The history and origins of Trump no income tax policies

The political landscape of the United States has long been shaped by fiscal strategies and ideological debates surrounding taxation. Among the most contentious and widely discussed policies in recent history are the initiatives associated with former President Donald Trump’s approach to income taxation, notably the instances and implications of policies that appeared to favor reduced or zero-income tax liabilities for certain segments of the population, sometimes termed “no income tax” policies. These policies did not emerge in a vacuum but are rooted in a complex confluence of historical, economic, ideological, and legislative forces. Understanding the origins and evolution of Trump’s no income tax policies requires a nuanced exploration of the broader narrative of American tax policy, the context of Republican fiscal ideology, and the political strategies that shaped their implementation.

The Evolution of Tax Policy in America: A Historical Overview

To contextualize Trump’s no income tax policies, it is essential to first examine the trajectory of American tax policy over the last century. The United States has experienced various phases—from the progressive tax era initiated in the early 20th century, designed to balance economic inequality and fund expansive government programs, to the conservative push for tax cuts that gained momentum in the latter half of the century. These shifts reflect broader societal debates about the role of government, economic growth, and equity.

The New Deal era, for example, saw increased taxation on higher income brackets as part of Franklin D. Roosevelt’s efforts to combat the Great Depression’s aftermath, aligning with the Progressive Movement’s aims. Conversely, the Reagan Revolution of the 1980s introduced significant tax cuts, notably in top marginal rates, fueled by supply-side economics. These historical inflections form the backdrop for contemporary tax policy debates, including those spearheaded during the Trump administration.

The Rise of Conservative Tax Ideology and the GOP’s Fiscal Agenda

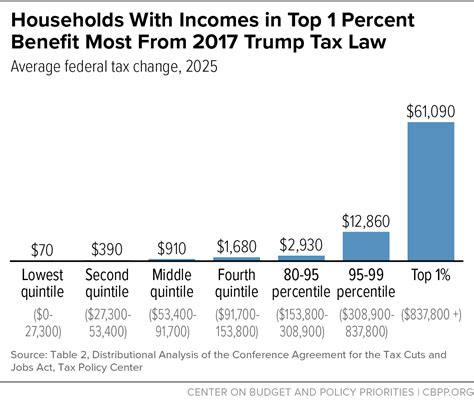

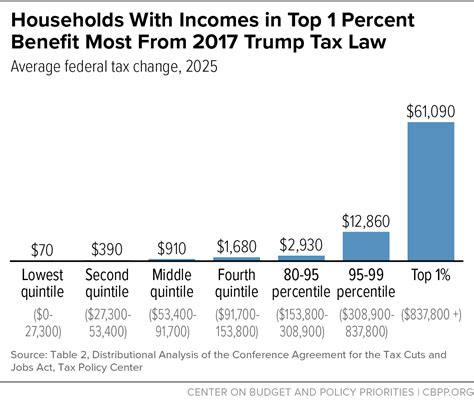

The ascendancy of conservative fiscal ideology within the Republican Party, emphasizing smaller government and lower taxes, has been pivotal. This ideological foundation gained renewed influence in the post-Reagan era, culminating in major legislative efforts to reduce tax burdens on corporations and high earners. The Tax Cuts and Jobs Act (TCJA) of 2017, enacted under Trump, exemplifies this trajectory, emphasizing dramatic reductions in corporate tax rates and substantial cuts in individual income tax brackets, with provisions favoring higher income earners.

Within this ideological framework, the concept of “no income tax” policies became politically salient, especially concerning efforts to simplify tax codes and expand the tax base to include previously exempt groups or to leverage tax incentives as economic stimuli. While outright “no income tax” policies were rarely enacted nationwide, certain states and jurisdictions experimented with such models, serving as precursors or ideological inspirations for national debates.

Specific Origins of Trump’s No Income Tax Policies

Although Donald Trump’s presidency did not see the abolition of the federal income tax, certain policies and proposals during his tenure echoed the principles of reduced or eliminated taxation for specific populations. The origins of these policies stem from several intertwined factors:

- Tax Reform Proposals and Campaign Pledges: During his 2016 campaign and subsequent administration, Trump championed sweeping tax reform, emphasizing the need to “simplify” taxes and “cut taxes for working Americans.” While opposed to outright zero-income tax, the rhetoric and policy drafts often aimed to reduce tax liabilities significantly, especially through large-scale deductions and credits.

- Use of Tax Incentives to Stimulate Economic Growth: Trump’s tax policies were heavily predicated on incentivizing investment through preferential treatment of capital gains and corporate rates. Although not directly about taxing or exempting low-income earners, the strategic focus on reducing overall effective tax burdens created perceptions of a “no-tax” scenario for certain economic actors.

- State-Level Experiments and Policy Influences: Some states, influenced by national conservative thought, implemented or proposed tax policies reducing or eliminating income taxes for specific groups. For example, states like Florida and Nevada lack state income taxes entirely, effectively functioning as “no income tax” jurisdictions. These models influenced broader federal policy debates.

- Historical and Political Narratives: The framing of tax policy as a mechanism to empower “ordinary Americans” and “remove government overreach” tied into Trump’s populist rhetoric. Although direct zero-income tax policies were not broadly enacted federally, the narrative created fertile ground for advocating such measures in theory or small-scale implementations.

Legislative and Policy Debates in the Trump Era

While comprehensive federal “no income tax” laws were not passed under Trump, multiple legislative initiatives and executive actions aimed at reducing effective tax rates exemplify this trend. The Tax Cuts and Jobs Act of 2017 was critical in this regard, lowering the top marginal rate from 39.6% to 37%, reducing the number of individual income-tax brackets, and expanding certain deductions. This legislation was pitched as a means to revitalize economic growth, but it also generated substantial debate about inequality and the concentration of tax benefits among wealthier Americans.

Additionally, proposals floated by Trump and his allies included flat tax systems or national sales taxes, which some proponents viewed as modern equivalents to “no income tax” policies—simplified, targeted, and ostensibly fairer. However, these ideas faced significant opposition from Democrats and certain policy analysts who argued they disproportionately favored the wealthy or increased financial burdens on low-income populations.

| Relevant Category | Substantive Data |

|---|---|

| Tax Bracket Reduction | From 7 brackets to 4, with the top rate reduced from 39.6% to 37% in 2018 |

| Corporate Tax Rate | Decreased from 35% to 21% under the TCJA |

| Standard Deduction | Increased from $6,350 to $12,000 for singles (2017 to 2018) |

| Minimum Tax | Revised to benefit higher earners and corporations, reducing effective marginal tax rates |

Societal and Political Ramifications of No Income Tax Policies

Policies that lean toward negligible or zero federal income taxes for specific populations inevitably spark debates about fairness, economic inequality, and the social contract. The rapid dissemination of tax reduction narratives, amplified through political rhetoric, influences human behavior and societal structures in multifaceted ways.

For affluent individuals and corporations, these policies often translate into increased disposable income and broader investment capacity, further entrenching wealth concentration. Conversely, low- and middle-income households may face relative taxation increases elsewhere—such as payroll, sales, or property taxes—highlighting the complex redistribution effects caused by such policy shifts.

Impact on Society and Human Behavior

From a sociocultural perspective, the portrayal of “tax relief” as a personal victory or economic liberation influences public perceptions and electoral behavior. The framing of tax policy as an issue of individual freedom resonates deeply within certain cultural narratives in America, fostering a collective expectation for continued tax reduction. Consequently, this shapes not only fiscal policy but also societal values regarding government’s role and responsibility.

Academic studies and behavioral economics suggest that tax policy framing can significantly influence consumer spending, savings behavior, and political participation. For instance, the perception of lower tax burdens can increase consumer confidence and spending, but may also reduce government revenues essential for public services, thereby affecting societal cohesion and long-term sustainability.

| Key Data Point | Implication |

|---|---|

| Effective Tax Rates for Top 1% | Reduced from 30% to approximately 20% post-TCJA, stimulating debate on inequality |

| Middle-Income Tax Burden | Marginally decreased, but net effect varies depending on state and local taxes |

| Public opinion polls | Majority favor tax cuts for lower and middle classes but express concerns about long-term deficits |

Concluding Reflections on the Origins and Future of No Income Tax Policies

Tracing the roots of Trump’s no income tax policies reveals a tapestry woven from historical precedents, ideological commitments, legislative innovations, and societal aspirations for economic liberation. While whole-scale federal zero-income tax laws remain elusive, the philosophical underpinnings of these policies continue to influence American fiscal discourse. As new administrations weigh the costs and benefits of further tax reductions, the debate around equitable fiscal policies and societal welfare remains central. Future explorations will likely grapple with balancing economic growth with social justice—the enduring challenge inherent in American tax politics.

What prompted the rise of no income tax policies in America?

+The rise was driven by ideological shifts toward conservative fiscal principles, efforts to stimulate economic growth through tax incentives, and state-level experiments that influenced national discourse.

How did Trump’s tax policies reflect no income tax principles?

+While not eliminating income tax federally, Trump’s policies significantly reduced effective tax burdens for high earners and corporations, echoing the broader goal of minimizing tax liabilities—often associated with no income tax ideologies.

What are the societal consequences of implementing no income tax policies?

+Potential consequences include increased wealth inequality, altered consumption behavior, and political polarization regarding the fairness of tax burdens and the role of government in providing public services.