Nv Clark County Tax Collector

The Nv Clark County Tax Collector plays a crucial role in managing and collecting taxes for Clark County, Nevada. With a diverse range of responsibilities, the tax collector's office is an integral part of the county's financial ecosystem, ensuring efficient revenue generation and proper allocation of resources.

In this comprehensive guide, we will delve into the workings of the Nv Clark County Tax Collector's office, exploring its services, processes, and the impact it has on the community. By understanding the role and functions of this office, residents and businesses can navigate the tax system more effectively and contribute to the economic growth of Clark County.

Understanding the Role of the Nv Clark County Tax Collector

The Nv Clark County Tax Collector's office is responsible for administering and enforcing the collection of various taxes within the county. These taxes include property taxes, business taxes, vehicle registration fees, and other applicable levies as mandated by state and local laws. The tax collector acts as a liaison between the government and taxpayers, ensuring compliance with tax regulations and providing essential services to the community.

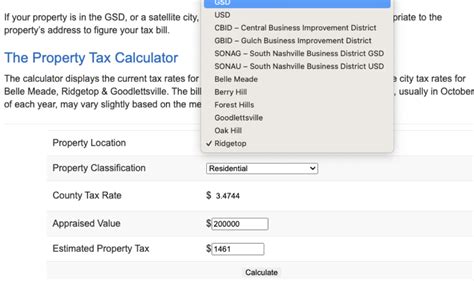

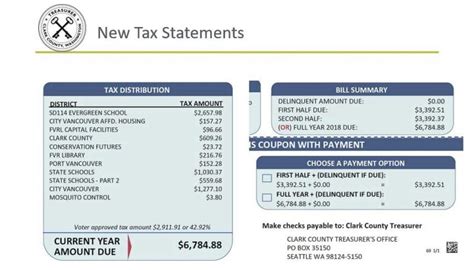

One of the primary functions of the Nv Clark County Tax Collector is to assess and collect property taxes. Property taxes are a significant source of revenue for the county, and the tax collector's office plays a pivotal role in determining the assessed value of properties, sending out tax bills, and collecting these taxes from homeowners and businesses. This process involves evaluating the market value of properties, applying relevant tax rates, and ensuring timely payments.

In addition to property taxes, the tax collector's office also handles business taxes. Businesses operating within Clark County are subject to various taxes, such as sales tax, business license tax, and occupation taxes. The Nv Clark County Tax Collector ensures that businesses are registered, files the necessary tax returns, and collects the appropriate taxes. This process helps fund essential services like infrastructure development, public safety, and education.

Another critical aspect of the tax collector's responsibilities is vehicle registration and licensing. Vehicle owners in Clark County must register their vehicles annually and pay the corresponding fees. The Nv Clark County Tax Collector's office facilitates this process, ensuring that vehicle owners comply with registration requirements and pay the necessary fees. This revenue stream contributes to the maintenance and improvement of transportation infrastructure within the county.

Services and Resources Offered by the Nv Clark County Tax Collector

The Nv Clark County Tax Collector's office provides a range of services and resources to assist taxpayers in understanding and fulfilling their tax obligations. These services are designed to make the tax payment process as convenient and efficient as possible, while also offering support and guidance to taxpayers.

Online Tax Payment and Management

In line with modern trends, the Nv Clark County Tax Collector has embraced digital transformation, offering an online platform for taxpayers to manage their tax accounts. Through the official website, taxpayers can access their account information, view tax bills, make online payments, and track the status of their payments. This online system provides a convenient and secure way to manage tax obligations, eliminating the need for in-person visits.

| Online Services Offered | Description |

|---|---|

| View Tax Bills | Taxpayers can access and download their current and previous tax bills. |

| Make Payments | Secure online payment options are available for property taxes, business taxes, and vehicle registration fees. |

| Account Management | Taxpayers can update their personal information, manage payment methods, and view payment history. |

| Tax Due Date Reminders | The system offers automated reminders for upcoming tax due dates. |

Assistance and Support

The Nv Clark County Tax Collector's office understands that taxpayers may have questions or face challenges when dealing with tax-related matters. To address these concerns, the office provides dedicated support services, including a knowledgeable customer service team.

- Taxpayer Assistance Centers: Physical locations where taxpayers can receive in-person assistance with tax-related queries, forms, and payments.

- Customer Service Hotline: A toll-free number is available for taxpayers to call and speak to a representative for guidance and support.

- Email Support: Taxpayers can send their inquiries and receive responses via email, providing a convenient and efficient communication channel.

Taxpayer Education and Resources

The Nv Clark County Tax Collector recognizes the importance of taxpayer education in fostering compliance and understanding. As such, the office provides a wealth of educational resources and materials to help taxpayers navigate the tax system effectively.

- Tax Guides and Brochures: Comprehensive guides are available, covering topics such as property tax assessment, business tax registration, and vehicle registration requirements.

- Online Tutorials and Webinars: Interactive tutorials and webinars are offered to explain tax processes, providing visual aids and step-by-step instructions.

- Community Outreach Programs: The tax collector's office engages in community events and workshops to educate residents about their tax responsibilities and provide practical advice.

Payment Options and Due Dates

Understanding the payment options and due dates for different taxes is essential for taxpayers to avoid penalties and maintain good standing with the Nv Clark County Tax Collector's office.

Property Taxes

Property taxes in Clark County are typically due in two installments. The first installment is due on or before October 1st of each year, while the second installment is due on or before March 1st of the following year. Taxpayers have the flexibility to pay the entire amount at once or opt for the installment plan. Late payments are subject to penalties and interest.

Business Taxes

Business taxes, including sales tax and business license tax, have varying due dates depending on the type of business and the frequency of tax filings. Generally, sales tax returns are due monthly, quarterly, or annually, depending on the business's revenue and operations. Business license taxes are typically due annually, and the tax collector's office provides clear guidelines and due dates for each business type.

Vehicle Registration Fees

Vehicle registration fees in Clark County are due annually. The registration renewal period typically starts a few months before the expiration date of the current registration. Taxpayers receive a renewal notice, and they can renew their vehicle registration online, by mail, or in person at designated locations. Late renewals incur penalties and may result in additional fees.

Tax Incentives and Exemptions

To encourage economic growth and support certain sectors or individuals, the Nv Clark County Tax Collector's office offers various tax incentives and exemptions. These measures aim to promote business development, encourage homeownership, and assist vulnerable populations.

Business Tax Incentives

Clark County provides several tax incentives to attract and support businesses. These incentives may include tax abatements, tax credits, or reduced tax rates for specific industries or businesses that meet certain criteria. For example, businesses engaged in research and development or those located in designated economic zones may be eligible for tax breaks.

Property Tax Exemptions

The Nv Clark County Tax Collector's office recognizes the importance of homeownership and provides property tax exemptions to certain groups. These exemptions can reduce the taxable value of a property, leading to lower property tax bills. Common exemptions include those for senior citizens, disabled individuals, veterans, and charitable organizations.

| Property Tax Exemption | Eligibility Criteria |

|---|---|

| Senior Citizen Exemption | Available to residents aged 65 and older with limited income and assets. |

| Disabled Exemption | Offered to individuals with permanent disabilities who own their primary residence. |

| Veteran Exemption | Honors military veterans with reduced property tax assessments. |

| Charitable Organization Exemption | Applies to properties owned by non-profit organizations used exclusively for charitable purposes. |

The Impact of the Nv Clark County Tax Collector on the Community

The Nv Clark County Tax Collector's office has a profound impact on the community, influencing economic development, public services, and the overall well-being of residents. The revenue generated through taxes plays a vital role in funding essential services and initiatives that shape the county's future.

Economic Development

Taxes collected by the Nv Clark County Tax Collector contribute to the county's economic growth and development. The revenue generated is used to support infrastructure projects, such as road improvements, public transportation, and the development of business districts. These investments create a more attractive business environment, leading to job creation and economic prosperity.

Public Services and Infrastructure

The tax collector's office ensures that funds are allocated to maintain and enhance public services. This includes funding for schools, law enforcement, fire departments, healthcare facilities, and social services. By providing adequate resources, the tax collector helps improve the quality of life for residents and ensures the efficient functioning of critical public services.

Community Initiatives and Programs

Beyond the essential services, the Nv Clark County Tax Collector's office also supports community initiatives and programs. The revenue generated through taxes is often directed towards initiatives such as affordable housing programs, community development projects, and initiatives focused on education, healthcare, and social welfare. These programs aim to address social issues and improve the overall well-being of the community.

Future Implications and Continuous Improvement

As Clark County continues to evolve and grow, the Nv Clark County Tax Collector's office remains committed to adapting and improving its services. By staying abreast of technological advancements and best practices, the tax collector's office strives to enhance efficiency, convenience, and transparency in tax administration.

Digital Transformation

The tax collector's office is actively pursuing digital transformation to streamline processes and enhance taxpayer experience. This includes further development of the online platform, integration of mobile payment options, and the use of data analytics to improve tax assessment and collection processes. By embracing technology, the office aims to reduce administrative burdens and provide a more seamless experience for taxpayers.

Community Engagement and Feedback

Community engagement is a priority for the Nv Clark County Tax Collector's office. The office actively seeks feedback from taxpayers, businesses, and community leaders to understand their needs and challenges. This feedback is invaluable in shaping future policies and initiatives. By fostering open communication, the tax collector's office can ensure that its services remain aligned with the community's expectations and requirements.

Continuous Training and Professional Development

The staff at the Nv Clark County Tax Collector's office undergo regular training and professional development programs to stay updated on tax laws, regulations, and best practices. This ensures that taxpayers receive accurate information and support, and it also helps the office adapt to any changes in tax policies or procedures.

Conclusion

The Nv Clark County Tax Collector's office is a vital component of the county's financial system, ensuring the efficient collection and management of taxes. Through its various services, resources, and initiatives, the tax collector's office supports economic growth, funds essential public services, and contributes to the overall well-being of the community. By understanding the role and functions of the tax collector's office, taxpayers can actively participate in the county's growth and development while fulfilling their tax obligations.

How can I pay my property taxes online in Clark County, Nevada?

+To pay your property taxes online, visit the official website of the Nv Clark County Tax Collector’s office. Navigate to the online payment portal and follow the instructions. You will need to create an account or log in if you already have one. Once logged in, select the property tax option, enter the required details, and make the payment using a credit card, debit card, or electronic check.

What are the due dates for business tax payments in Clark County?

+Business tax due dates in Clark County vary depending on the type of business and the frequency of tax filings. It is recommended to consult the official website of the Nv Clark County Tax Collector’s office or contact their customer service for specific due dates and requirements based on your business type.

Are there any tax incentives available for new businesses in Clark County?

+Yes, Clark County offers various tax incentives to attract and support new businesses. These incentives may include tax abatements, tax credits, or reduced tax rates. It is advisable to research and consult with the Nv Clark County Tax Collector’s office or local economic development agencies to understand the available incentives and eligibility criteria.

How can I apply for a property tax exemption as a senior citizen in Clark County?

+To apply for a property tax exemption as a senior citizen in Clark County, you need to meet certain eligibility criteria. Contact the Nv Clark County Tax Collector’s office or visit their website to obtain the necessary application forms and guidelines. The process typically involves providing proof of age, income, and assets. Once your application is approved, you will receive a reduced property tax assessment.