Goods Service Tax

The Goods and Services Tax (GST) is a comprehensive, multi-stage, destination-based tax that has revolutionized the taxation landscape in various countries, notably India. Implemented with the aim of simplifying and unifying the indirect tax system, GST has had a profound impact on businesses, consumers, and the economy as a whole. In this in-depth analysis, we will explore the intricacies of GST, its benefits, challenges, and its role in shaping the fiscal policies of nations.

Understanding the Goods and Services Tax

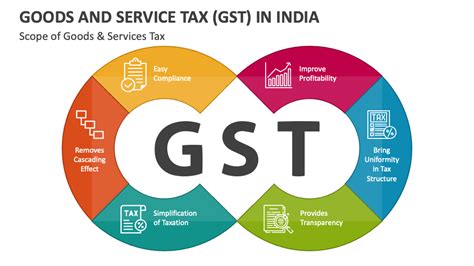

The Goods and Services Tax, often referred to as GST, is a complex yet unified tax system that has been adopted by numerous countries to streamline their tax structures. It is a consumption tax levied on the supply of goods and services, designed to replace a multitude of indirect taxes, such as value-added tax (VAT), excise duties, and service taxes.

GST operates on the principle of value addition at each stage of the supply chain, ensuring that the tax is paid only on the value added by the current supplier, while the previous stages' taxes are claimed as input tax credits. This multi-stage and destination-based nature of GST makes it a transparent and efficient tax system, eliminating the cascading effect of taxes and promoting a level playing field for businesses.

The implementation of GST brings about a paradigm shift in the way taxes are levied and collected. It is a comprehensive tax that captures the entire supply chain, from the manufacturer to the end consumer, ensuring a seamless flow of tax revenues. The tax is levied at each stage of the supply chain, but with the ability to claim input tax credits, businesses effectively pay tax only on the value they add to the goods or services.

One of the key advantages of GST is its simplicity and transparency. By replacing a myriad of indirect taxes with a single tax, GST reduces the compliance burden on businesses and simplifies tax administration. It also promotes fair competition by treating all businesses equally, regardless of their size or industry. The destination-based nature of GST ensures that the tax revenue accrues to the state where the consumption takes place, providing a boost to the local economies.

GST in Practice: A Global Perspective

The concept of GST has gained widespread acceptance globally, with many countries recognizing its potential to streamline tax systems and boost economic growth. Here’s a glimpse of how GST has been implemented in different parts of the world:

| Country | GST Implementation |

|---|---|

| India | India's GST, implemented in 2017, is a complex yet transformative tax system. It has unified various state and central taxes, creating a single national market and promoting ease of doing business. |

| Australia | Australia's GST, introduced in 2000, is a 10% tax on most goods and services. It has played a significant role in simplifying the tax system and improving revenue collection. |

| Canada | Canada has a harmonized sales tax (HST), which is a combination of GST and provincial sales taxes. This system ensures uniformity in tax rates across the country. |

| New Zealand | New Zealand's GST, at 15%, is a broad-based tax that applies to most goods and services. It has been in place since 1986 and is a key source of government revenue. |

| Singapore | Singapore's GST, currently at 7%, is a multi-stage tax system that is well-integrated into the country's economic framework. It has undergone various rate adjustments over the years. |

Key Components of GST

GST is a multifaceted tax system that comprises several critical components, each playing a crucial role in its effective functioning. Understanding these components is essential to grasp the complexities and nuances of GST.

Tax Rates and Structure

GST is typically structured into multiple tax rates, catering to the diverse nature of goods and services. These rates can vary depending on the jurisdiction and the specific tax laws of a country. In India, for instance, the GST rates are categorized into 5%, 12%, 18%, and 28%, with certain items exempt from GST.

The tax rates are carefully designed to balance revenue generation and the affordability of goods and services. Essential items, such as food and medicines, often attract lower tax rates or are exempt to ensure accessibility for all sections of society. On the other hand, luxury goods and services may attract higher tax rates to generate additional revenue.

The tax structure also includes provisions for input tax credits, which allow businesses to claim a refund or reduction in their GST liability based on the taxes paid on their purchases. This mechanism ensures that GST is paid only on the value addition at each stage of the supply chain.

Registration and Compliance

Businesses involved in the supply of goods and services are required to register for GST, ensuring compliance with the tax laws. The registration process varies across countries but typically involves providing essential business information and obtaining a unique GST identification number.

Compliance with GST regulations is a critical aspect for businesses. It involves accurate record-keeping, timely filing of tax returns, and proper invoicing. Non-compliance can result in penalties and legal consequences, making it essential for businesses to understand and adhere to the GST requirements.

To assist businesses, many countries provide online platforms and tools for GST registration and compliance. These platforms offer a user-friendly interface for businesses to manage their GST obligations, file returns, and access relevant information and updates.

Input Tax Credit and Refunds

One of the key advantages of GST is the mechanism of input tax credit (ITC). ITC allows businesses to claim a credit for the GST paid on their purchases, which can be utilized to offset their GST liability. This ensures that businesses are not burdened with the cost of taxes paid at previous stages of the supply chain.

The ITC system promotes efficiency and fairness in the tax system. It encourages businesses to maintain accurate records and ensures that the tax burden is distributed equitably across the supply chain. By claiming ITC, businesses can effectively reduce their tax liability, leading to cost savings and improved cash flow.

In addition to ITC, businesses are also entitled to GST refunds if they have paid more tax than they are liable to pay. This could occur due to various reasons, such as excess tax payments, input tax credits exceeding output tax liability, or exports, which are zero-rated under GST.

Impact of GST on Businesses and Consumers

The implementation of GST has had a significant impact on both businesses and consumers, shaping their behaviors and strategies. Let’s explore how GST has influenced these key stakeholders.

Benefits for Businesses

GST has brought about several advantages for businesses, particularly in the areas of simplification and efficiency. By replacing multiple indirect taxes with a single tax, GST has reduced the compliance burden on businesses, making tax administration more straightforward.

The unified tax system of GST has also promoted fair competition among businesses. With a level playing field, businesses can focus on their core competencies rather than navigating through a complex web of taxes. This has led to increased efficiency and competitiveness in the market.

Furthermore, GST has encouraged supply chain optimization. Businesses now have an incentive to streamline their supply chains to minimize the tax burden. This has resulted in improved inventory management, reduced wastage, and enhanced overall operational efficiency.

Challenges for Businesses

While GST offers numerous benefits, it also presents certain challenges for businesses. One of the primary concerns is the initial adjustment period required to adapt to the new tax system. Businesses need to invest time and resources in understanding the GST regulations, updating their systems, and training their staff.

The complexity of GST, especially with multiple tax rates and compliance requirements, can be a hurdle for small and medium-sized enterprises (SMEs). They may face challenges in managing the additional administrative burden and ensuring compliance.

Additionally, the impact of GST on pricing and margins is a critical consideration for businesses. The transition to GST may require businesses to review their pricing strategies and absorb or pass on the tax incidence to consumers. This can impact their profitability and market competitiveness.

Impact on Consumers

GST has had a direct impact on consumers, primarily in the form of price changes for goods and services. The implementation of GST has led to a shift in tax incidence, with certain products becoming more affordable while others may have witnessed an increase in prices.

Consumers have also benefited from the transparency and simplicity brought about by GST. With a single tax system, consumers can easily understand the tax component in the prices they pay. This transparency enhances consumer awareness and empowers them to make informed purchasing decisions.

Furthermore, GST has the potential to reduce the overall tax burden on consumers. By eliminating the cascading effect of taxes, GST ensures that the tax paid by consumers is limited to the value addition at the final stage. This can lead to more competitive pricing and improved affordability for essential goods and services.

GST and Economic Growth

The implementation of GST has far-reaching implications for a country’s economy, impacting various sectors and driving overall economic growth. Let’s delve into the economic implications of GST.

Boosting Economic Efficiency

GST has played a pivotal role in enhancing economic efficiency by streamlining the tax system. The removal of multiple taxes and the introduction of a single tax have reduced the compliance burden on businesses, leading to increased productivity and cost savings.

The simplified tax structure of GST has encouraged businesses to focus on their core activities rather than spending resources on tax compliance. This has resulted in improved resource allocation, allowing businesses to invest in innovation, research, and development, thereby contributing to economic growth.

Promoting Investment and Trade

GST has been instrumental in attracting investments and fostering economic growth. The unified tax system has created a favorable business environment, making it easier for domestic and foreign investors to navigate the tax landscape. This has led to increased investment inflows and the creation of new business opportunities.

Furthermore, GST has facilitated international trade by simplifying the tax system for cross-border transactions. With a uniform tax structure, businesses can participate in global trade more efficiently, leading to increased exports and imports. This has a positive impact on the country's trade balance and overall economic growth.

Enhancing Fiscal Transparency

GST has brought about increased fiscal transparency by providing a comprehensive view of tax revenues. The tax system’s transparency and the availability of real-time data have enabled better tax administration and policy formulation. This has led to more efficient allocation of resources and improved tax compliance.

The transparency of GST has also fostered accountability in tax administration. With a clear and visible tax system, taxpayers can easily understand the tax burden and ensure that their contributions are utilized effectively. This promotes a sense of trust and confidence in the tax system.

Challenges and Future Implications

While GST has brought about significant benefits, it is not without its challenges. As countries continue to refine and improve their GST systems, it is essential to address these challenges and explore future implications.

Addressing Implementation Challenges

The implementation of GST is a complex process that requires careful planning and execution. One of the key challenges is ensuring a smooth transition from the existing tax system to GST. This involves extensive training and awareness campaigns to educate businesses and taxpayers about the new tax system.

Another challenge is managing the initial impact of GST on businesses and consumers. The transition to GST may lead to short-term disruptions, such as price fluctuations and supply chain adjustments. It is crucial to have robust support systems in place to mitigate these impacts and ensure a stable transition.

Future Enhancements and Innovations

As GST continues to evolve, countries are exploring various enhancements and innovations to improve the tax system further. One of the key areas of focus is digitalization, with the aim of creating a seamless and paperless GST ecosystem.

Digital technologies, such as blockchain and artificial intelligence, are being leveraged to enhance GST compliance and administration. These technologies can improve data accuracy, streamline processes, and reduce the scope for errors and fraud. By embracing digitalization, countries can create a more efficient and transparent GST system.

International Cooperation and Harmonization

In an increasingly globalized world, international cooperation and harmonization of tax systems are becoming essential. Countries are recognizing the need to align their GST systems to facilitate cross-border trade and investment.

Efforts are underway to harmonize GST rates and regulations across countries, creating a unified tax environment. This harmonization can simplify tax compliance for businesses operating in multiple jurisdictions and promote a more integrated global economy. International cooperation on GST can also address issues related to tax evasion and ensure a fair tax system for all.

Conclusion

The Goods and Services Tax has emerged as a transformative force in the realm of taxation, reshaping the way taxes are levied and collected. Its implementation has brought about significant benefits, including simplified tax systems, enhanced economic efficiency, and increased fiscal transparency.

While GST has faced challenges, particularly during its initial implementation, countries have demonstrated resilience and adaptability. The ongoing refinements and innovations in GST systems reflect a commitment to continuous improvement and a recognition of the tax's critical role in shaping economic policies.

As we look to the future, the potential of GST to drive economic growth and promote fair competition remains unparalleled. With continued efforts towards digitalization, harmonization, and international cooperation, GST is poised to become an even more powerful tool for economic development and tax administration.

What is the purpose of GST?

+GST aims to simplify and unify the tax system by replacing multiple indirect taxes with a single tax, promoting fairness, efficiency, and economic growth.

How does GST benefit businesses?

+GST offers benefits such as reduced compliance burden, fair competition, and supply chain optimization, leading to increased efficiency and competitiveness.

What impact does GST have on consumers?

+GST can result in price changes for goods and services, but it also brings transparency and has the potential to reduce the overall tax burden on consumers.

How does GST contribute to economic growth?

+GST enhances economic efficiency, promotes investment and trade, and increases fiscal transparency, all of which contribute to overall economic growth.