How Much Is Florida Sales Tax

Florida, known for its vibrant tourism industry and diverse economy, implements a sales tax system that plays a crucial role in funding essential public services and infrastructure. Understanding the sales tax landscape in Florida is vital for both residents and businesses, as it directly impacts their financial planning and compliance obligations.

The Florida Sales Tax System: A Comprehensive Overview

The sales tax in Florida is a consumption tax levied on the sale of goods and certain services. It is a vital source of revenue for the state, contributing significantly to its overall budget. The tax is administered by the Florida Department of Revenue, which ensures compliance and provides guidance to taxpayers.

As of my last update in January 2023, the general state sales tax rate in Florida stands at 6%. This rate is applicable across the state and forms the foundation of the sales tax system. However, it is important to note that Florida also allows local governments, such as counties and municipalities, to levy additional sales taxes, creating a more complex landscape.

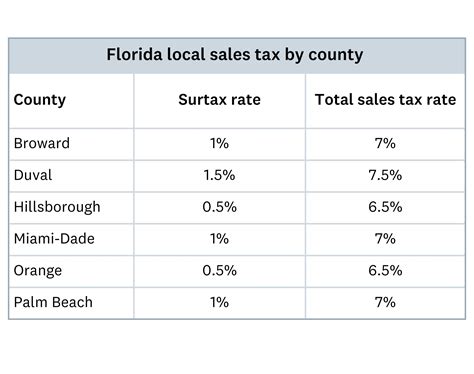

Local Sales Tax Variations

Florida’s sales tax structure allows for considerable variation at the local level. While the state’s base rate remains consistent, counties and cities can implement their own local option taxes, known as discretionary sales surtaxes. These surtaxes are often used to fund specific projects or initiatives within the local community, such as infrastructure development, education, or public safety enhancements.

The discretionary sales surtax rates can range from 0% to 1.5%, with some counties opting for higher rates to address unique local needs. As a result, the total sales tax rate can vary significantly across the state. For instance, while the base rate is 6%, a county with a 1.5% surtax would have a combined rate of 7.5%, making it important for businesses and consumers to be aware of these local variations.

| County | Local Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|

| Miami-Dade | 1.5% | 7.5% |

| Hillsborough | 1.5% | 7.5% |

| Orange | 1.5% | 7.5% |

| Broward | 1.5% | 7.5% |

| Palm Beach | 1.5% | 7.5% |

| Volusia | 1.0% | 7.0% |

| Pinellas | 1.0% | 7.0% |

| Lee | 1.0% | 7.0% |

| Polk | 1.0% | 7.0% |

| Sarasota | 1.0% | 7.0% |

Exemptions and Special Considerations

Florida’s sales tax system also includes a range of exemptions and special provisions. Certain categories of goods and services are exempt from sales tax, such as essential food items, prescription drugs, and some agricultural products. Additionally, there are specific tax holidays during which certain types of purchases are exempt from sales tax, providing a boost to consumers and retailers.

For businesses, understanding these exemptions is crucial for accurate tax calculation and compliance. The Florida Department of Revenue provides detailed guidelines on exempt items and situations, ensuring businesses can navigate the sales tax landscape with confidence.

The Impact of Sales Tax on Florida’s Economy

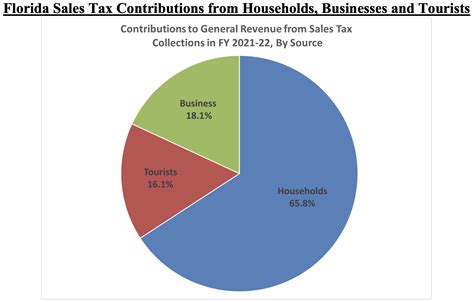

The sales tax in Florida plays a significant role in shaping the state’s economic landscape. As a major tourism destination, Florida relies heavily on sales tax revenue from the hospitality industry, retail establishments, and entertainment venues. This revenue stream funds essential services, including education, healthcare, and infrastructure development, making the sales tax a critical component of the state’s fiscal health.

Moreover, the sales tax system in Florida encourages economic growth by providing a stable revenue base. The consistent state rate, coupled with the flexibility for local governments to implement surtaxes, ensures a steady flow of funds for local projects and initiatives. This, in turn, attracts businesses and investors, contributing to the state's overall economic prosperity.

Tourism and Sales Tax

Florida’s thriving tourism industry is a key driver of its sales tax revenue. Visitors to the state contribute significantly to the sales tax base through their purchases of goods and services. This includes everything from hotel stays and restaurant meals to retail shopping and entertainment. As a result, the sales tax system plays a pivotal role in supporting the state’s tourism infrastructure and services.

To further enhance tourism and promote economic growth, Florida occasionally offers tax incentives and programs. For instance, the state may waive sales tax on certain tourism-related purchases or provide tax credits for eligible businesses. These initiatives not only stimulate tourism but also attract new businesses and investments, fostering a vibrant and competitive business environment.

Compliance and Enforcement: Ensuring a Fair Sales Tax System

Maintaining a fair and efficient sales tax system is essential for Florida’s economic health and stability. The Florida Department of Revenue plays a critical role in ensuring compliance and administering the sales tax laws. This includes educating taxpayers on their obligations, providing resources for accurate tax calculation, and enforcing compliance through audits and other measures.

For businesses, understanding their sales tax obligations is crucial. This includes registering with the Department of Revenue, collecting and remitting the appropriate tax rates, and keeping accurate records. The Department provides a range of resources, including online tools and guidance documents, to assist businesses in meeting their sales tax responsibilities.

Audits and Enforcement Actions

To ensure compliance, the Florida Department of Revenue conducts audits and investigations. These audits are designed to verify that businesses are accurately calculating and remitting sales tax. If discrepancies are found, the Department may impose penalties and interest on the outstanding tax liability. In severe cases of non-compliance, businesses may face legal consequences.

While audits can be a source of concern for businesses, they are a necessary part of the sales tax system. By ensuring compliance, the Department can maintain a level playing field for all businesses and prevent unfair advantages. Regular audits also help identify areas where businesses may need additional support or guidance, allowing the Department to provide more effective resources and assistance.

The Future of Sales Tax in Florida: Trends and Innovations

As Florida’s economy continues to evolve, so too will its sales tax system. Several trends and innovations are shaping the future of sales tax in the state, including the increasing importance of e-commerce and online sales, the potential for sales tax rate adjustments, and the integration of technology for more efficient tax administration.

E-commerce and Online Sales

The rise of e-commerce has transformed the retail landscape, and Florida is no exception. With an increasing number of purchases being made online, the state is adapting its sales tax system to ensure that these transactions are properly taxed. This includes implementing regulations and guidelines for remote sellers and ensuring that consumers understand their tax obligations when making online purchases.

To facilitate compliance, the Florida Department of Revenue has introduced resources and tools specifically for e-commerce businesses. These resources help online sellers understand their tax obligations, register for sales tax permits, and accurately collect and remit sales tax. By embracing the digital age, Florida is ensuring that its sales tax system remains relevant and effective in the modern economy.

Potential Rate Adjustments

The sales tax rate in Florida has remained relatively stable in recent years, but there have been discussions and proposals for rate adjustments. Some proponents argue that a higher sales tax rate could provide additional funding for critical public services and infrastructure projects. Others suggest that a lower rate could stimulate economic growth and make Florida more competitive with neighboring states.

While any changes to the sales tax rate would have significant implications for both businesses and consumers, it is important to consider the broader economic context. A comprehensive analysis of the state's revenue needs, economic growth prospects, and the impact on different sectors would be necessary before any rate adjustments are implemented. This ensures that any changes are made with a deep understanding of their potential effects on Florida's economy and its residents.

Technology and Tax Administration

Advancements in technology are revolutionizing the way sales tax is administered and collected. Florida is embracing these innovations to enhance efficiency and accuracy in tax administration. This includes the use of digital platforms and tools for registration, filing, and payment, as well as the integration of data analytics for more effective tax enforcement.

For businesses, these technological advancements can simplify the sales tax process, reducing the time and resources required for compliance. Online filing systems, for instance, provide a convenient and secure way to submit tax returns and make payments. Additionally, the use of data analytics can help businesses identify potential errors or areas of improvement in their sales tax processes, further enhancing their compliance and efficiency.

Conclusion: Navigating Florida’s Sales Tax Landscape

Florida’s sales tax system is a complex but crucial component of its economic framework. By understanding the state’s sales tax rates, local variations, and exemptions, businesses and consumers can navigate this landscape with confidence and compliance. The sales tax not only funds essential public services but also shapes the state’s economic growth and competitiveness.

As Florida continues to evolve and adapt to new economic realities, its sales tax system will play a pivotal role in sustaining its prosperity. By staying informed and engaged with the latest developments, businesses and individuals can ensure they are prepared for any changes and can contribute effectively to the state's economic future.

What is the current sales tax rate in Florida for online purchases?

+The sales tax rate for online purchases in Florida is the same as the rate for in-person purchases, which is 6% at the state level. However, local sales tax rates may apply, depending on the location of the buyer or the seller.

Are there any tax holidays in Florida, and what items are typically exempt during these periods?

+Yes, Florida occasionally offers tax holidays, during which certain types of purchases are exempt from sales tax. These typically include school supplies, hurricane preparedness items, and energy-efficient appliances. The specific dates and eligible items vary from year to year, so it’s important to check the Florida Department of Revenue’s website for the most up-to-date information.

How often does the Florida Department of Revenue conduct sales tax audits, and what triggers an audit?

+The Florida Department of Revenue conducts sales tax audits on a regular basis to ensure compliance with tax laws. Audits can be triggered by various factors, including random selection, changes in business operations, or discrepancies in tax filings. It’s important for businesses to maintain accurate records and be prepared for potential audits to ensure smooth compliance.