Nj Income Tax Brackets 2025

In the world of personal finance and tax planning, staying informed about income tax brackets is crucial, especially as we navigate the complexities of the US tax system. As we approach 2025, it's essential to understand the income tax brackets for the state of New Jersey, as they can significantly impact your financial strategies and decisions.

New Jersey Income Tax Brackets: Unraveling the 2025 Landscape

New Jersey, known for its diverse economy and vibrant communities, has a progressive income tax system that adjusts its brackets annually to account for inflation and changing economic conditions. Let's delve into the details of the 2025 income tax brackets for the Garden State, providing you with the insights you need to make informed financial choices.

Understanding the Progressive Tax Structure

New Jersey's income tax system operates on a progressive basis, meaning that as your income increases, so does the tax rate applied to your earnings. This structure ensures that individuals with higher incomes contribute a larger proportion of their earnings to the state's revenue, fostering a sense of fairness and equity.

The 2025 tax brackets for New Jersey are categorized into six distinct income ranges, each with its own tax rate. These brackets are determined by the New Jersey Division of Taxation, taking into account the state's budgetary needs and economic forecasts. Let's explore each bracket in detail, providing you with the rates and income thresholds that will shape your tax obligations in the coming year.

| Income Bracket | Tax Rate | Income Range (Single Filers) | Income Range (Joint Filers) |

|---|---|---|---|

| 1 | 1.4% | Up to $20,000 | Up to $30,000 |

| 2 | 1.75% | $20,001 - $35,000 | $30,001 - $50,000 |

| 3 | 3.5% | $35,001 - $40,000 | $50,001 - $60,000 |

| 4 | 5.525% | $40,001 - $75,000 | $60,001 - $150,000 |

| 5 | 6.37% | $75,001 - $500,000 | $150,001 - $500,000 |

| 6 | 8.97% | Over $500,000 | Over $500,000 |

These tax brackets are designed to distribute the tax burden fairly across different income levels, ensuring that those with higher earnings contribute a larger share to the state's coffers. It's worth noting that these brackets and rates are subject to change annually, influenced by economic factors and legislative decisions. Staying abreast of these changes is crucial for effective tax planning.

Factors Influencing Tax Bracket Adjustments

The New Jersey Division of Taxation carefully considers various economic indicators when determining the annual tax brackets. These factors include:

- Inflation: Adjustments are made to account for the rising cost of living, ensuring that taxpayers are not disproportionately affected by inflation.

- State Budget: The state's financial needs and projected revenue play a significant role in shaping the tax brackets. A balanced budget often relies on a mix of tax rates and brackets.

- Economic Forecasts: Experts analyze economic trends to predict income growth and adjust brackets accordingly. This ensures that the tax system remains responsive to the state's economic reality.

By considering these factors, the state aims to create a tax system that is both sustainable and equitable, allowing for effective revenue generation while minimizing the tax burden on lower- and middle-income earners.

Tax Planning Strategies for 2025

Understanding the 2025 income tax brackets is just the first step in effective tax planning. Here are some strategies to consider as you navigate the financial landscape in New Jersey:

- Maximize Deductions: Explore eligible deductions and credits to reduce your taxable income, potentially moving you into a lower tax bracket. This can include contributions to retirement accounts, medical expenses, and charitable donations.

- Optimize Investment Strategies: Consider the tax implications of your investment decisions. Capital gains and losses, as well as dividend income, can impact your overall tax liability. Consult with a financial advisor to devise a strategy that aligns with your goals.

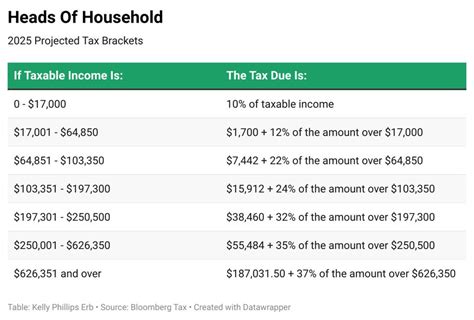

- Review Filing Status: Evaluate whether you qualify for a different filing status, such as head of household or married filing jointly. This can significantly impact your tax bracket and overall tax liability.

- Utilize Tax-Advantaged Accounts: Take advantage of tax-deferred or tax-free accounts, such as 401(k)s or HSAs, to reduce your taxable income and potentially lower your tax bracket.

By implementing these strategies and staying informed about tax law changes, you can optimize your financial position and ensure compliance with the state's tax regulations.

The Role of Tax Professionals

Navigating the intricacies of the tax system can be complex, especially when considering the nuances of state-specific tax laws. Engaging the services of a qualified tax professional can provide invaluable guidance and support. They can help you:

- Understand the implications of the 2025 income tax brackets on your specific financial situation.

- Identify opportunities for tax savings and optimization tailored to your circumstances.

- Ensure compliance with state and federal tax laws, minimizing the risk of penalties and audits.

- Provide ongoing support and advice throughout the year, helping you make informed financial decisions.

Frequently Asked Questions

How often do New Jersey income tax brackets change?

+

New Jersey’s income tax brackets are typically adjusted annually to account for inflation and economic factors. These changes are announced by the New Jersey Division of Taxation each year.

Are there any special tax credits or deductions for residents of New Jersey?

+

Yes, New Jersey offers various tax credits and deductions to its residents, including the Senior Citizen Deduction, the Property Tax Relief Credit, and the Earned Income Tax Credit. It’s essential to research and understand these benefits to maximize your tax savings.

What is the difference between federal and state income tax brackets?

+

Federal income tax brackets are set by the Internal Revenue Service (IRS) and apply to taxpayers across the United States. State income tax brackets, like those in New Jersey, are determined by individual states and may have different rates and brackets than the federal system.

How can I estimate my 2025 New Jersey income tax liability?

+

To estimate your 2025 New Jersey income tax liability, you can use tax estimation tools or consult with a tax professional. These tools consider your income, deductions, and tax credits to provide an estimate of your tax obligation.

Are there any tax planning strategies for high-income earners in New Jersey?

+

Yes, high-income earners in New Jersey can benefit from strategies such as maximizing charitable contributions, utilizing tax-efficient investment strategies, and exploring tax-advantaged retirement plans. Consulting with a financial advisor or tax professional is recommended to optimize your tax position.