Pay Indiana State Taxes

Indiana, the Hoosier State, is known for its vibrant culture, diverse economy, and rich history. As a resident or business owner in Indiana, it is essential to understand the process of paying state taxes to ensure compliance with the law and avoid any potential penalties. This comprehensive guide will walk you through the steps to pay your Indiana state taxes, covering the various tax types, payment methods, and resources available to make the process as smooth as possible.

Understanding Indiana State Taxes

Indiana’s state tax system encompasses a range of tax types, each serving a specific purpose and contributing to the state’s revenue. These taxes support essential services, infrastructure development, and various programs that benefit Indiana’s residents and businesses.

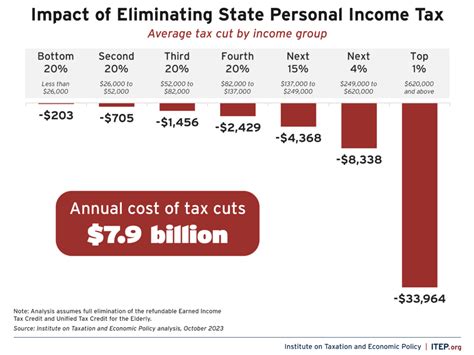

Income Tax

Indiana imposes an individual income tax on residents and nonresidents with income sourced from the state. The tax rates vary based on the type of income and the taxpayer’s filing status. As of 2023, the state’s income tax rates range from 3.23% to 4.9%.

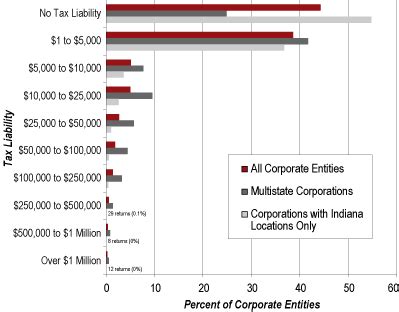

For businesses, Indiana offers a Corporate Income Tax, which applies to corporations, partnerships, and limited liability companies. The tax rate is 5.75% for most entities, with certain exemptions and incentives available for specific industries.

Sales and Use Tax

Indiana levies a sales and use tax on the retail sale, lease, or rental of tangible personal property and certain services. The standard sales tax rate in Indiana is 7%, which includes both the state and local taxes. Some jurisdictions may have additional local sales tax rates, so it’s essential to check the specific rate for your location.

Indiana also imposes a use tax on goods and services purchased from out-of-state vendors or online retailers if the item would have been subject to sales tax had it been purchased within the state. This ensures fairness and compliance with the tax system.

Property Tax

Property taxes are a significant source of revenue for local governments in Indiana. These taxes are assessed on real estate properties, including land and improvements, as well as personal property such as vehicles and business equipment.

The property tax rates vary depending on the location and the assessed value of the property. The local government, typically the county, is responsible for assessing and collecting property taxes. Property owners receive tax bills, which they must pay by the due date to avoid penalties and interest.

Other Taxes

Indiana also collects various other taxes, including:

- Inheritance Tax: Tax on assets received through inheritance or bequest.

- Estate Tax: Tax on the transfer of an individual’s estate upon their death.

- Excise Taxes: Taxes on specific goods and services, such as alcohol, tobacco, and fuel.

- Motor Vehicle Taxes: Taxes on the ownership and registration of vehicles.

Payment Methods and Resources

Indiana offers a range of convenient payment methods to ensure taxpayers can easily and securely pay their state taxes. Here are some of the options available:

Online Payment

The Indiana Department of Revenue provides an online payment portal, INtax, which allows taxpayers to make secure payments for various tax types, including income tax, sales tax, and excise taxes. The portal offers a user-friendly interface and accepts major credit cards, debit cards, and electronic checks.

To make an online payment, taxpayers can visit the INtax payment portal and create an account. The portal provides step-by-step instructions and offers the option to schedule payments in advance.

Electronic Funds Transfer (EFT)

For businesses and taxpayers with high-volume tax obligations, Indiana offers the Electronic Funds Transfer (EFT) program. This method allows for the automatic transfer of funds from the taxpayer’s bank account to the state’s treasury. It is a secure and efficient way to ensure timely payments.

To enroll in the EFT program, taxpayers can download the EFT application form from the Indiana Department of Revenue’s website. Once completed, the form should be submitted to the department for approval.

Check or Money Order

Taxpayers can also pay their Indiana state taxes by sending a check or money order via mail. The payment should be made payable to the Indiana Department of Revenue and include the taxpayer’s name, address, and taxpayer identification number (TIN) on the check or money order.

The payment should be mailed to the following address:

Indiana Department of Revenue

P.O. Box 7224

Indianapolis, IN 46207-7224

Payment Plans and Installment Agreements

For taxpayers who are unable to pay their taxes in full, Indiana offers payment plans and installment agreements. These options allow taxpayers to pay their taxes over time, making the process more manageable.

To apply for a payment plan, taxpayers can visit the Payment Plan Information page on the Indiana Department of Revenue’s website. The website provides detailed instructions and eligibility criteria for payment plans.

Taxpayer Assistance and Resources

The Indiana Department of Revenue understands that paying taxes can be complex and offers a range of resources to assist taxpayers. These resources include:

- Taxpayer Guides: Comprehensive guides explaining various tax types, filing requirements, and payment options.

- Tax Forms: Official tax forms and instructions for individuals and businesses.

- Tax Calendars: Schedules of important tax dates and deadlines.

- Taxpayer Assistance Centers: Physical locations where taxpayers can receive in-person assistance and guidance.

- Online Chat and Phone Support: Real-time support through online chat or by calling the department’s helpline.

Compliance and Penalties

It is crucial for taxpayers to understand the importance of timely and accurate tax compliance. Failure to pay taxes or provide correct information can result in penalties, interest, and potential legal consequences.

Indiana’s tax laws outline specific penalties for late payments, underpayments, and other violations. These penalties can vary depending on the tax type and the severity of the infraction. It is recommended to review the Penalty and Interest Information Sheet provided by the Indiana Department of Revenue for more details.

Audit and Enforcement

The Indiana Department of Revenue has the authority to audit taxpayers to ensure compliance with the state’s tax laws. Audits may be conducted for various reasons, including random selection, suspicion of non-compliance, or as a result of a taxpayer’s error or omission.

During an audit, taxpayers should cooperate fully and provide the necessary documentation and information. It is essential to maintain accurate records and be prepared to support the accuracy of the tax returns filed.

Stay Informed and Seek Professional Advice

Tax laws and regulations can be complex and subject to change. It is advisable for taxpayers to stay informed about any updates or amendments to Indiana’s tax system. The Indiana Department of Revenue’s website is a valuable resource for the latest tax news, updates, and important announcements.

For complex tax situations or specialized tax advice, taxpayers may consider seeking professional assistance from tax advisors, accountants, or tax attorneys. These professionals can provide personalized guidance and ensure compliance with the state’s tax laws.

Conclusion

Paying Indiana state taxes is a responsibility that contributes to the state’s growth and development. By understanding the various tax types, payment methods, and resources available, taxpayers can navigate the process efficiently and ensure compliance with the law. Remember, timely payment and accurate reporting are key to maintaining a positive tax standing and avoiding potential penalties.

What are the tax deadlines in Indiana for individual income tax returns?

+For individual income tax returns, the deadline in Indiana is typically April 15th of each year. However, it’s important to note that this deadline may be extended due to federal or state tax changes. It’s recommended to check the official Indiana Department of Revenue website for the most up-to-date information on tax deadlines.

How can I estimate my sales tax liability in Indiana?

+The Indiana Department of Revenue provides a Sales and Use Tax Guide that offers detailed information on calculating sales tax liability. This guide explains the tax rates, exemptions, and specific rules applicable to different transactions. Additionally, the department’s website offers tools and resources to help businesses estimate their sales tax obligations accurately.

Are there any tax incentives or credits available for businesses in Indiana?

+Yes, Indiana offers various tax incentives and credits to encourage business growth and investment. These incentives include tax credits for research and development, job creation, and investment in certain industries. The Indiana Economic Development Corporation (IEDC) provides detailed information on these incentives, and businesses can explore their eligibility and benefits. It’s recommended to consult with a tax professional or visit the IEDC’s website for more information.