Michigan Tax Refund Tracker

The Michigan Tax Refund Tracker is a valuable tool for residents of the Great Lakes State to monitor the status of their tax refunds. This online service provided by the Michigan Department of Treasury offers a convenient and efficient way for taxpayers to stay informed about the processing of their returns. In this comprehensive guide, we will delve into the intricacies of the Michigan Tax Refund Tracker, exploring its features, benefits, and the steps involved in utilizing this service effectively.

Understanding the Michigan Tax Refund Tracker

The Michigan Tax Refund Tracker is a user-friendly platform designed to provide real-time updates on the progress of your tax refund. By leveraging secure digital technology, the Department of Treasury enables taxpayers to access their refund information without the need for frequent phone calls or visits to tax offices. This innovative tool not only enhances transparency but also simplifies the entire tax refund process, ensuring a smoother and more efficient experience for Michigan residents.

Features and Benefits

The Michigan Tax Refund Tracker offers a range of features that streamline the tax refund process and provide added convenience to taxpayers. Here’s an overview of its key benefits:

Real-Time Refund Status

With the Tax Refund Tracker, you can check the status of your refund at any time. The platform provides up-to-date information, indicating whether your return has been received, is being processed, or if the refund has been issued. This real-time visibility allows you to stay informed and plan your finances accordingly.

Secure Online Access

The Michigan Department of Treasury prioritizes the security of taxpayer information. The Tax Refund Tracker employs advanced encryption protocols to safeguard your personal and financial data. By accessing the tracker through the official website, you can rest assured that your information remains confidential and protected.

User-Friendly Interface

Designed with simplicity in mind, the Tax Refund Tracker boasts an intuitive and user-friendly interface. Even if you’re not tech-savvy, navigating the platform is a breeze. The straightforward design ensures that you can quickly find the information you need without any unnecessary complications.

Multiple Refund Tracking Options

The Michigan Tax Refund Tracker offers flexibility by providing multiple tracking options. Whether you prefer to use your Social Security Number, Individual Taxpayer Identification Number (ITIN), or even your refund confirmation number, the tracker accommodates various methods to access your refund status. This versatility ensures that you can choose the most convenient and secure option for your specific circumstances.

Direct Deposit and Payment Status

If you opted for direct deposit, the Tax Refund Tracker provides updates on the status of your refund deposit. You’ll receive notifications if there are any delays or issues with the deposit, allowing you to take prompt action if necessary. Additionally, the tracker displays the date and time of the refund deposit, providing a comprehensive overview of the entire refund process.

Tax Refund History

For those who want to keep a record of their tax refund history, the Michigan Tax Refund Tracker has you covered. The platform maintains a detailed history of your past refunds, including the dates of refund issuance, methods of payment, and the amounts received. This feature is particularly beneficial for tax planning and financial record-keeping.

How to Use the Michigan Tax Refund Tracker

Using the Michigan Tax Refund Tracker is a straightforward process. Follow these simple steps to access your refund status:

Step 1: Visit the Official Website

Begin by navigating to the official Michigan Department of Treasury website. This is the trusted source for accessing the Tax Refund Tracker and ensuring the security of your information.

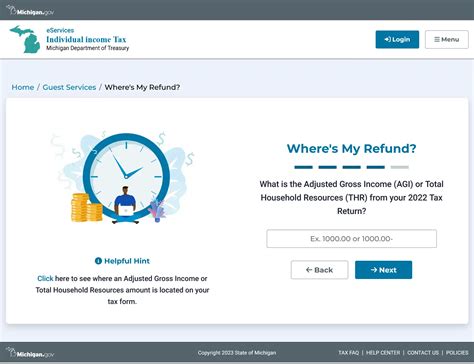

Step 2: Locate the Tax Refund Tracker

On the Department of Treasury’s website, look for the “Tax Refund Tracker” or “Check Your Refund Status” link. This link will direct you to the secure online portal for tracking your refund.

Step 3: Enter Your Credentials

To access your refund status, you’ll need to provide certain credentials. These may include your Social Security Number, ITIN, or refund confirmation number, along with other personal details to verify your identity.

Step 4: Track Your Refund

Once you’ve successfully logged in, you’ll be presented with your refund status. The tracker will display the current stage of your refund processing, providing clear and concise information about the progress of your return.

Step 5: Stay Informed

Keep checking the Tax Refund Tracker regularly to stay updated on the status of your refund. If any changes occur, such as the refund being issued or additional information being required, the tracker will notify you promptly.

Tips for a Smooth Tax Refund Process

To ensure a seamless experience with the Michigan Tax Refund Tracker and the overall tax refund process, consider the following tips:

- File Your Taxes Early: Submitting your tax return early in the tax season can reduce processing time and potential delays. The sooner you file, the sooner you can track your refund.

- Double-Check Your Information: Accuracy is crucial when filing your taxes. Review your return carefully to avoid errors that may lead to delays or additional scrutiny.

- Use Direct Deposit: Opting for direct deposit as your refund method simplifies the process. It eliminates the need for physical checks and provides faster access to your refund.

- Keep Important Documents: Retain copies of your tax return and any supporting documents. These records can be useful for reference and may be required if there are any issues with your refund.

- Monitor Your Email: Stay vigilant by regularly checking your email, especially during tax season. The Michigan Department of Treasury may send important updates or notifications regarding your refund.

Addressing Common Concerns

While the Michigan Tax Refund Tracker is a reliable tool, some taxpayers may encounter common concerns or issues. Here are a few frequently asked questions and their answers to address these concerns:

What if I don’t receive my refund within the estimated time frame?

If your refund is not issued within the estimated time frame, it’s advisable to wait a few more days before taking further action. Refund processing times can vary, and occasional delays are possible. However, if you notice a significant delay, you can contact the Michigan Department of Treasury’s Customer Service Center for assistance.

Can I track my refund status without a confirmation number?

Yes, you can still track your refund status even if you don’t have a confirmation number. The Tax Refund Tracker offers alternative methods, such as using your Social Security Number or ITIN, to access your refund information.

How can I verify the authenticity of the Tax Refund Tracker website?

To ensure the authenticity of the Tax Refund Tracker website, always access it through the official Michigan Department of Treasury website. Look for security indicators such as a padlock icon in the address bar and “https” at the beginning of the URL. These indicators confirm that the website is secure and protected.

What should I do if I suspect fraudulent activity related to my tax refund?

If you suspect any fraudulent activity or identity theft related to your tax refund, it’s crucial to take immediate action. Contact the Michigan Department of Treasury’s Identity Theft Unit and follow their guidance. They will provide the necessary steps to protect your identity and resolve the issue.

Can I track the status of my amended tax return using the Tax Refund Tracker?

Unfortunately, the Tax Refund Tracker is designed to track the status of original tax returns. If you’ve filed an amended return, you’ll need to contact the Michigan Department of Treasury’s Customer Service Center to inquire about the status of your amended refund.

Future Developments and Enhancements

The Michigan Department of Treasury is committed to continuously improving the Tax Refund Tracker to enhance the taxpayer experience. Future developments may include:

- Enhanced security measures to further protect taxpayer data.

- Integration of additional tracking options, such as mobile apps or text message notifications.

- Real-time updates and notifications to keep taxpayers informed without the need for constant manual checks.

- Improved user interface and accessibility to make the tracker more user-friendly and inclusive.

Conclusion

The Michigan Tax Refund Tracker is a valuable resource for residents of the state, offering a convenient and secure way to track the status of their tax refunds. By leveraging this innovative tool, taxpayers can stay informed, plan their finances effectively, and streamline the entire tax refund process. With its user-friendly interface and real-time updates, the Tax Refund Tracker exemplifies the Michigan Department of Treasury’s commitment to transparency and efficiency in serving its taxpayers.

How long does it typically take to receive a Michigan tax refund?

+The processing time for Michigan tax refunds can vary, but on average, it takes approximately 21 days from the date your return is received by the Department of Treasury. However, factors such as the volume of returns, complexity of the return, or any errors or discrepancies can impact the processing time.

Can I track the status of my refund if I filed jointly with my spouse?

+Yes, you can track the status of your joint tax refund using the Tax Refund Tracker. Both spouses can access the tracker using their respective Social Security Numbers or ITINs to check the progress of their joint refund.

What if I need to make changes to my tax return after filing?

+If you need to make changes or corrections to your tax return after filing, you’ll need to file an amended return. Contact the Michigan Department of Treasury’s Customer Service Center for guidance on the process and to obtain the necessary forms.

Are there any alternative methods to check my refund status if I don’t have access to the internet?

+Yes, if you don’t have internet access, you can contact the Michigan Department of Treasury’s Customer Service Center by phone. They will assist you in checking the status of your refund and provide any necessary updates.