

- If you're due a refund, the state will provide you with a Form 104CR to claim it.

Step 3: Track Your Refund Status

After filing your return, you can track the status of your refund through the Colorado Department of Revenue’s website. You’ll need to provide some basic information, such as your Social Security Number and the amount of your expected refund. The website will provide you with an estimated refund date, which can be useful for planning your finances.

Maximizing Your Refund: Strategies and Tips

While the primary goal is to ensure accurate reporting and compliance with tax laws, there are several strategies you can employ to maximize your refund and minimize your tax burden. Here are some tips to consider:

- Review Your Withholdings: Ensure that the amount of tax being withheld from your paychecks is appropriate for your tax situation. You can use the Colorado Department of Revenue's Withholding Calculator to estimate your tax liability and adjust your withholdings accordingly.

- Claim All Eligible Deductions and Credits: Make sure you're taking advantage of all the deductions and credits you're entitled to. This includes the standard deduction, itemized deductions, and any applicable tax credits. For example, the Child Tax Credit can significantly reduce your tax liability if you have qualifying children.

- Consider Tax-Advantaged Savings: Contribute to tax-advantaged accounts such as IRAs or 401(k) plans, which can reduce your taxable income and increase your refund.

- Track Your Expenses: Keep good records of your deductible expenses throughout the year. This can include medical expenses, charitable donations, and work-related expenses. The more you can deduct, the lower your taxable income will be.

Future Implications and Tax Planning

Understanding the Colorado State Income Tax system and effectively claiming your refund is just one aspect of financial planning. It’s equally important to look ahead and consider the future implications of your tax situation. Here are some key points to consider:

Tax Law Changes

Tax laws are subject to change, and it’s crucial to stay informed about any updates that may impact your tax liability. The Colorado Department of Revenue regularly publishes updates and guidance on its website, so it’s a good idea to check in periodically. Additionally, federal tax law changes can also affect state taxes, so monitoring federal updates is beneficial as well.

Long-Term Financial Planning

While claiming your refund is an important part of your financial strategy, it’s just one piece of the puzzle. To ensure long-term financial health, it’s essential to develop a comprehensive financial plan that takes into account your income, expenses, savings, and investments. This plan should also consider potential future changes in your financial situation, such as career advancements, family planning, or retirement.

Seeking Professional Advice

Tax laws can be complex, and navigating them can be challenging, especially for those with unique or complex financial situations. In such cases, seeking the advice of a qualified tax professional can be invaluable. A tax advisor can help you understand the full range of deductions and credits you may be eligible for, as well as provide guidance on strategies to minimize your tax burden and maximize your refund.

Conclusion

The Colorado State Income Tax Refund process, while straightforward for many taxpayers, can be complex and challenging for others. By understanding the state’s tax system, eligibility criteria, and the steps involved in claiming a refund, you can ensure that you receive the refund you’re entitled to. Additionally, by employing effective tax planning strategies and staying informed about tax law changes, you can minimize your tax burden and maximize your financial well-being.

What is the average amount of a Colorado State Income Tax Refund?

+The average refund amount can vary significantly from year to year and depends on various factors such as income level, tax credits claimed, and the amount of tax withheld or paid during the year. According to the Colorado Department of Revenue, the average refund for the 2021 tax year was approximately $950.

How long does it typically take to receive a Colorado State Income Tax Refund?

+The processing time for refunds can vary, but the Colorado Department of Revenue aims to process refunds within 45 days of receiving a complete and accurate return. However, it’s important to note that this timeline can be impacted by factors such as the volume of returns being processed and the complexity of your tax situation.

Can I check the status of my Colorado State Income Tax Refund online?

+Yes, you can check the status of your refund online through the Colorado Department of Revenue’s website. You’ll need to provide some basic information, such as your Social Security Number and the amount of your expected refund. The website will provide you with an estimated refund date and allow you to track the progress of your refund.

What should I do if I believe there’s an error in my refund amount or I haven’t received my refund within the expected timeframe?

+If you believe there’s an error in your refund amount or you haven’t received your refund within the expected timeframe, you should contact the Colorado Department of Revenue’s Taxpayer Services Division. They can help you investigate the issue and provide guidance on next steps. You can reach them by phone at (303) 238-7378 or toll-free at (800) 351-7613.